In the first paragraph of yesterday's Market Alert we wrote the following:

"One of the tools that is ready and that we are (successfully) testing provided us with a bearish indication for the gold market. The suggestion is that gold would drop at least $30 in a week or so. The tool is based on detecting self-similar patterns and it seems that it based the above indication on the possible completion of the ABC (zigzag) pattern - the one that we have shown in the GLD ETF chart in the latest Premium Update (gray, dashed lines). This is not a sure bet, of course, but something to keep in mind if you are speculatively long gold or silver at the moment."

Unfortunately (for those who were speculatively long gold or silver), it seems that our soon-to-be-released tool was right about the bigger decline in gold in the coming days. The worst part of today's decline in gold and silver is that it is accompanied by a slight decline in the USD Index and higher stock prices.

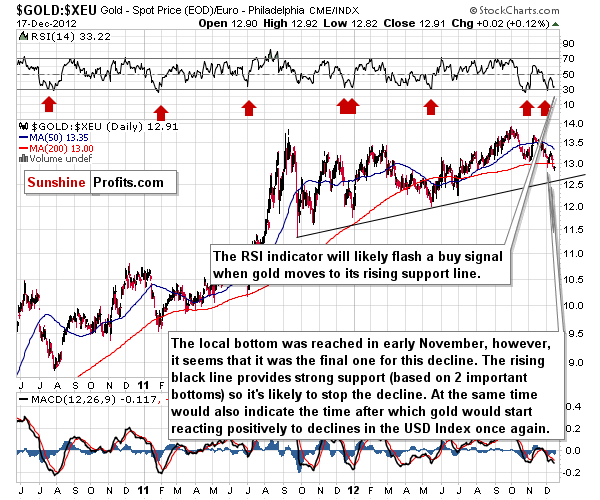

Gold has yet to regain its significantly negative correlation with the dollar. In light of what we wrote in the previous Premium Update, gold priced in the euro provides us with a useful way to establish if the decline in gold and USD index is already excessive or not.

Gold formed a local bottom (also in terms of the euro) at the beginning of the month but in the past days it moved below that bottom so we might see a decline to the 12.6 level in the gold:XEU ratio (gold to Euro index ratio) before the final bottom is reached as this is where the long-term support line is located (the one that is based on the September 2011 low and the May 2012 low). When this support line is reached it will likely mark an important turning point for the precious metals market. We expect to see a confirmation from the SP Gold Bottom Indicator (its long-term version). When that happens, the odds that the bottom is really in will be further increased.

Please note that compared to today's decline in gold and silver, the one seen in the mining stocks (especially in silver stocks) is quite small. Gold moved below its December low and also slightly below the November low, while at the same time miners (GDX ETF) are visibly above these lows. Silver stocks (SIL ETF) are not even close to these lows.

At this time, we continue to believe that being out of speculative positions in gold and silver is a good idea and so is being only partially long in case of the precious metals mining stocks (because of the buy signal from one of the SP Indicators.)

We're not even close to suggesting getting out of the long-term precious metals investments here.

All in all, the information reported in the latest Premium Update remains up-to-date.

The situation can change in the following days. As always, we'll keep you updated should our views on the market change - even if it means sending another message in several minutes. We will also continue to send you Market Alerts on a daily basis (with the exception of Fridays when Premium Updates are posted) at least until the end of December.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA