Briefly: In our opinion short speculative positions in silver (half) and mining stocks (full) are justified from the risk/reward perspective.

The decline in the precious metals sector continued in silver, while gold and mining stocks paused. The preceding move lower was quite volatile, so this seems quite natural… Or does it? Let’s take a look (charts courtesy of http://stockcharts.com.)

Interestingly, we can summarize the above chart in the same way that we did yesterday, because the daily move that we saw on Thursday didn’t change anything:

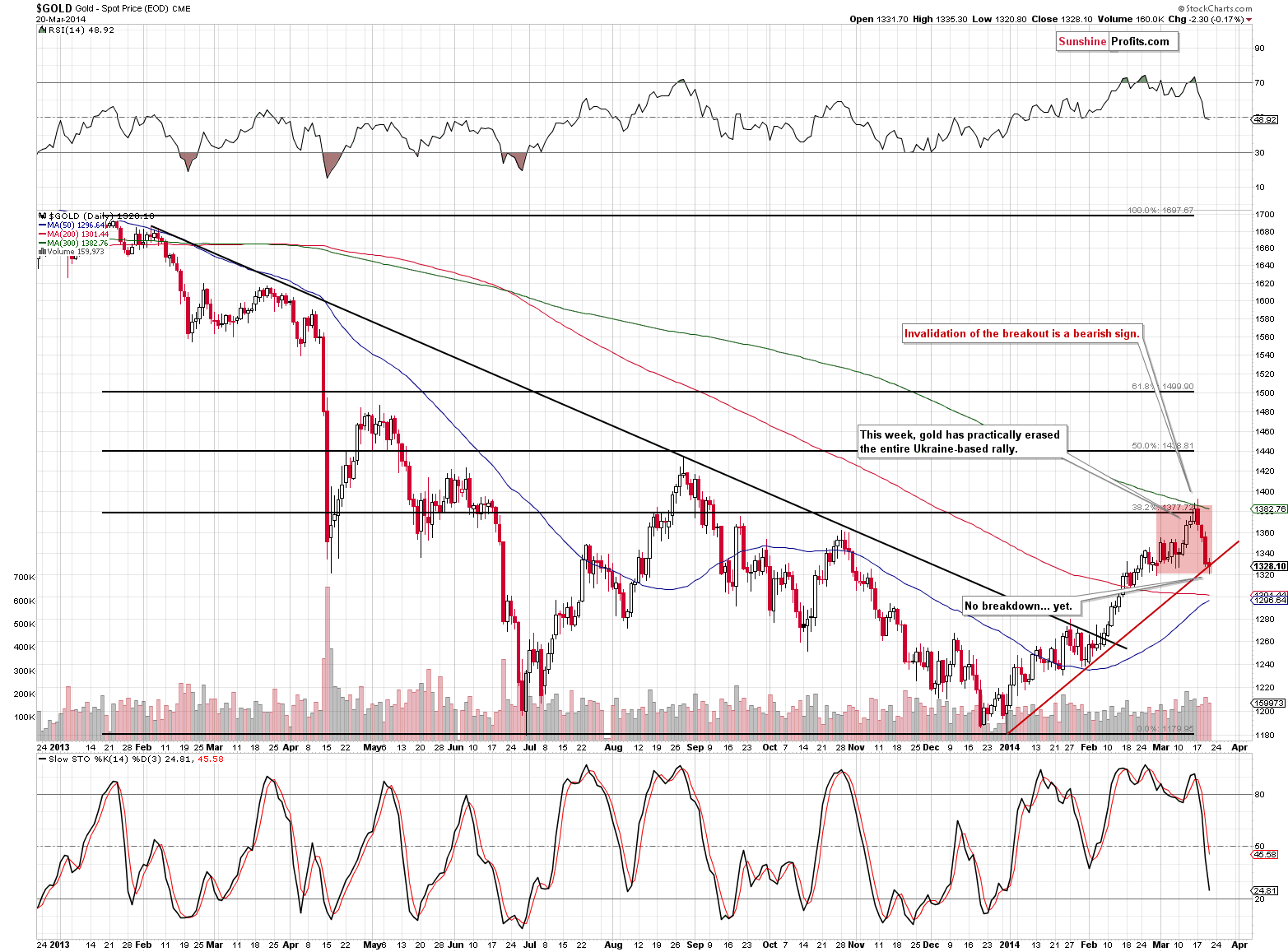

Gold moved lower once again but still not low enough to break below the rising support line. Gold is still outperforming silver and mining stocks (taking this month into account), but now the extent of the outperformance is much smaller. Still, with the situation in Ukraine still being tense, gold might hold up relatively well even if the rest of the precious metals sector declines.

At this time we see that gold’s reaction to the events in Ukraine has been very limited. When markets don’t react to factors that should make them move in a certain direction, they will likely move in the opposite direction relatively soon. In this case, it seems that gold will move lower.

The move below the rising support line (marked in red) could symbolize the start of another big downleg regardless of the geopolitical tensions. For now, the price of gold is already close to this support, but not yet below it.

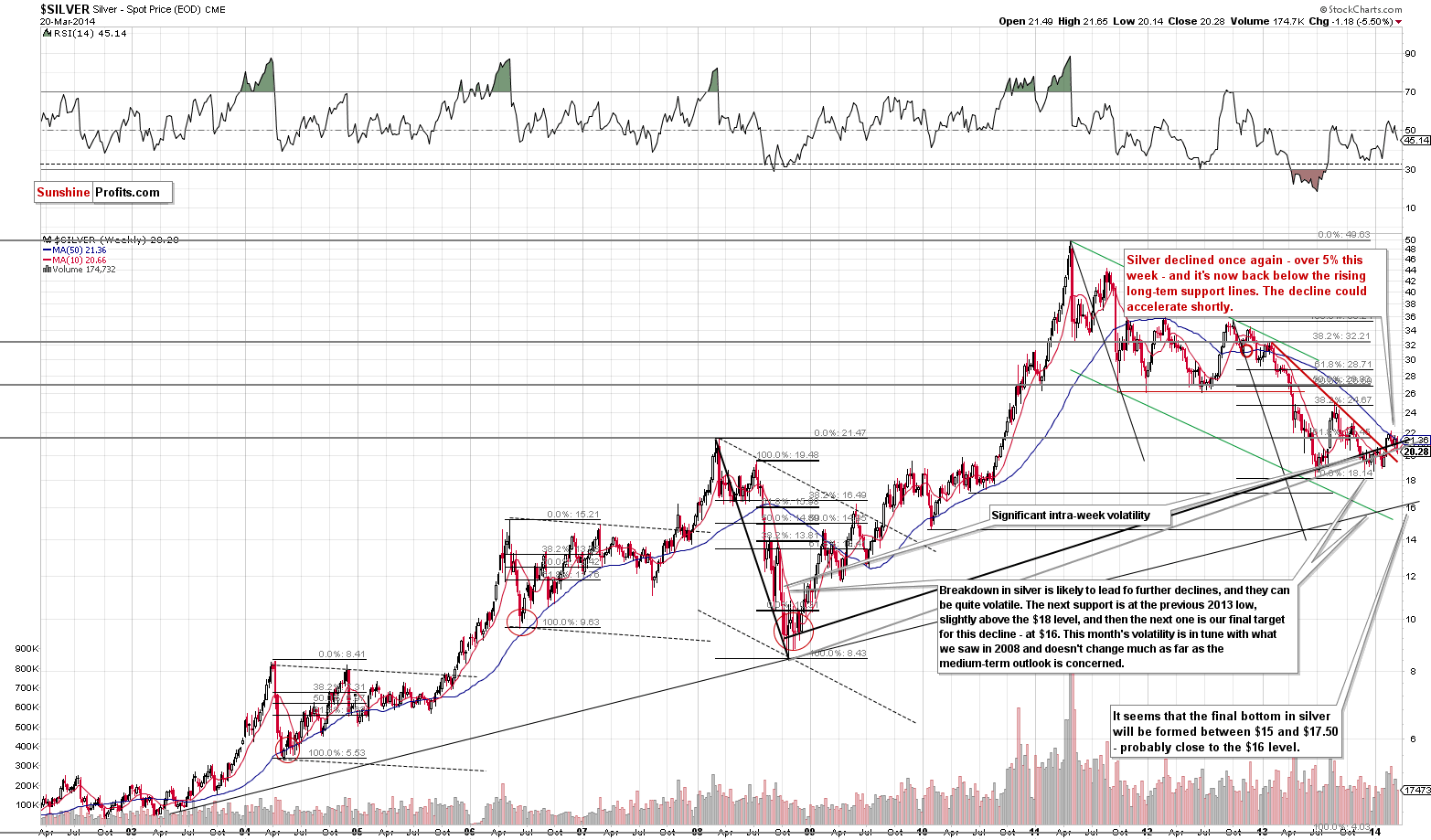

Silver declined more significantly once again, a total of more than 5% this week. It moved below the rising support lines, which is a bearish indication, but it’s also oversold on a very short-term basis, so this time we will wait for the breakdown to be confirmed before we suggest adding to the profitable short positions in the white metal.

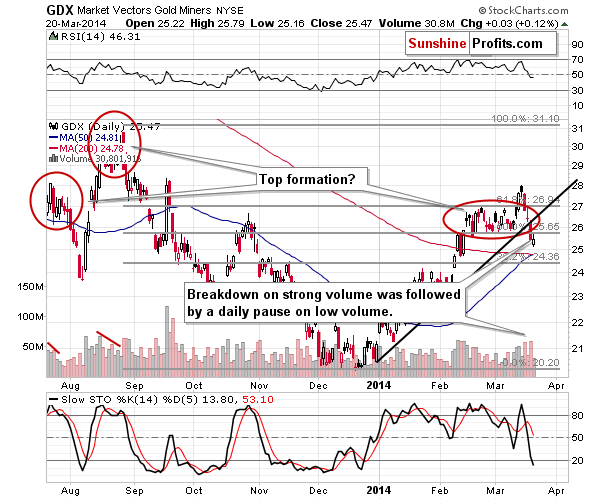

The GDX ETF is still below the rising support line and closed below the 50% retracement for another day, which are both bearish factors. The breakdown below the rising support line is now almost confirmed, and yesterday’s pause on relatively low volume suggests that it will be confirmed. The outlook remains bearish.

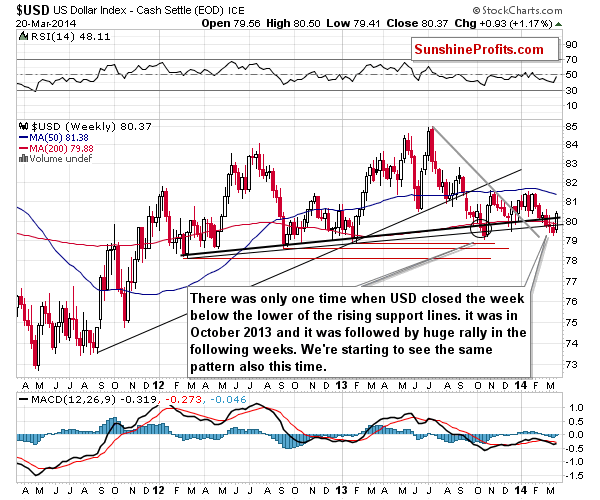

The situation in the USD Index has become even more bullish for the medium term based on yesterday’s continuation of the rally. What we wrote yesterday remains up-to-date:

The U.S. currency was about to rally and it finally did. It took only one day to erase the declines of many previous days. Back in 2013 an analogous rally was even bigger, so it might be the case that the rally is not over just yet. In fact, we think the USD Index has much further to go.

The last two-day rally was quite volatile so a pause here would not surprise us, though.

All in all, we can summarize the current situation in the precious metals market in the same way we have been summarizing it for the last couple of days:

It seems that the precious metals sector will move lower in the coming weeks, but just in case the situation in Ukraine deteriorates, we are keeping half of the long-term investment position in gold. In fact, gold has been outperforming both silver and mining stocks since Russian troops entered Crimea.

At this time however, the technical picture for mining stocks has deteriorated significantly, and thus in our opinion adding to the currently opened short position in mining stocks is justified from the risk/reward perspective.

It seems to us that if it weren’t for the events in Ukraine, the precious metals sector would be already declining and perhaps testing the 2013 lows or moving below them. This could still take place and it’s quite likely to happen once the situation in Ukraine stabilizes.

To summarize:

Trading capital (our opinion): Short positions: silver (half) and (full) mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.9

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts