Briefly: in our opinion, full (100% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In yesterday’s analysis, we discussed how meaningful gold and silver’s pre-market decline was given a relatively small move in the USD Index. The implications were quite bearish for the PM market, especially that we had just seen a target being reached in gold stocks. And because mining stocks had just underperformed gold for the first time in weeks. Yet, before the day was over, the USD, gold and silver had all reversed and erased most of their daily moves. Does it make the outlook bullish again? Is gold still likely to reach $1,300 shortly?

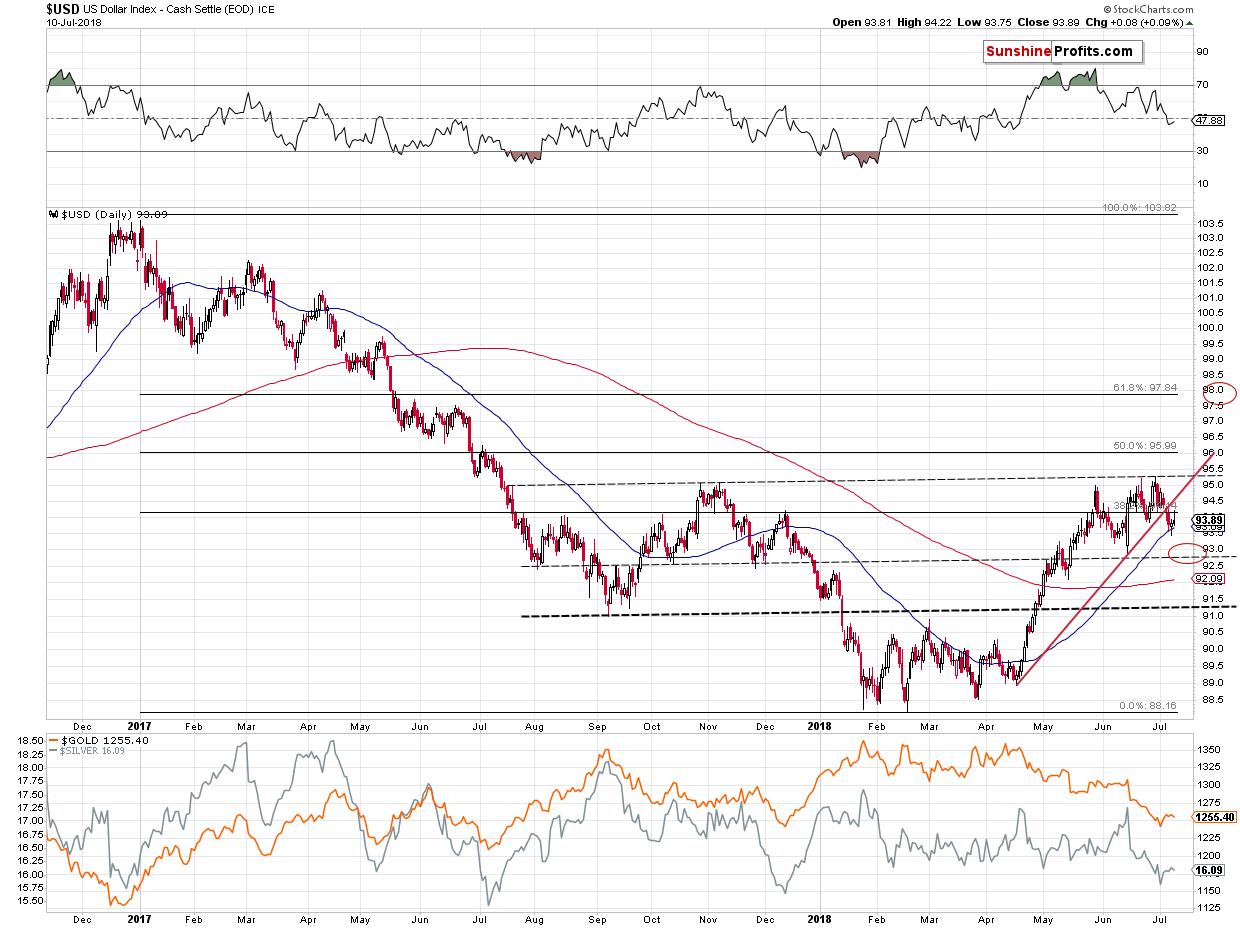

No. The USD Index indeed reversed its course, but the precious metals’ initial reaction shows how vulnerable they are with regard to the rallies in the USD Index. This is not the kind of reaction that one wants to see when keeping a long position. It’s the one that is preferred while holding a short one.

Let’s take a look at the charts for details. This time, we’ll start with the USD Index (charts courtesy of http://stockcharts.com).

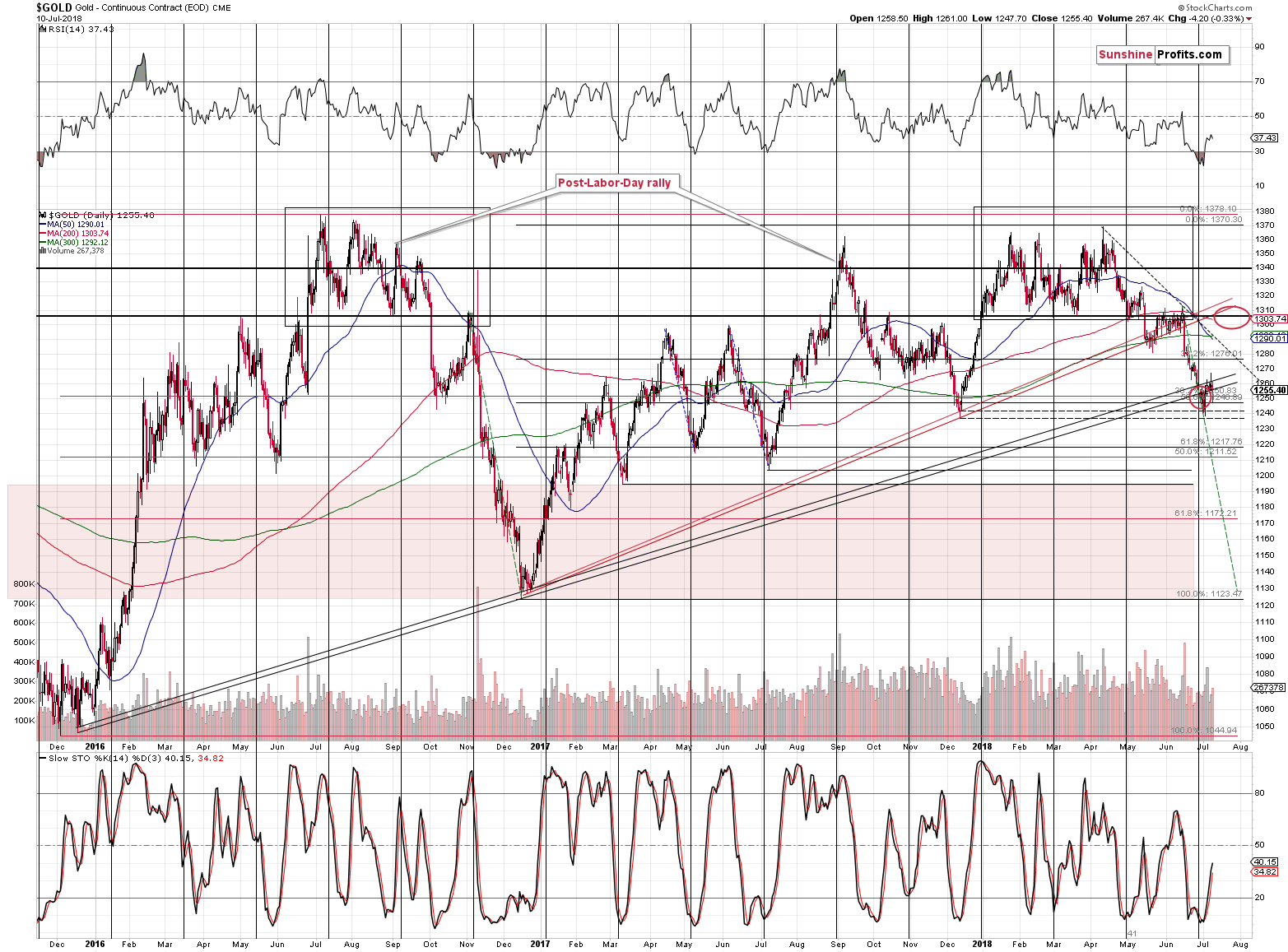

During a real, sizable upswing, gold usually reacts in a most profound way to the USD’s weakness in the initial part of the rally and the strength of the reaction diminishes as gold’s rally continues. A very weak reaction to the USD’s bullish signals is a sign that the rally is close to its end. Consequently, if gold was really to rally above $1,300, it should have rallied to $1,280 or so during the initial part of the rally as a response to USD Index’s decline.

Nothing like that happened.

Instead, we saw a breakdown below the medium-term support line that was based on major bottoms (late 2015 and late 2016 price extremes). Gold was likely to rally based on multiple factors – and it did - but, instead of invalidating the breakdown and rallying to $1,300 (which seemed quite realistic given the previous oversold situation in terms of the RSI indicator), gold just moved back to the rising support line and verified it as resistance.

In other words, we had many bullish signals, but perhaps what was likely to happen based on them has already happened. We saw a rally, but gold was not strong enough to even invalidate a breakdown, let alone rally back to the June highs.

On a short-term basis, we see that yesterday’s decline took place on volume that was higher than Monday’s move up, which is a bearish sign. That’s one of the reasons that confirms that taking profits off the table and closing our previous short-term long position in the precious metals market was indeed a good idea.

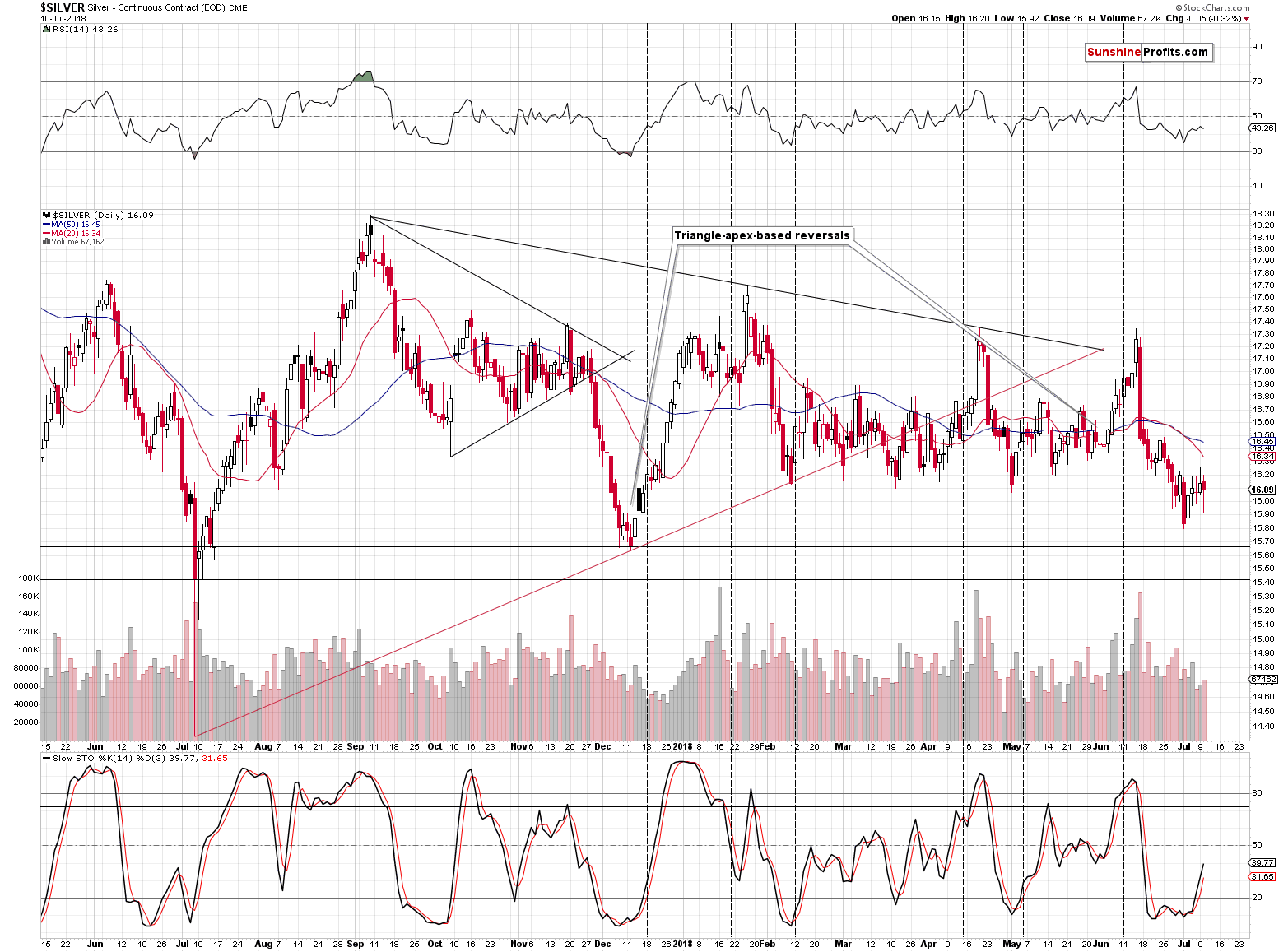

Silver moved back up after the overnight decline, but it closed the session below the previous day’s closing price. What’s really important is that silver closed the day below the previous lowest close of the year ($16.13). This means that – in analogy to gold – silver broke below an important support level (previous 2018 lows) and the recent rally was just a verification of the breakdown.

In general, it’s one of the best trading (here: shorting) opportunities when a market is after a breakdown and then it confirms it by moving back to the previous support and verifies it as resistance. That’s what just happened in gold and what happened in silver.

Both precious metals had good technical reasons to rally back above the mentioned support/resistance levels – but they didn’t manage to do so. This indicates that the short-term outlook can no longer be described as bullish.

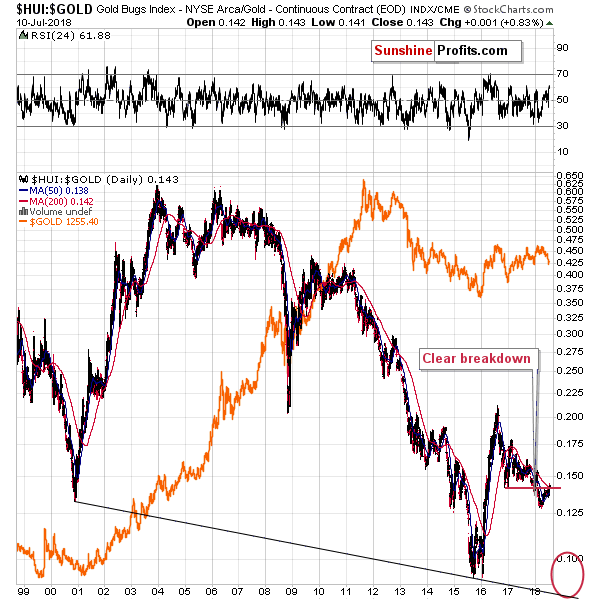

As we discussed yesterday – the most important confirmation comes from the analysis of gold stocks and their ratio to gold. The situation hasn’t changed since yesterday and our previous comments remain up-to-date:

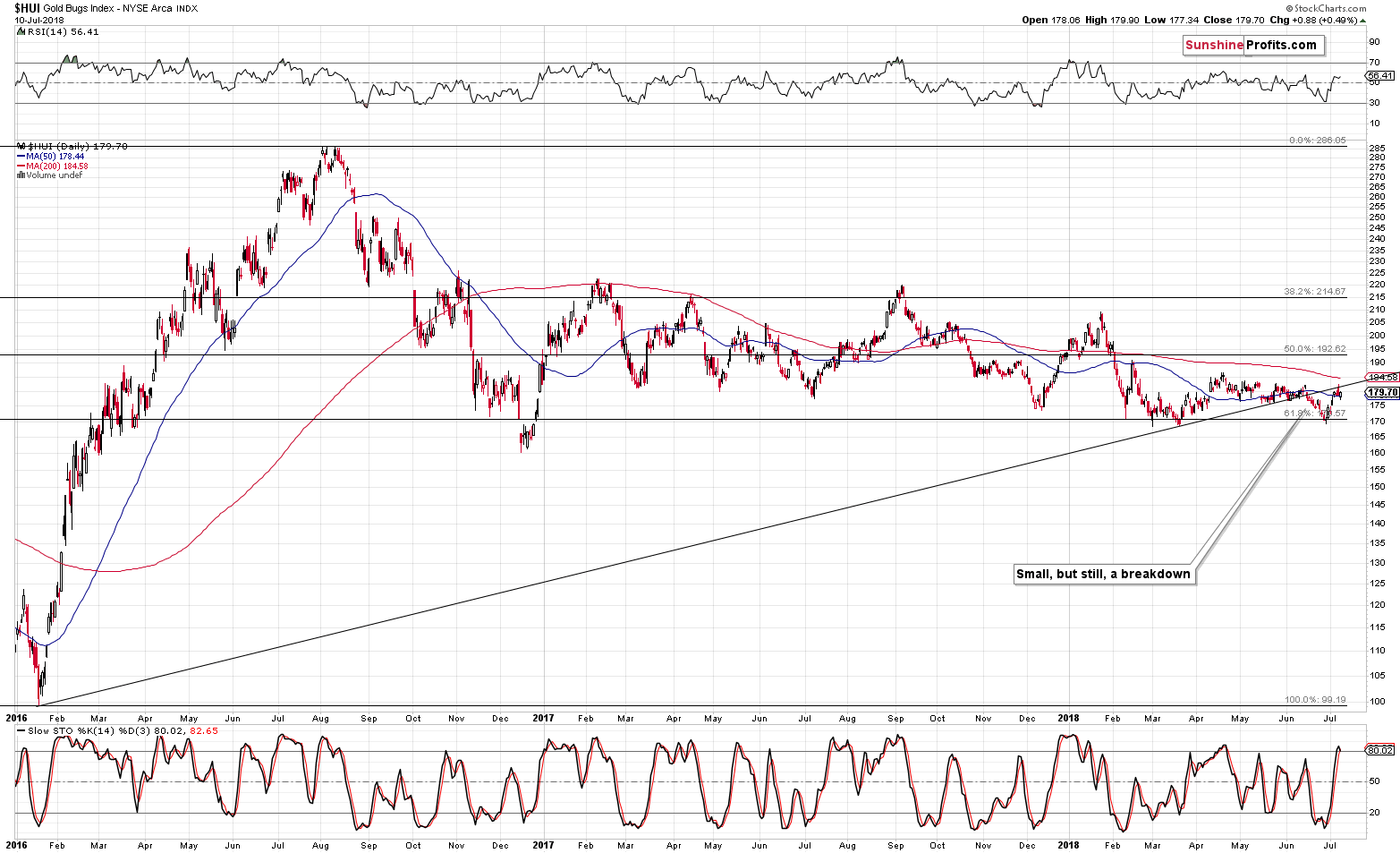

Gold Stocks and their Ratio with Gold

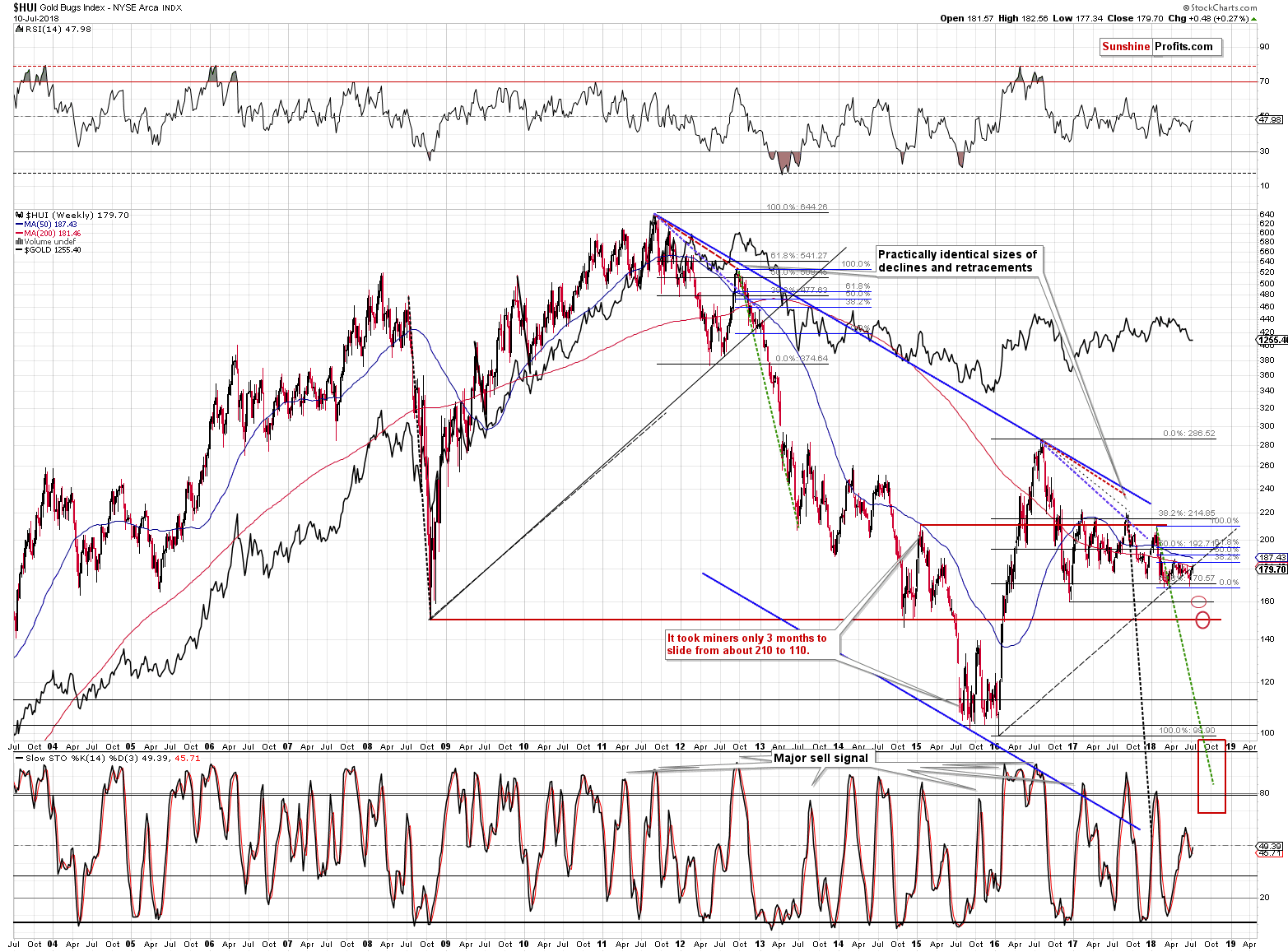

The HUI Index just moved to its June high and – more importantly – to its rising medium-term resistance line, below which it broke a few weeks ago. From the technical point of view, the breakdown was simply verified – the above chart (on its own) has no bullish implications. It has bearish ones.

After the breakdown, the rising line became a natural price target for a short-term rally and it was just reached. Combined with the previously mentioned underperformance in the miners relative to gold it seems quite toppy.

But wait, there’s more.

Remember the key breakdown that we saw earlier this year? Gold stocks to gold ratio broke below the long-term support created by the late-2016 low, which was a very important sign pointing to a medium-term decline in the precious metals market.

This breakdown was just verified as the ratio just moved back to the late-2016 low, tried to move above it, and failed. The long-term signals, support lines, breakdowns etc. are more important than the short-term ones, so the above is an important issue.

The implications are bearish for the entire precious metals sector in general. The above indicates that the days of gold stocks outperformance relative to gold are over and that we saw an important turnaround in the PM market in general.

Combining all the three above-mentioned mining-stock-based factors creates a quite strong bearish case for the PMs on its own and these are not the only bearish factors that are currently in play, not to mention the multiple medium-term factors pointing to lower PM values.

Before summarizing, we would like to discuss why we set the target for the GDX at its late-2016 low.

The reason is that besides this year’s low, it’s the first reasonable support that we have from the long-term point of view. Since mining stocks are likely in a medium-term decline, then we can expect the support levels of medium-term significance to trigger turnarounds – the short-term support level will likely not be able to do this.

Also, if the entire precious metals market is about to slide much lower – and that remains likely – then we should expect a significant acceleration in the metals’ and miners’ decline. Therefore, miners should drop lower than just to this year’s low. The nearest support level that fits all the above is the late-2016 low.

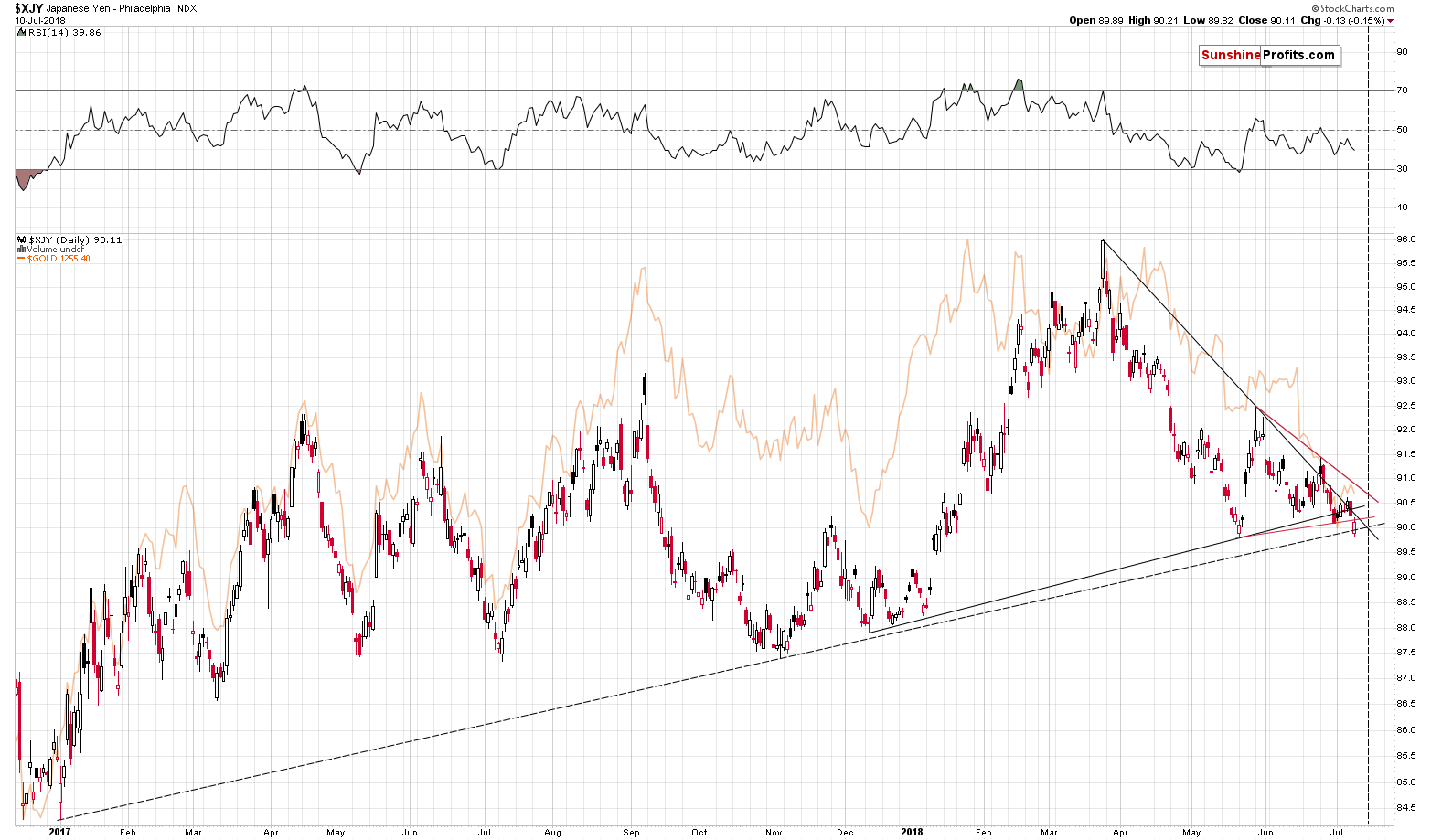

Also, in yesterday’s analysis, we discussed the situation in the Japanese yen.

As we discussed yesterday, the price of gold quite often moves in tune with the Japanese yen. The latter just broke below several support levels, which has very bearish implications going forward. When we posted our yesterday’s analysis, the breakdowns were not confirmed. Based on the closing prices, we know that there was finally no breakdown below the rising medium-term support line, but there was a breakdown below the triangle marked in red. Therefore, the outlook and thus the implications for the PMs deteriorated anyway.

Moreover, the Japanese yen is down once again in today’s pre-market trading, suggesting that we may see a breakdown below the rising medium-term support line shortly.

Summary

Summing up, due to several developments, the outlook for the precious metals market in the short term is no longer bullish, but bearish. The mining stocks’ underperformance on Monday, the HUI reaching its target, the HUI to gold ratio at a critical resistance, the relative strength of gold vs. the USD, the partial breakdown in the Japanese yen all point to lower precious metals prices. The overall outlook is already bearish enough to justify a short position. We will likely increase the size of this position once we get more bearish confirmations, but we are not doing so at this time.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (100% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,142; stop-loss: $1,272; initial target price for the DGLD ETN: $63.96; stop-loss for the DGLD ETN $46.38

- Silver: initial target price: $14.42; stop-loss: $16.46; initial target price for the DSLV ETN: $32.97; stop-loss for the DSLV ETN $24.07

- Mining stocks (price levels for the GDX ETF): initial target price: $19.12; stop-loss: $23.64; initial target price for the DUST ETF: $37.97; stop-loss for the DUST ETF $20.87

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $28.10; stop-loss: $34.82

- JDST ETF: initial target price: $74.83 stop-loss: $42.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

They say that the fortune favors the bold, but “they” clearly have never tried making money while trading the forex market. “Nobody ever got broke by taking profits” seems more reasonable as far as sayings go, but the truth is that in the end it’s always the risk to reward that decides whether a given position should be held or not and deviating from it is costly sooner or later. The situations in the EUR/USD and USD/CAD pairs were just very favorable, but they are now only somewhat favorable and exercising the above key rule seems appropriate. This is a profitable execution.

USD/CAD - The Good, The Bad and… The Profit

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold prices fall as dollar gains vs yuan in escalating trade war

Rand Refinery, South African Mint introduce 1 oz silver Krugerrand

Wage Talks Begin in South Africa's Shrinking Gold Industry

=====

In other news:

Stocks, metals hit by new U.S. trade war salvo

China says will hit back after U.S. proposes fresh tariffs on $200 billion in goods

Mobius Says Trade War Is Just a Warm-Up Act for Financial Crisis

Trump’s Tariff Barrage Pushes China Fight to Point of No Return

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts