Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

The precious metals market declined once again yesterday. Will it continue this trend for much longer? There are some reasons that lead us to believe that it will move higher, and there are some that make us think that it will move lower. When will it move in which way? Before we look at the charts (charts courtesy of http://stockcharts.com), let’s reveal the secret – nothing changed based on yesterday’s price action. The USD Index is still likely to turn south based on the current cyclical turning point and the Euro Index could rally any day now. Speaking of the latter, we even decided to take the profits off the table in the case of our recent short position in the EUR/USD pair. Quoting yesterday’s Forex Trading Alert:

So far, we noticed only one-day rally and a small consolidation, which didn’t change the short-term picture. Nevertheless, it’s quite likely that a local bottom is materializing right now as EUR/USD reached an important support zone (and also our downside price target), which may translate to a bigger corrective upswing. Therefore, we think that cashing out of the short positions (opened on July 16 at 1.3523) and taking profits off the table seems to be appropriate.

All in all, the Euro Index is likely to decline, but probably only after a short-term corrective upswing.

What about gold?

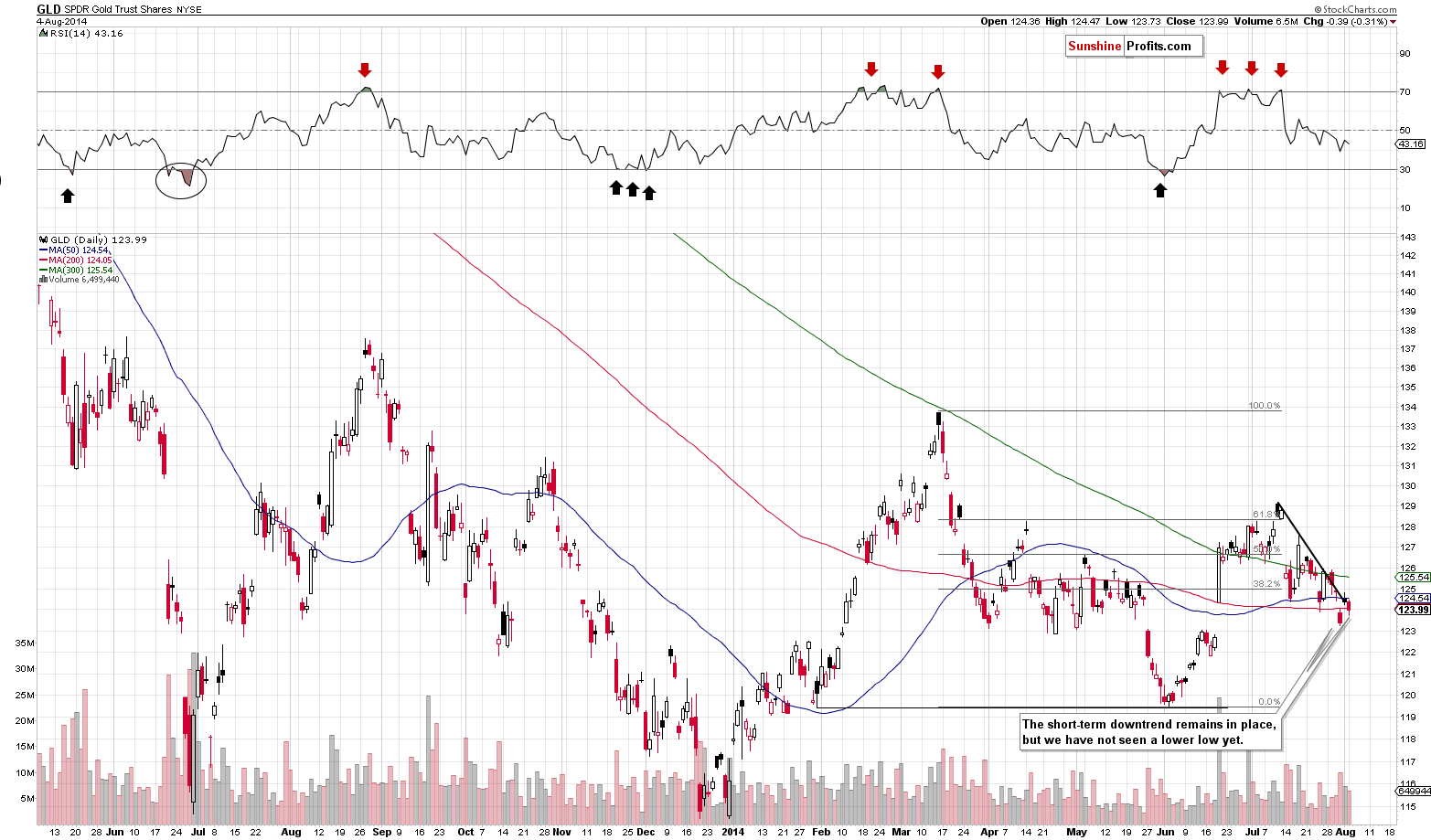

Gold declined yesterday, but just a little, so overall not much changed. The trend is down for both the short and medium term, but since gold has not declined as much as it “should” based on the dollar’s rally, it still seems likely that a correction is just around the corner.

The implications of the situation in the silver market remain unchanged:

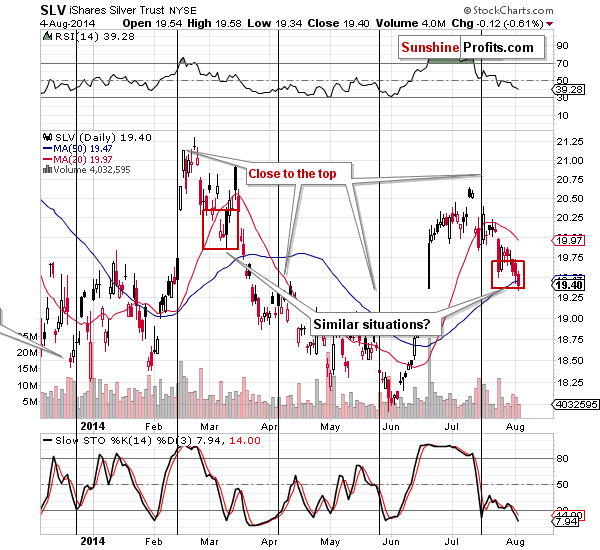

The current situation is similar to what we saw in March. Silver declined after a local top was formed close to the turning point, then bounced a bit and then it moved a bit below the previous low. Back in March it rallied for a few days only to disappoint and plunge shortly thereafter. This scenario seems quite probable at this time, not only because of the similarity on the above SLV ETF chart but also because of the situation in the currency markets.

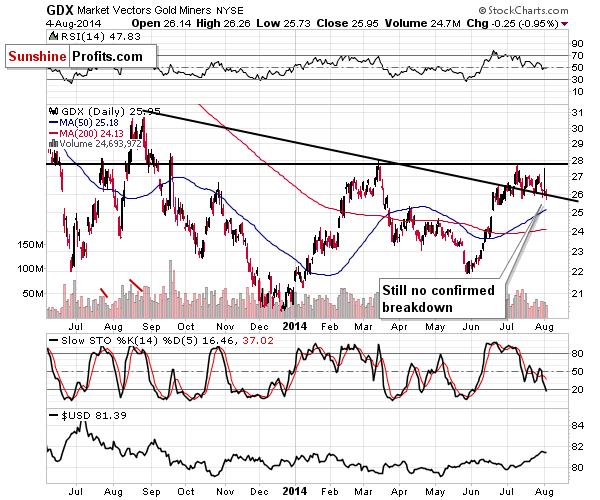

The situation hasn’t changed in the case of mining stocks either. There was no breakdown below the declining support line, so we could see a move higher here, based on the verified breakout above the declining support/resistance line, or we could see a decline based on Friday’s reversal. All in all, the situation is unclear for mining stocks.

Summing up, it seems that even though the next big move in the precious metals sector is still likely to be to the downside (we have not yet seen actions that are usually seen at important bottoms, like huge underperformance of silver, and gold is not actively hated in the mass media), the odds for a corrective rally are relatively high. We plan to re-enter short positions when we see either a small rally an some kind of confirmation that the next local top is in (more likely scenario in our view) or a confirmation that there will be no visible correction (for example a continuation of the dollar’s rally despite the current turning point). At this time, we prefer to say out of the market.

We were asked if we have any price targets for this likely short-term upswing in gold, silver and mining stocks. Unfortunately, the situation seems too unclear to provide targets for the precious metals market. The clearest picture that we have at this time is for the Euro Index – it seems that the index will move to its February lows before moving lower once again. This could be the turning point for the precious metals market as well, but it’s difficult to tell what price levels this would mean for gold, silver and mining stocks.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts