Briefly: In our opinion no speculative positions are currently justified from the risk/reward perspective.

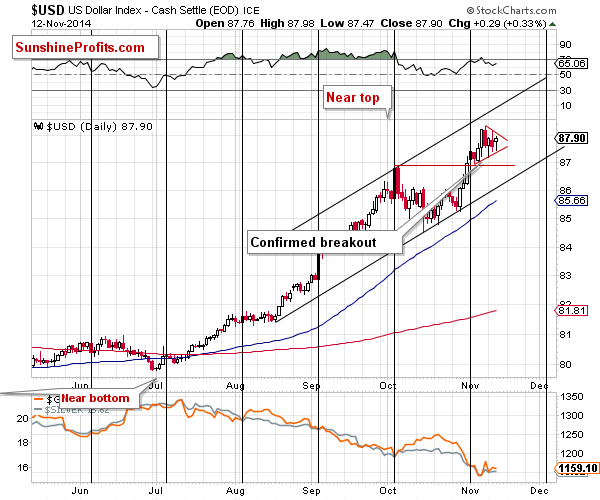

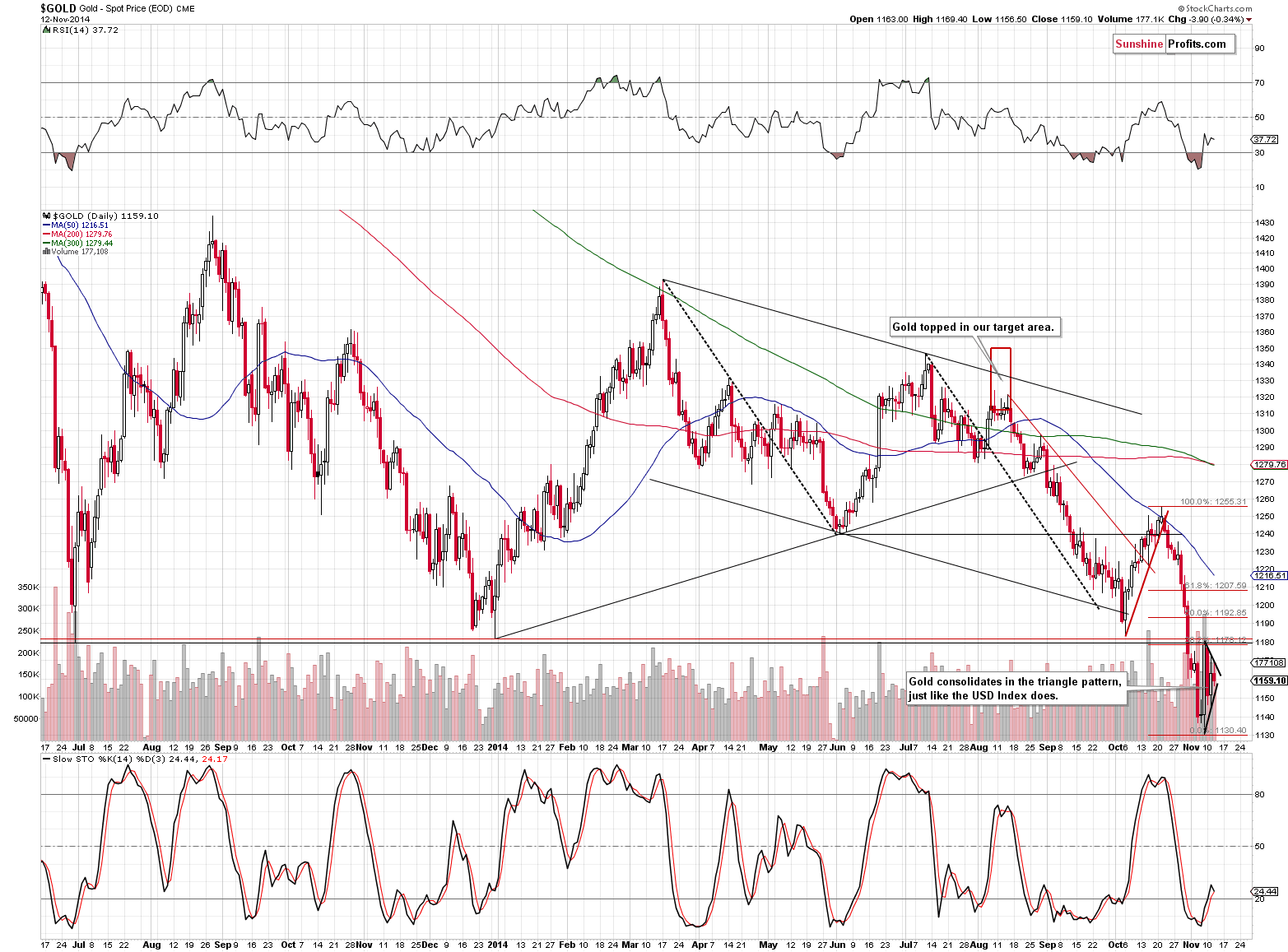

Generally, what we wrote yesterday remains up-to-date. The USD Index remains in the post-rally triangle consolidation pattern and gold is in the post-decline triangle consolidation pattern. Let’s take a closer look (charts courtesy of http://stockcharts.com).

Since the situation and outlook remain as previously, quoting the previous alert seems appropriate:

Based on the recent price action, we see that the USD Index created a small triangle pattern. We marked it with red lines. Triangles are generally a consolidation pattern, especially during upswings. The size of the next move (after the USD breaks above the upper red line) is – based on the triangle formation – likely to be significant as the move that preceded the pattern was also significant. The USD rallied for more than 2 index points, so it could move over 90, based on this pattern alone.

The USD Index moved a bit higher yesterday, but it didn’t move above the upper border of the triangle, so generally nothing changed.

Yesterday’s comments about gold are up-to-date as well:

The U.S. dollar’s consolidation meant also a consolidation in the precious metals sector. Since the USD Index is more likely than not to continue its rally, then gold is more likely than not to continue its decline. However, it will be only after the USD breaks above the triangle that the odds for these moves will become much greater. Until we see a confirmed breakout (or at least an unconfirmed one) the situation will remain rather unclear for the short term (with a bearish bias for gold).

(…)

Gold definitely has room for further declines, as no strong support was reached and the closest one is below $1,100.

There’s not much more to say about silver and mining stocks, so before summarizing we will feature a different chart.

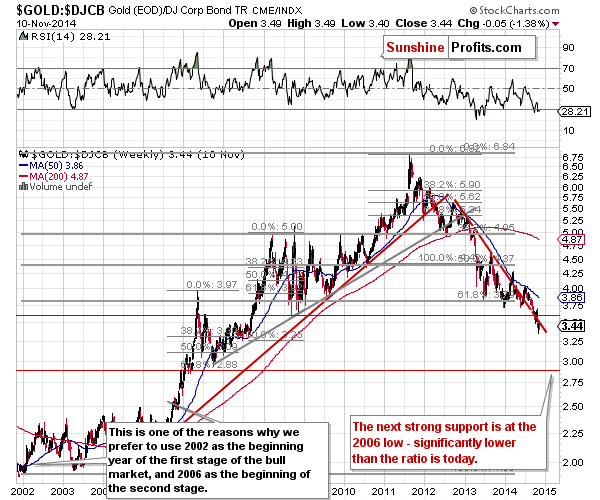

The gold to bonds ratio does a very good job of emphasizing the main trends in the precious metals market. Overall, it moves in tune with gold, but the short-term movements are smaller, which allows us to focus on the bigger price swings and trends. At this time it “tells” us that gold is likely to move significantly lower before the decline is completely over. The reason is that the ratio broke below the previous strong support levels and thus it is likely to move to at least the next one. The “problem” is that the next support is quite far away – at the 2006 low. This doesn’t mean that gold itself would move to its 2006 low, but it indicates that gold could bottom when the ratio moves to its own 2006 low. Either way, it seems that gold is likely to slide further before the final bottom is in.

All in all, we can summarize the current outlook for the precious metals market just as we did yesterday:

Summing up, the final bottom is most likely not yet in, but there are some signs that point to further increases in the very short term (several days). Not all signs, however, suggest strength in the short run and the overall the situation is rather unclear. The medium-term trend remains down, so the surprises should be to the downside and we think that we will see another decline relatively soon. Based on yesterday’s price action in the USD Index, we have something that will help us determine when the risk associated with having a short position decreases significantly. It seems that this will be the case when the USD Index successfully breaks above from the triangle pattern.

As always, we will continue to monitor the situation and report to you – our subscribers – accordingly. We will aim to multiply the recent profits and will quite likely open another trading position shortly – stay tuned.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index remains close to Tuesday’s all-time high as it fluctuates along the level of 2,040. Is holding short position justified?

Stock Trading Alert: Uncertainty Following Recent Move Up – Will Uptrend Extend Even Further?

Although crude oil moved lower after the market’s open, the commodity erased losses later in the day, hitting an intraday high of $78.04 as concerns over the situation in Libya supported the price. In this way, light crude gained 0.45% and bounced off the recent lows. Will we see a post double-bottom rally in the coming days?

Oil Trading Alert: Sinking Or Rebounding?

=====

Hand-picked precious-metals-related links:

Swiss regulator flags attempt to manipulate bullion benchmarks

Gold struggles to find buyers in third quarter

Barrick to push ahead with Pascua Lama, ‘no margin for error’

Gold loses luster as retail investors look to silver

=====

In other news:

Is the Fed Targeting Another Bubble?

U.S. stocks still look great compared to the rest of the world

European probe lands on comet, but fails to anchor down

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts