Briefly: In our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

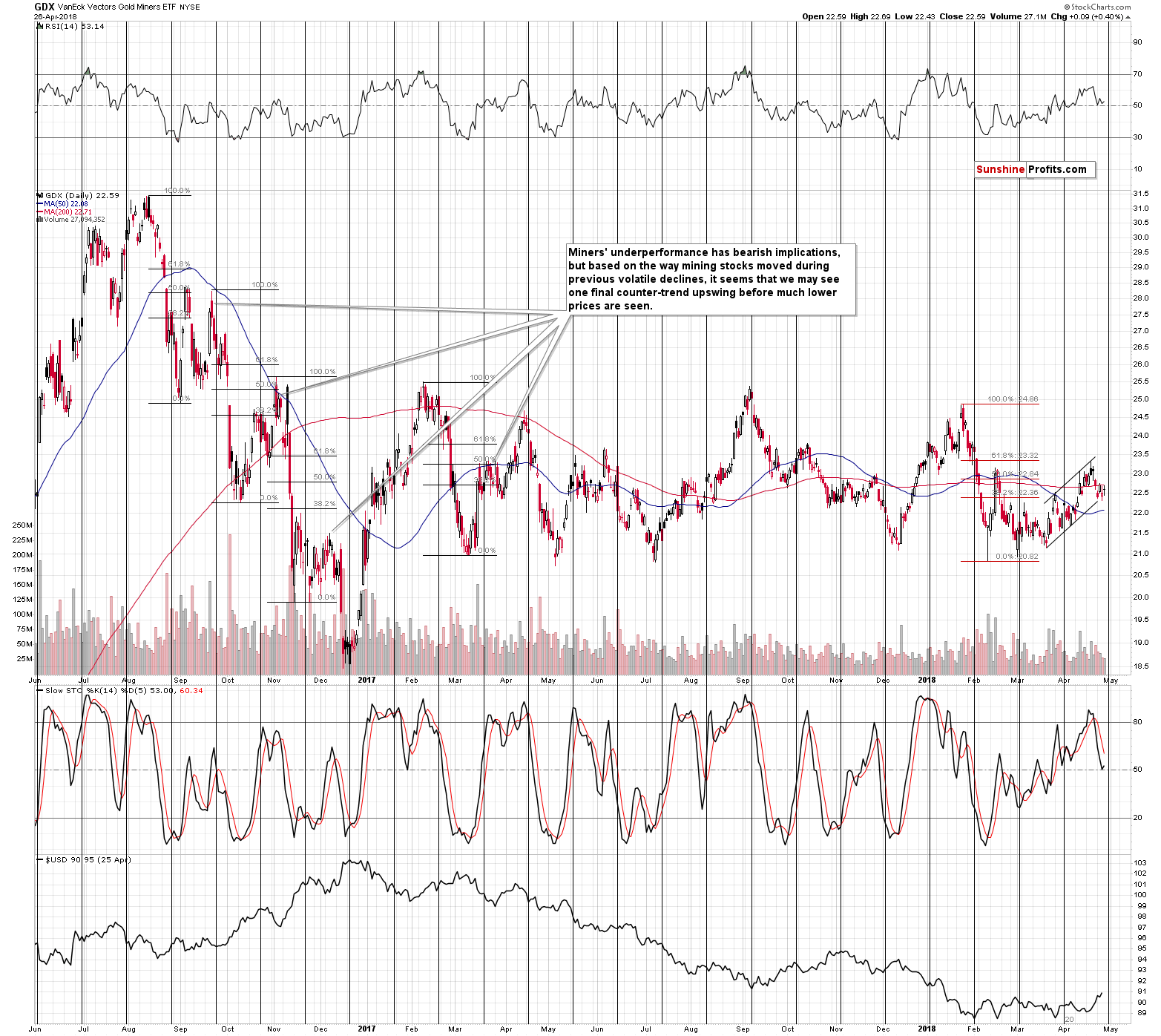

In the previous alerts we wrote about the mining stocks’ strength and why it was not really important because it was just a very short-term event. But during yesterday’s session we saw the mining stocks’ strength once again and it was more profound than what we had seen previously. Namely, miners closed the day higher even though gold and silver closed it lower. What does it mean? Should we prepare for a rally?

In short, yes. It might seem surprising given that we think that the outlook for gold and silver for the following weeks is bearish, but it does appear likely that we’ll see an interim pause or even a rally before the rally continues.

We previously wrote that we were expecting a temporary correction at the end of April or in early May and this remains up-to-date. The mining stocks’ relative strength simply seems to confirm this scenario, indicating that the time for the temporary turnaround is getting closer.

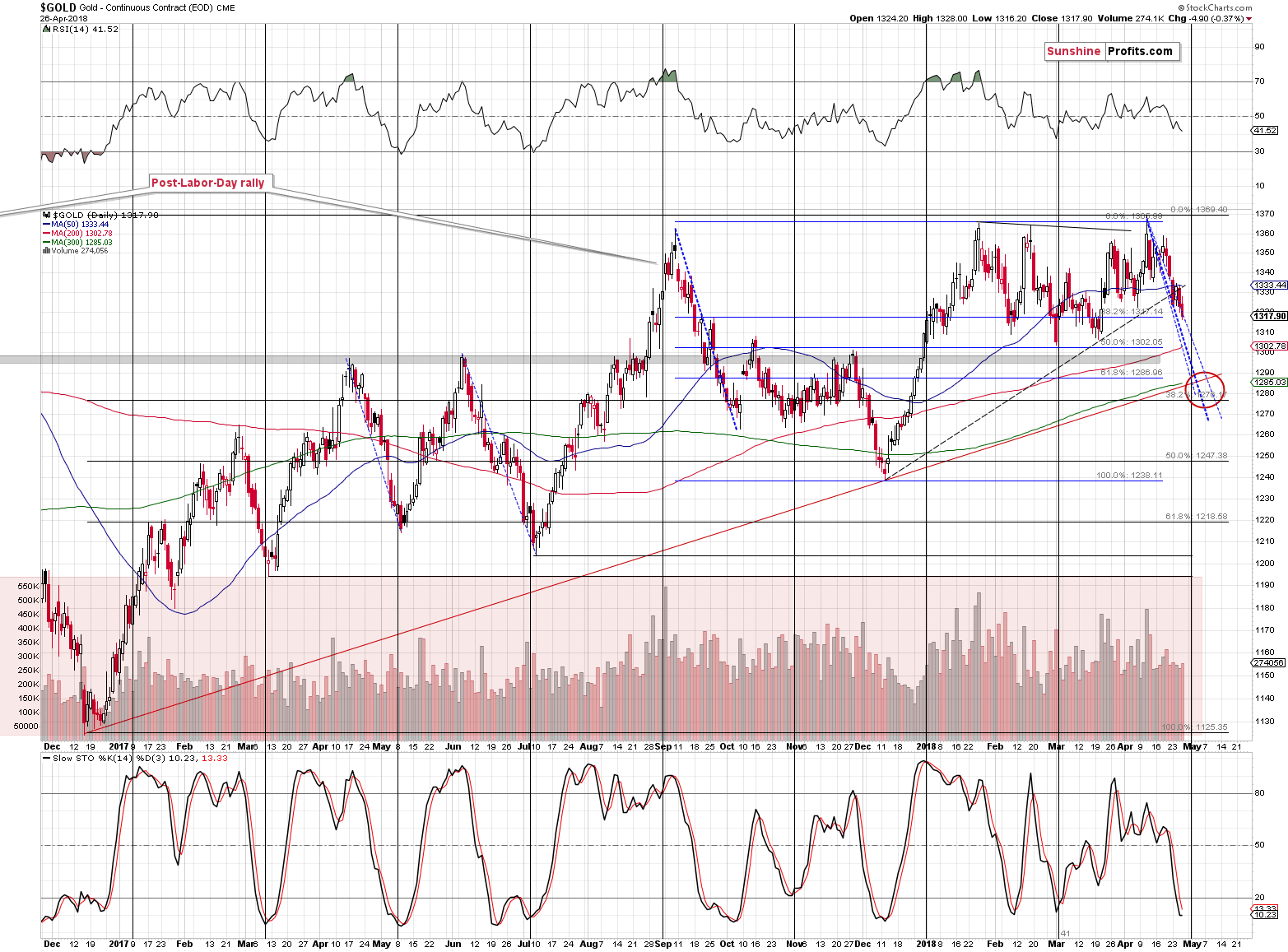

In fact, it could be as early as on Monday and there are several techniques that point to it. Let’s take a closer look for details (chart courtesy of http://stockcharts.com).

Both gold and mining stocks have cyclical turning points nearby and the most recent move was definitely down. The strength that we saw recently in the miners is a reason to expect a corrective upswing, but it doesn’t give a definite reversal signal. The turning points are just around the corner, but they are not very precise.

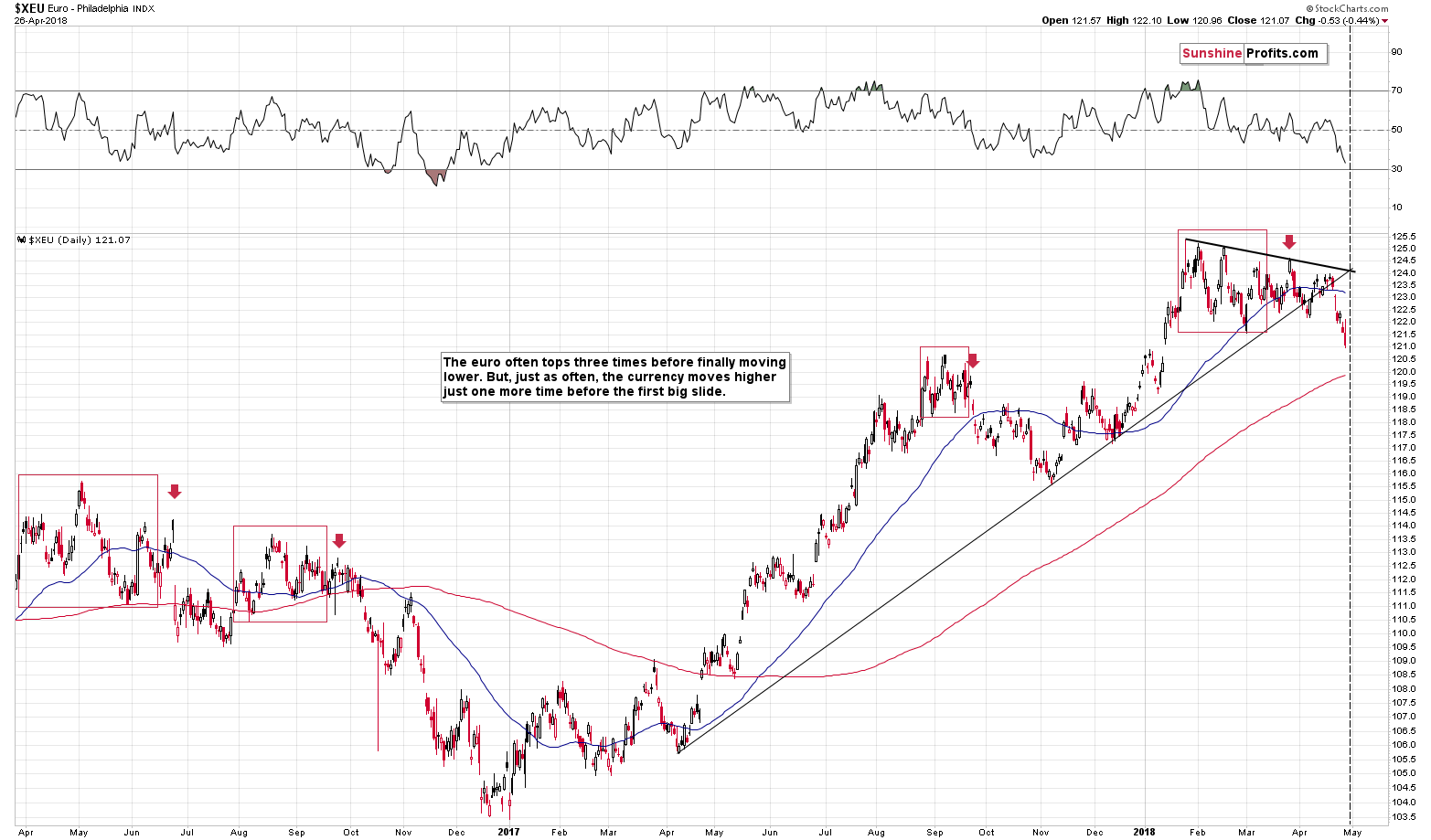

However, the apex-based-triangle reversal in the euro is.

The European currency moved sharply lower after the breakdown below the rising medium-term resistance line (and the medium-term outlook is bearish), but let’s not forget that no market can move up or down in a straight line and the euro will also correct. The apex of the triangle is on Monday and since it’s quite likely that the currencies and the metals will turn around at the same time, it makes a turnaround for the latter also likely to be seen on Monday.

It’s tempting to close the short position right away, but we finally decided not to do so, because after all gold hasn’t moved to any important support level just yet. The rising medium-term support line in the case of the yellow metal is at about $1,285, which is considerably below yesterday’s closing price. Therefore, we’ re likely to see a powerful slide to this level (or at least to $1,300) shortly and thus closing position now might be premature.

The same goes for silver – it didn’t move to any major support and thus it doesn’t seem that a rebound is likely from the current price levels. The temporary move higher seems to be looming but doesn’t seem to be starting just yet.

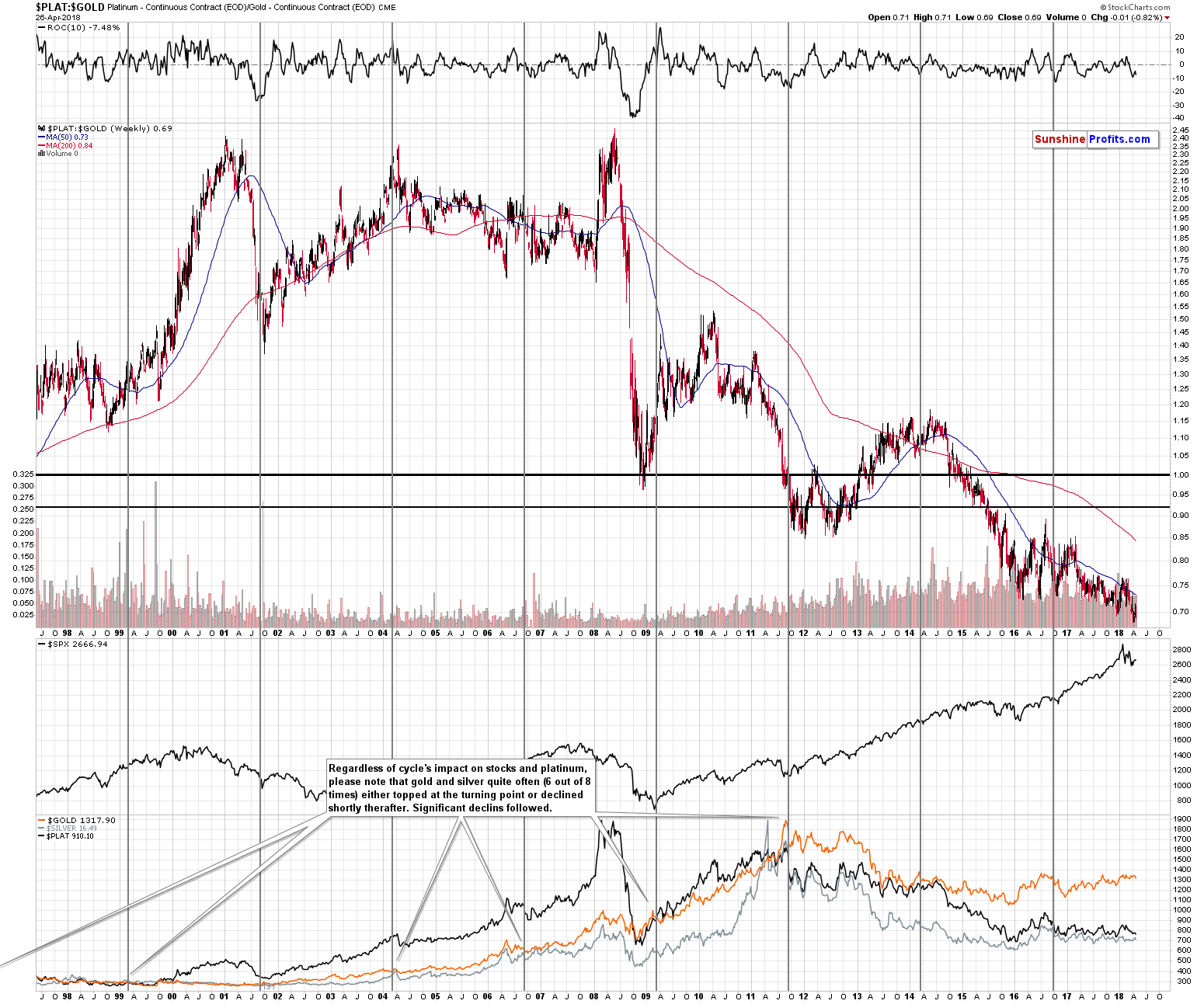

Gold vs. Platinum

Before summarizing, we would like to reply to a question that we received recently about platinum’s performance relative to gold:

At a 400$ discount to gold, the ratio is already very depressed so my questions are:

Is platinum undervalued or gold overvalued?

Can the ratio indeed go to 0.5?

The markets and ratios often tend to move back to their long-term averages as it is obvious that markets move from being overbought to being oversold and vice versa. Somewhere in the middle of these states, there should be an equilibrium, to which everything should move eventually. The above is true regarding the emotional part of investing, but it all assumes that the fundamentals stay the same, or at least that they don’t change in a meaningful way.

In the case of platinum, the fundamentals have indeed changed as the demand for this precious metal is likely to decline substantially in the future. The same destiny likely awaits palladium, but not as soon. We discussed this issue thoroughly in the past, but to make a long story short, platinum is heavily used in diesel cars, while palladium is heavily used in gasoline cars. The automotive market is moving away from diesel engines to gasoline engines (it may even be forbidden to drive into some European cities with diesel cars) and at the same time both diesel and gasoline engines are going to lose market share to electric cars. The shift will not happen overnight, but the trend is already visible. The markets are forward-looking, so the prices are already reacting to it.

The move from diesel to gasoline is the one that we’re seeing in a more profound way and we can say the same about the weak performance of platinum. Palladium was quite strong on a medium-term basis, but this is not likely to continue in the following years. Well, it could be quite strong relatively to platinum, but it’s not likely to outperform silver, for example.

Keeping the above in mind, let’s move back to the questions:

Is platinum undervalued or gold overvalued?

Neither of the above needs to be the case. Over- and undervaluation assumes no change in the fundamentals. It could be the case that the trend in the ratio simply reflects the change in the fundamental picture for platinum, which is deteriorating.

Can the ratio indeed go to 0.5?

Yes, it can go to this level as the demand for platinum is likely to decline in the future and investors are likely to sell it earlier, expecting it.

Summary

Summing up, the recent strength in mining stocks serves as a bullish indication, but it doesn’t seem that we have reached a bottom just yet. It’s likely that we’ll see it shortly based on the cyclical turning points and the apex-based-reversal, but since no major support levels were reached in gold and silver, it seems that the precious metals market will drop further before forming a bottom.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,382; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $37.68

- Silver: initial target price: $14.63; stop-loss: $18.06; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $19.27

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $23.54; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $21.46

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $36.14

- JDST ETF: initial target price: $94.88 stop-loss: $41.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Can gold be valued like other assets? Is it merely a speculation play? We invite you to read our today’s article about our investing philosophy to find out what gold really is – pricing or value game – and what are the investment implications of its nature. We’ll also explain how technical analysis of gold is justified from the fundamental point of view.

Gold: Pricing vs. Value and Fundamental Look on Technicals

Earnings season is in full swing. We will see earnings releases from Microsoft, Amazon, Intel today. Stocks sold off on Tuesday, but yesterday's trading session was pretty neutral. Is this a short-term bottoming pattern or just quick flat correction before another leg down? We may see some more uncertainty ahead of earnings releases and investors will continue to react to bonds yield changes. There are still two possible medium-term scenarios.

Probably Just an Upward Correction, but...

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold steady near 5-wk lows, heads for biggest weekly fall in 4

=====

In other news:

Two Koreas Agree to End War This Year, Pursue Denuclearization

Weak consumer spending seen restraining U.S. growth in first quarter

BOJ removes timeframe for price goal, keeps policy steady

The Brexit economy: looming rate rise clouds outlook as inflation dips

Bitcoin frenzy settles down as big players muscle into market

IBM's Blockchain Tech to Track Jewels From Mine to Retail Stores

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts