In short: No changes: small (half) short position in gold, silver, and mining stocks.

Gold and mining stocks moved higher yesterday, but did it really change much in the outlook for the coming days? Let’s take a look (charts courtesy of http://stockcharts.com.)

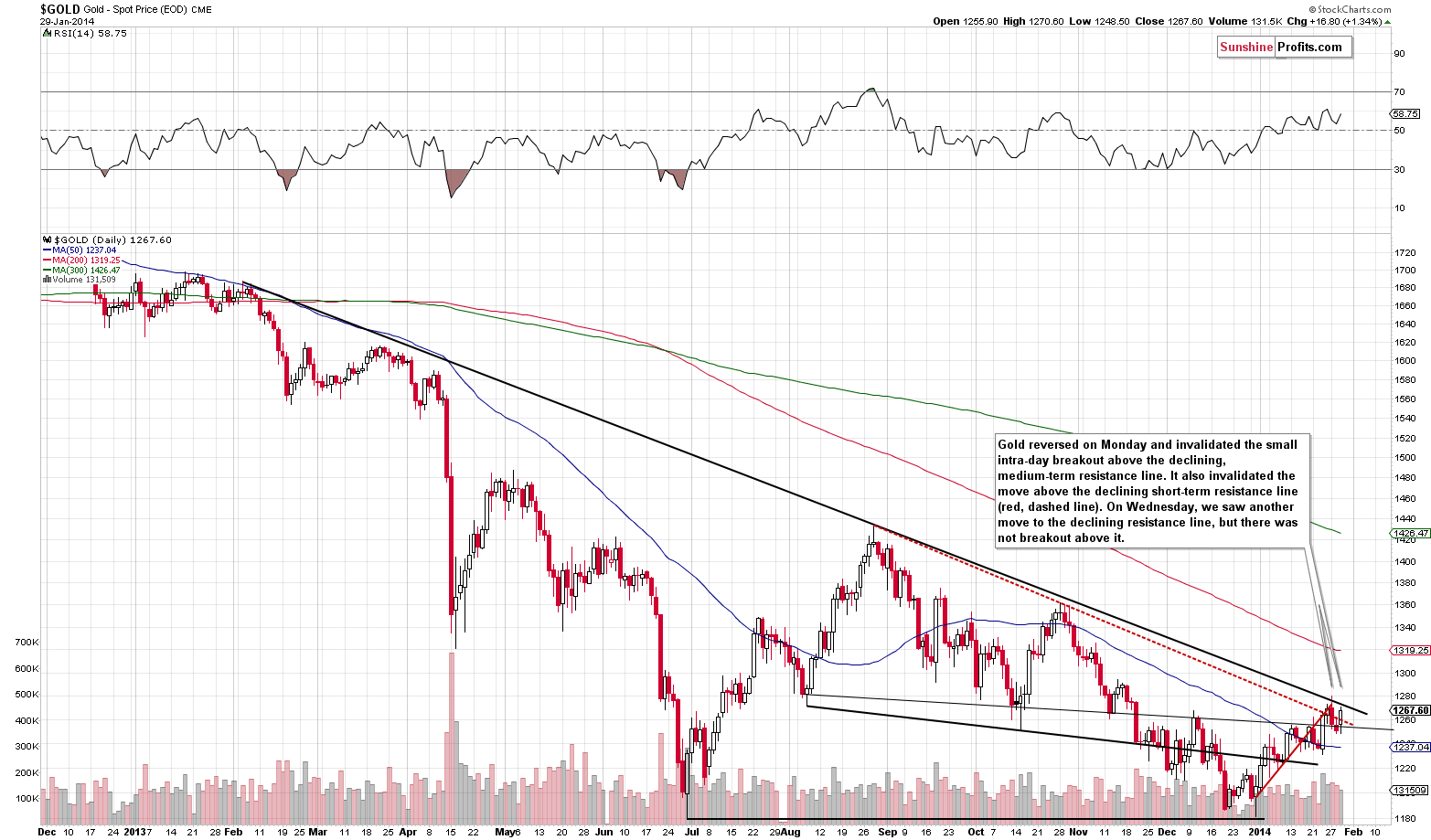

Gold moved once again to the declining resistance line, but since it didn’t broke it, nothing really changed. The medium-term trend remains down.

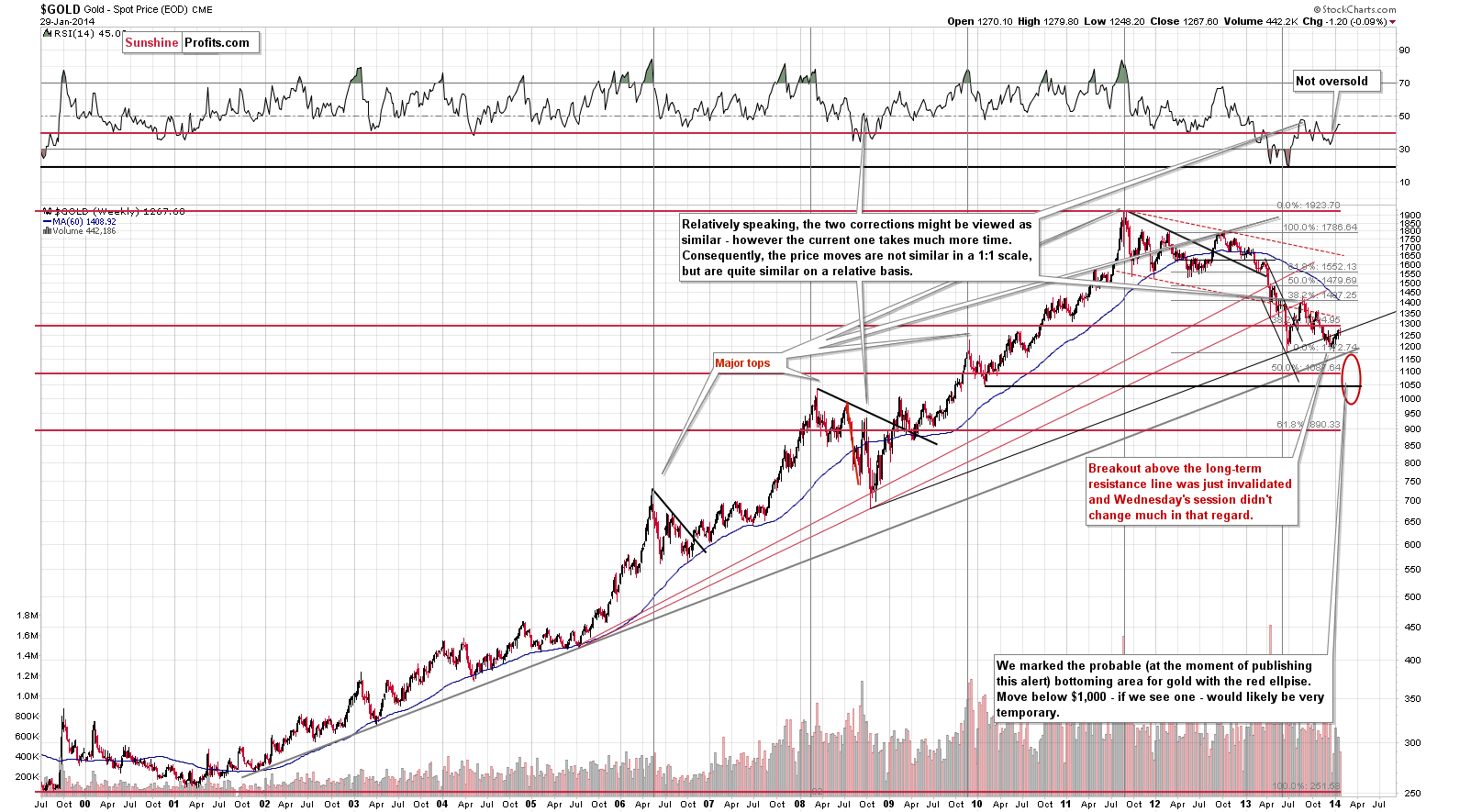

From the long-term perspective, there was a very subtle move higher, which – no surprise here – doesn’t change anything.

The move higher didn’t really take gold above the long-term rising resistance line. Since there was no breakout, the outlook remains bearish.

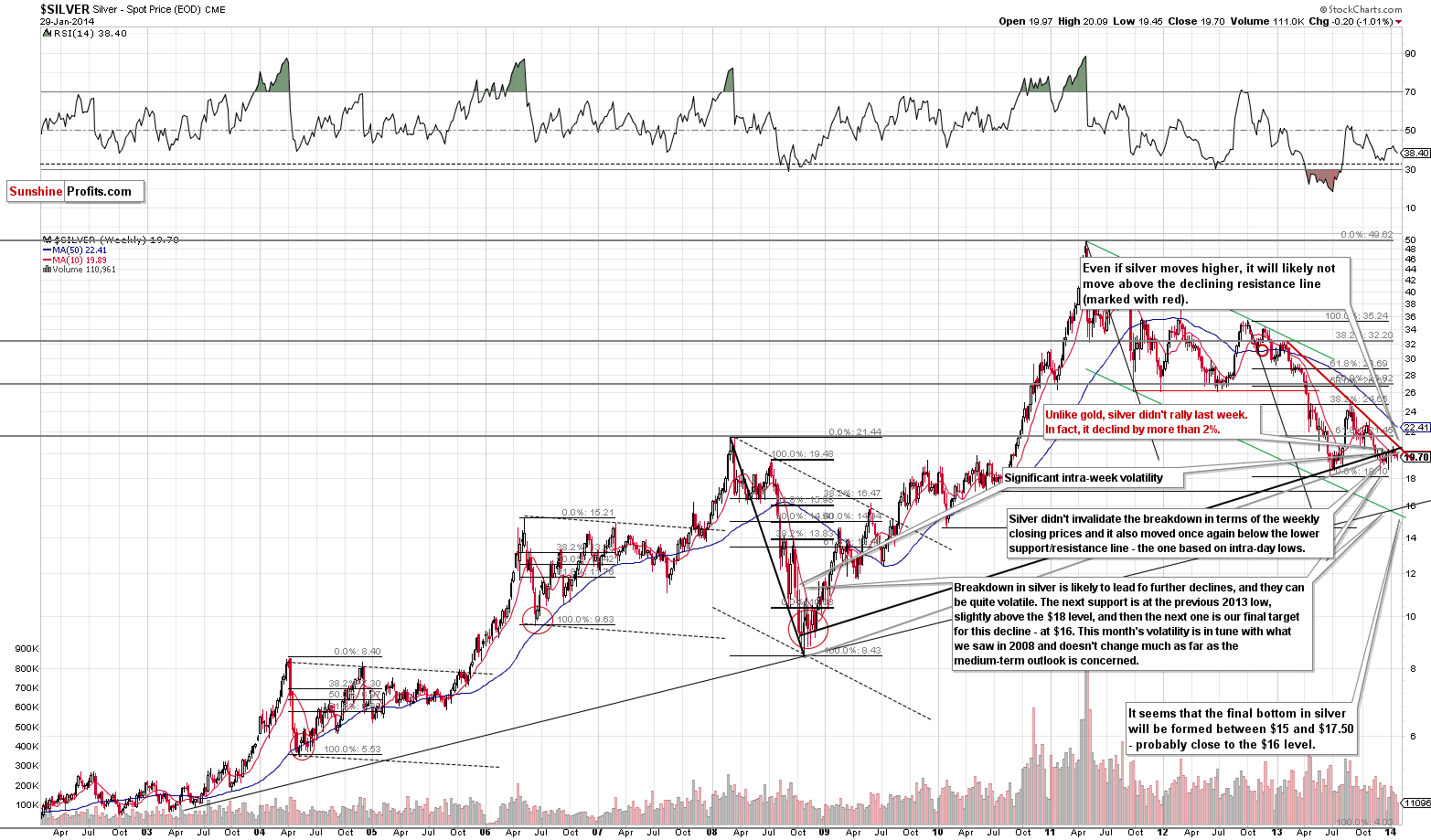

Silver didn’t do much yesterday.

The white metal remains below its key resistance lines, so the recent moves up were just counter-trend corrections. The trend remains down.

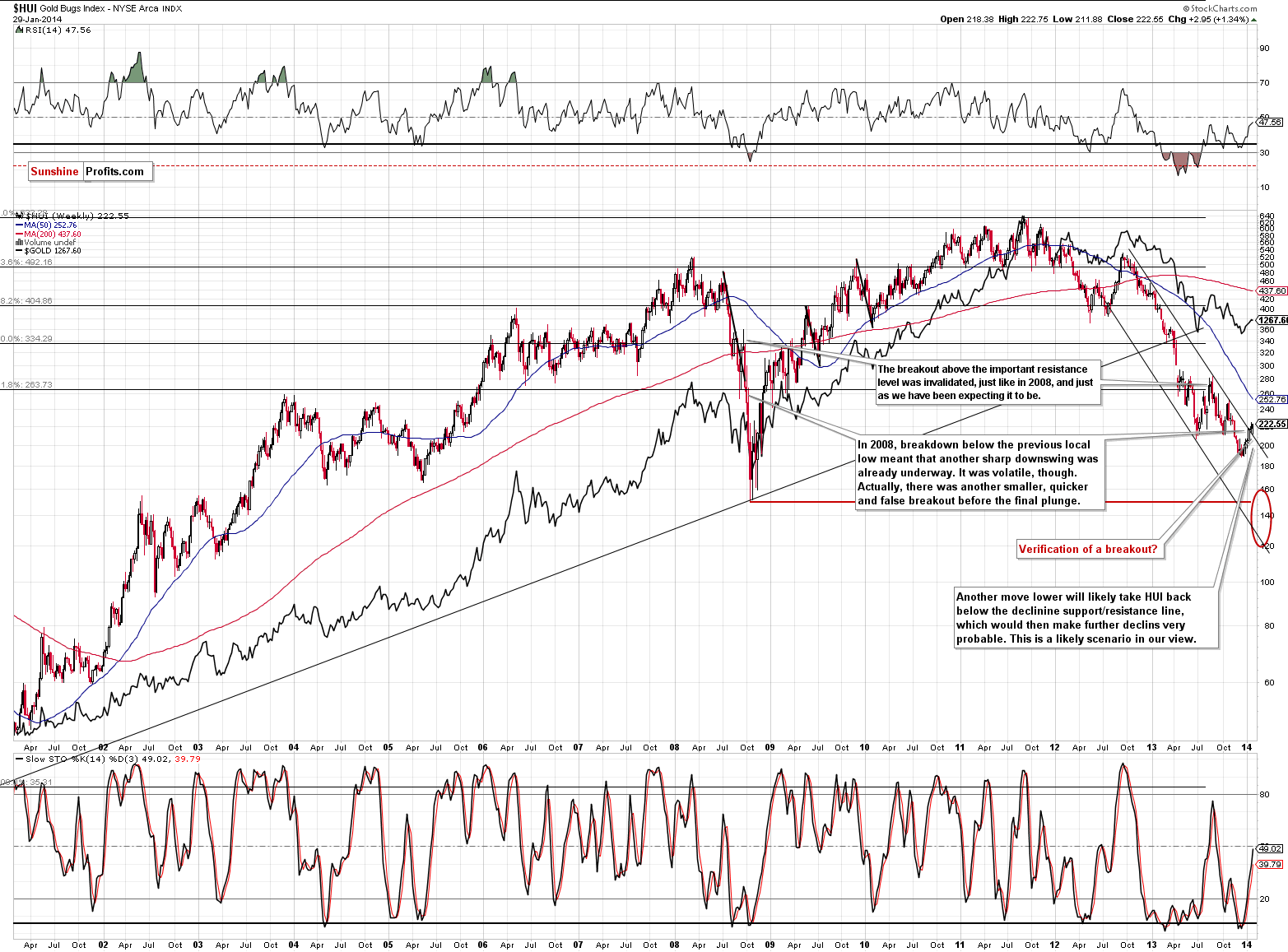

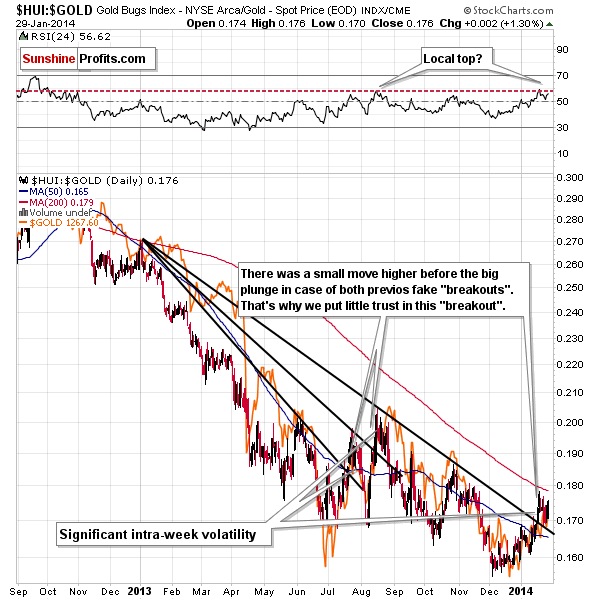

The HUI Index moved higher yesterday, but it didn’t move much higher. Please note that the current price action is still quite in tune with what we saw in 2008 – a small fake breakout right before the final part of the plunge. This analogy is what’s preventing us from being bullish about the gold miners’ breakout.

From the relative perspective, a repetition of a bearish pattern is also visible.

Gold stocks were trading sideways after a fake breakout in July 2013 and in August 2013 – it seems that we have a similar pattern once again. We just saw another move higher in the ratio. That’s something that is bullish per se, but not necessarily when one compares it to previous “breakouts”. At this time, we don’t view this action as bullish.

Summing up, taking all of the above into account (a small improvement in gold stocks and non-existent breakout in gold), we arrive at the same conclusion, at which we arrived yesterday – namely, that it’s a good idea to use a small part of your speculative capital to trade the (likely) coming decline in precious metals. If we see a confirmation of the bearish case (for instance, a decline on strong volume), we will likely suggest adding to the position. Naturally, in case of an invalidation of the bearish outlook, we will keep you informed as well.

To summarize:

Trading capital: Short position (half) in: gold, silver and mining stocks. We are planning to profit on a significant downswing, so the stop-loss orders will not be that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop-loss orders are not reached).

Stop-loss orders for the short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA