Briefly: in our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In yesterday’s alert, we explained why mining stocks’ strength was not to be trusted and the market agreed with us. The precious metals sector declined and the HUI Index – proxy for gold stocks – moved to new monthly lows. Friday’s strength was therefore completely invalidated. But, since gold’s and mining stocks’ cyclical turning point is tomorrow and gold is already at our target area of $1,250 - $1,260, one should still prepare for a rebound. But, what does the above mean exactly? Should one take profits from their short positions and prepare for opening long ones?

It’s tempting to do so, but let’s keep in mind that there are multiple bearish signs in place that point to lower gold prices in the upcoming weeks. Plus, gold is still likely to move to about $900 in late September or early October and this means that we are likely to see a few-hundred-dollar decline in the yellow metal in a relatively short timeframe. Consequently, the biggest emphasis should be on taking advantage of this big move (or a series of few smaller, but still big moves) and only treating the short-term corrective upswings as something that we can optionally take advantage of if multiple signs confirm it. Let’s see what kind of signals we have at this time, starting with gold (charts courtesy of http://stockcharts.com).

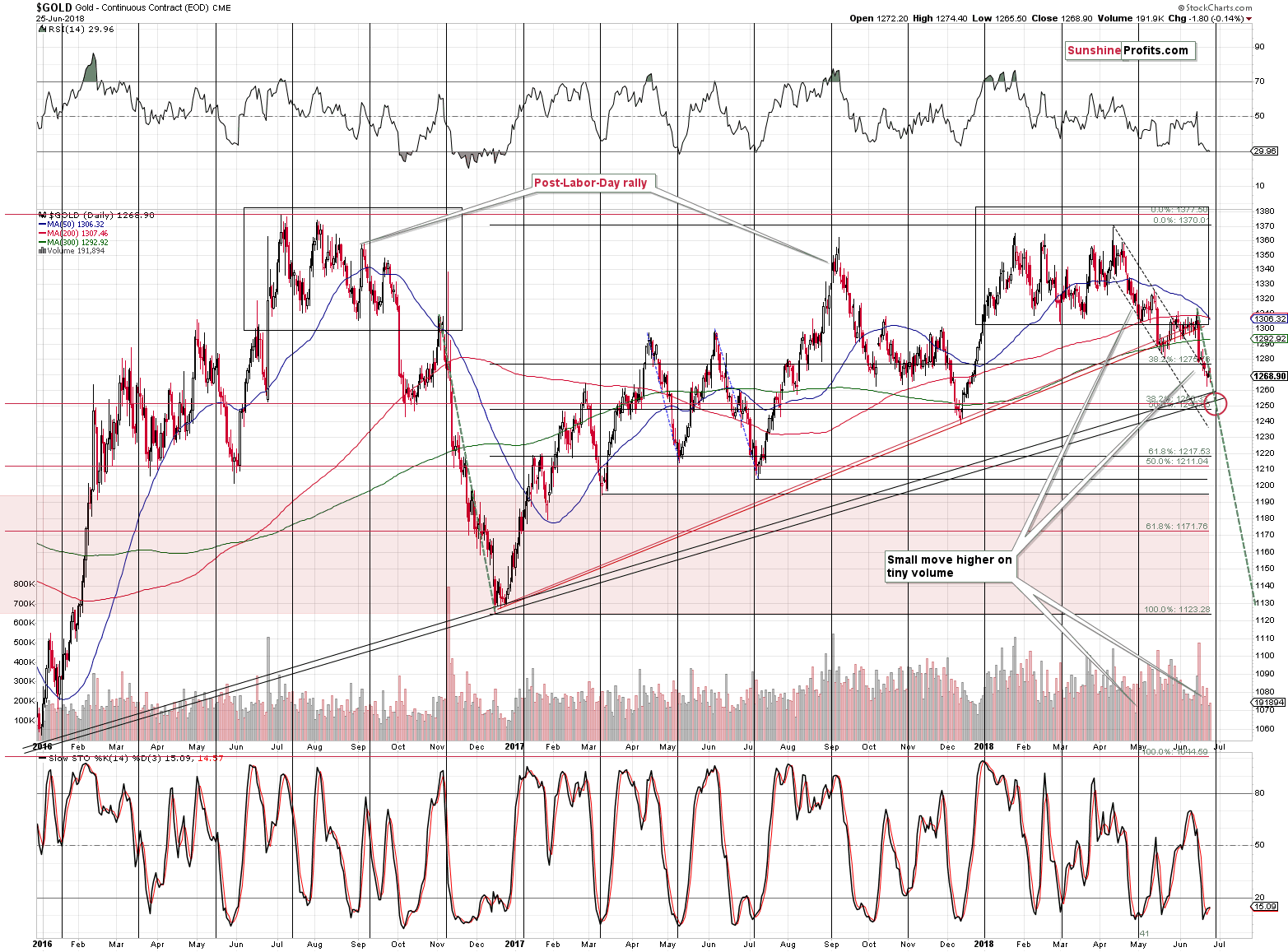

Gold’s Decline and Downside Target

Gold declined a few dollars yesterday and it declined once again in today’s pre-market trading. It moved into our $1,250 - $1,260 target and the question is what one should do about it.

Since it appears that the rising support line is going to be reached any hour now and the cyclical turning point is tomorrow, closing the position may seem to be justified.

Yet, keeping the above discussion of medium-term outlook in mind, it seems that we can see something else than a bottom in a few hours. We could see a sharp slide below the $1,250 level (for instance to $1,217.53 or so as that’s where we have the 61.8% Fibonacci retracement based on the December 2016 – April 2018 rally) bottom at the cyclical turning point (tomorrow) or a day after it and then a rebound back to the $1,250 - $1,260 range. After such corrective upswing, gold would be likely to slide in a volatile manner.

Should the above scenario take place, closing the position now would be problematic in the following days. Missing the decline (and possibly the corrective upswing) is one thing, but the difficulty in getting back at the short side of the market is another. What if gold didn’t come back to $1,250 - $1,260, but instead corrected only to $1,247 or so? One would have probably not get back at this level, only much lower, waiting for the pullback that might not come for some time. The result would be a significant profit that was missed and a lot of stress (which is more important than one might think – stress impacts one’s health in numerous ways).

So, what should one do with all the above? First idea is to really accept that catching all trades is impossible, which should lower the stress in the long run. The second idea is to adjust the positions only after getting numerous confirmations as this is what improves the risk to reward. Now, since gold is likely to decline profoundly in the following months, we need a lot of bullish signs in order to justify a position other than a full short one.

Did we see such signals so far?

No.

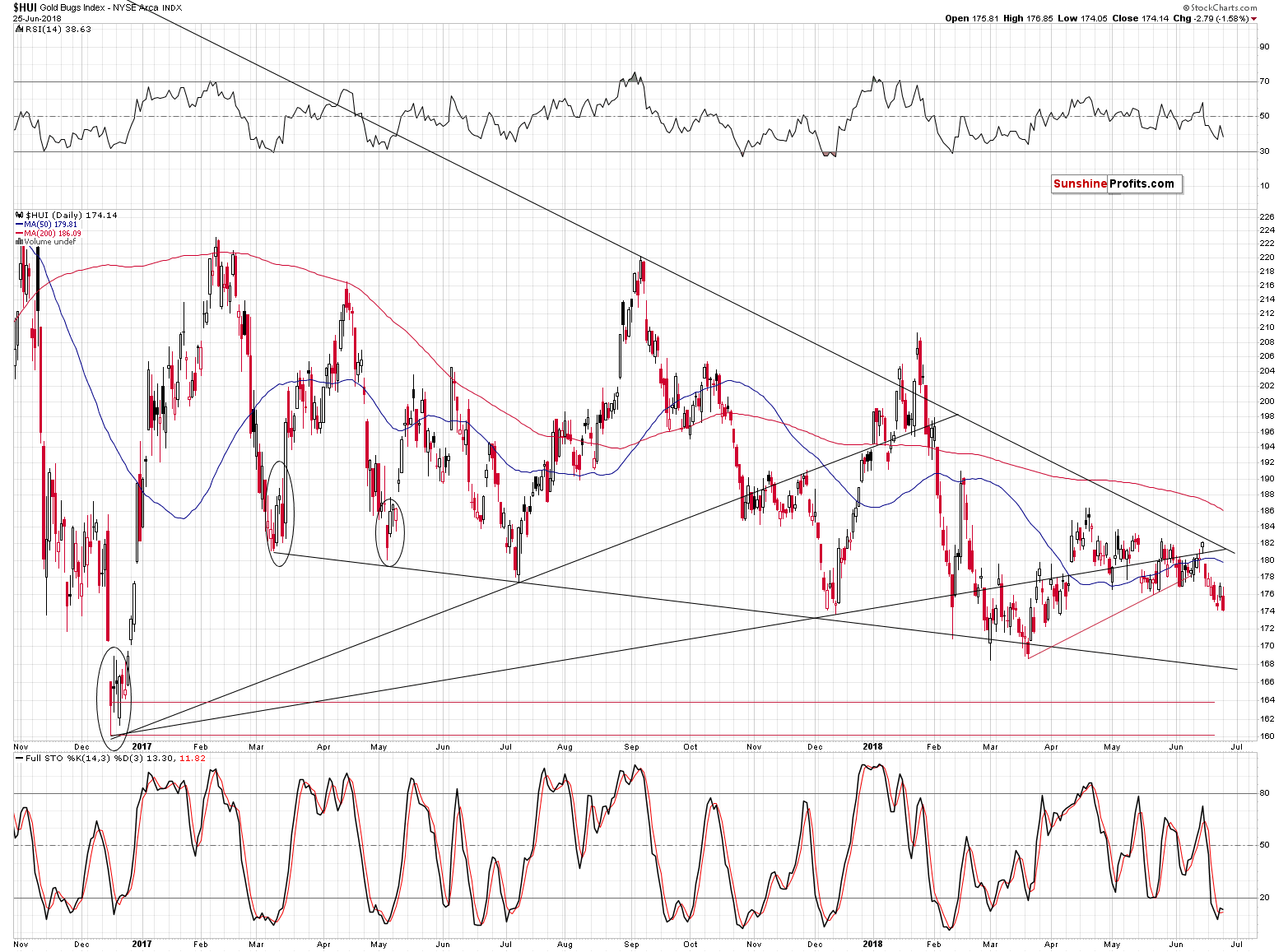

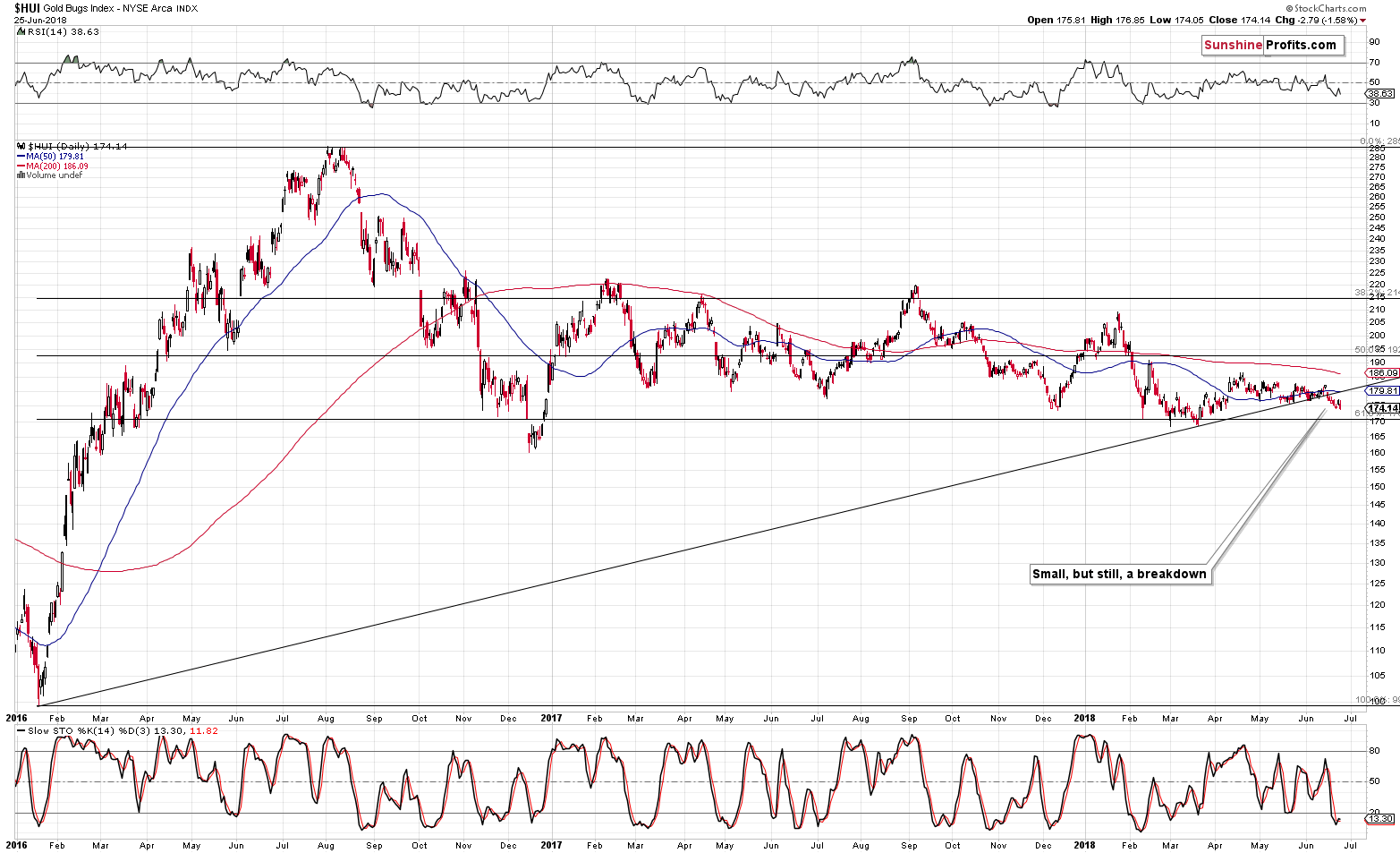

Gold Stocks’ Weakness

Gold stocks seemed strong on Friday, but since their strength was accompanied by silver’s strength it was suspicious. It turned out that the caution was well-justified. The daily rally was more than erased yesterday. The HUI Index moved significantly lower, closing at the new monthly low.

From the bigger point of view, it means that the post-breakdown decline is likely beginning.

Now, if a big, post-breakdown decline is really just starting then it’s a great moment to enter short positions, not to close them. So, instead of a confirmation, mining stocks are providing us with a suggestion that a bigger decline is coming.

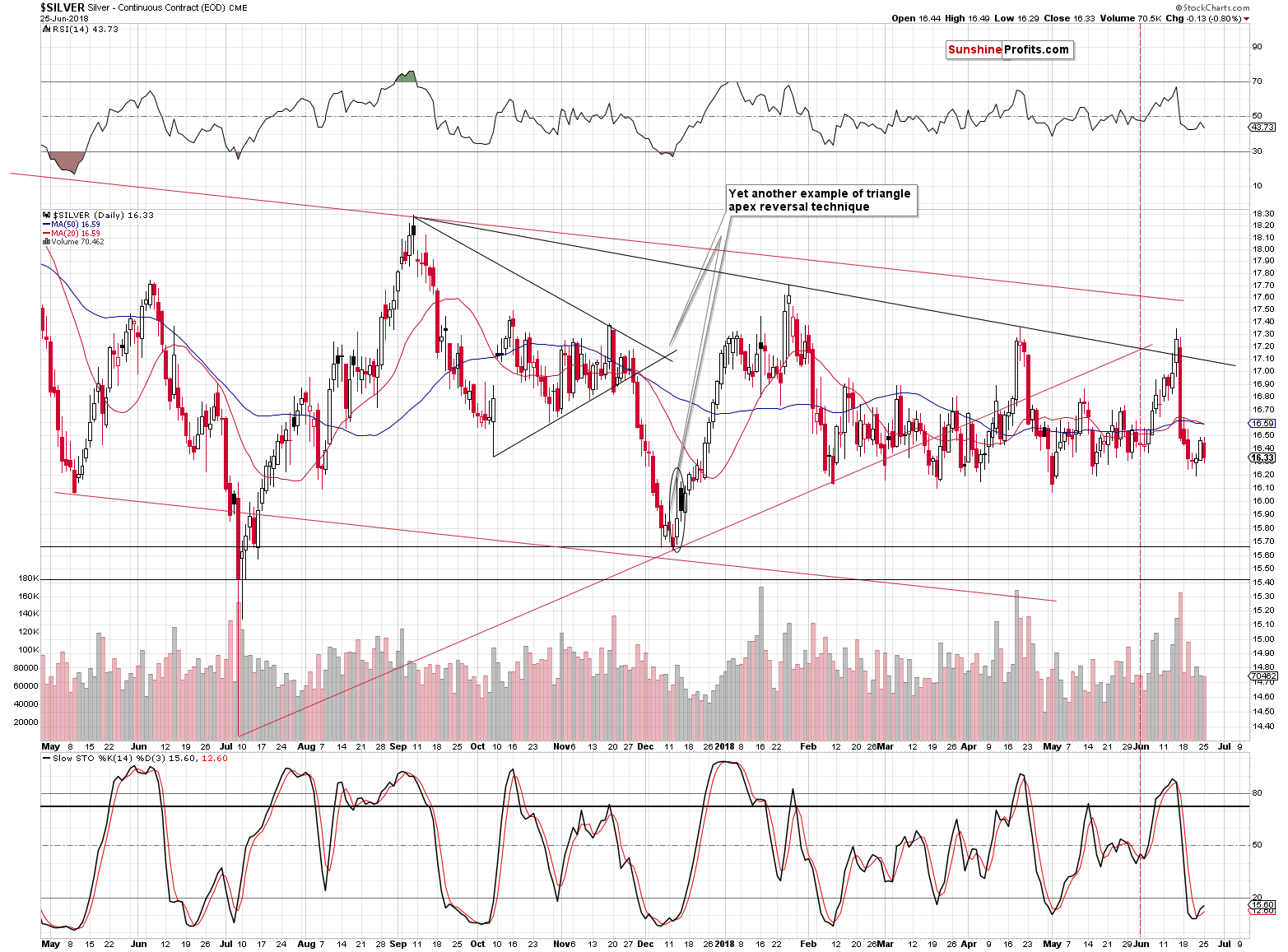

Silver’s Price Target

Silver more or less erased the Friday’s gains and in today’s pre-market trading it moved even lower – to $16.11 (at the moment of writing these words). That’s just 1 cent above our target for the white metal, so we can say that it was practically reached.

Yet, without a bullish confirmation from mining stocks and given very weak performance of gold relative to the USD Index, we could see even lower silver prices in the near term.

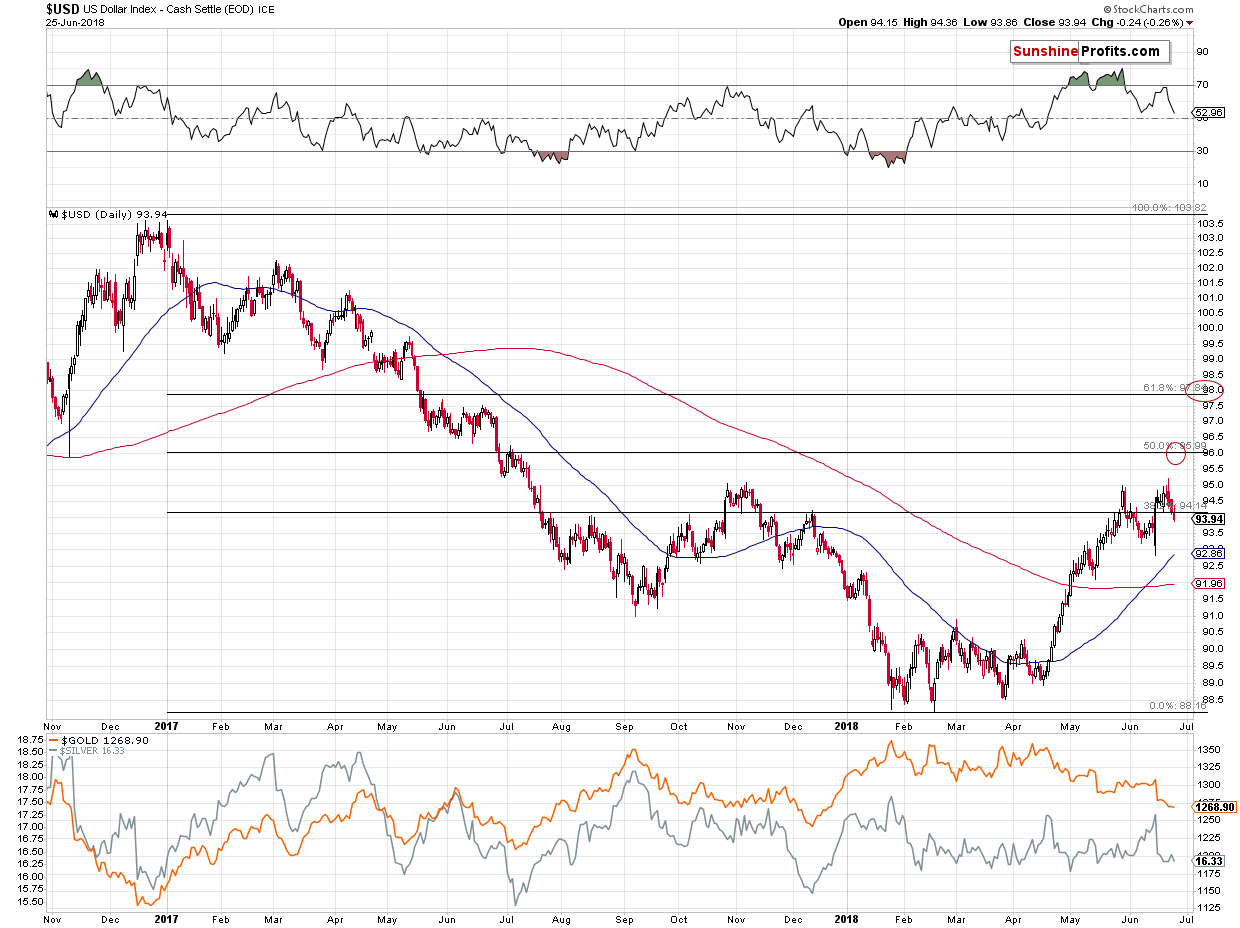

Speaking of relative performance, let’s take a look at yesterday’s USDX performance and the one of gold.

Gold vs. USD

The USD Index declined yesterday and this should have caused gold and the rest of the precious metals sector to move higher. Instead, we saw a decline in gold, silver and mining stocks and HUI even closed at new monthly low.

In the previous alerts, we already wrote about gold’s weak reaction to changes in the USDX and yesterday’s session put the exclamation mark behind it all. The implications of such weakness were strongly bearish and today’s pre-market price moves are the result.

We previously wrote that if gold doesn’t want to respond to the USD’s bullish signals, it’s likely to respond to the bearish signals that are likely to follow. The USD Index was downy by 0.24 yesterday and it’s already up by 0.20 at the moment of writing these words. Gold reacted to yesterday’s move with a small decline and it’s reacting to today’s move with a bigger decline – that’s exactly what we had indicated previously.

If the rally in the USDX is to continue, like it did in 2014, then gold could magnify this move and the sharpness of its decline could increase dramatically.

Is this the environment in which it seems to be a good idea to exit short positions without very strong confirmations? No. Did we see them so far? No. Therefore, we are not closing our speculative short positions at this time. Naturally, if we see bullish signs today, for instance in the form of rallying mining stocks despite gold’s daily downswing, we’ll send you a follow-up message in which we’ll discuss if taking profits from the current short position is justified.

Summary

Summing up, gold and silver reached our downside targets in today’s pre-market trading, but since we saw new bearish signs instead of bullish confirmations, we are not taking profits from the current short positions. It might become justified based on the risk to reward ratio shortly and if that happens, we’ll let you know. So far, it seems that short positions remain justified and it seems likely that the profits on them will increase further.

We are moving our initial target price for gold lower.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,221; stop-loss: $1,382; initial target price for the DGLD ETN: $51.88; stop-loss for the DGLD ETN $37.48

- Silver: initial target price: $15.73; stop-loss: $18.06; initial target price for the DSLV ETN: $27.58; stop-loss for the DSLV ETN $19.17

- Mining stocks (price levels for the GDX ETF): initial target price: $21.03; stop-loss: $23.54; initial target price for the DUST ETF: $28.88; stop-loss for the DUST ETF $21.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $30.62; stop-loss: $36.14

- JDST ETF: initial target price: $59.68 stop-loss: $40.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Do you have enough of constant fluctuations, changes in the short-term trends? Are you tired of checking the gold prices all the time? Good, so let’s rest from the daily hustle and bustle and focus today on what will be in thirty years.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold hits more than 6-month low as dollar, equities recover

Gold to reclaim $1,350 an ounce by the end of 2018

=====

In other news:

Stocks claw higher after China enters bear territory

Chinese Stocks Enter Bear Market as Trade, Growth Risks Increase

European shares crawl up from trade war sell-off

Ex-HSBC Trader Will Have to Put Up More Money to Get Out of Jail

Oil rises as outages balance trade dispute, OPEC

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts