Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective.

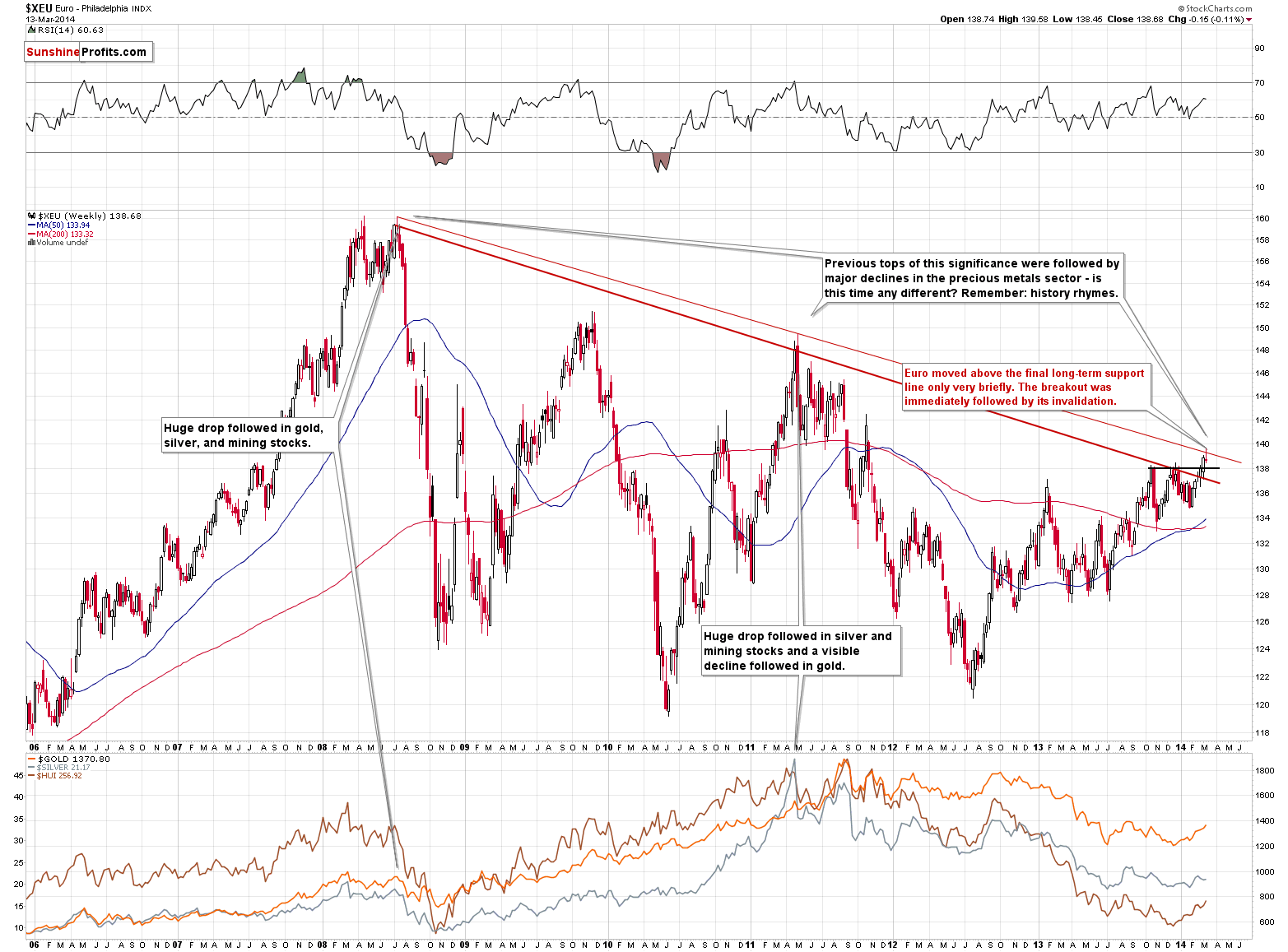

Once again, the most important change in the markets that could drive precious metals prices was seen on the Euro Index chart. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

Yesterday, we wrote the following:

The euro has moved higher recently, above the lower of the declining long-term resistance lines. The most important thing to keep in mind now is the fact that the upper of these lines – the more important one – has not been broken, and it is very close to where the euro is right now. More precisely, the euro was close to the declining resistance line yesterday, but in today’s pre-market trading it has moved higher and is right at this line.

Consequently, the index is likely to decline sooner rather than later and this could trigger a decline in the precious metals sector. Of course, if the situation in Ukraine gets worse, PMs might rally or the decline could be postponed, but at this time the tendency for this market seems to be to move lower.

The above is mostly up-to-date with a slight difference – the Euro Index already moved above the resistance line and then quickly back down. This invalidation of the breakout is a very bearish phenomenon that is likely to lead to lower euro values in the coming weeks.

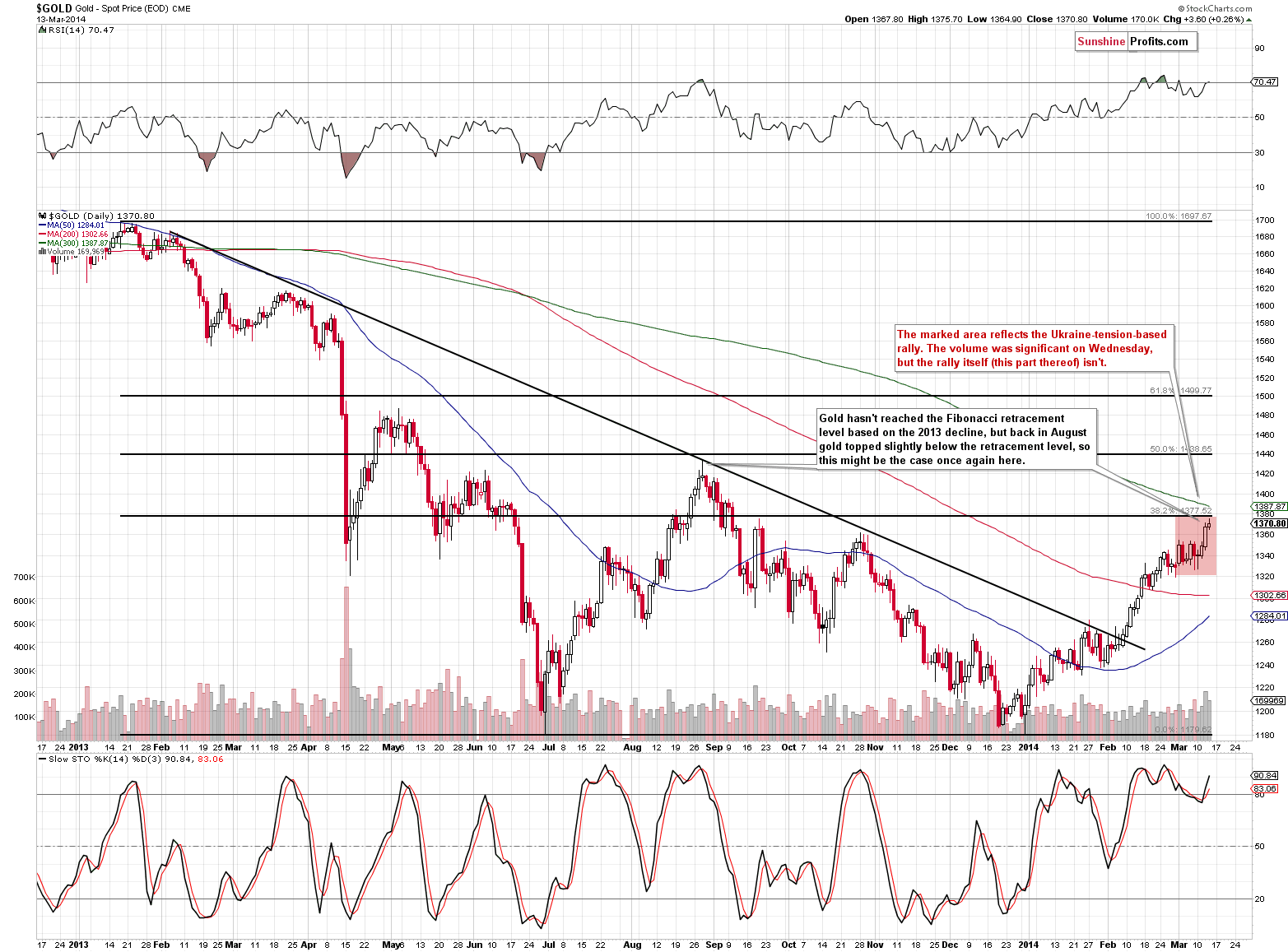

As far as gold is concerned, we wrote the following yesterday:

As mentioned previously, gold has indeed rallied, and it has moved above the previous 2014 high, however, there has been no breakout above the first Fibonacci retracement level based on the 2013 decline. Technically, this year’s rally is just a big correction within a downswing. Back in August, gold moved slightly below the 50% retracement, and topped there, so perhaps we don’t have to see gold reaching the 38.2% retracement for the top to be formed. The volume during Wednesday’s rally was significant, so another daily rally here – possibly to the 38.2% retracement – would not surprise us.

In the red rectangle, you can see the part of the rally that has taken place since Russian soldiers entered Crimea. The rally is present, but it’s relatively small. Based on possible repercussions and how the situation is evolving, we might have seen a $100 rally or even a greater one. We haven’t and the implications are bearish – it looks like gold is simply waiting for the situation in Ukraine to stabilize before declining.

With today’s rally in the euro and gold, the latter is quite likely to move to the Fibonacci retracement at $1,377.

Again, the above is generally up-to-date. We have indeed seen a move very close to the 38.2% Fibonacci retracement level. Gold’s reaction to what’s going on in Ukraine and close to its borders is still relatively small.

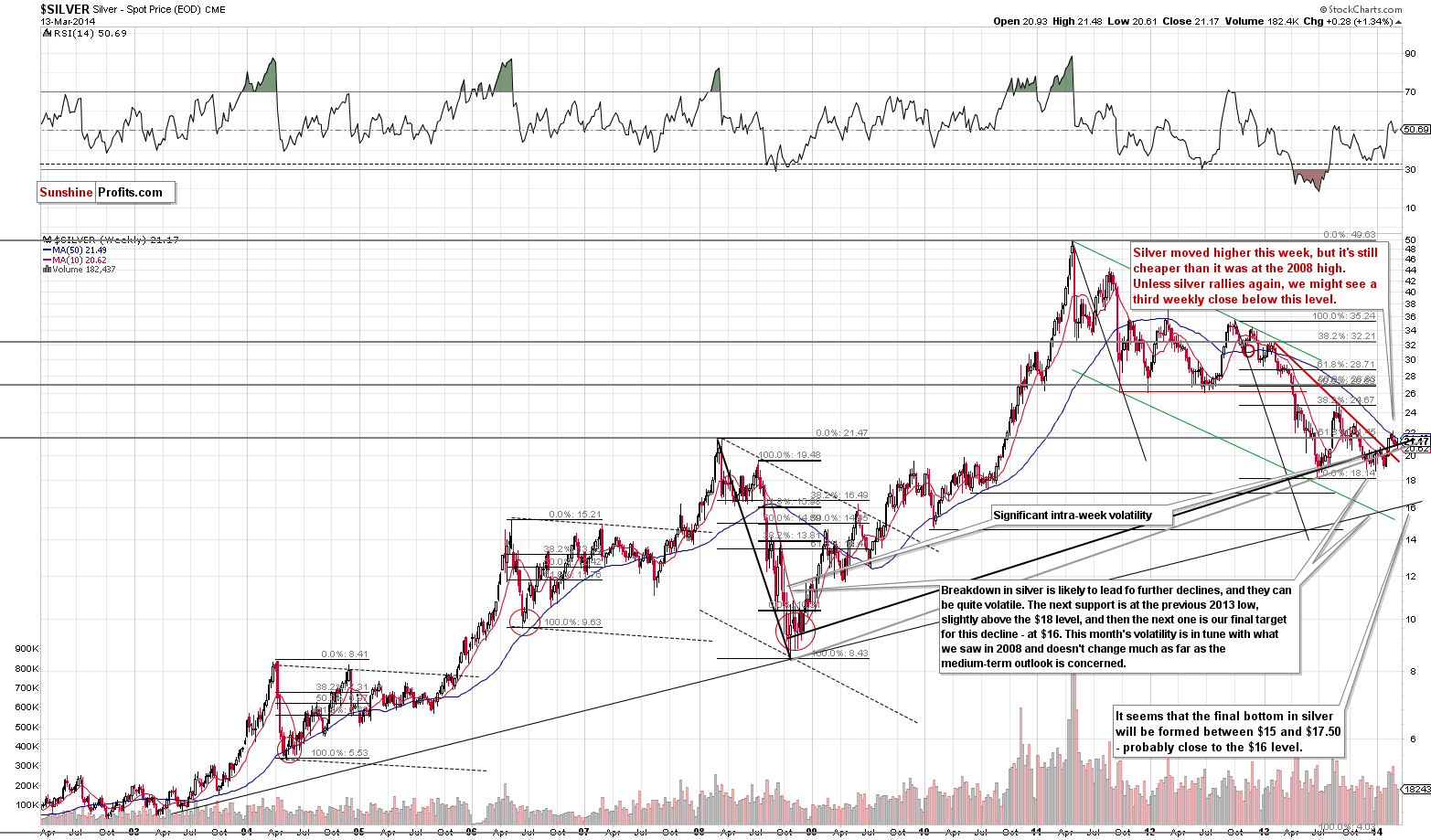

Silver didn’t do much yesterday – it actually declined slightly. This means that the white metal continues to underperform. Unless it rallies today, it will close below the 2008 high for a third consecutive week, which would have bearish implications.

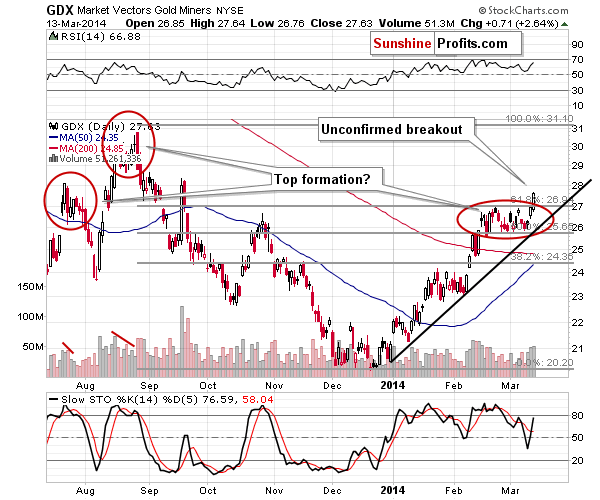

Now, mining stocks moved significantly higher and the move took place on significant volume. That’s bullish price action on its own, but let’s keep in mind that the breakout is not verified, and neither gold (no breakout above the 38.2% Fibonacci retracement), nor silver (no rally at all) confirm it. Perhaps miners are leading the way here, but it’s too early to say so.

It seems that the precious metals sector will move lower in the coming weeks, but just in case the situation in Ukraine deteriorates, we are keeping half of the long-term investment position in gold. In fact, gold has been outperforming both silver and mining stocks since Russian troops entered Crimea. Yesterday’s outperformance of mining stocks is a small exception to the above rule.

If the precious metals market declines, it seems that short positions in gold will gain more than the long-term investment in gold will lose, and if the sector rallies, then gold’s appreciation – due to its outperformance – can more than make up for the miners’ and silver’s move up. The above depends on the size of the positions, but still, it seems that utilizing this spread was a good idea.

Based on where the Euro Index and gold have moved today in pre-market trading, we might have seen or perhaps will see a local top today. However, based on the situation in Ukraine, we choose not to close the long position in gold as far as long-term investment capital is concerned.

To summarize:

Trading capital (our opinion): Short position (half): silver and mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.9

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts