Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

The back and forth movement in gold continued in the final trading hours of 2014 and resulted in the forming an interesting pattern. The most significant action, however, took place in the USD Index, which ended the year by setting a new yearly high.

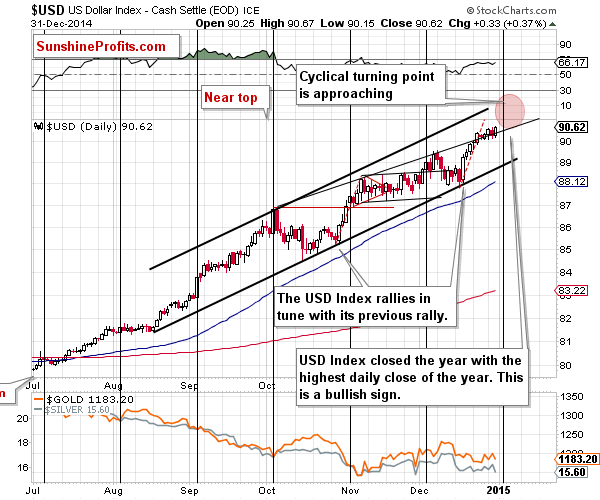

Let’s jump right into the USD Index chart (charts courtesy of http://stockcharts.com).

The USD index moved visibly higher and it continues to move higher also today. It’s now visibly above the previous Dec. high and also above the rising support/resistance line. However, the cyclical turning point is just around the corner, so we can expect a move lower sooner rather than later.

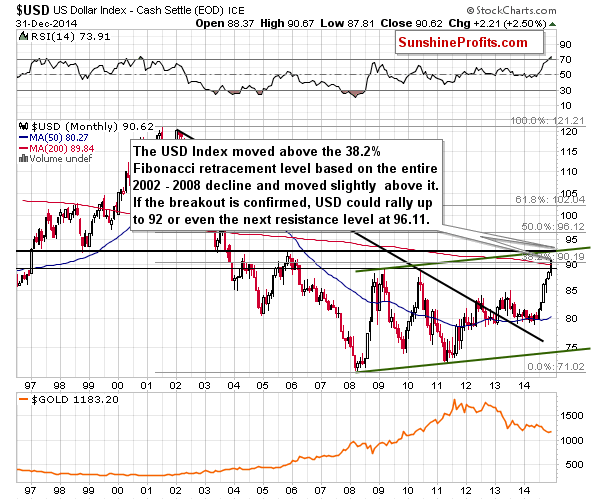

How low will the USD Index fall? It’s simply likely to correct to the previously broken 38.2% Fibonacci retracement that we can see on the long-term chart.

The move above it is visible also from this perspective, so one could discuss whether the breakout is confirmed or not. Since the USD Index is likely to decline relatively soon based on the cyclical turning point we might see a correction to the retracement. A local bottom at this level would finally confirm the breakout.

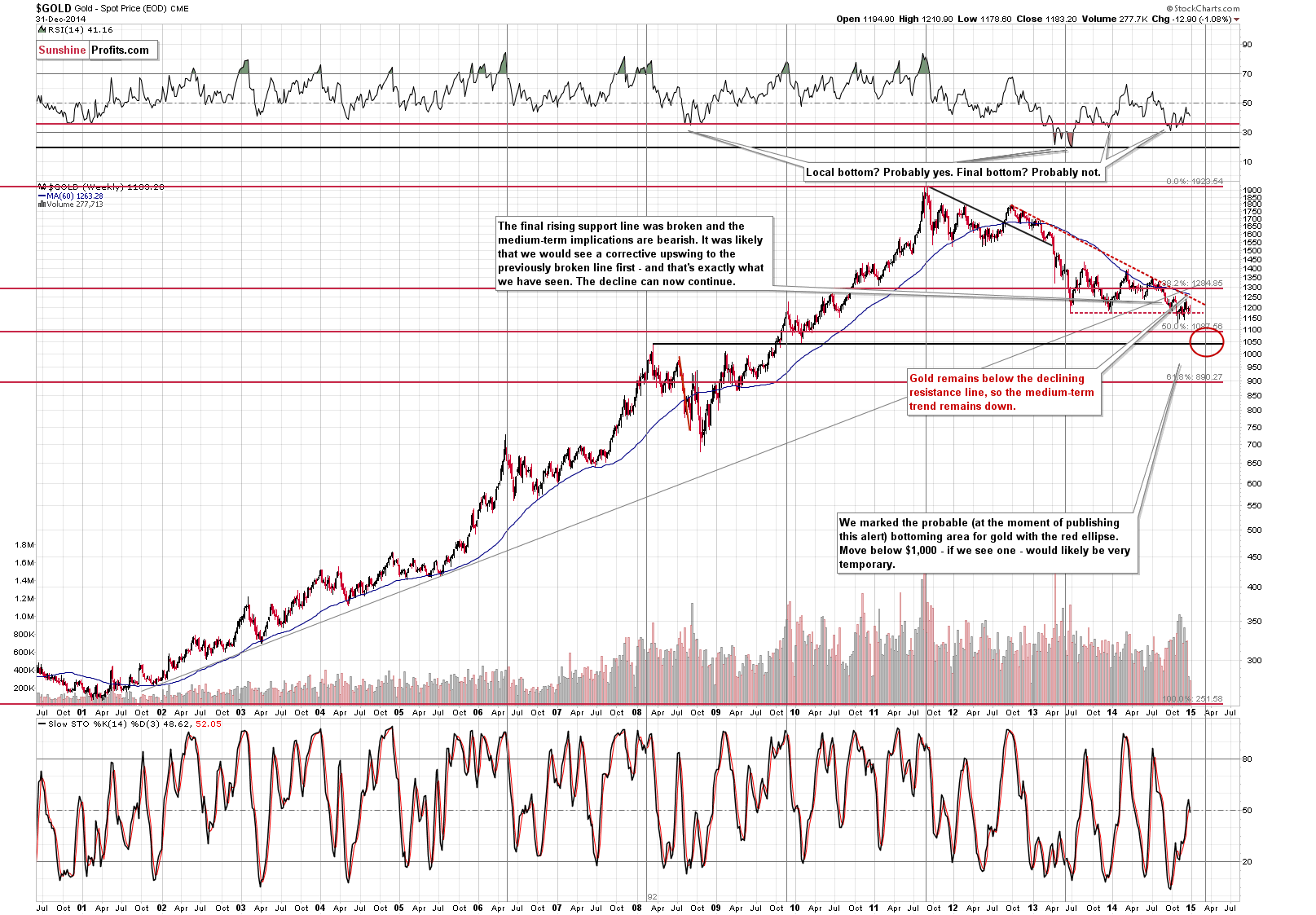

What’s the status of gold? From the long-term perspective, nothing changed and the trend remains down.

What we wrote previously remains up-to-date:

The long-term picture for gold remains unchanged. The events of the last two weeks didn’t change much as gold ended the previous week below $1,200 and – more importantly - well below the declining resistance line. The medium-term trend remains down.

Please note that the long-term turning point will come into play in a few months – it may be the case that this is when the final bottom will form.

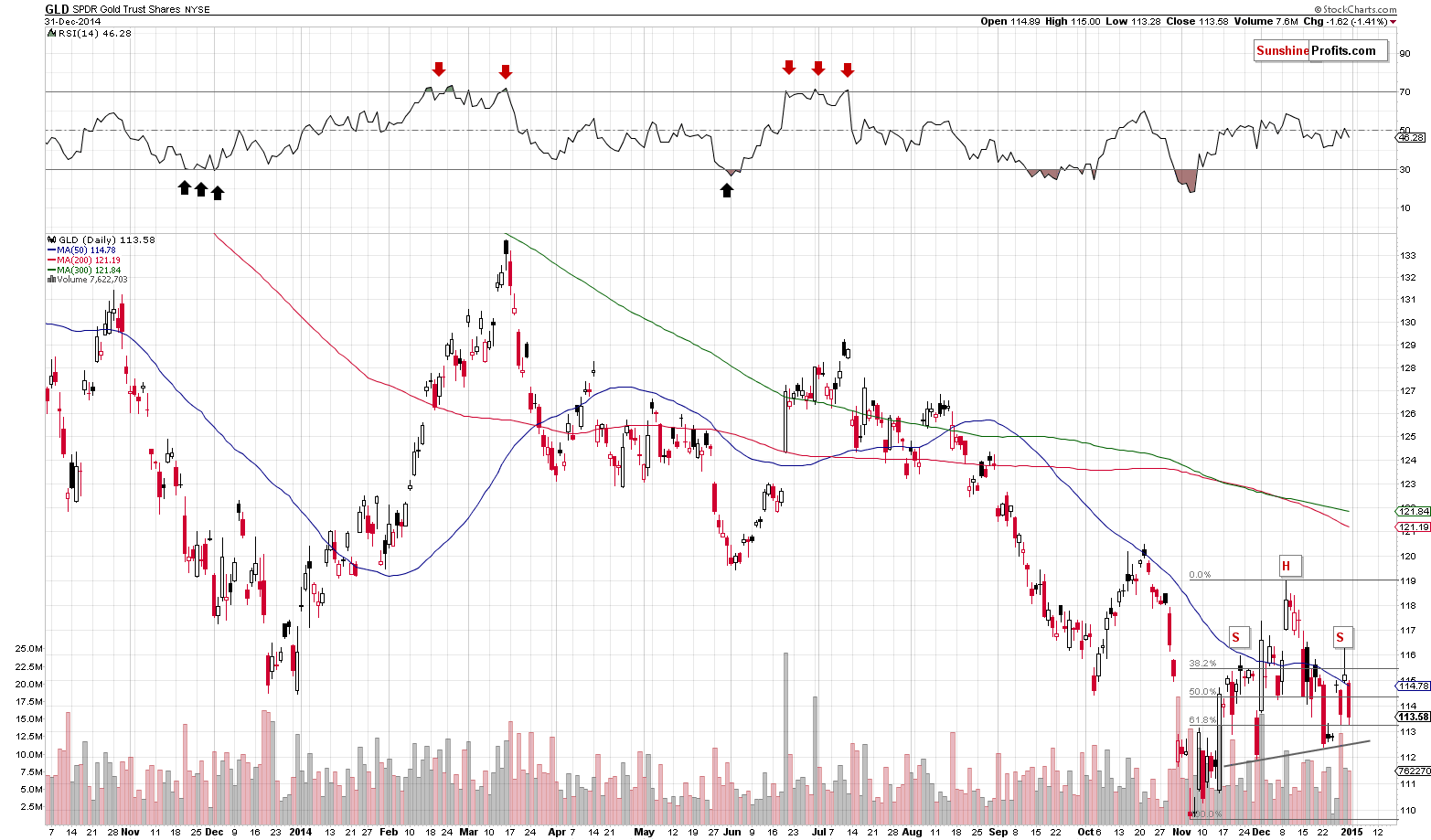

As far as the short term is concerned, today we’ll comment on the popular proxy for gold – the GLD ETF. The important thing that we can see on the above chart is the bearish head-and-shoulders pattern. The GLD ETF is about to complete it as the price is very close to the neck level of the formation. If gold confirms the breakdown below it, then we will likely see a move lower that would be equal to the height of the head of the pattern. This means a move below the 2014 lows, which could in turn result in a much bigger decline.

There’s not much new that we can say about silver, so let’s move to mining stocks.

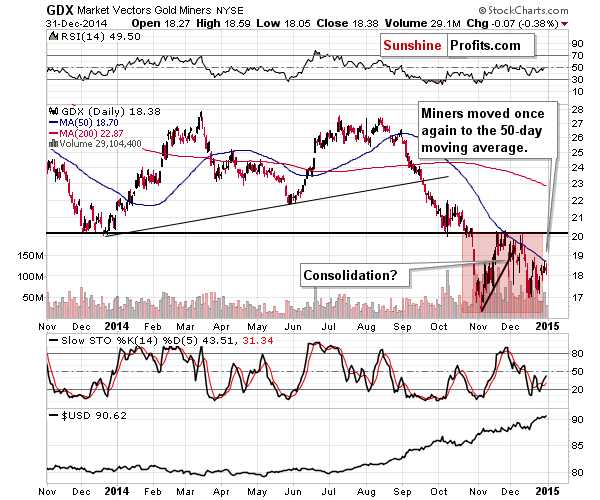

The situation in the GDX ETF didn’t change much either, but we’re featuring it as it has short-term implications. Our previous comments remain up-to-date:

The GDX ETF moved once again to its 50-day moving average. That’s the average that has been stopping local rallies since late November. We now see a 5th attempt to move above it. Since all the recent attempts failed and history tends to repeat itself, we are quite likely to see another local top relatively soon.

Please note that even if miners rallied from here – say to the $20 level or so – it would not really change the bearish outlook for the medium term.

Summing up, while the situation in the precious metals market still remains too unclear to open speculative positions, it seems that the situation will clarify shortly. The reason is the head-and-shoulders formation in gold and – most importantly – the likely correction in the USD that could lead to a verification of the USD’s breakout. If gold moves higher on low volume or moves only a little higher when the USD declines, it will provide a bearish confirmation and we will likely open speculative short positions at that time. However, we are not at that point yet and other factors will need to be considered as well. We will be monitoring the market and we’ll keep you – our subscribers - informed.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Tuesday, crude oil continued to fall after the market’s open on concerns over global supplies, which resulted in a fresh 2014 low. In this way, light crude reached the next solid support zone, but will it withstand the selling pressure?

Oil Trading Alert: Crude Oil Tests Support Zone – What’s Next?

=====

Hand-picked precious-metals-related links:

Federal Reserve Bank New York Lost 47t Of Gold In November

Cold a gold supply crunch be coming in 2015?

The Historical View On Gold -- Where It's Been, Where It's Going?

=====

In other news:

Draghi drives euro to four and a half year low

Lithuania Adopts Euro as Russian Worries Rattle Baltics

The $9 Billion Witness: Meet JPMorgan Chase's Worst Nightmare

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts