Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are keeping the stop-loss levels close to the current prices, so in a way we are keeping the “increased profits locked-in”, and at the same time, we’re keeping a chance of increasing them further.

The USD Index moved higher yesterday, which was nothing unexpected as the breakout above the previous October high had just been confirmed. Gold didn’t decline and miners rallied. Can the strength finally be sustainable?

Not likely – at least not yet. Gold and miners have dropped sharply recently, so a pause is not only not odd, but it should be expected as something natural. As such it doesn’t necessarily mean that the decline is over. Markets often take 2 steps forward and 1 step back only to take further steps forward. In the precious metals’ case, the step back seems to have taken the form of a pause.

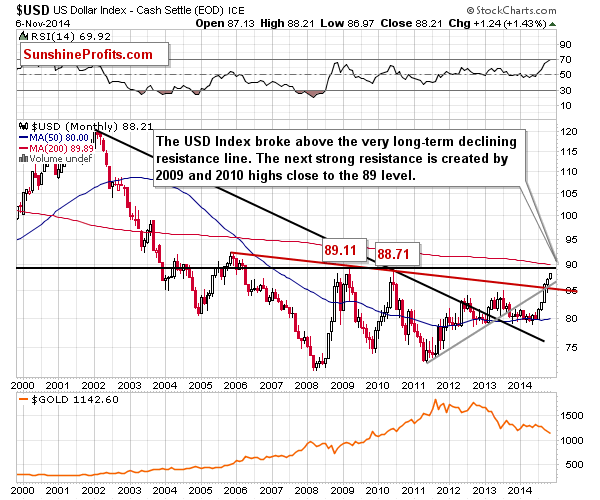

Did the USD Index stop rallying? As you may see on the chart below (charts courtesy of http://stockcharts.com) – likely not.

Yesterday we wrote the following:

The USD Index is after a major breakout and there is no strong resistance level until about 89. This means that the USD Index is likely to rally for another 1 – 1.5 before the top is in. In other words, the USD Index has room for further gains and gold seems to have room for further declines.

Yesterday’s session confirmed it. The USD Index rallied and closed the session above the 88 level. It now has only 0.5 – 0.9 until it reaches 2010 and 2009 highs, respectively. It seems more likely to us that it would stop at the higher of them, which still gives us significant room for a further rally – and a further decline in gold.

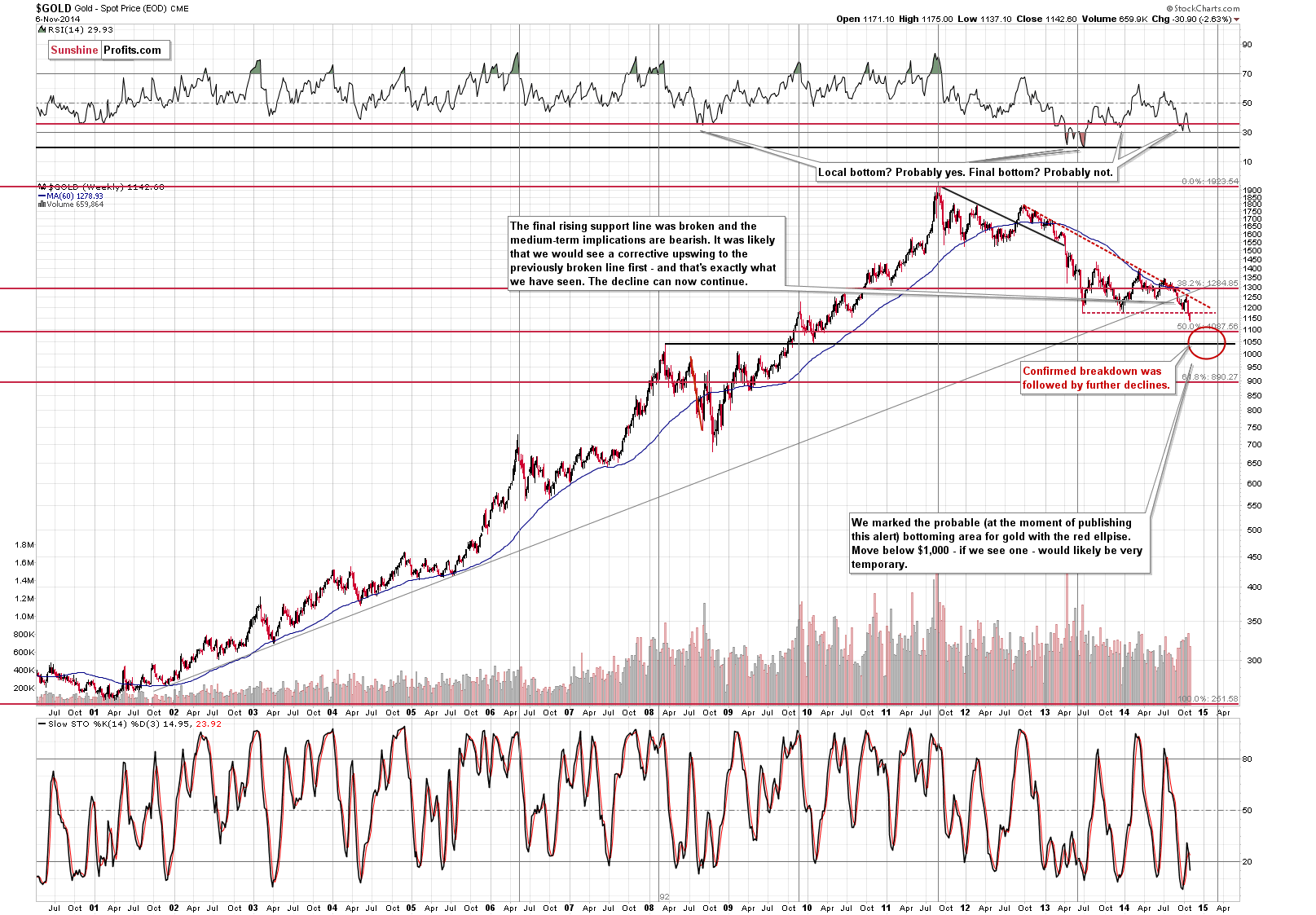

Gold already replied to the U.S. dollar’s strength by declining visibly on Tuesday. We didn’t see this kind of reaction yesterday, but a one-day event doesn’t have to be meaningful. Did gold reach an important support yesterday? No. The closest strong support is at $1,087.56, and it seems likely that gold will move at least to $1,100 before bottoming (at least initially).

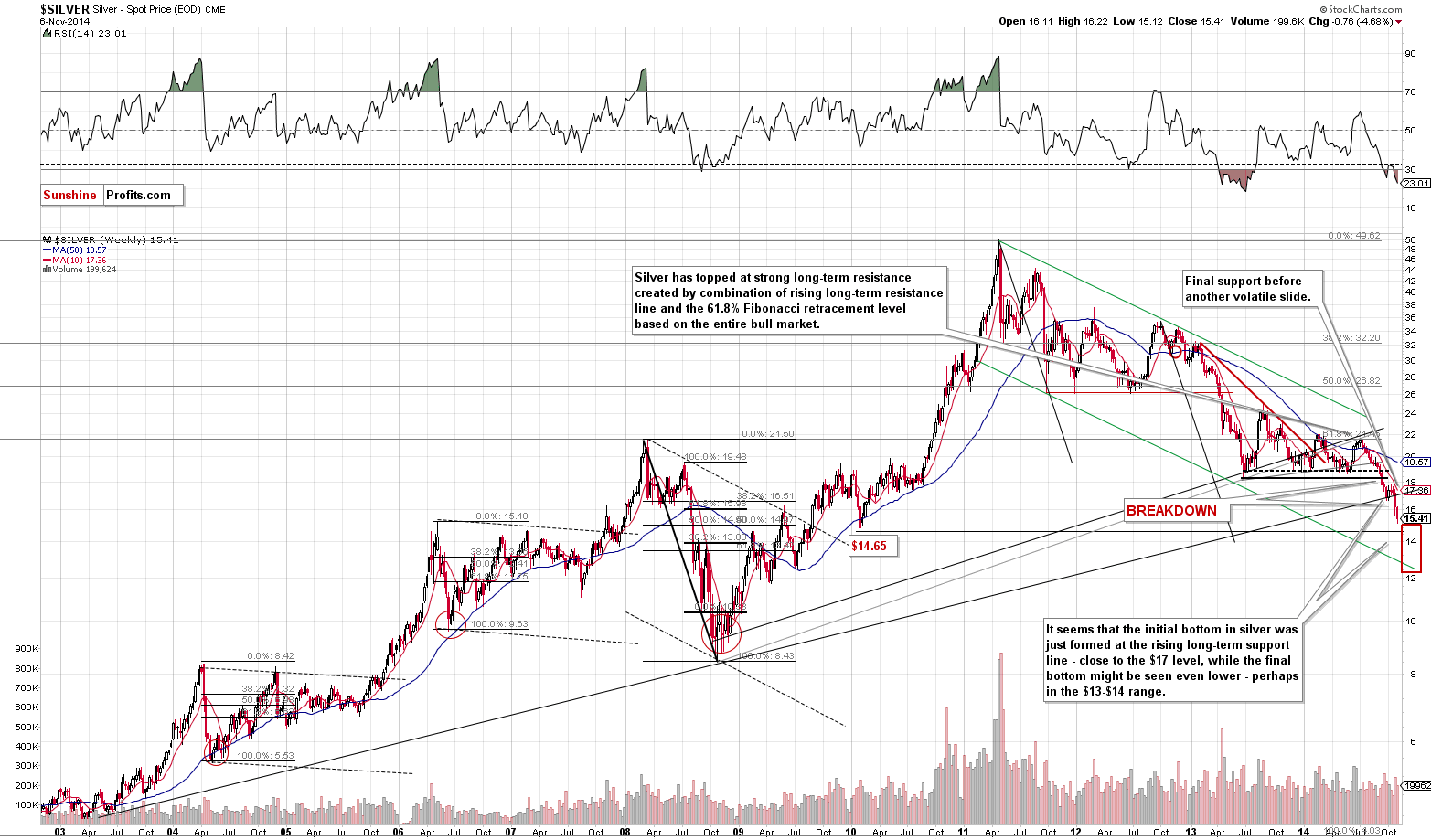

In the case of the white metal, our yesterday’s comments also remain up-to-date:

Silver declined substantially once again and almost reached the $15 level. It’s now relatively close to the early 2010 low, which is the closest significant support level – at $14.65. It seems that silver will move at least slightly below the $15 level before the bottom (it’s not clear if it will be the final one; most likely not) is formed.

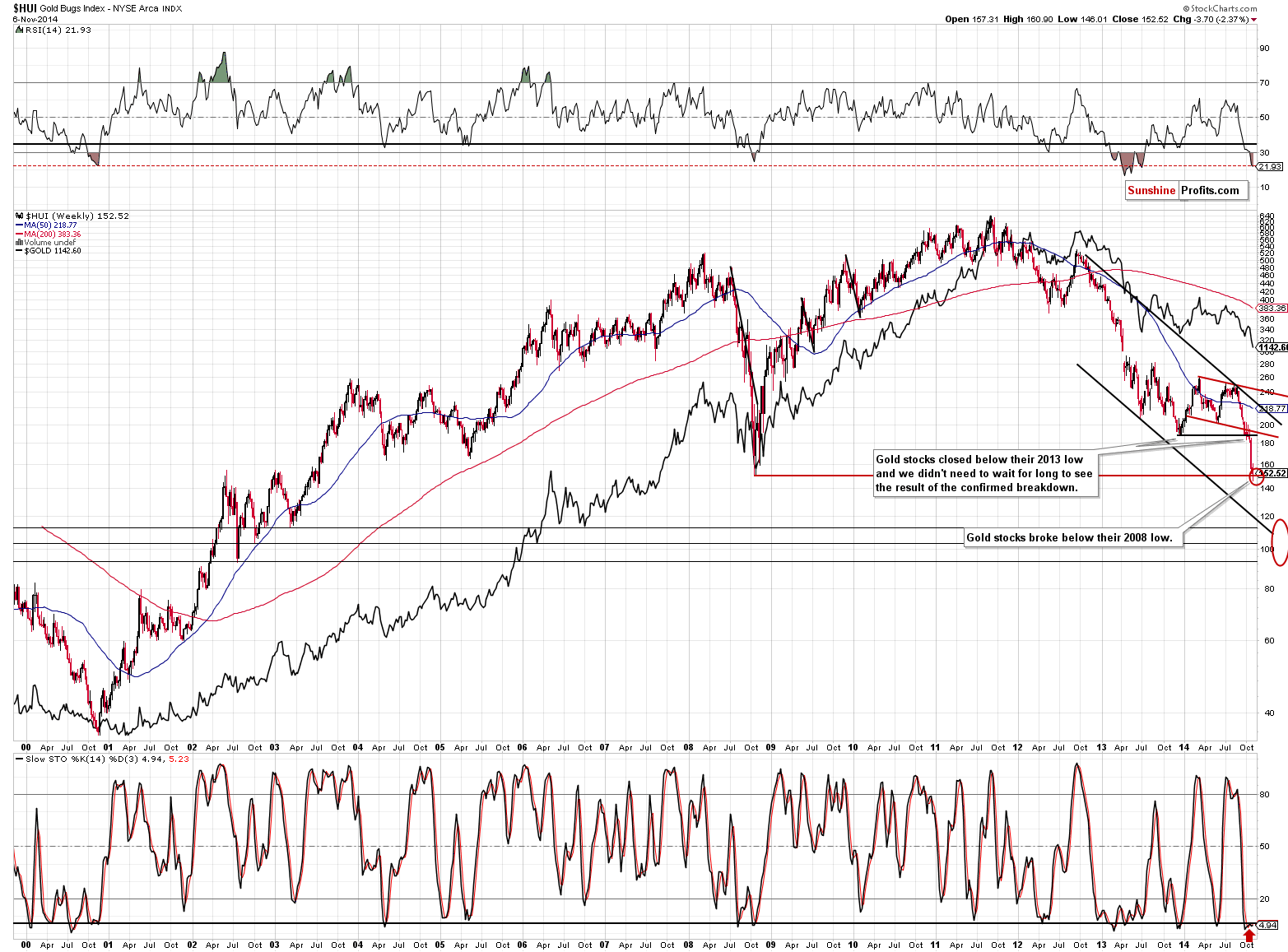

Gold stocks moved back above their 2008 low, but as it was the case with silver not too long ago, this could only mean that the decline will be delayed, not absent. Let’s keep in mind that silver refused to move below its rising, long-term support line for several days, but when it finally broke below it, it plunged with a vengeance. We could see the same in gold and silver stocks.

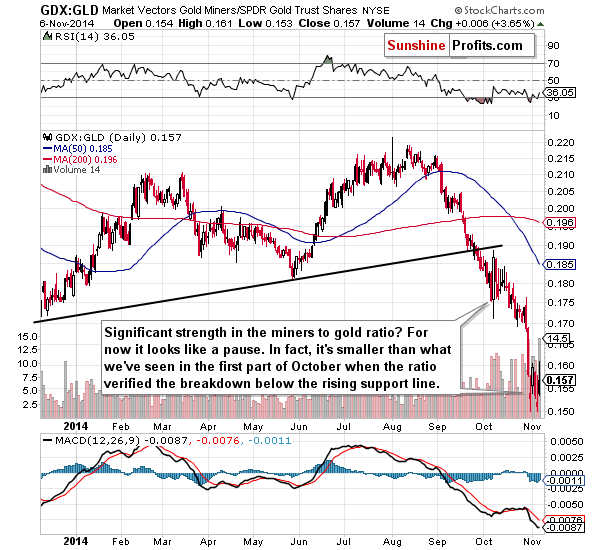

Our comments on the miners to gold ratio remain up-to-date:

Furthermore, if we consider the miners to gold ratio, we see that yesterday’s early outperformance was much less significant than it had initially seemed. In fact, it was smaller than what saw about a month ago. It was not necessarily a sign of strength – it might have simply been a pause.

Other than the above, nothing changed in the precious metals market and what we wrote in Tuesday’s and Monday’s alerts remains up-to-date (please read the latter if you haven’t done so already).

Consequently, we will summarize today’s alert exactly as we did yesterday.

Summing up, the situation in the precious metals market was bearish and metals and miners were likely to decline – and they did. Will they decline further based on gold’s major breakdown (after all, gold didn’t break down from more than a yearly consolidation pattern to decline $40) or will the resistance and turning point in the USD Index trigger a bigger upswing in the precious metals sector?

As always, there are no sure bets in any market, but we think that the short-term resistance in the USD Index (given the metal’s negative correlation with the U.S. dollar) is much less important than the breakdown in silver and gold. The critical support in gold and silver was broken and they are likely to decline significantly now. They could still turn around and rally today or in the coming days, but they could also continue their decline and if they do, they could drop fast and far – and it would be a waste not to take advantage of this move.

Consequently, we think that instead of closing the short positions, we will keep them “almost closed”. By this we mean moving the stop-loss orders lower once again. In this way, if gold, silver and mining stocks rebound, the short positions will be automatically closed and substantial profits will be secured anyway. If metals and miners continue to slide, we plan to continue to move the stop-loss order lower and thus make the substantial profits from the current short positions even bigger. Please note that by entering a new stop-loss order, you are effectively making sure that the current trade is profitable no matter what the market does.

The miners’ outperformance that we saw yesterday doesn’t seem to be a major bullish signal (at least not yet) and, at the same time, we have room for a further rally in the USD Index and for further declines in gold and silver.

Our plan is to exit the short positions at the below levels as the risk of a corrective upswing will become significant (too significant to justify keeping a short position opened – it seems to be a better idea to take substantial profits off the table at that time). At this time it doesn’t seem that this will be the final bottom for this decline.

We are not automatically suggesting opening long positions at these levels (at least not yet).

We will continue to monitor the situation and report to you – our subscribers – accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) short positions in gold, silver and mining stocks is a good idea:

- Gold: exit order: $1,094 ; stop-loss: $1,176, exit order for the DGLD ETN: $99.87; stop loss for the DGLD ETN $80.65

- Silver: exit order: $14.83 ; stop-loss: $16.36, exit order for the DSLV ETN: $99.83; stop loss for DSLV ETN $72.41

- Mining stocks (price levels for the GDX ETN): exit order: $15.83 ; stop-loss: $18.33, exit order for the DUST ETN: $57.25; stop loss for the DUST ETN $38.03

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: exit order: $20.13 ; stop-loss: $26.53

- JDST: exit order: $53.35; stop-loss: $25.80

Important: If gold reaches its exit order value ($1,094) we think it will be a good idea to close the entire short position (also in silver and mining stocks).

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Our special anniversary offer is about to end. It expires on Monday. If you’ve been considering it, this is the final call to lock in the lower prices (15% for all packages including the All-Inclusive Package, and 10% for all “new” products) for the next month, quarter or a year. The lowered price will be valid for the first billing period, so long-term subscriptions save you more. Use the following link to continue:

Anniversary Offer - Final Call

=====

Latest Free Trading Alerts:

Without a doubt, Oct was the worst month for oil bulls since May 2012. In the previous month, the commodity lost over 11% as the combination of a stronger greenback, rising supplies and weaker demand weighted on the price. Additionally, the first days of the new month have been very negative for oil investors. After the breakdown below the psychologically important barrier of $80, oil bears pushed the price lower and light crude hit a four-year low of $75.84, breaking under long-term support lines. In this way, the commodity posted its sixth weekly loss in a row. Will light crude drop any further in the near future? Is it possible that crude oil’s ratios will give us some interesting clues?

What Crude Oil’s Ratios Are Saying About Future Moves?

Earlier today, the Labor Department showed that the initial claims for unemployment benefits decreased by 10,000 in the week ended Nov. 1, beating analysts’ forecast. This second lowest level for claims this year supported the greenback and pushed GBP/USD below the barrier of 1.6000. Will we see a fresh multi-month low?

Forex Trading Alert: What’s Next For GBP/USD?

=====

Hand-picked precious-metals-related links:

JP Morgan lowers gold, silver forecasts

Swiss yes vote could lift gold price 18%

Looming gold reserve cuts, write-downs

Physical Gold Shortage Worst In Over A Decade: GOFO Most Negative Since 2001

Gold firms plan drastic cuts to stay afloat as bullion sinks

=====

In other news:

Could a strong dollar derail Wall Street's rally?

Ruble sinks, markets await U.S. jobs numbers

ECB's Mario Draghi: Disagreement is 'normal'

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts