Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

There’s not much that we can comment on today. Gold, silver and mining stocks have barely moved and we can say the same about the USD Index. The latter is one additional day after the cyclical turning point so the odds for a decline have diminished, but that’s still a rather likely outcome for the short term. Let’s take a closer look at what happened with gold (charts courtesy of http://stockcharts.com.)

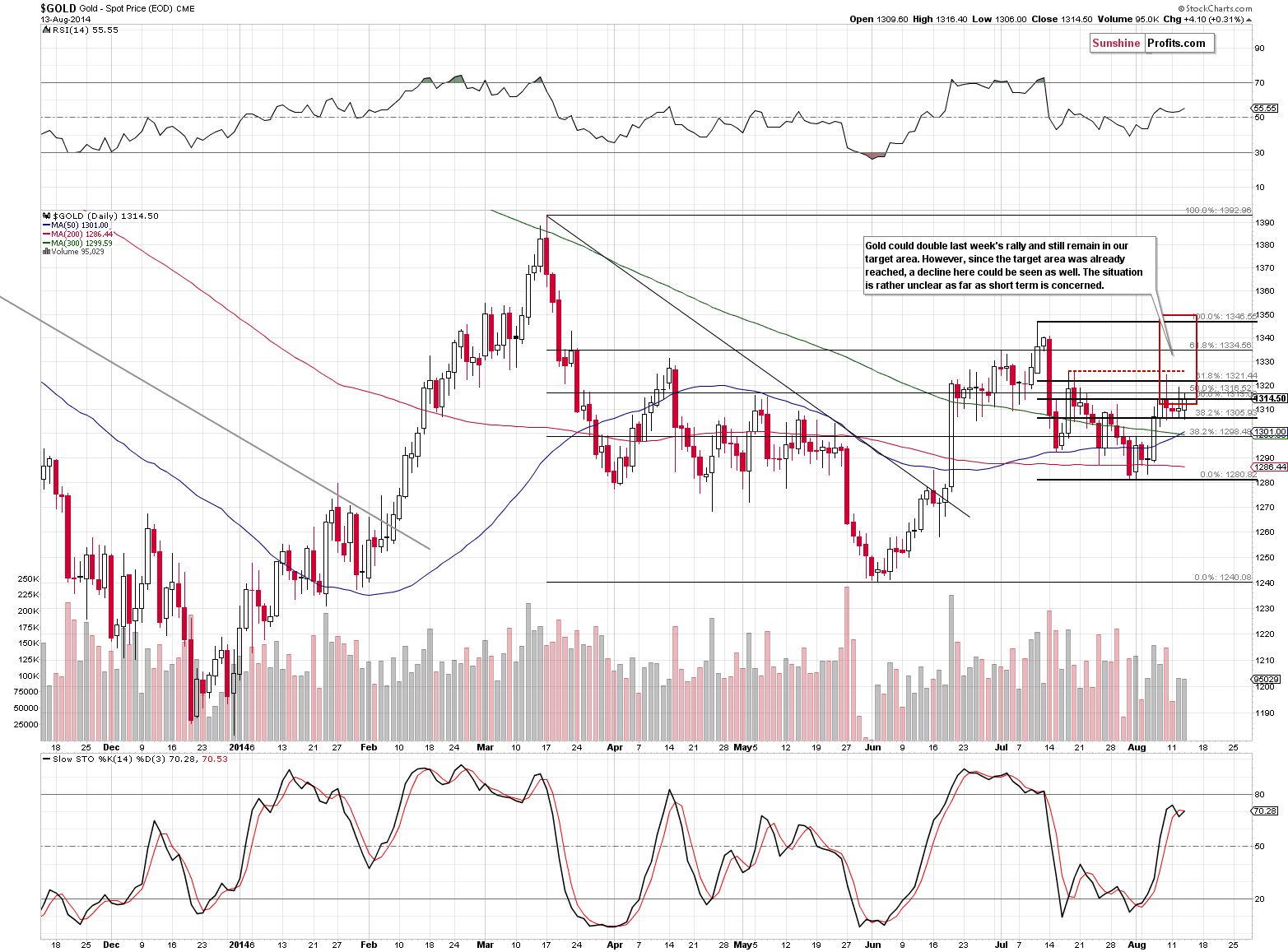

Gold moved a bit higher yesterday, but the intra-day high was lower than on the previous day. Generally, there are little or no consequences of such action. What we wrote yesterday remains up-to-date:

The interesting phenomenon was the intra-day decline right before the markets closed in the U.S. It caused the entire day to become a daily reversal – similar to the one that we saw on Friday. These reversals are bearish signs for the short term that contradict the bullish signal from mining stocks.

Consequently, even though the situation for mining stocks improved, it overall remains unclear and, in our opinion, it is still too risky to open a speculative position here. We realize that markets and our take on this situation might seem boring, but ultimately we are not investors and traders for the excitement, but for the growth of our portfolios, and it seems to us that at this time the risk that we would expose ourselves to by opening a position outweighs the potential profits that we could make.

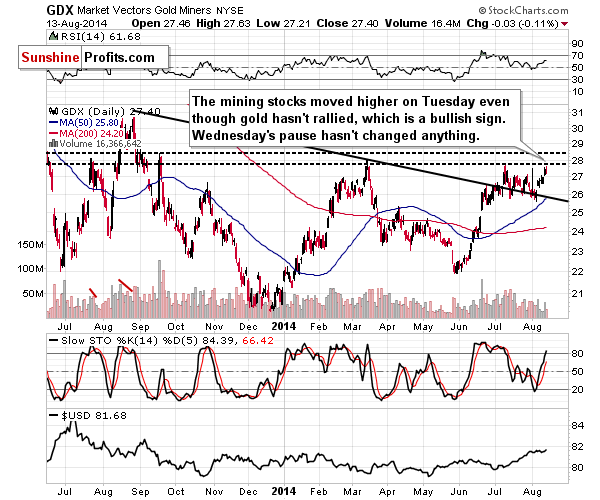

Mining stocks moved a little in both directions and ended the session only 0.11% lower than on the previous day. In other words, nothing changed and what we wrote yesterday remains up-to-date:

Miners moved higher [on Tuesday] and the volume that accompanied this move was rather average. It was not high enough to confirm the direction of the move by itself, but it was not low enough for us to say that the move was fake.

The fact that miners rallied without a rally in gold or a decline of the dollar is bullish for the short term. Consequently, we plotted an additional resistance line on the chart, in case GDX moves above its July high. The next resistance is close to the $28.50 level, at the September 2013 high.

The mining stocks to gold ratio also moved higher on Tuesday, but, in our opinion, this bullish sign is more than nullified by the situation in the USD Index. Speaking of the USD Index, if you haven’t done so already, we invite you to read this week’s free Forex Trading Alert which is dedicated to this index. In short, the USD Index could – and in our opinion is likely to – move significantly higher in the coming weeks / months. The probability for a “true capitulation” in the precious metals market and for a move well below $1,200 in gold is at the same level it was a few months ago – at 70% or so (our subjective estimation). The breakouts in the USD Index are likely to take the index much higher and gold will have to prove that it can rally in this environment. At this time we have indeed seen a rally in the USD Index (in July), but this move is still more or less within the trading range that we’ve seen for almost a year now. The real reaction in gold could be seen once the USD moves higher – above the late-2013 and early-2014 highs.

Putting technicals aside for a minute, the Fed officials are not yet saying that the interest rates are going to be increased. Even if they don’t want to increase them anytime soon, they could signal that to check the markets’ reaction – it could be the case that markets would view this as an ultimate confirmation of strength in the economy – meaning that it would appear to be strong enough to expand despite higher rates. After all, if the “pros in the Fed” believe so, why would investors doubt them? At least that’s what the majority of investors will probably think.

Such an indication would very likely take gold much lower temporarily. It could be the trigger for the final part of the decline. If gold then manages to stop declining despite such news, and despite the rallying dollar, we will have a major confirmation that the bottom is in. We have not seen this just yet.

Overall, once again we can summarize the current outlook in the same way as we did previously.

Summing up, it seems that even though the next big move in the precious metals sector is still likely to be to the downside (we have not yet seen actions that are usually seen at important bottoms, like huge underperformance of silver [what we saw this week was not huge enough], and gold is not actively hated in the mass media), the odds for a corrective rally are relatively high.

The USD Index is [still, but less with each passing day] likely to decline at least a little, which is likely to cause a rally in the precious metals sector. However, let’s not forget that the USD Index is after long-, medium-, and short-term breakouts, so this corrective downswing could be small and temporary – the next big move is likely to be to the upside. The opposite seems likely for the precious metals sector.

We plan to re-enter short positions when we see either a small rally an some kind of confirmation that the next local top is in. At this time, we prefer to say out of the market. The situation simply seems too unclear and risky to open a speculative position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts