Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are keeping the stop-loss levels at yesterday’s levels, so in a way the “increased profits” remain locked-in, and at the same time, we’re keeping a chance of increasing them.

Yesterday’s extensive commentary on metals, miners and corresponding ratios remains up-to-date also today. In case you have not read it yet, we recommend that you do. As for today, instead of quoting yesterday’s alert almost in its entirety, we will focus on the few things that changed.

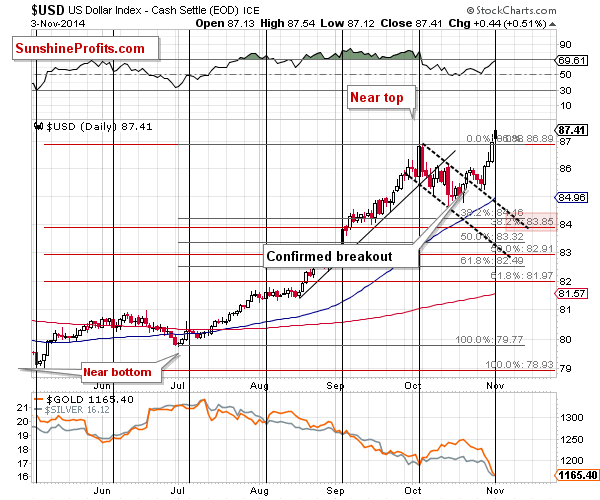

Let’s start with the U.S. dollar (charts courtesy of http://stockcharts.com).

In the previous alert we wrote the following:

The USD Index moved even higher – to 87.25, but closed only slightly above the previously-broken level. It’s still quite likely to decline given the unconfirmed status of the breakout and the cyclical turning point.

The USD Index closed above the previous high once again, so unless it closes below it today, the breakout will be confirmed, and the outlook will be bullish once again. The cyclical turning point still has bearish implications, but they would be less important than a confirmed breakout, especially in light of the July – October rally, during which turning points only caused pauses, not big declines.

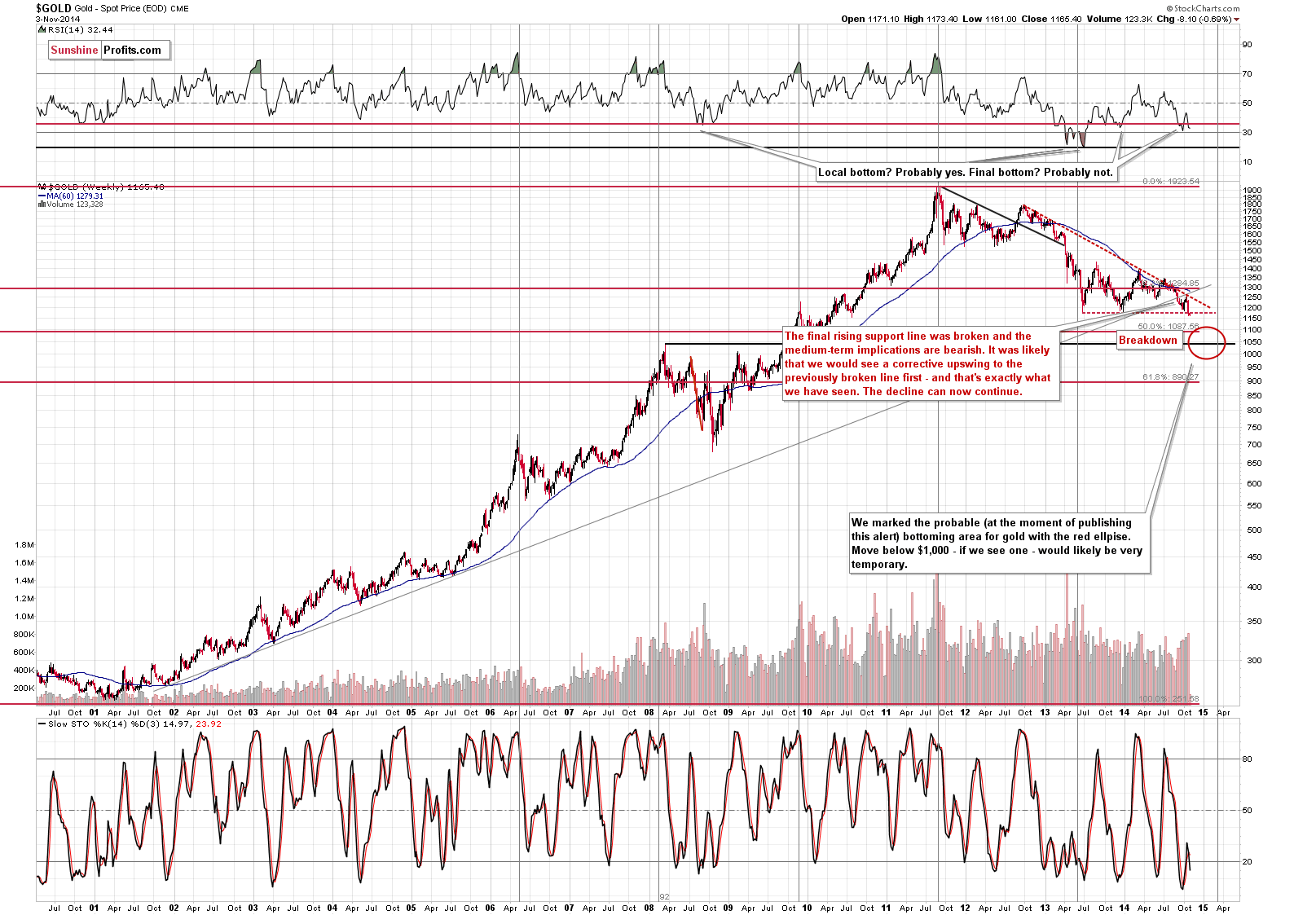

Let’s move to metals. Has the outlook become bullish for the precious metals sector based on the above? Just as we wrote in yesterday – not necessarily.

The key thing here is that gold closed below the 2013 low once again yesterday. As it is the case with the USD Index, only one additional day is required for the breakdown to be confirmed by 3 consecutive trading days. Then the odds of a continuation of the move will further increase.

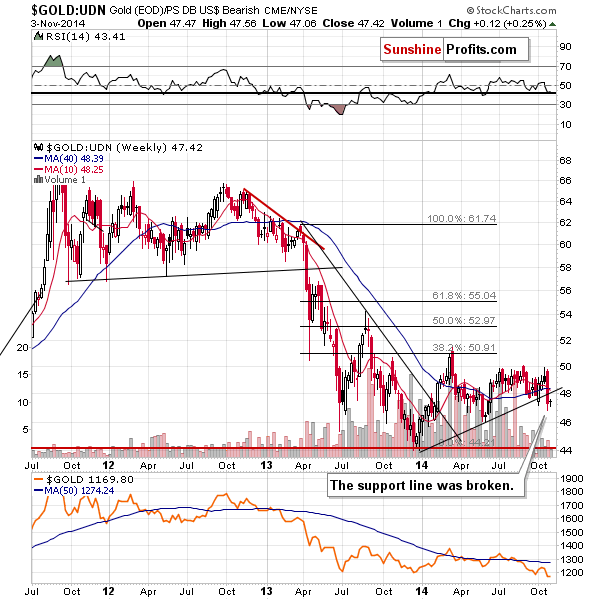

Please note that the breakdown was also seen from the non-USD perspective.

Gold is not below its 2013 lows from this perspective, but it could very well get there relatively soon, since the medium-term rising support line was just broken.

Generally, nothing changed in the silver market, and the outlook for it remains bearish, so we will move right to the mining stocks.

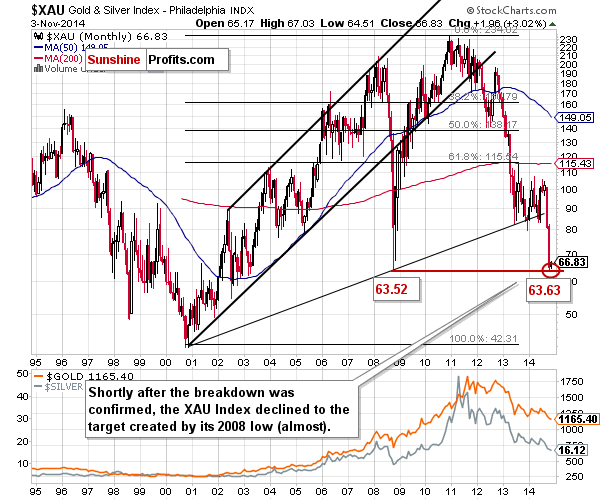

The title of today’s alert is “Miners Start to Outperform…” – that was indeed the case yesterday. However, the implications are not necessarily bullish at this time. One day’s performance doesn’t have to be meaningful and since the preceding decline was so significant, a move up is quite natural.

The above chart shows just how big and significant yesterday’s move was – barely significant at all. If we see additional strength in the next several days, we might change our mind regarding the implications of this situation, but for now, it seems there are very little bullish implications and they are nullified by the bearish implications of gold staying below the 2013 low for an additional day.

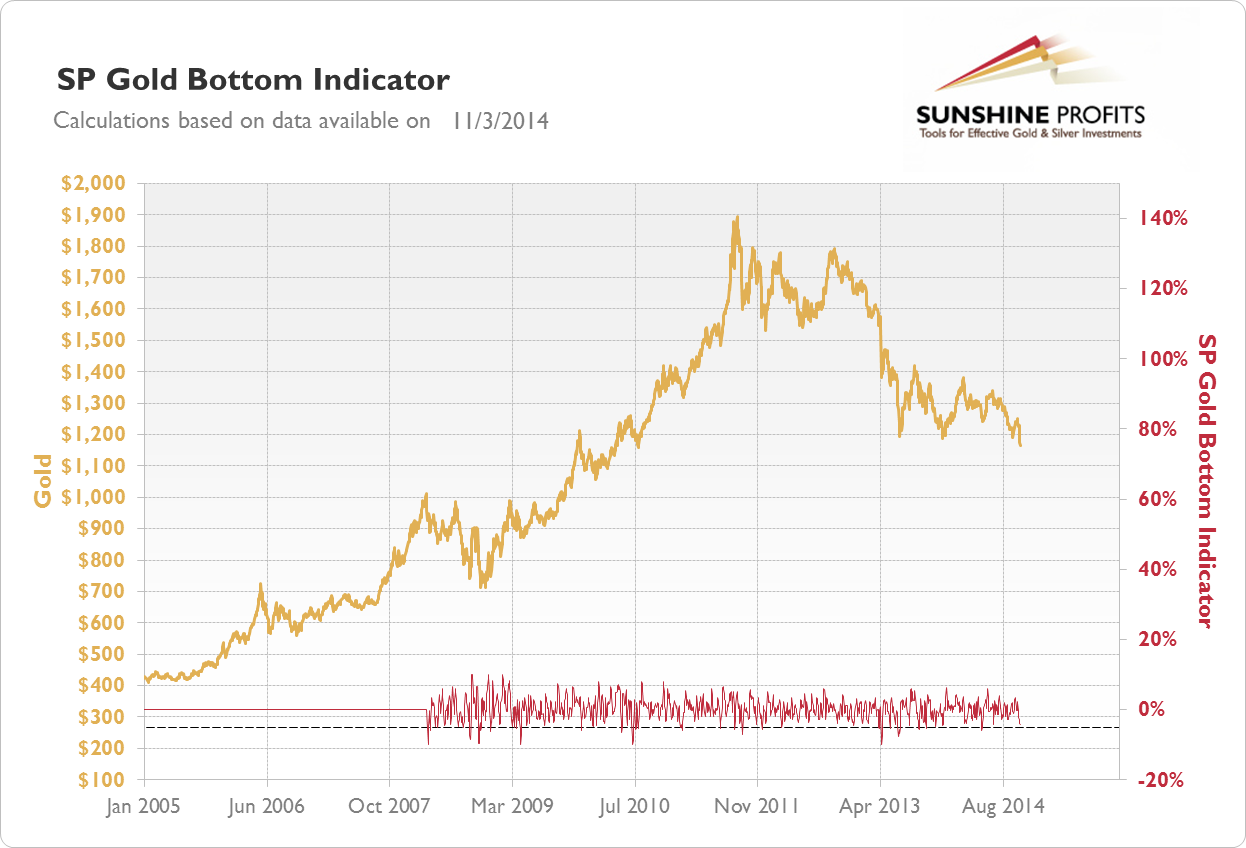

Before summarizing, let’s take a look at something that we have not featured in a long time as we were far from the final bottom (at least in our opinion) – our SP Gold Long-term Indicator, and more precisely, it’s long-term version.

As a reminder, this indicator detects major bottoms in gold. It’s also useful for the rest of the precious metals sector. One of the ways to use it is to treat it as a confirming signal. Please note that almost all major bottoms in gold were accompanied by a buy signal (move below the dashed line) from this indicator. At times, it indicated local bottoms, not the final ones, but it was very rarely the case that we would see a major bottom without it. We have not seen it since the May/June bottom earlier this year. It is extremely unlikely that the final bottom in gold would not be accompanied by this signal – and we have not seen it so far. Consequently, while we could see some kind of bounce in the precious metals sector, it doesn’t seem that the final bottom is in.

All in all, we can summarize the situation in a similar way we did on Friday and yesterday.

Summing up, the situation in the precious metals market was bearish and metals and miners were likely to decline – and they did. Will they decline further based on gold’s major breakdown (after all, gold didn’t break down from more than a yearly consolidation pattern to decline $20) or will the resistance and turning point in the USD Index trigger a bigger upswing in the precious metals sector?

As always, there are no sure bets in any market, but we think that the short-term resistance in the USD Index (given the metal’s negative correlation with the U.S. dollar) is much less important than the breakdown in silver and gold. The critical support in gold and silver was broken and they are likely to decline significantly now. They could still turn around and rally today or in the coming days, but they could also continue their decline and if they do, they could drop fast and far – and it would be a waste not to take advantage of this move.

Consequently, we think that instead of closing the short positions, we will keep them “almost closed”. By this we mean moving the stop-loss orders lower once again. In this way, if gold, silver and mining stocks rebound, the short positions will be automatically closed and substantial profits will be secured anyway. If metals and miners continue to slide, we plan to continue to move the stop-loss order lower and thus make the substantial profits from the current short positions even bigger. Please note that by entering a new stop-loss order, you are effectively making sure that the current trade is profitable no matter what the market does.

The fact that XAU and HUI moved very close to their 2008 lows and the HUI to gold ratio moved to its 2000 low doesn’t have to mean that the bottom is in at this time. Gold moved below its 2013 low and it doesn’t look like it’s ended a huge triangle-shaped consolidation to decline $20 or $30 dollars. If it continues to slide, the move could be very sharp and miners would likely follow.

The miners’ outperformance that we saw yesterday might simply have been a breather that followed an extensive decline. It’s too early to say that this is really a bullish sign. If it is, then it is still nullified by gold closing below its 2013 low for a second consecutive trading day.

We will continue to monitor the situation and report to you – our subscribers – accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) short positions in gold, silver and mining stocks is a good idea:

- Gold: initial target level: $1,107 ; stop-loss: $1,187, initial target level for the DGLD ETN: $96.83 ; stop loss for the DGLD ETN $79.90

- Silver: initial target level: $15.07 ; stop-loss: $16.56, initial target level for the DSLV ETN: $93.83 ; stop loss for DSLV ETN $72.29

- Mining stocks (price levels for the GDX ETN): initial target level: $14.07 ; stop-loss: $18.33, initial target level for the DUST ETN: $73.11 ; stop loss for the DUST ETN $38.03

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target level: $18.57 ; stop-loss: $26.53

- JDST: initial target level: $59.49 ; stop-loss: $25.80

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Hand-picked precious-metals-related links:

Chinese unmoved by gold price drop, see it cheaper still

Swiss gold bugs: Careful what you wish for

Gold wagers drop as $1.3bn pulled from funds

Perth Mint's gold, silver sales drop in October

Germany's eurosceptic party begin selling gold

=====

In other news:

Gross Says Deflation a ‘Growing Possibility’ Threatening Wealth

Why the ECB may not want to join the QE dance

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts