Gold price moved higher as the Fed now expects to cut rates by 0.75% next year, and while the immediate-term reaction was bullish, let’s keep in mind that the implications for the following days don’t have to be bullish. There are two important reasons for it.

The first is technical.

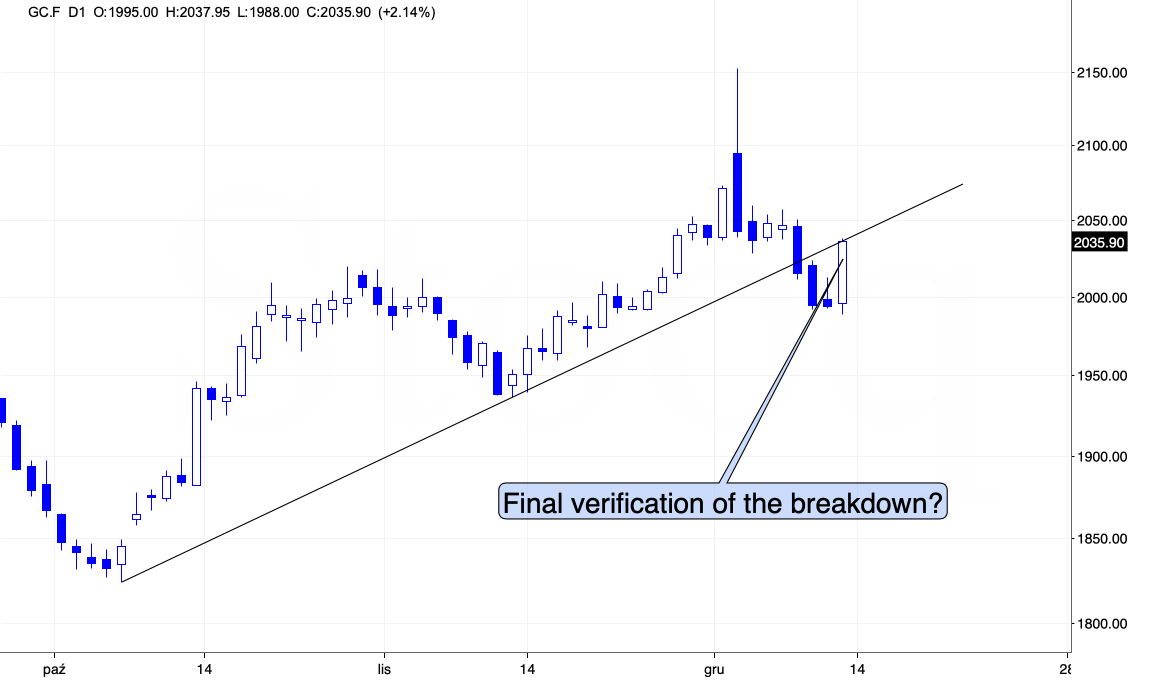

Gold didn’t invalidate the breakdown below the rising support line – it simply moved to it. Therefore, the breakdown is now being verified. Consequently, today’s rally is not really a big deal, so far it’s just a regular thing that happens after breakdowns.

The second is fundamental, and we already wrote about it in Friday’s Gold Trading Alert. Quoting:

Debunking Rate-Cut Optimism

The recent narrative uplifting stocks and the PMs is the belief that a pivot is bullish. Conversely, pivots are not bullish, and risk assets often crash when they realize why rate cuts are occurring.

Please see below:

To explain, the blue line above tracks the S&P 500, while the green line tracks the federal funds rate (FFR). If you analyze the horizontal gray lines, you can see that the last three times the Fed cut the FFR, the S&P 500 was already sinking or was approaching a cliff.

Therefore, while it may seem like new highs are inevitable for all assets, the recent optimism is more of a ‘buy the rumor, sell the news’ type trade. In other words, investors will likely bail on the S&P 500 and the GDXJ ETF when the Fed actually cuts rates. To that point, with oil prices resuming their crash, it’s a bad look for global growth when crude oil falls below $70.

Overall, the fundamentals continue to unfold as expected, with higher rates weighing heavily on the U.S. economy. And while the ‘bad news is good news’ trade remains intact, history shows it should end with sharp drawdowns of the S&P 500 and the GDXJ ETF, and a meaningful rise in the USD Index.

Again, the immediate-term reaction is one thing, as people reacted emotionally to more dovish approach. We also saw an immediate-term rally in 2019, but then a decline materialized, anyway.

So, no, the current move higher doesn’t change the outlook. The big move is still likely to be to the downside. I know that it might be difficult to think so while gold jumped over $30, but this really is the case. Remember how difficult it was to doubt gold’s breakout to new highs? On Dec 4, 2023, I wrote that the breakout is likely to be invalidated and followed by a massive slide. I started that day’s analysis with the following sentence:

“During sharp rallies, it’s nearly impossible to convince investors that this move is about to end. And yet, that’s exactly what is likely.”

That was the top.

And this sentence applies also today. The breakdown below the rising support line in gold was not invalidated and the next big move is likely to be to the downside.

I’ll write more in tomorrow’s Gold Trading Alert.

As always, we’ll keep you - our subscribers - informed.

===

As we’re on a streak of 11 profitable (closed, unleveraged) trades, and – just like I wrote today and in the previous days – it looks like we’re going to see much more of them in the near future, I want to provide you with even more great news!

We’re opening the possibility to extend your subscription for up to three years (at least by one year) with a 10% discount from the current prices.

Locking in those is a great idea not only because it’s perfect time to be ready for what’s next in the precious metals market, but also because the inflation might persist longer than expected and prices of everything (including our subscriptions) are going to go up in the future as well. Please reach out to our support – they will be happy to assist you and make sure that your subscription days are properly extended at those promotional terms. So, for how many years would you like to lock-in your subscription?

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief