Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

The situation in the precious metals sector and in the currency indices did not change yesterday and generally everything that we wrote in yesterday’s alert remains up-to-date. If you haven’t read it, we encourage you to do so today. Since there’s not much new to comment on, today we’ll simply focus on the only part of the precious metals sector where we can see a more visible move – the gold stocks (charts courtesy of http://stockcharts.com.)

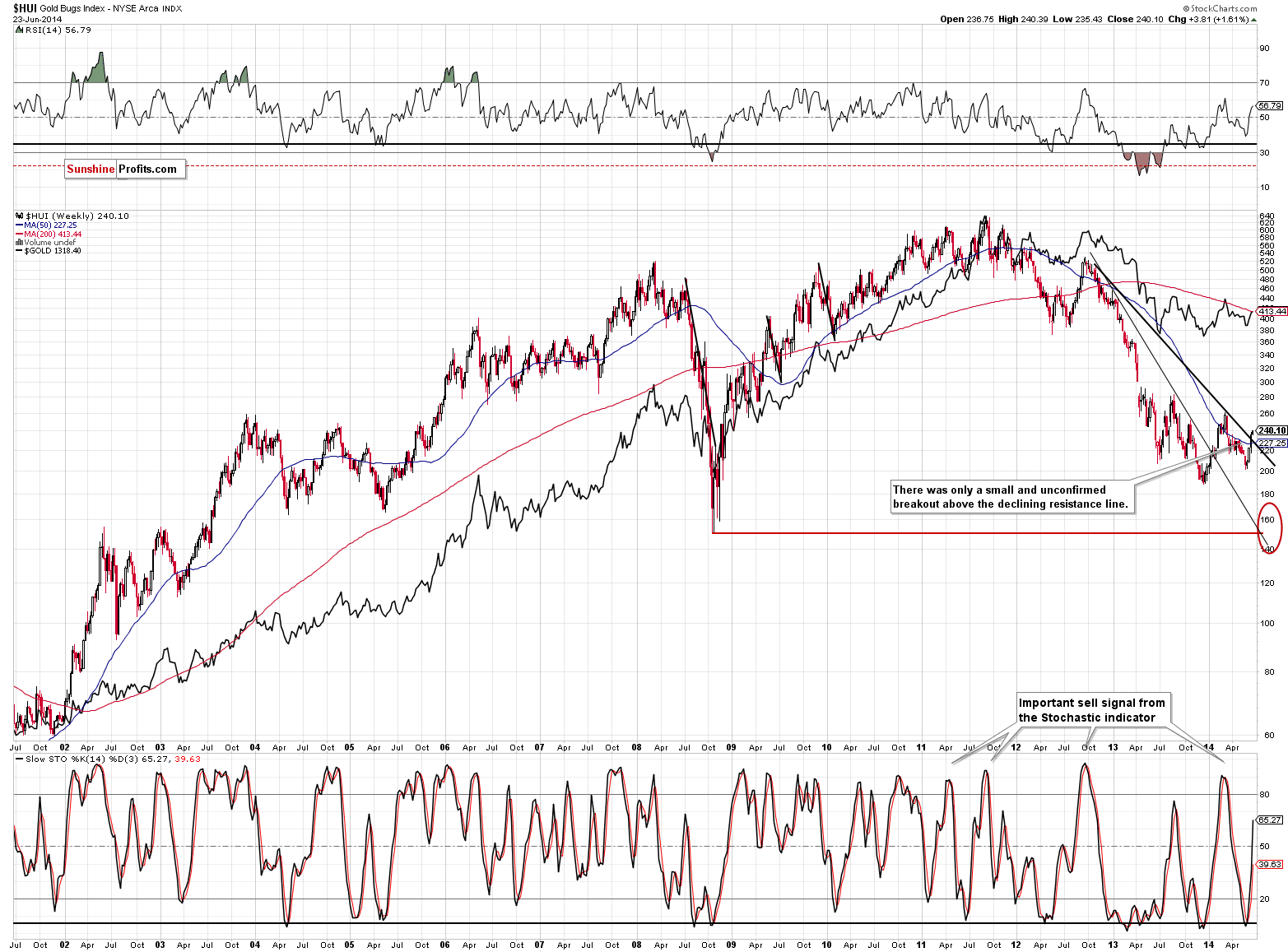

Gold stocks rallied significantly last week and continued the rally also this week. The move that we saw yesterday was much smaller than what we had seen previously, but still, miners moved a bit higher. Has this move changed anything yet? We don’t think so – the move above the declining resistance line is still rather small compared to the size of the declining line. It still seems more likely than not that that we will see an invalidation of this breakout relatively soon.

It might appear that the situation in the precious metals market has calmed down based on the last 2 trading days. We don’t think that this is really the case and we expect more volatility to follow. We will be actively monitoring the markets and report to you accordingly.

Summing up, even though the precious metals sector moved much higher, it seems that we are at or quite close to a local top in the precious metals sector. While the medium-term trend in the precious metals market is down, we were likely to see a corrective upswing – and we have. While in the past days it seemed that the corrective upswing was not over yet, we have some signs that it is over now. We have gold at a significant resistance line, we have short-term outperformance in silver, gold has made the headlines and its volatility is very low – and these are all bearish signs.

The only thing that seems exceptionally bullish at the first sight – the miners’ strength – is not really that bullish after one examines it more closely. We think that we will see a good risk/reward situation in the following days that will allow us to open a trading position in the precious metals sector, but at this time the short-term outlook is still too unclear.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts