Gold, silver, and mining stocks (and other stocks) just moved higher while the USD Index moved lower on lower CPI data. That’s a fact. But what does it change going forward?

Does it change the outlook?

It doesn’t.

Why? For the same reason why higher inflation numbers were bullish for gold. Lower inflation numbers are bearish for gold. Market’s very initial responses are usually emotional and not logical. This time, it’s quite likely that the market participants think something along the lines of “the inflation is down so the Fed will now cut rates”.

It might make some sense, but the reality is that it’s a bunch of “maybes”.

The reality is also that since the rates are where they were and inflation is lower (and people might expect inflation to move lower), the real interest rates actually moved higher. After all real rates = nominal rates - expected inflation rates.

And real rates are one of the two key fundamental drivers of gold prices – and they are inversely correlated. So, what happened, was actually bearish for gold!

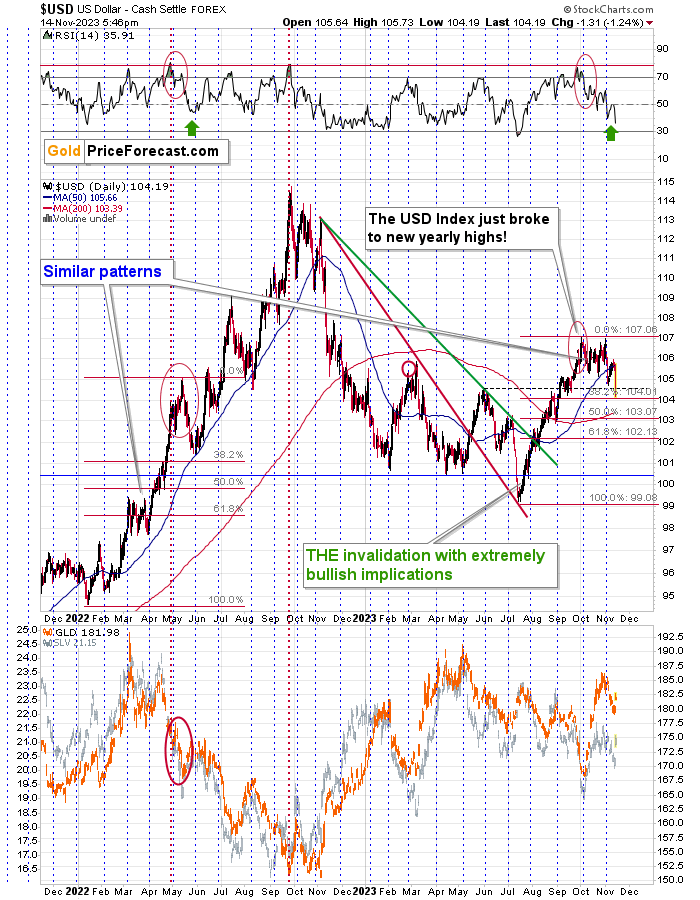

The other key fundamental driver is the USD Index. The USDX plunged today, and it seems that the market overreacted to the news by a huge margin.

The USDX moved to the 104 level, which is slightly below its May highs, and right at its 38.2% Fibonacci retracement level.

This is a strong combination of support levels, and it’s quite likely enough to end the current correction. The corrective decline has probably just burnt itself out.

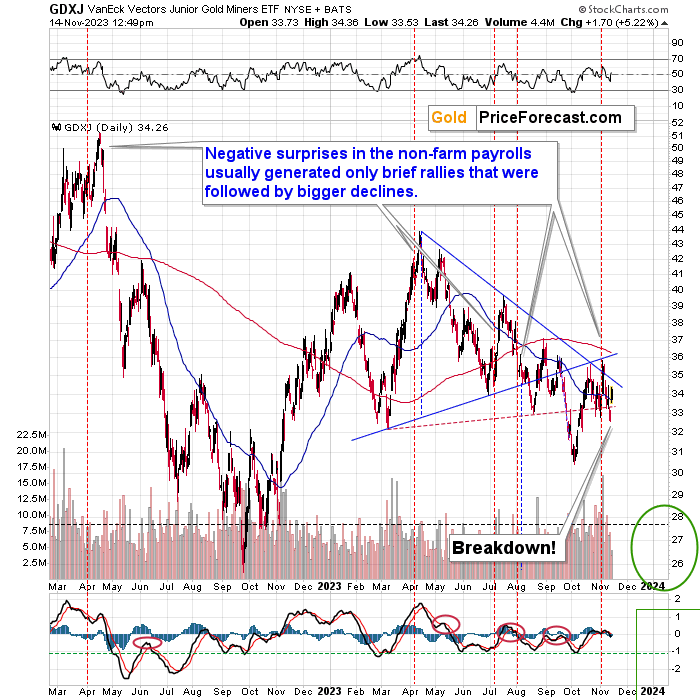

And the best part about all this? While the correction in the USDX appears to be over and the USDX seems ready to resume its medium-term uptrend… Our short position in the GDXJ remains profitable, as we entered it very close to the local high at about $35.20.

So, even this huge move lower in the USDX wasn’t able to make our positions unprofitable. The junior mining stocks are truly weak at this time, and it bodes extremely well for the future of this short position. Our profits are likely to increase substantially before the take them off the table.

As always, we’ll keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief