Briefly: In our opinion, long (half) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

Gold, silver and mining stocks finally showed some strength yesterday. This was not a huge move, but in light of the previous several-day-long decline a daily rally is rather significant. Is the rally really back?

That seems quite likely. The breakdown in the HUI Index that we described yesterday was just invalidated, which is a significant bullish signal. Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

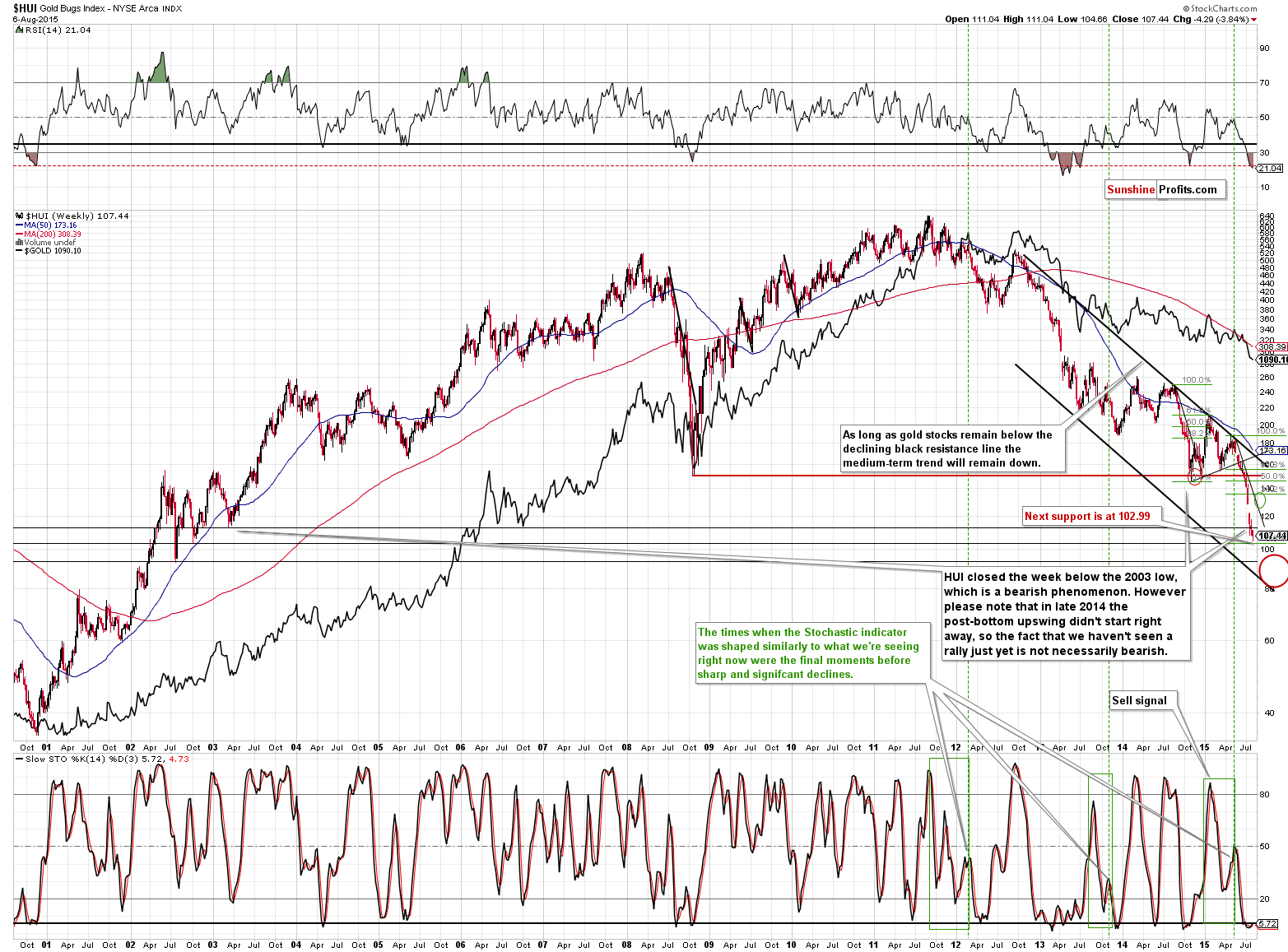

Yesterday we commented on the above chart by saying that the HUI’s decline was not something particularly important as the index had moved lower but not to the next significant resistance level. Yesterday’s rally seems to confirm that. Unless miners plunge again today, they will form a weekly reversal candlestick, which will have bullish implications.

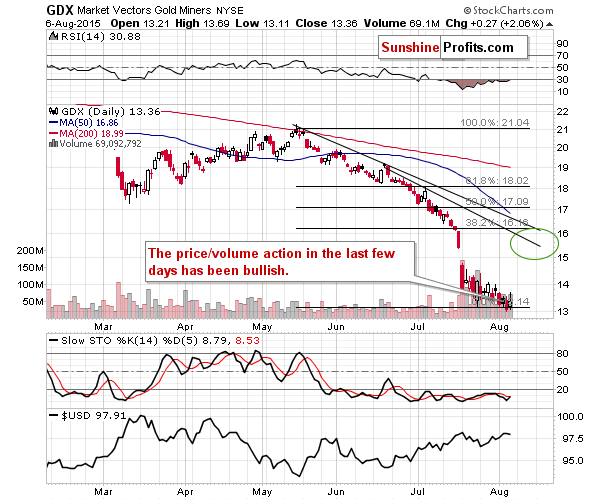

On the short-term chart we see that the breakdown below the previous lows was just invalidated and the implications are bullish. Whenever a market is not strong enough to move the price below a certain level and keep it there it’s a rather strong suggestion that the price will likely move in the opposite direction. In this case, this direction is up.

Moreover, please note that the price/volume action in the last few days has been supporting higher prices. The volume during daily upswings was higher than during daily downswings. The implications are bullish.

What about the underlying metals?

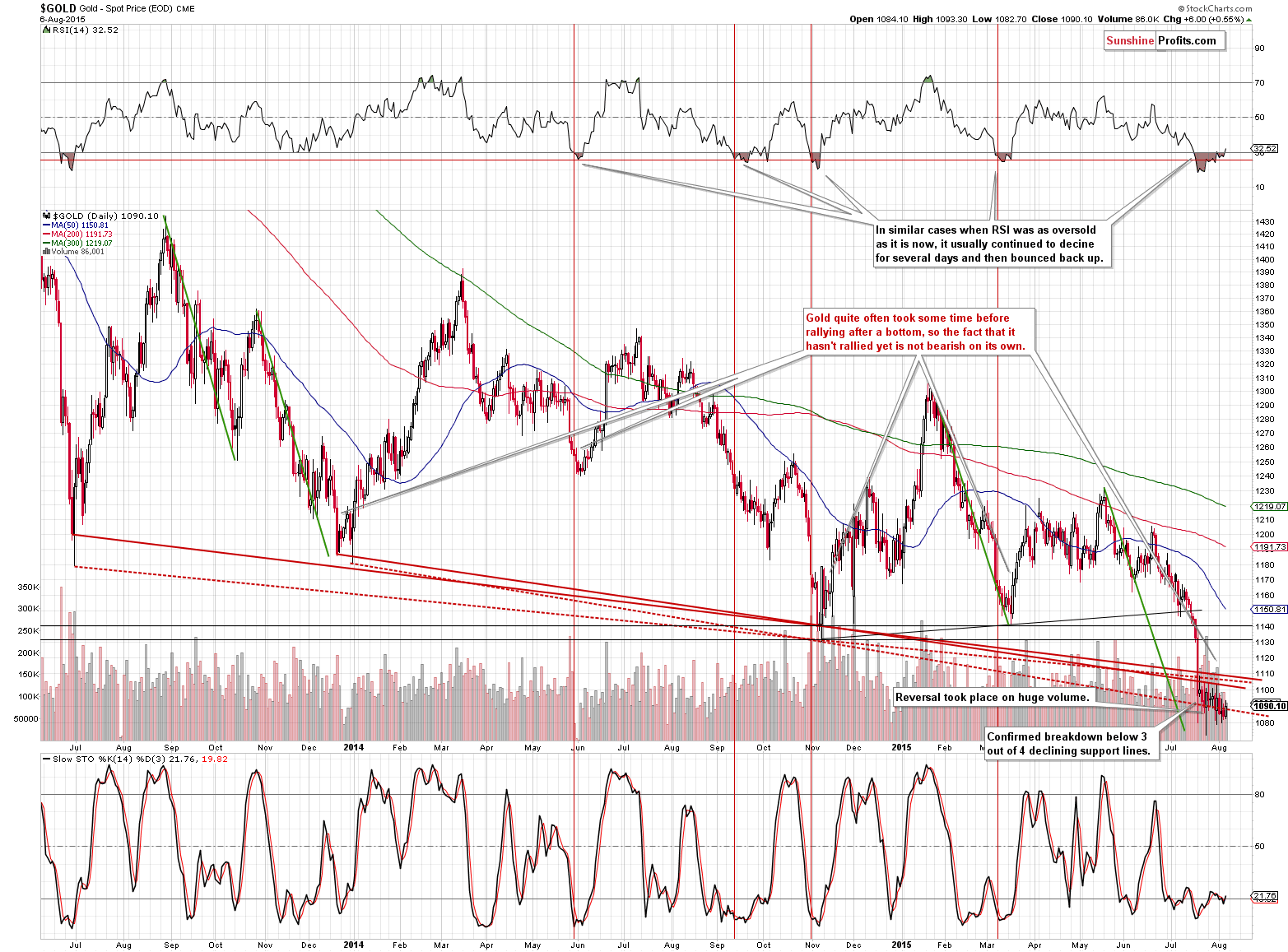

Gold invalidated the small breakdown below the lowest of the declining support lines, which is a bullish phenomenon. The volume accompanying the comeback was low, which is actually bearish, so the situation improved, but only a bit – not significantly.

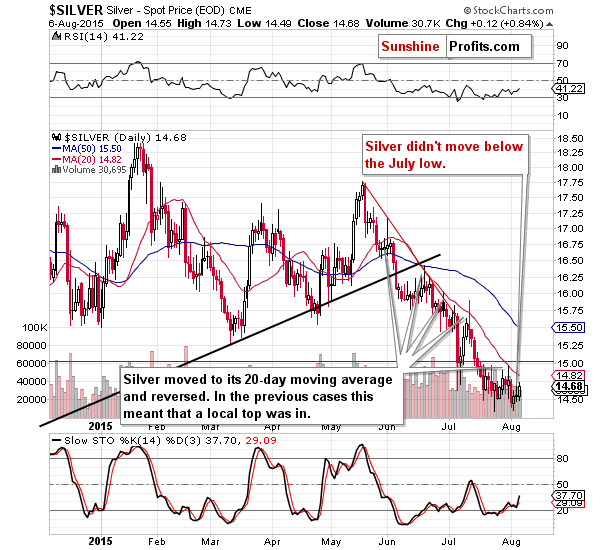

Meanwhile, silver moved higher, but it’s hard to say that a 12-cent rally had meaningful bullish implications. Naturally, it’s a bullish phenomenon, given that the USD Index didn’t do much, but that’s not a breakout above the resistance levels.

Overall, once again, there’s not much that we can say in addition to the above, so we can summarize today’s alert in the same way as we summarized the yesterday’s issue:

Summing up, from the medium-term perspective nothing changed in the precious metals market recently as the situation was and still is bearish, but – as we described yesterday - from the short-term perspective the situation is bullish but not extremely so (the situation in the HUI Index improved somewhat, but not significantly, so overall not much changed based on yesterday’s price swings). The precious metals market is still oversold on a short-term basis and the situation still seems bullish for the short term (and we think that taking profits off the table and closing our previous short position when silver moved to $14.33 was a good idea), but it’s not as bullish as it was just a few days ago and not as bullish as it was when we decided to open the speculative long positions.

While – based on the bearishness in the mainstream media – it doesn’t seem that closing the speculative long positions entirely is a good idea, it does seem that only half of the regular size of the position is currently justified from the risk/reward point of view.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long position (half) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,130; stop-loss: $1,063, initial target price for the UGLD ETN: $9.24; stop loss for the UGLD ETN $7.69

- Silver: initial target price: $15.20; stop-loss: $14.12, initial target price for the USLV ETN: $14.40; stop loss for USLV ETN $11.51

- Mining stocks (price levels for the GDX ETN): initial target price: $15.87; stop-loss: $12.37, initial target price for the NUGT ETN: $5.17; stop loss for the NUGT ETN $2.46

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.78; stop-loss: $17.67

- JNUG: initial target price: $12.01; stop-loss: $6.39

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

At the end of July, commodities plunged to a 13-year low. What does it mean for the global economy and the gold market?

Commodities Plunge to 13-year Low

=====

Hand-picked precious-metals-related links:

Massive gold reserves in Greece offer unique opportunity for Eldorado Gold

Total commodity AUM fell $6 billion in June: Barclays

=====

In other news:

Dominant Dollar Eyes Jobs as Signal for September Rate Increase

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts