Briefly: In our opinion no speculative positions are currently justified from the risk/reward perspective.

The precious metals sector moved much higher on Friday, but it started this week by erasing a significant part (in the case of gold and mining stocks) of Friday’s rally. Can we forget about gold’s most recent strength and get back on the short side of the market?

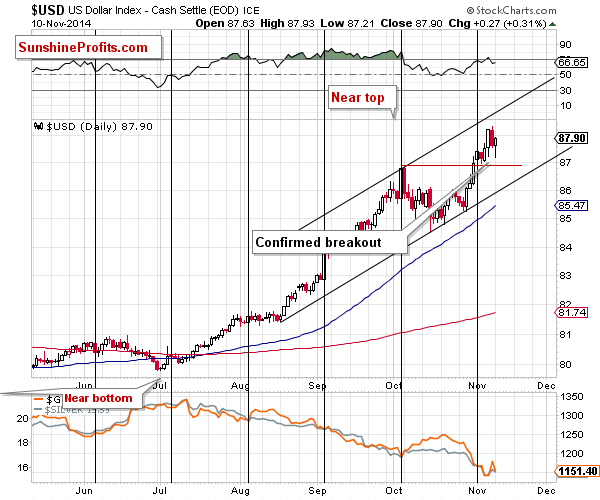

Let’s take a look at the charts, starting with the USD Index (charts courtesy of http://stockcharts.com).

The USD Index moved lower initially yesterday, but reversed and came back before the session was over. It seems that traders were betting that the top in the USD was already in and were surprised by its late-session strength. Perhaps it was the surprise factor that contributed to gold’s decline. Either way, it seems that the breakout above the Oct. high is now confirmed and verified, and we can expect the USD to move higher. How high? Comments from our previous alerts remain up-to-date:

The USD Index is after a major breakout and there is no strong resistance level until about 89. This means that the USD Index is likely to rally for another 1 – 1.5 before the top is in. In other words, the USD Index has room for further gains and gold seems to have room for further declines.

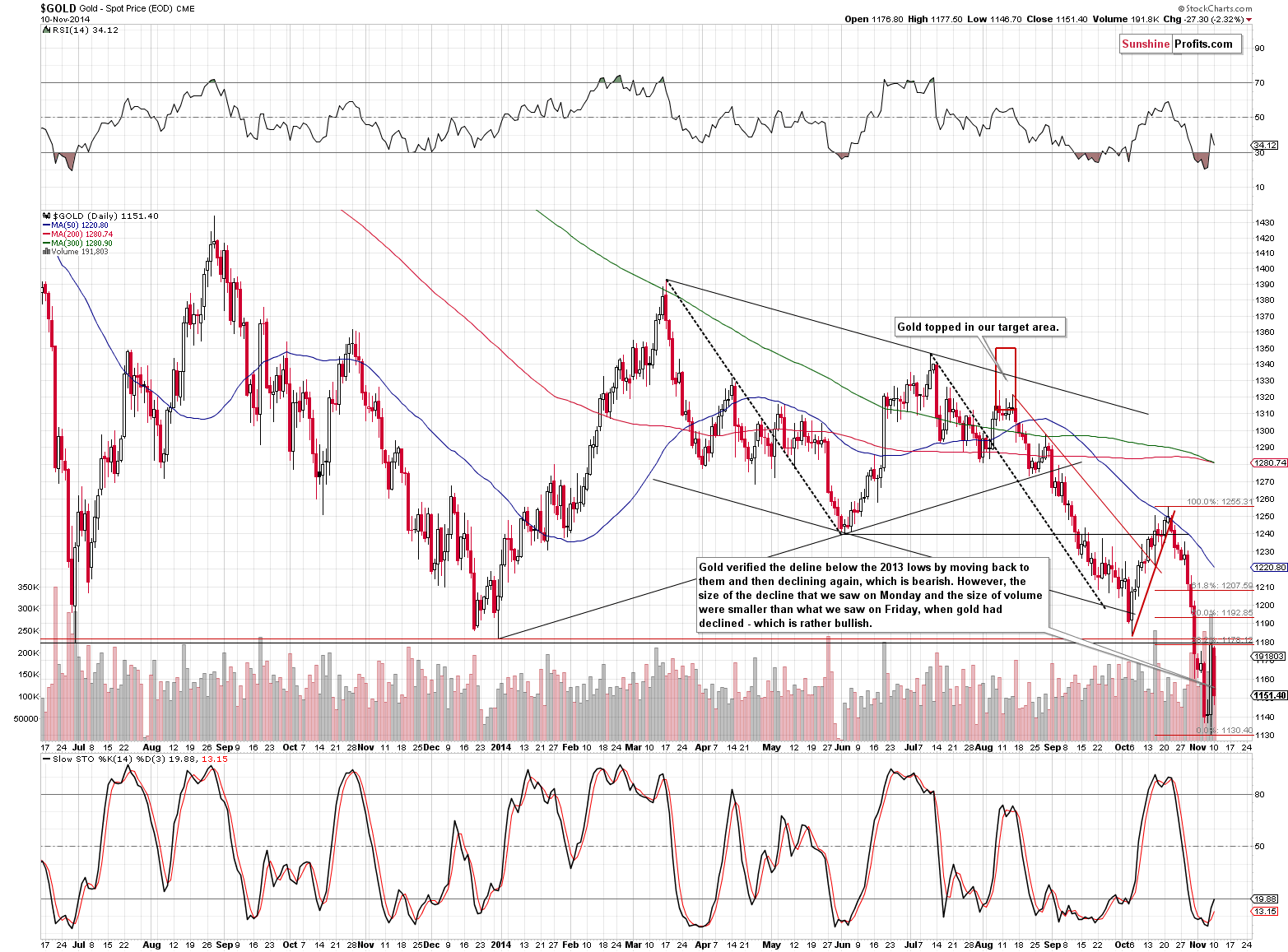

Gold definitely has room for further declines, as no strong support was reached and the closest one is below $1,100. Friday’s rally was definitely a significant development and what we wrote about it yesterday remains up-to-date:

On Friday, however, gold moved higher on strong volume, which is a bullish sign. Gold didn’t manage to close the week above the 2013 low, so the breakdown below it was not invalidated – which in turn is a bearish sign. Moreover, gold corrected to the 38.2% Fibonacci retracement, which means 2 things. Firstly, the current move is still down - until we see a move above the 61.8% retracement the rally will be a correction, not necessarily a beginning of a bigger upswing, and gold hasn’t even moved above the lower retracement of 38.2%. Secondly, the rally could be already over as the resistance was reached.

Gold moved sharply lower yesterday, so the question is if this cancelled the bullish implications of Friday’s rally. Our reply is that it cancelled only part of the bullish implications. The reason is that the size of the move and the volume that accompanied it were smaller than what we had seen on Friday. Monday’s action could (it most likely is not, but it could be) be a correction after Friday’s rally that would be followed by further gains. Again, most likely it was the Friday’s rally that was the corrective move, but the situation is still a bit unclear.

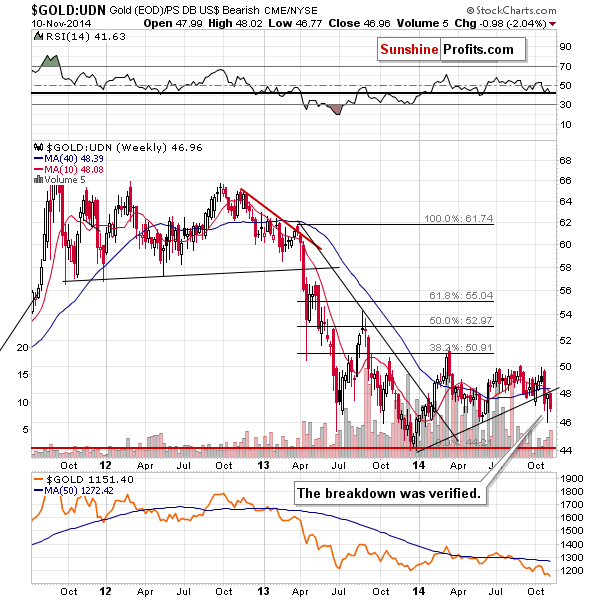

From the non-USD perspective, the outlook remains bearish.

On Friday, gold moved back to the support level, but not above it. This made a subsequent decline quite likely. The candlestick based on the last weekly price changes is a hammer, which signaled a reversal, but based on Monday’s price action we now see that a verification of a breakdown was the correct interpretation.

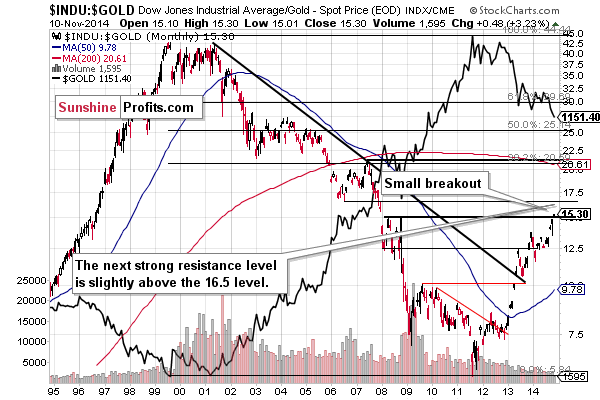

The Dow to gold ratio moved above the resistance line, as it was likely to. The next resistance is slightly above the 16.5 level, so from this perspective, we can expect gold’s decline to continue.

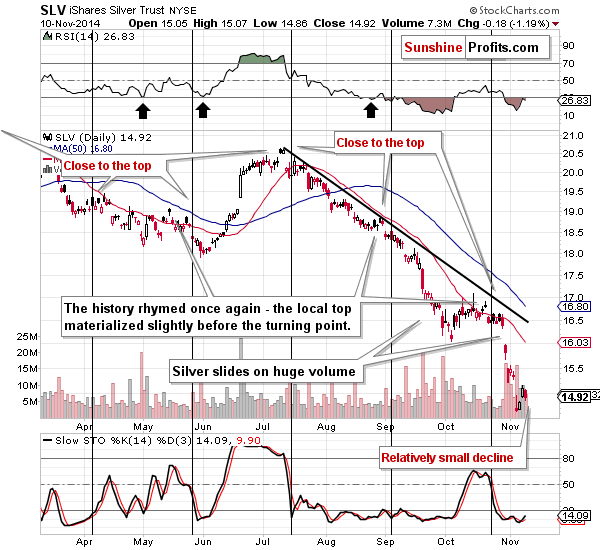

Silver moved lower as well, but the size of its decline was rather limited. However, the previous upswing was small as well, so overall we can say that silver’s reactions were smaller in general – there didn’t have to be meaningful implications in either direction.

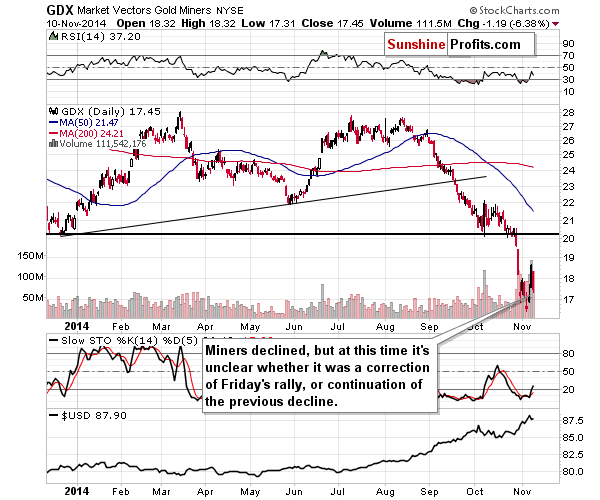

The reaction in gold stocks is similar to the one that we’ve seen in gold. It moved lower, but the move was not as significant as Friday’s rally. At this time, the implications are rather unclear, with the situation being more bearish than it was yesterday.

Overall, we can summarize the situation in the same way as we did yesterday, because even though the situation deteriorated (in tune with our expectations), it remains too unclear to open speculative short positions (these simply seem too risky).

Summing up, the final bottom is most likely not yet in, but there are some signs that point to further increases in the very short term (several days). Not all signs, however, suggest strength in the short run – there are some that suggest further declines (gold below the 2013 low and non-USD gold below the rising support/resistance line). The situation was not as clear on Friday, as it is now, as we now have the final weekly price changes and weekly closing prices. All in all, the outlook for the next few weeks remains unchanged and bearish (we are likely to see lower gold, silver and mining stock values), but the outlook for the next week or so is a bit unclear. Consequently, it seems that waiting on the sidelines for either a bearish or bullish confirmation is a good idea now. The odds favor a move lower, but the risk associated with [having] a short position at this time seems too high. Today it also seems that taking profits off the table yesterday was justified.

As always, we will continue to monitor the situation and report to you – our subscribers – accordingly. We will quite likely open another trading position shortly – stay tuned.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Friday, crude oil gained 0.77% as a weaker dollar and concerns over the situation in Ukraine pushed the price higher. As a result, light crude approached the previously-broken barrier of $80. Is this a sign of strength or the last stop before new lows?

Oil Trading Alert: What’s New For Crude Oil?

=====

Hand-picked precious-metals-related links:

Exclusive: Russian central bank buys up domestic gold output as sanctions bite

Goldman cautious on gold outlook

Nearly $1.7 Billion Wiped Out From Precious Metal Funds

Investors Purchase Large Volume of Put Options on Yamana Gold (AUY)

Gold bulls beware: 'More pain coming' before the metal finds a bottom

=====

In other news:

Fears of German recession as moment of truth looms

Greek Recession Seen Ending in Respite for Samaras

How the Bad Economy Breaks Up Families

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts