Briefly: In our opinion short speculative positions in gold (half), silver (half) and mining stocks (full) are justified from the risk/reward perspective.

Generally, everything that we wrote in the previous alerts is up-to-date, but since another trading week was completed, we would like to comment on the key 3 charts: gold, silver and mining stocks (charts courtesy of http://stockcharts.com.)

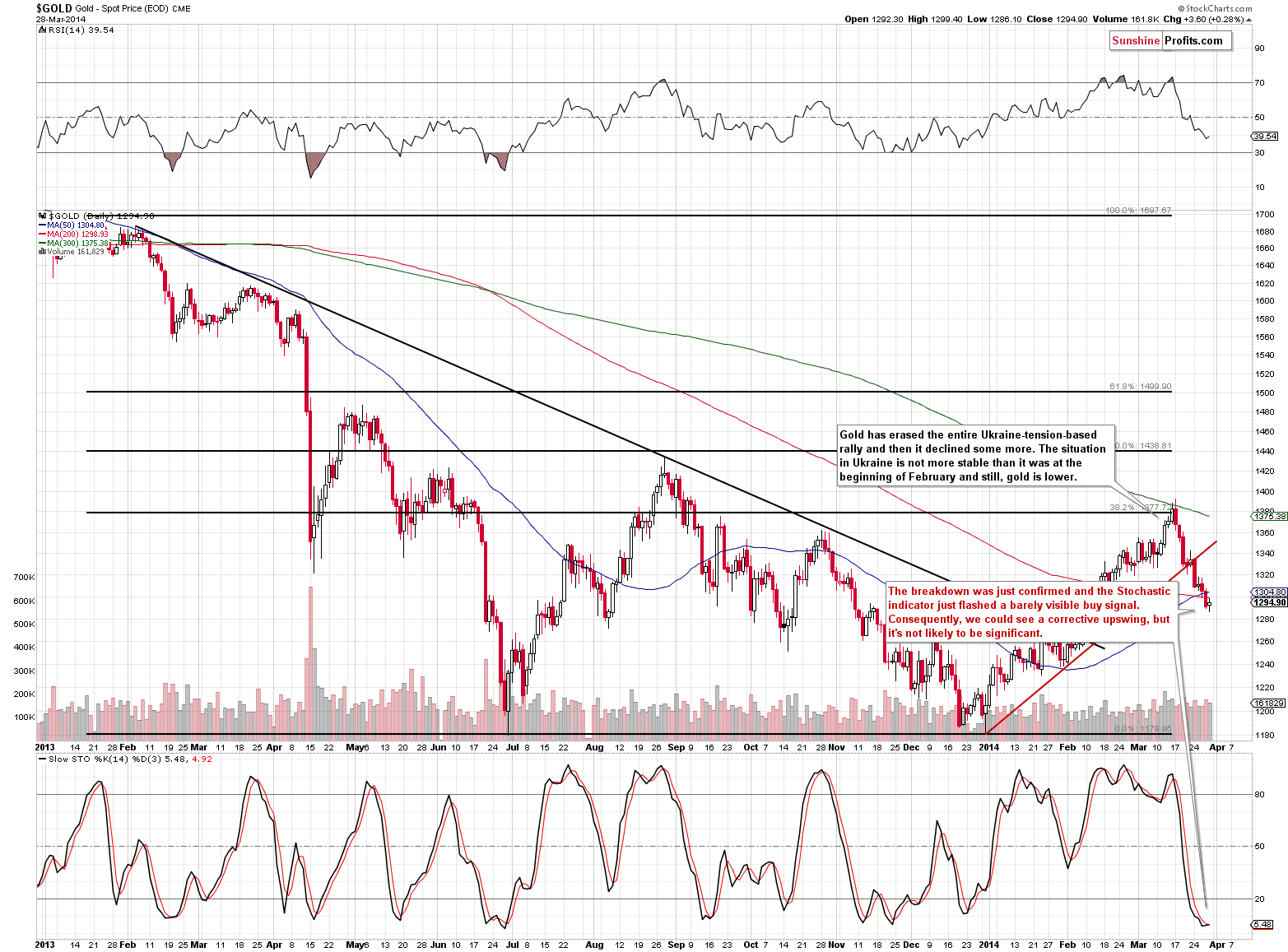

Gold paused. To be precise, it moved slightly higher, but that move was barely visible. Nevertheless, it was enough to make the Stochastic indicator generate a buy signal and thus the probability of a very short-term move higher increased. Still, we don’t think it will be really significant – it seems that since the breakdown was well confirmed and the outlook for the USD Index is bullish, gold will only manage to start a limited rally. It even seems “risky” to close the short position based on this signal as the rally could be cancelled on an intra-day basis.

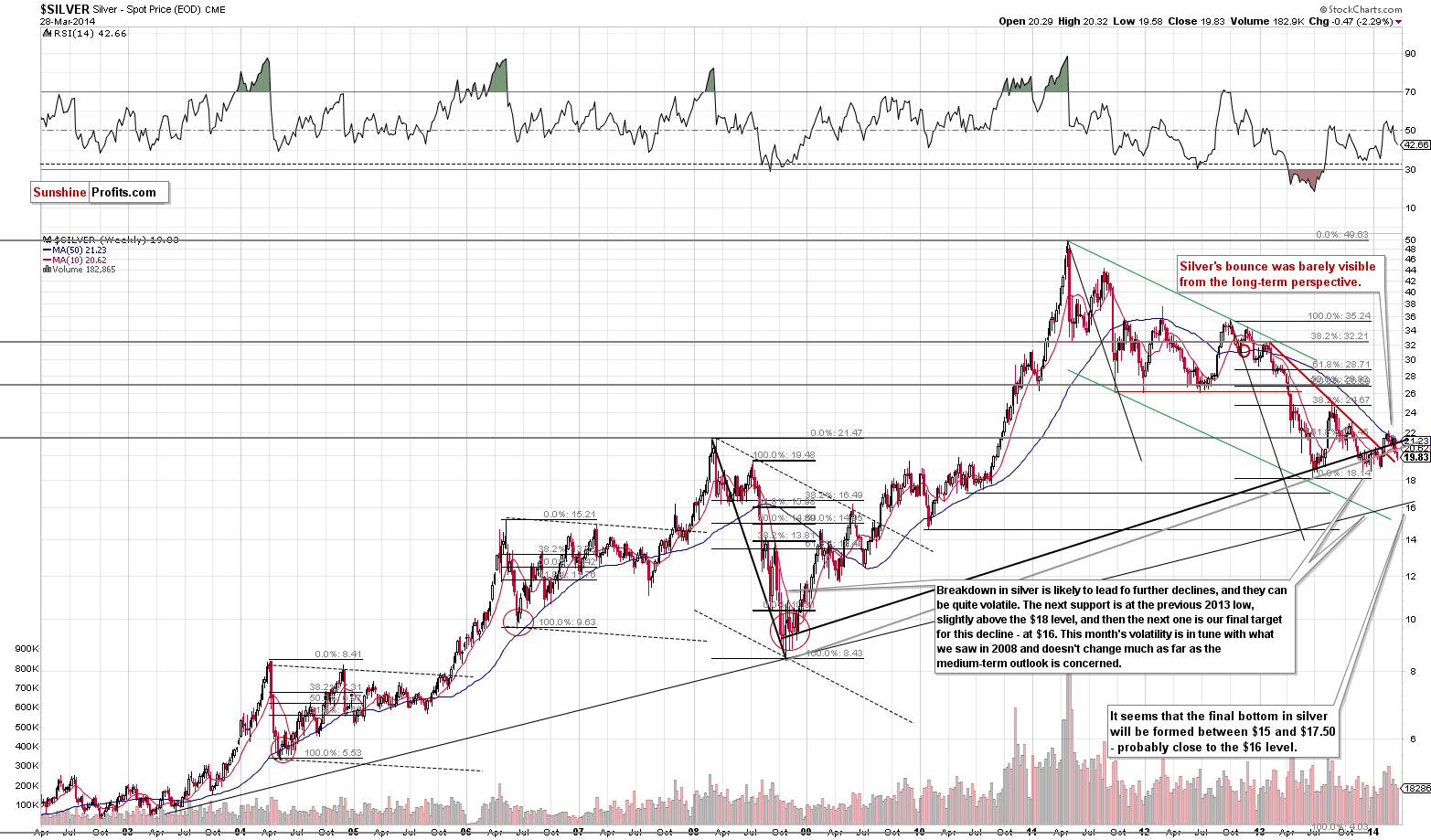

In case of silver, there’s not much to be discussed. The moved higher that we saw in the final part of last week was very small and practically nonexistent from the long-term perspective. Consequently, the outlook remains bearish.

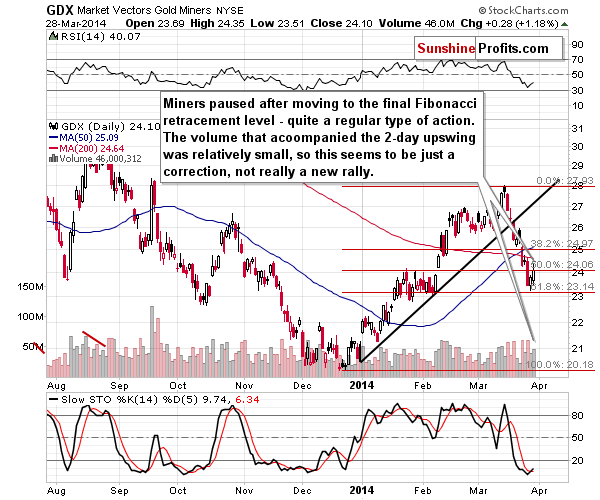

Mining stocks have declined particularly strongly in the past several days so it’s no wonder that we saw the most visible correction in this part of the precious metals sector. However, the 2-day rally materialized on relatively low volume, which suggests that it’s indeed a correction and not the first days of a new significant rally.

As you can see in the lower part of the above chart, the Stochastic indicator generated a buy signal, but this doesn’t necessarily mean that a major rally is about to be seen. Please note how miners performed in mid-November 2013 after an initial buy signal – they corrected just a little before declining much more than they had previously. We could see this type of action here once again.

It still seems to us that mining stocks could move to their 2008 lows in the coming months or weeks. Taking the pace of the previous declines into account it seems that we could see these levels being reached this summer (June seems to be the earliest month when this could be seen) – no guarantees, of course.

Overall, the outlook for the precious metals sector remains bearish.

To summarize:

Trading capital (our opinion): Short positions: gold (half), silver (half) and (full) mining stocks.

Stop-loss details:

- Gold: $1,342

- Silver: $20.85

- GDX ETF: $25.6

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts