Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

The precious metals sector moved higher on Friday after a few weeks of sliding prices. We were expecting to see a short-term move higher despite the medium-term trend being down, and it seems that this move is underway. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

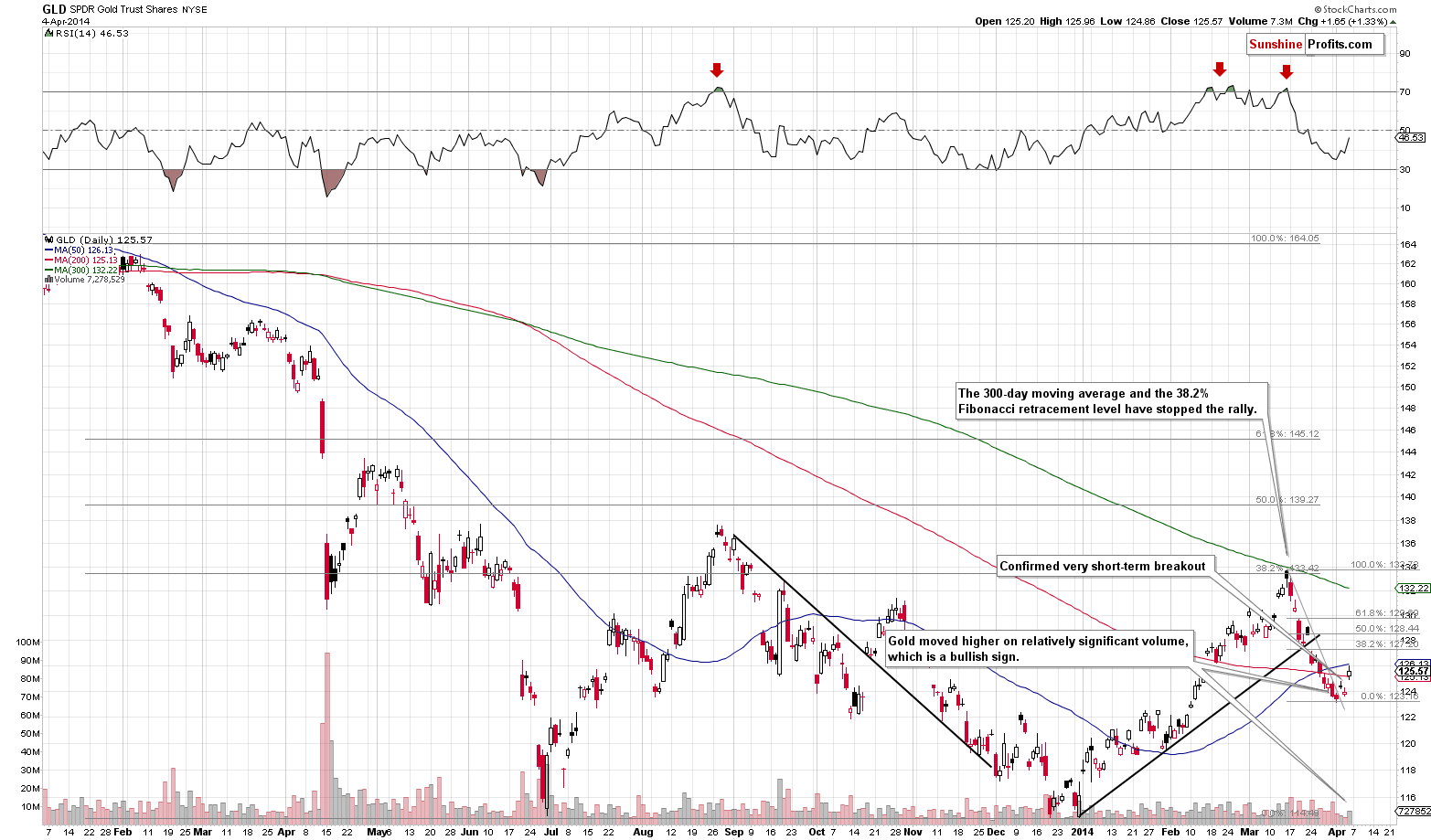

Gold moved higher on relatively high volume, which is a bullish sign for the following days. The volume was not huge, so the strength of the above is limited. Gold’s close on Friday was also the third close above the previously-broken declining resistance line, which means that the breakout was confirmed. The resistance was not that significant, so the implications are not very strong as well.

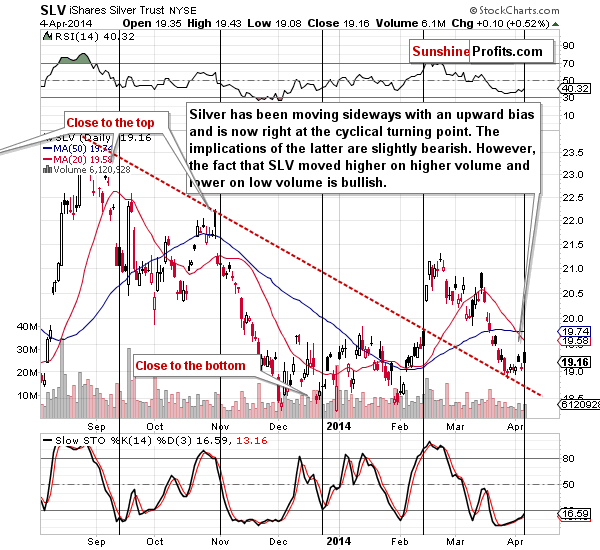

While the gold chart had some bullish implications, the silver chart is rather unclear. The proximity of the cyclical turning point is the reason. More precisely, the lack of clarity regarding the most recent move is the major contributor to the uncertainty here. Silver moved higher last week, but the move was small enough to make the reversal doubtful – it’s not much that can be reversed.

The SLV ETF moved higher on relatively strong volume and declined on relatively low volume in the past 3 trading days. The implications are bullish.

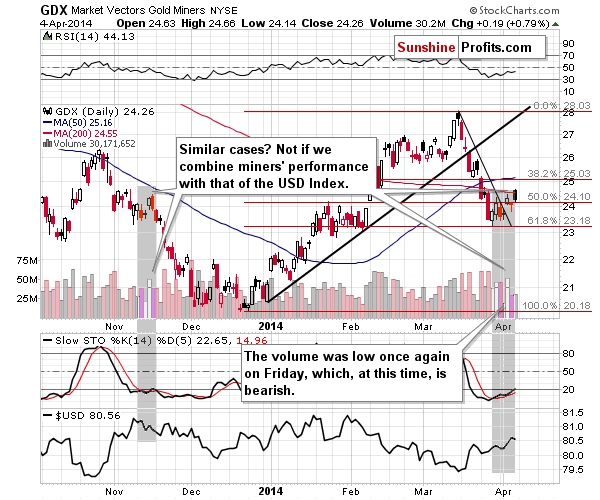

Just like gold, mining stocks also broke above the declining resistance line and confirmed this move by closing above it for third consecutive trading day. However, the volume on which miners rallied on Friday was weak, and the rally itself was quite small. Overall, the above chart is unclear.

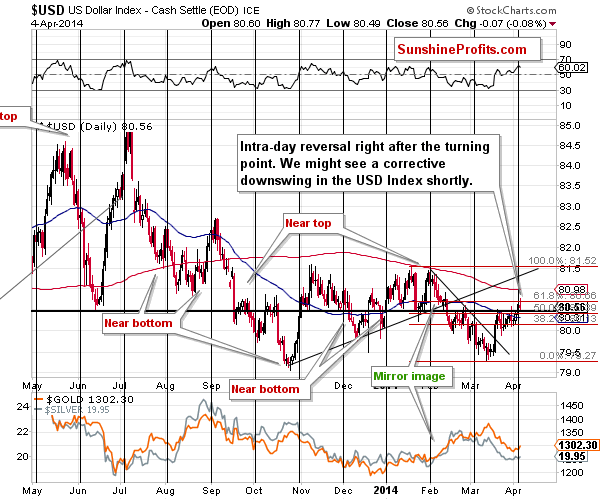

The situation in the USD Index suggests at least a small pullback as the currency corrected to the 61.8% Fibonacci retracement level based on the 2014 decline, and it did so very close to the cyclical turning point. Moreover, we saw an intra-day reversal on Friday.

Consequently, the precious metals market might get a temporary boost from the USD market.

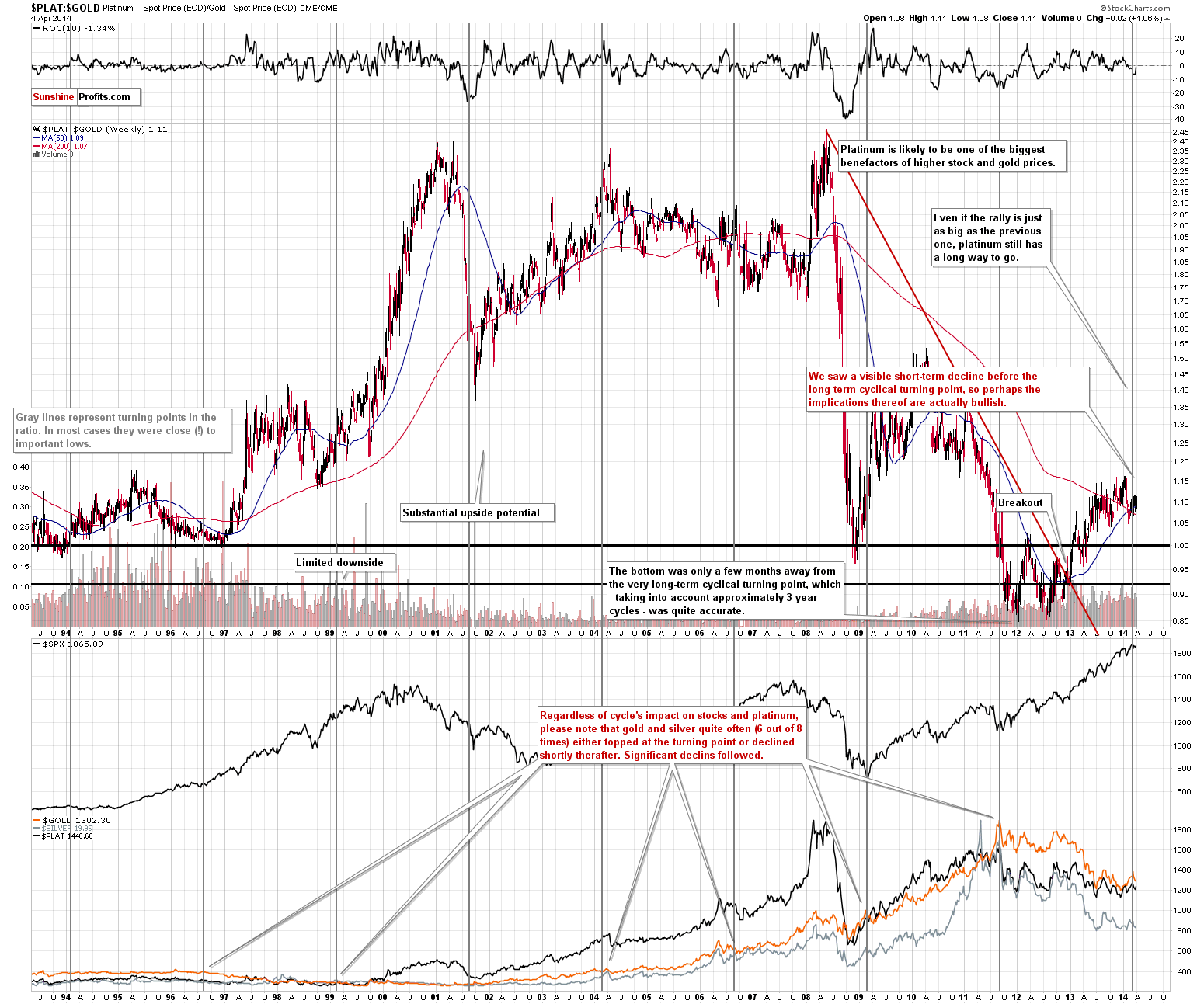

The final chart that we would like to show you today features multiple things: the platinum to gold ratio, the stock market, and gold, silver and platinum themselves. It also features the very long-term turning points and that’s what we would like to draw your attention to.

Please note that the very long-term cycles in the precious metals market were followed by declines in most cases (6 out of 8) – the declines were either seen immediately or shortly. Important (at least medium-term) tops were formed right at the turning points as well. We just saw such a turning point – at the beginning of March. Gold indeed topped at that time. Since it already happened, you are probably wondering why are we bringing this up today. The reason is that the previous declines had generally been bigger than what we saw in March. Therefore, based on this signal alone, gold has probably not completed the decline just yet. This is in tune with what we think about the medium-term trend (which is still down) – we simply have another sign that this is indeed the case.

There are both direct and indirect implications here. The direct implication is that being long precious metals with the long-term investment capital is not really justified from the risk/reward perspective (since the move lower could be significant). The indirect implication is that in the case of short-term trades, it makes sense to focus on short positions, because the odds of making profits on them are greater than in the case of long positions. After all, when the upper-level trend is in tune with the trading position, then one can just wait out corrections. We don’t think the situation is bullish enough to justify going long at this time – also because of the above-mentioned reasons.

We plan to re-enter short positions in the coming days or weeks (most likely in the near future).

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts