Briefly: In our opinion, full (150% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

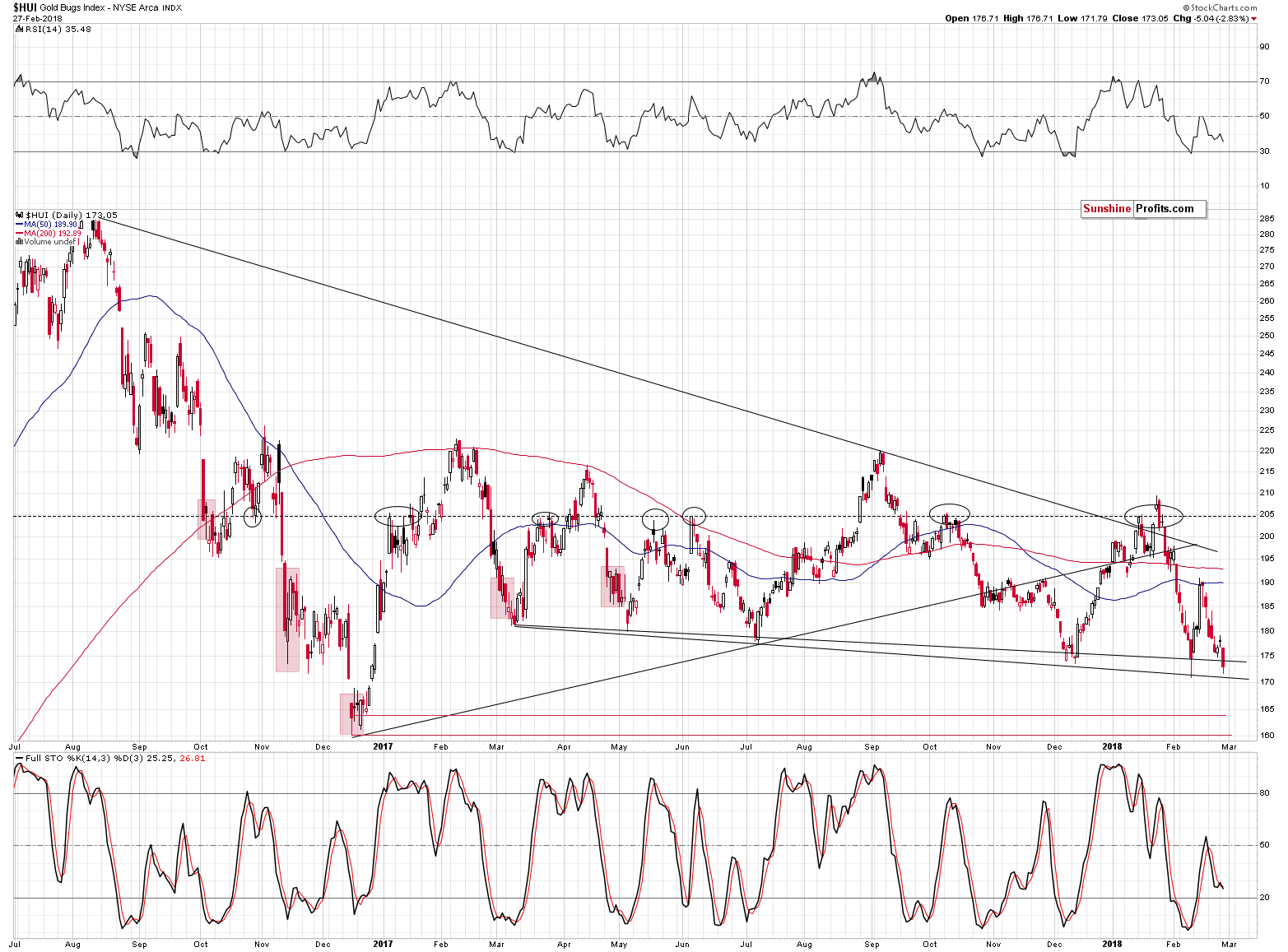

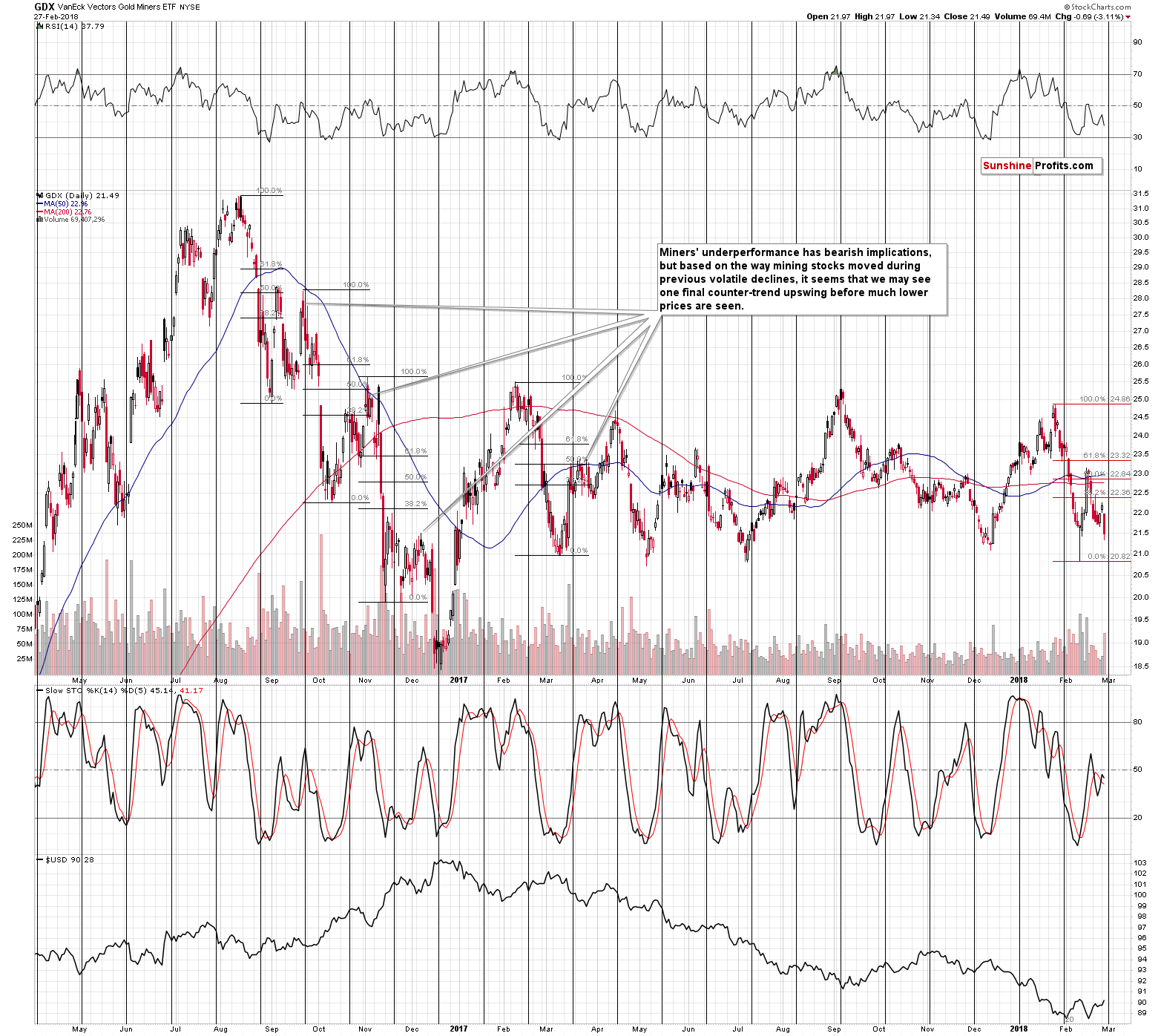

The HUI Index just closed below both 2017 and 2018 lows. The interpretations of many developments in the market are vague and subjective. But not major breakdowns. Gold miners just showed exceptional weakness by closing at new lows even though gold is still above $1,300 and the S&P corrected more than half of its recent sharp decline. Can anything save the precious metals sector from falling further?

Yes, but based on what happened yesterday, it seems that the golden Superman may have some trouble getting into the scene.

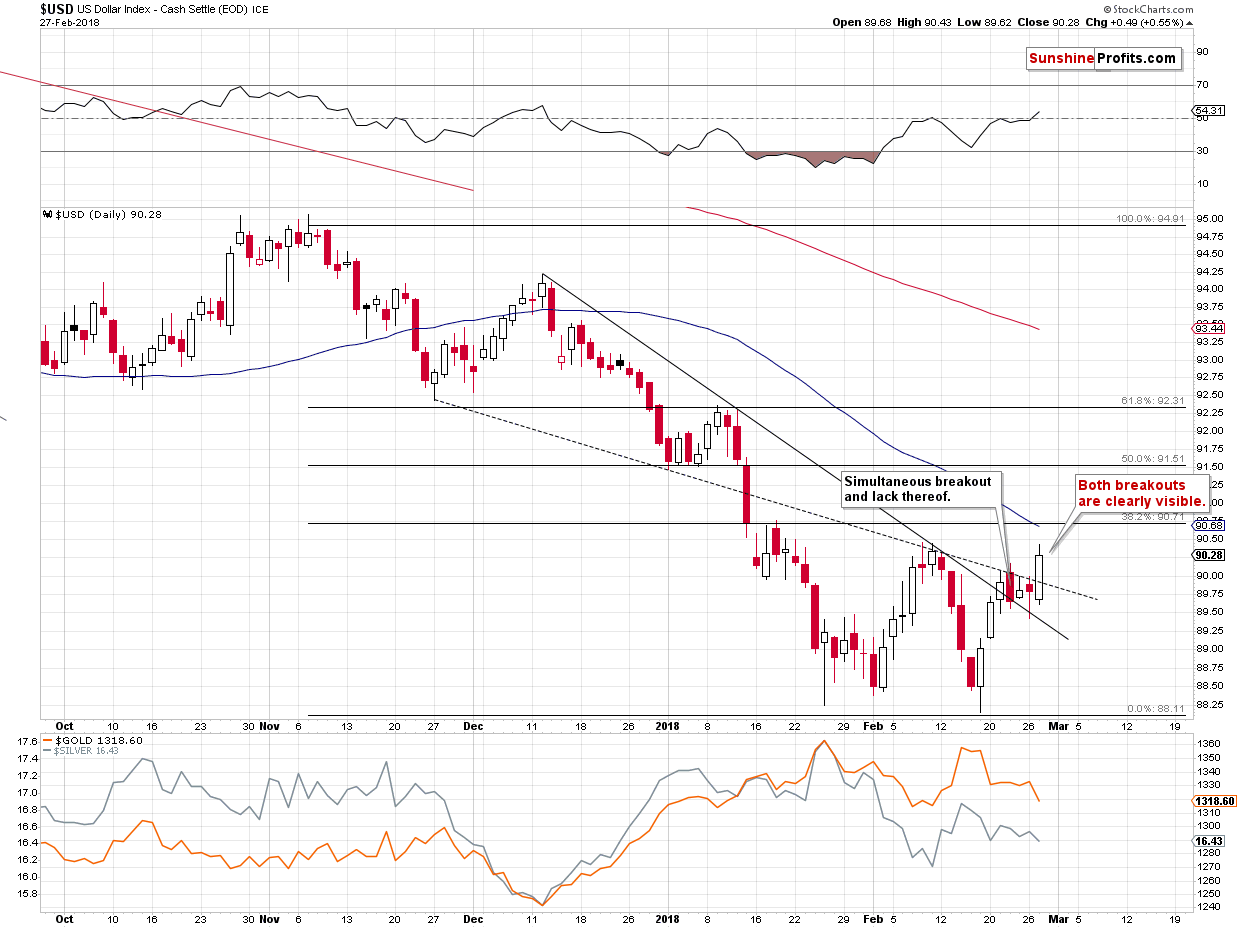

Another downturn in the USD Index would likely trigger a corrective upswing in gold and silver, which would in turn cause the prices of mining stocks to move higher. The “problem” here is that the USD has just invalidated the breakdown below the declining medium-term support line, which significantly lowered the odds for another short-term decline.

Let’s take a closer look at what happened, starting with the forex action (chart courtesy of http://stockcharts.com).

No More Megaphones for the USD

From the short-term point of view, it’s clear that the USD Index has broken above both declining short-term resistance lines. It hasn’t broken above the previous February high, but the implications of breakouts above the declining lines are already significantly bullish as they were two of the things that stopped the rally about 3 weeks ago.

The third – and most important – thing that stopped the previous attempt to move higher was the long-term declining resistance line based on the 2015 and 2016 lows. Both are important, so the line based on them is also important.

If a line is important, then a breakdown below it is also important, and the invalidation of the breakdown can be even more important. That’s what we saw during yesterday’s trading – the USD rallied above the mentioned resistance line, thus invalidating the previous breakdown.

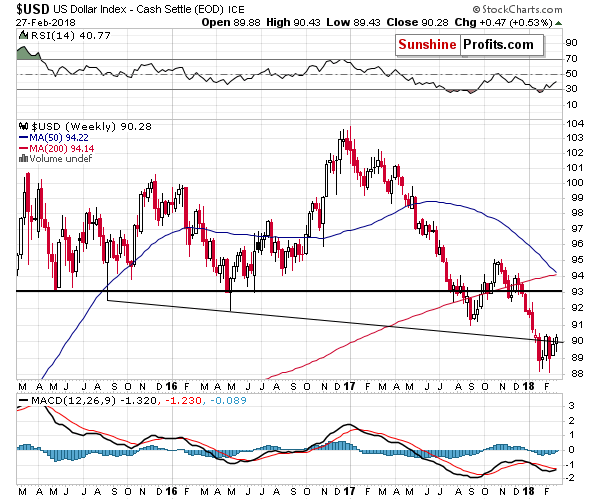

The implications are already bearish, but they will be much more bearish when we also see a breakout above the previous February high and at least two weekly closes above it. Since the previous move above this line was followed by new lows in the USD (in the following week), we are still a bit skeptical toward yesterday’s move. Still, overall, it was a bullish development and based on the short-term breakouts that we discussed earlier, this invalidation has a much bigger chance of being a true one.

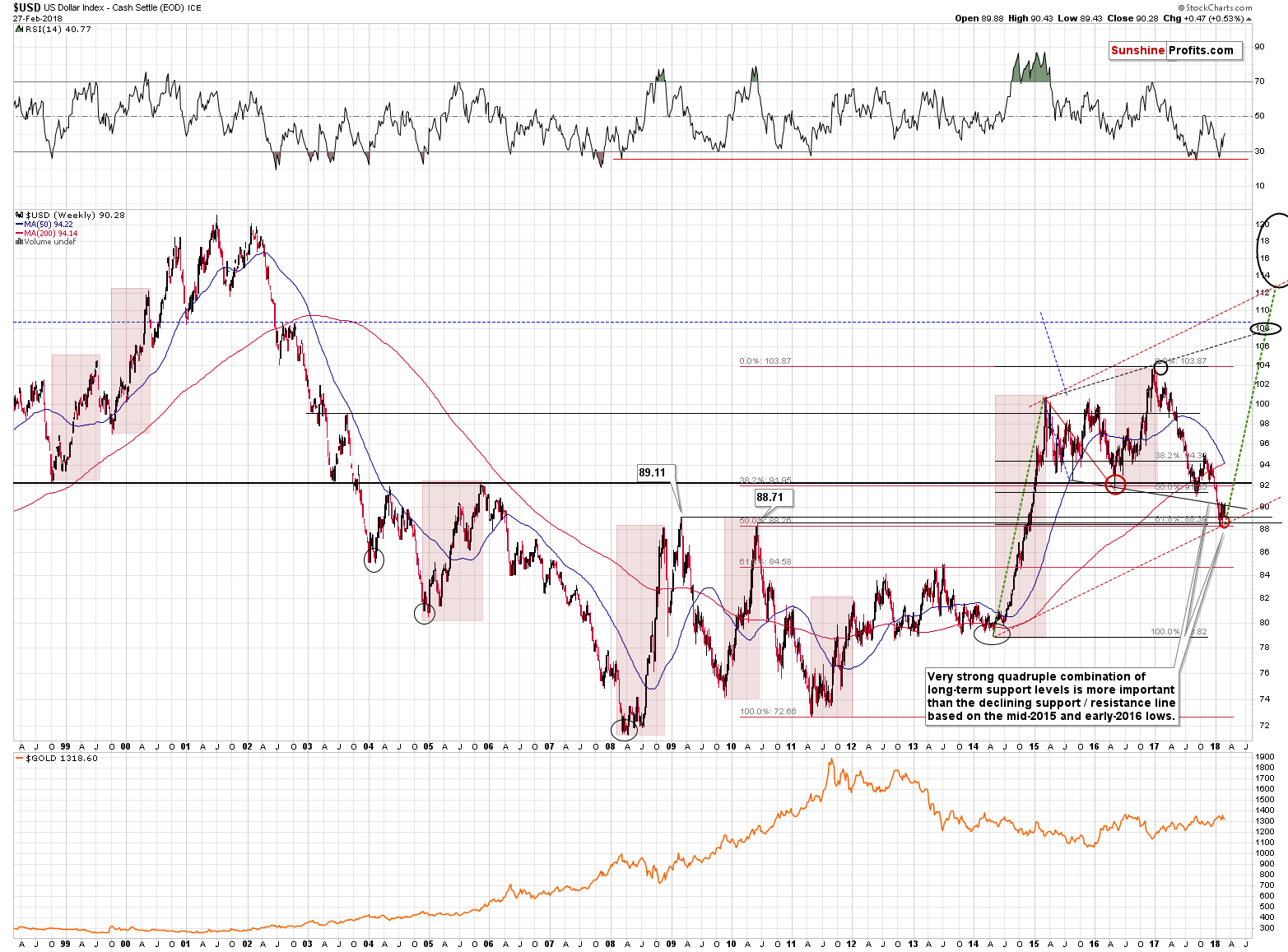

On the long-term chart you can see why we were very skeptical toward the possible long-term bearish implications of the previous breakdown below the mentioned declining support line. It’s because a much more important support was reached, and it held. Precisely, there was only a tiny breakdown below the combination of support levels and it was invalidated immediately.

The key mentioned support levels that held are the 2009 and 2010 tops along with 2 major retracements based on major extremes (marked with red and black on the above chart). The above combination is much stronger than the previously discussed declining line. The reason is that the mid-2015 and 2016 lows are less prominent than the 2009 and 2010 tops and the line based on the former is not strengthened by key Fibonacci retracements, while the latter is.

Consequently, the invalidation of breakdowns below the key, long-term support levels is far more important than the declining shorter-term line.

The above has been the reason for one to expect the move back above the declining resistance line. Yesterday’s session proved that the above expectation was correct. Moreover, thanks to the simultaneous breakout above the declining short-term resistance lines, the odds are that rallies will follow.

Also, the above chart explains the title of this section. The mentioned declining resistance line based on the 2015 and 2016 lows, along with the rising dashed line based on the 2015 and 2017 tops create an expanding triangle pattern that is sometimes referred to as a megaphone pattern.

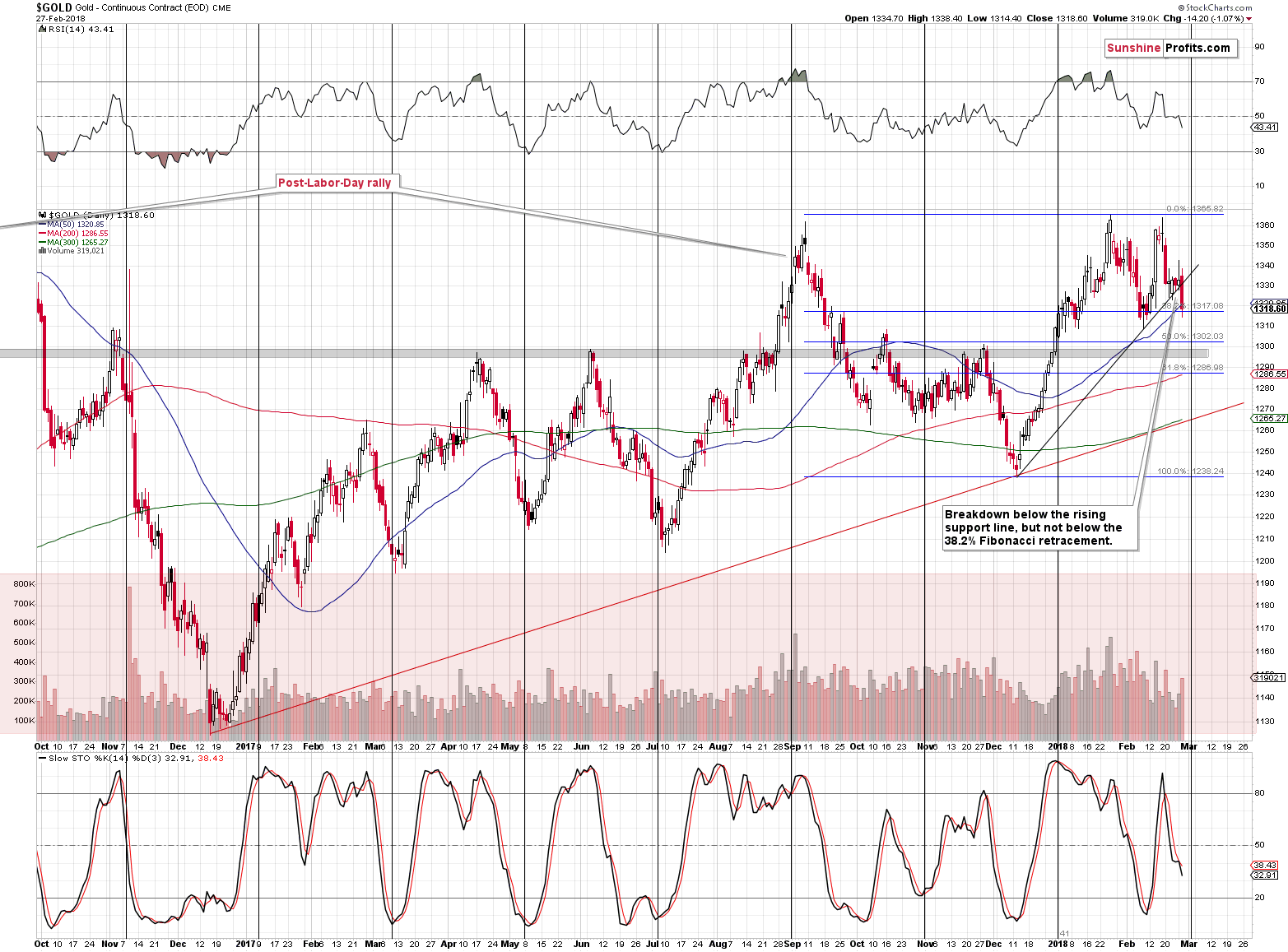

The Golden Breakdown

Just as the USD Index moved close to its previous highs, the price of gold moved to its previous lows. It also broke below the rising support line based on the previous short-term lows. Gold is at its 38.2% Fibonacci retracement, which is an important short-term support level. The previous breakdown below it was invalidated and followed by an upswing, so gold could still move temporarily higher.

Still, if silver is to outperform gold and the former is to move close to its recent short-term high, then gold should not move as high. The volume that accompanied Monday’s move higher was rather low, which suggests that the strength of the bulls is limited. It fits the scenario in which gold moves higher for a few days (to gold’s cyclical turning point which is marked with a vertical line) or a week and a few days and then starts a big slide.

Again, there are multiple long-term factors in play that favor lower gold prices and they could trigger a decline regardless of the short-term signals – the surprises can and are likely to be to the downside.

Consequently, the medium-term outlook remains bearish, but just as we are skeptical regarding the USD’s breakout, we are still skeptical regarding gold’s short-term breakdown below the rising support line. Yes, it’s bearish, but we will not be surprised by another attempt to move higher before the big slide starts.

The latter is certainly possible in light of silver’s self-similar pattern.

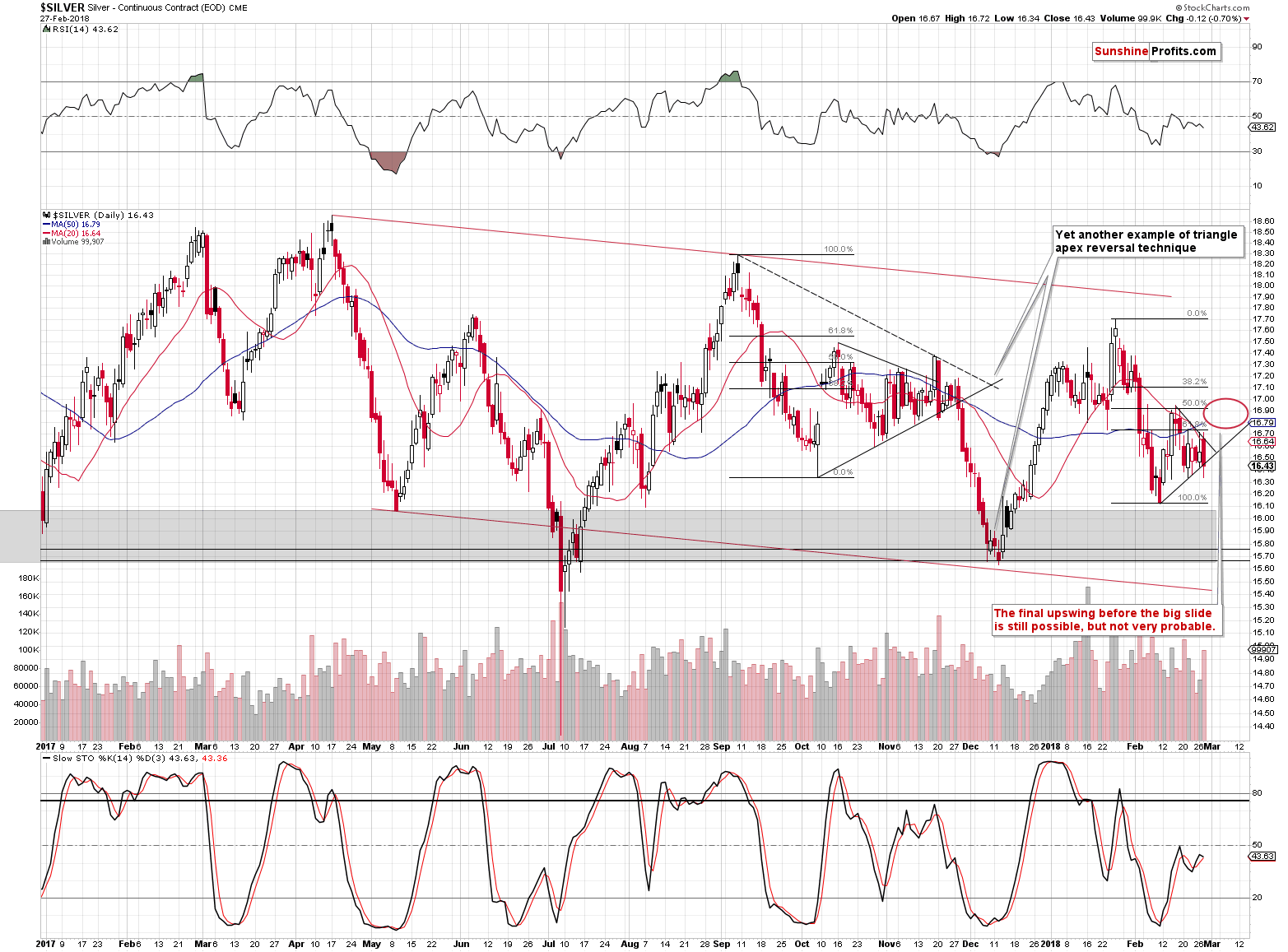

Silver’s Self-similarity

In short, everything that we wrote yesterday regarding the above silver chart remains up-to-date as silver seems to be repeating its performance from the second half of the previous year:

The January 2018 – February 2018 decline is a quicker version of the September – October 2017 downswing. The subsequent corrections are very similar – in both cases, silver moved a bit above the 50% Fibonacci retracement, but not above the 61.8% one. The following decline erased most of the correction. Then, back and forth trading started where intraday highs were not as high as the highest intraday price of the preceding corrective upswing. The intraday lows of subsequent sessions were increasing.

The initial corrective upswing also took silver above both moving averages: the 20- and 50-day one. Then, the back and forth trading took place around the red moving average, but below the blue one. That’s what happened yesterday – silver moved a bit above the red MA, but not above the blue one.

Having established the self-similarity, let’s see how we can use it.

We can use to determine the next turning point and the trading opportunity. In this particular case, we see that the final top and the superb opportunity to go short presented itself in mid-November, when silver rallied above the declining resistance line based on the previous intraday highs and visibly above the blue (50-day) moving average.

It took a bit more time for silver to rally in November 2017 than it did for it to decline in October, so in this case, we can expect silver to take a bit more time to rally than it did to decline in the second half of February.

Combining the above price and time analogies, we get the target that we marked with a red ellipse on the above chart. The target is quite wide and there are good reasons for it. Back in November, silver topped below the previous top, but silver is known to get ahead of itself during these intraday outperformance cases, so we’re not ruling out a scenario in which it “breaks out” above the mid-February top only to invalidate the “breakout” shortly thereafter.

As far as time is concerned, please recall that in yesterday’s alert we thoroughly discussed the apex triangle reversal technique for gold and it pointed to two scenarios: one in which the top is already in and a second one in which the top is going to be in in about two weeks (a bit less, counting from today). Moreover, gold’s cyclical turning point is just a few days away, so it could be the case that it triggers silver’s rally and the subsequent reversal. Overall, it’s rather unclear when precisely the silver reversal will take place, but we know more or less when to expect it and we know what signs to look for as a confirmation (silver’s breakouts above the declining, short-term resistance line and the 50-day moving average).

Speaking of apex-triangle-based reversals, please note that the above chart shows yet another confirmation of this technique’s usefulness. The triangle based on the October and November 2017 lows (solid line) and the September and November 2017 tops (dashed line) had their apexes exactly at the time when one would want to reverse their short positions or close them. Perhaps applying this technique to the upcoming decline will serve as a way to detect a short-term reversal as well.

Silver moved a bit below the rising short-term support line, but closed right at it, without a meaningful breakdown. The volume that accompanied it was significant, which is bearish, but please note that since the back-and-forth movement in silver still continues and the self-similar pattern remains in place, we should still take into account the possibility of a quick upswing right before the slide.

Gold Stocks’ Breakdown

Gold miners declined substantially yesterday and closed at new 2018 lows, which means that they also broke below the previous 2017 lows. There was no new intraday low, but the closing prices are more important with regard to breakdowns below important price levels.

More importantly, this time, the breakdown was not triggered by a huge and volatile decline in main stock indices. The S&P Index is above the 50% Fibonacci retracement based on the decline, so it’s definitely not moving to new lows. Therefore, the gold stocks’ performance represents true weakness of the PM sector.

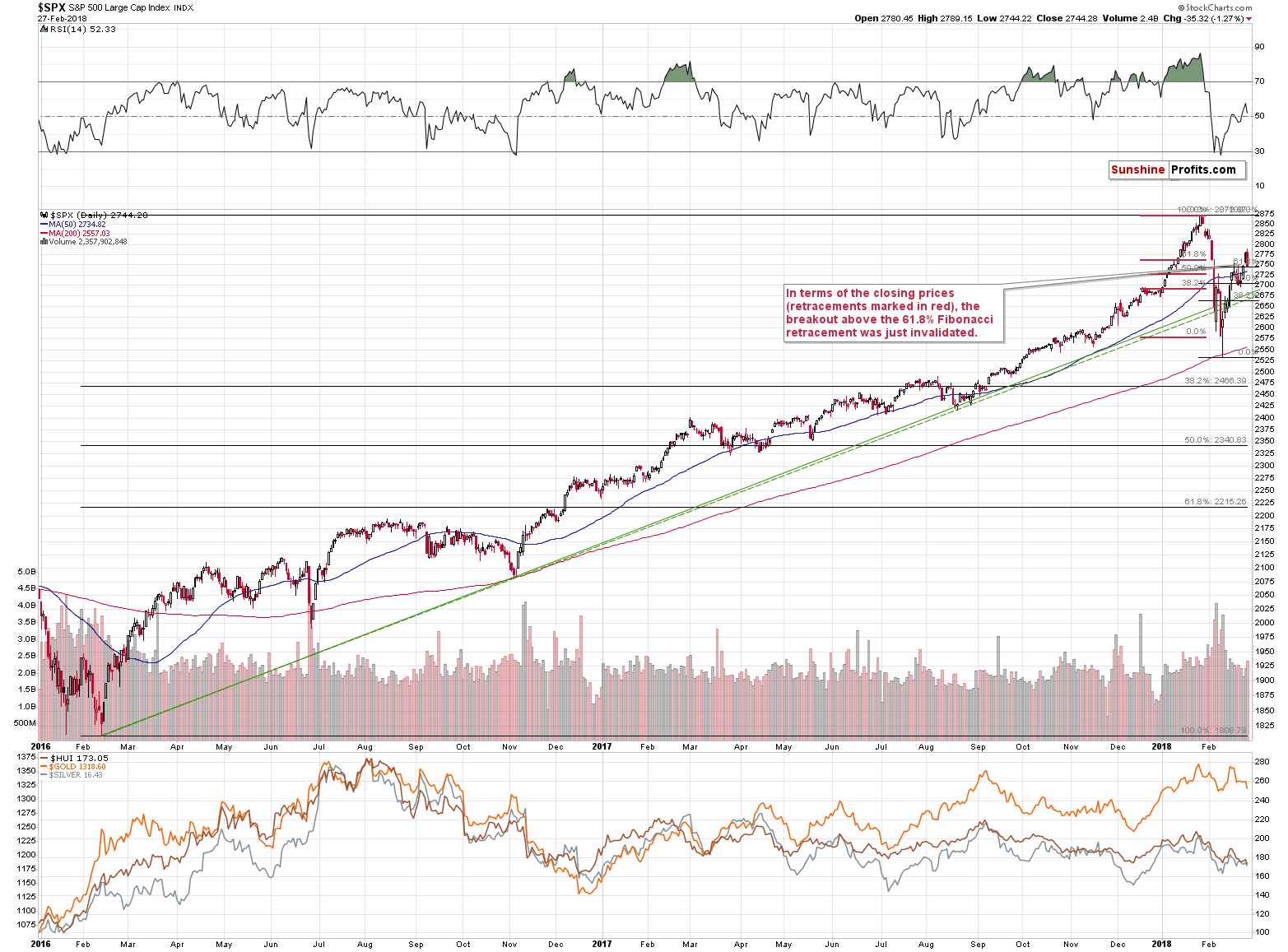

By the way, the S&P 500 Index just invalidated the breakout above the 61.8% Fibonacci retracement level based on the daily closing prices, so we might (!) see another slide lower.

Moving back to mining stocks, the breakdown below the previous 2017 and 2018 lows is not yet confirmed as that was just one daily close, but in light of the long-term breakdowns in the gold stocks to gold and gold stocks to S&P ratios, it seems that bearish outlook is definitely justified.

But, does the above rule out the possibility of seeing another move higher before the big slide in the miners begins? It’s definitely less likely than it was before yesterday’s session, but it’s still possible.

As a reminder, during the previous volatile declines, gold and silver mining stocks quite often corrected twice before another big wave down started. Is this time any different? It could be the case based on the mentioned breakdowns in the ratios, but it’s not certain.

While we’re at it, we would like to provide you with a reply to a question that we received about using the RSI to time the upcoming bottom in the GDX. Our price targets may (and it even seems likely) correspond to the RSI below 30, so the question is if the targets are not too low. Here’s our take.

It seems that we have entered the stage in the precious metals market where aggressive downside targets for mining stocks are justified. The reasons are the key breakdowns in the HUI to gold and the HUI to S&P ratios that you saw in Monday’s alert. Based on them we should expect a lot of negativity from mining stocks in the coming weeks and months. The RSI around (!) 30 is a bullish factor, but please keep in mind that targets based on prices are more precise than those that are based on the RSI.

For instance, about a year ago, on March 2nd, the RSI for GDX was at about 32 when GDX closed at 21.75. It was relatively close to the bottom, but the true bottom formed only once RSI moved below 30 in the following days. On March 9, the closing price was 20.97 - about 4% lower. In August 2016, the RSI-around-32 bottom was $26.68, and the real bottom was several days later with RSI below 30 and GDX at $25.21 (closing price). About 6% lower.

The key thing, however, is what happened during the 2013 decline - as that’s what we think is likely to be seen once again. In late January 2013, the RSI around 30 served as a good buy signal but only for the immediate future. In fact, for many investors, it would have been better to stay short at that time. Most subsequent bottoms were formed with the RSI at or below 25 and exiting positions with the RSI at 30 would have been very premature.

Concluding, the RSI may not be as effective in the next several months as it was in the past 2 years or so. Even if it is, bottoms may form with the indicator a bit below 30, instead of being a bit above it. Consequently, it seems better to look at the price levels based on support lines, retracements and other techniques than to put huge weight to the RSI’s indication. It’s still going to be important, but not to the extent it used to.

Little-known Confirmation from Palladium

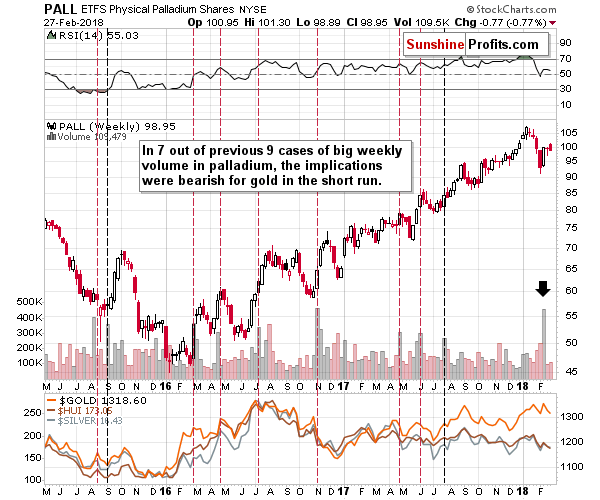

Some signs, like breakouts and breakdowns are clearly visible, but some are known only to those who have been in the market for a long time and have taken the time to analyze it thoroughly. One of the latter sings comes from the palladium market.

The less-popular white metal provides us with important short- and medium-term signals, but only if one knows where to look. The volume that accompanies the weekly upswing is the thing that can help us determine what kind of move we should expect. The size of the palladium market is limited and it’s not as popular as gold or silver, so sudden increases in the buying activity may imply big upswings in interest among individual investors (this market may be too small for many institutions).

Where do people want to “buy buy buy!”? At the tops. Therefore, the big increase in the volume may indicate a surge in the sentiment, which in turn indicates a local top. The above worked in 7 out of 9 recent cases, so it seems that the above kind of link does indeed exist. Consequently, the implications of the most recent weekly upswing are bearish and the above strengthens the already bearish case.

Summary

Summing up, the top in gold, silver and mining stocks is probably in, but there’s still a possibility that the PMs’ decline will be delayed by a few days or a week and a few days. Mining stocks and – in particular – silver will be the assets to look at for necessary confirmations before making adjustments to the current trading position. In both cases, however, the outlook for the following months will remain bearish.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,218; stop-loss: $1,382; initial target price for the DGLD ETN: $53.98; stop-loss for the DGLD ETN $37.68

- Silver: initial target price: $14.63; stop-loss: $17.82; initial target price for the DSLV ETN: $33.88; stop-loss for the DSLV ETN $20.88

- Mining stocks (price levels for the GDX ETF): initial target price: $19.22; stop-loss: $26.14; initial target price for the DUST ETF: $39.88; stop-loss for the DUST ETF $15.78

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $27.82; stop-loss: $38.22

- JDST ETF: initial target price: $94.88 stop-loss: $37.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold prices flat as outlook for faster U.S. interest hikes weigh

‘Boring’ Gold Giants Struggle to Compete With Hot Battery Metals

The Next Gold Rush Is Not Cryptos, But ‘Outer Space Gold Mines’ — Famed Physicist

Platinum price crashes through $1,000 after German diesel ban

World's Oldest Gold Trader Fails To Find A Buyer

Scotland to have its first commercial gold mine

=====

In other news:

Fed's Powell sends world stocks reeling to five-day low to end turbulent February

Costly dollar hedges tarnish U.S. bonds for overseas investors

Euro zone inflation slows, underlining ECB caution

Slowing Euro-Area Inflation Helps Draghi Push Back Exit Debate

UK unemployment rises at fastest rate in almost five years

Goldman Sachs investment chief: Bitcoin is definitely a bubble, Ethereum even more so

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts