Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

Not much happened in the precious metals market yesterday, but quite a lot happened in the currency markets. We’ll start with gold and the HUI and then move to the Euro and USD Indices (charts courtesy of http://stockcharts.com.)

What we wrote yesterday remains up-to-date:

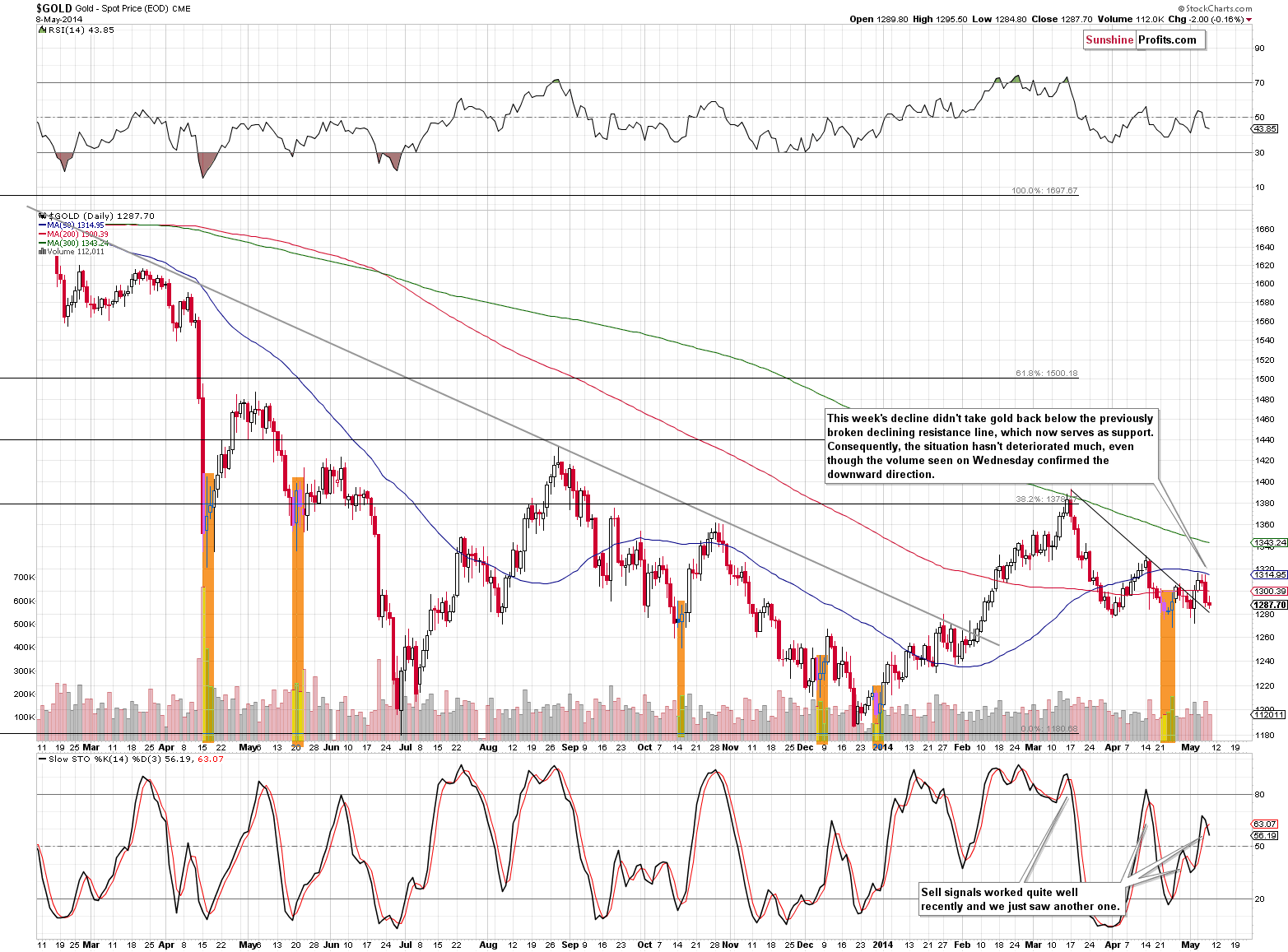

Gold moved higher in the past few days and has basically erased these gains just yesterday. Yesterday’s decline materialized on huge volume, which suggests that this is the real direction in which the precious metals market is moving / about to move. The move itself was bearish, but not overly bearish. It hasn’t taken gold below the declining support/resistance line, which means that the situation hasn’t become more bearish. The significant decline on significant volume is what we saw, but it’s not enough to justify increasing the size of the short position in this market.

Gold didn’t move much yesterday but that was enough to generate a sell signal in the Stochastic indicator, and these signals have been quite effective in the past several weeks, so we assume that its meaningful this time as well.

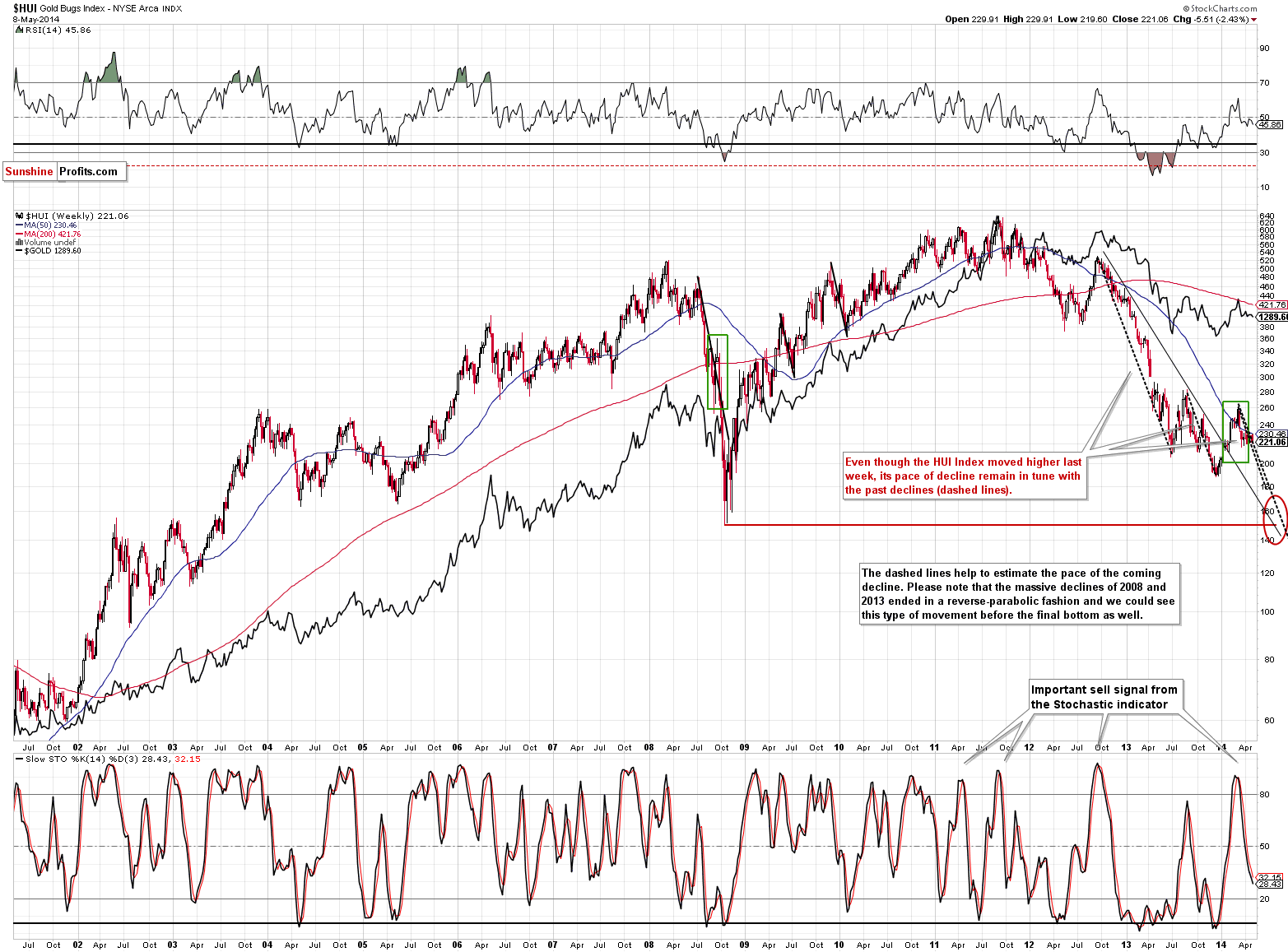

We don’t see much new information on the above chart… And that’s actually bearish – because the trend is down. The most recent move higher was bullish only from the short-term perspective. The above chart clearly emphasizes that the pace of the current decline is in tune with the previous ones. Therefore, the most recent move higher didn’t change much.

As mentioned earlier, the most important changes were seen in the currency indices. Let’s take a look at them.

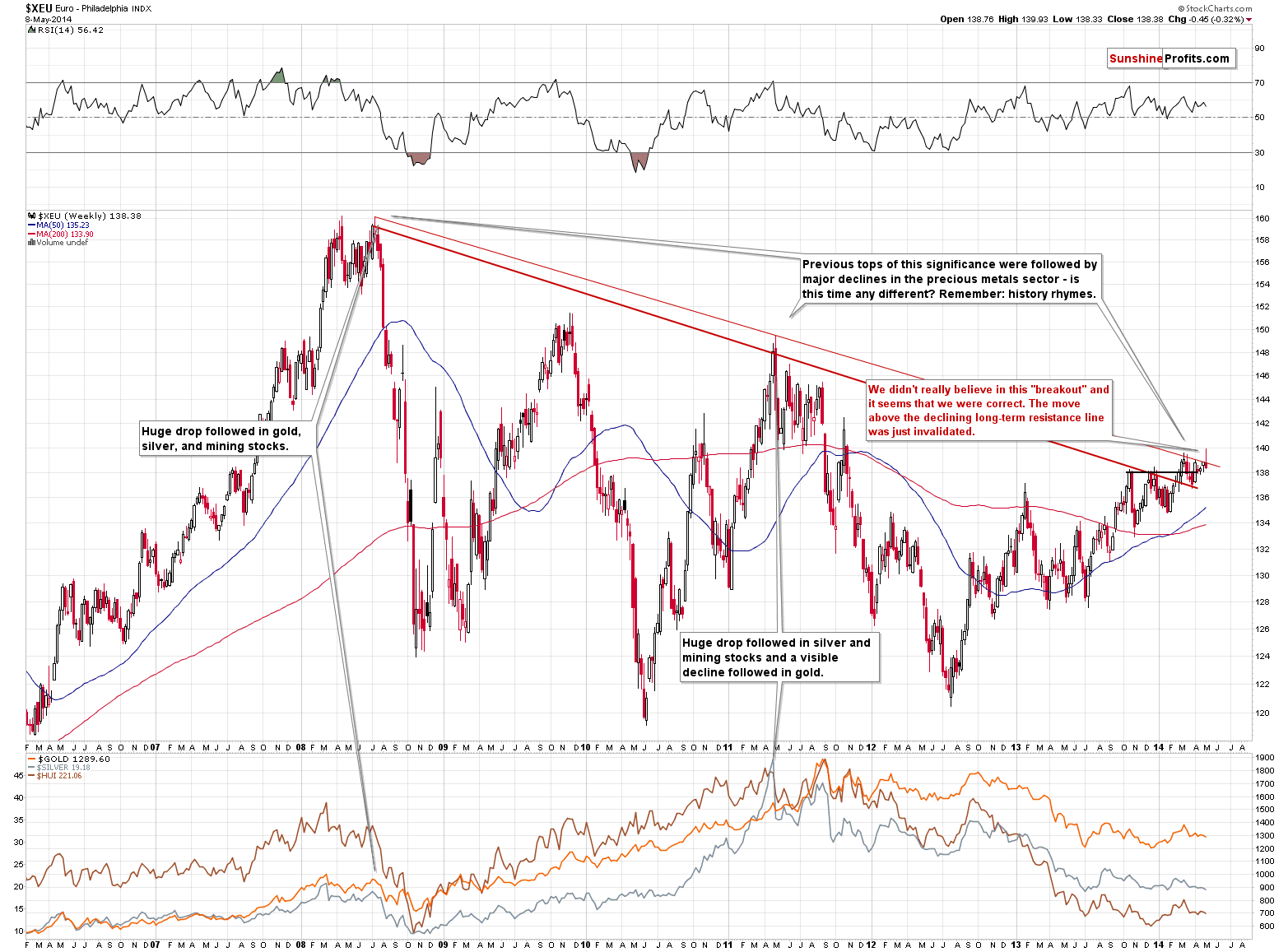

The Euro Index attempted to move above the very long-term declining resistance, but failed to do so and invalidated the move almost immediately. If the currency doesn’t move much higher today, we will have a bearish shooting star candlestick, which would be a major bearish sign. It’s quite likely that we will see it, and the implications for the precious metals sector are bearish.

Since the situation in the EUR/USD pair is very important from gold & silver investor’s point of view, and this week’s price action is very important as well. Consequently, we are making the latest Forex Trading Alert (which includes more detailed description of this action) for all our current Gold & Silver Trading Alert subscribers. You can access the latest Forex Trading Alert using this link.

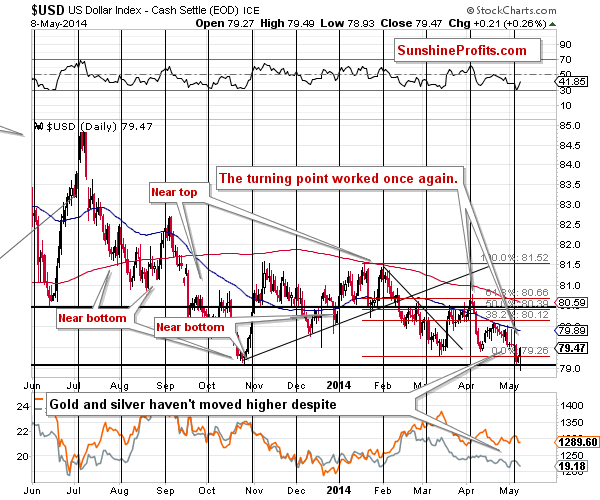

The USD Index shows the same even from a different angle. We saw a temporary move below the 2013 low, which was immediately invalidated and this, by itself, made the situation more bullish. Please note that the move materialized very close to the cyclical turning point – it was not surprising. The cyclical turning point plus the strong support in the form of the 2013 low create a very bullish combination.

We had previously emphasized that the cyclical turning points for the USD Index worked particularly well for the precious metals market, and this time was no different. The implications for the PMs are bearish.

Summing up, the way precious metals market reacted to the U.S. dollar’s move lower (to the 2013 lows) this week is a bearish sing, and it confirms the bearish outlook that we outlined in the previous alerts. The lack of declines yesterday is not concerning because the precious metals market had already declined on Wednesday. The outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts