Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

Yesterday was one of those sessions when we were glad that we were out of the market. The sharp drop in the first part of the session perhaps made one think “why am I not shorting this?!” but the subsequent, even sharper, move up could have made the same person think “why wasn’t I long before this?!”

The truth is that yesterday’s session could be called “the stop-loss killer”. Whatever position one would have had on Wednesday, it would have probably been closed automatically at an unfavorable price yesterday. That’s why‘re glad that we were out. Of course, one can imagine being short in the first part of the session, then timing the intra-day bottom perfectly and then selling at the local top, but… Not every price move can be realistically caught (just like you can’t earn all the money in the world).

When a trade appears too risky, it’s better to wait it out and enter the market when the odds and potential reward are better. That’s why we use the “justified from the risk/reward ratio” phrase so often – that’s ultimately what matters for trading positions. Yesterday’s session serves as an excellent example as to why a “no positions” suggestion can be just as valuable as one with a winning position. Yesterday, no speculative positions were safe and it was much better to keep the capital as it was than to lose it.

Let’s see if the risk/reward ratio is more favorable today (charts courtesy of http://stockcharts.com.)

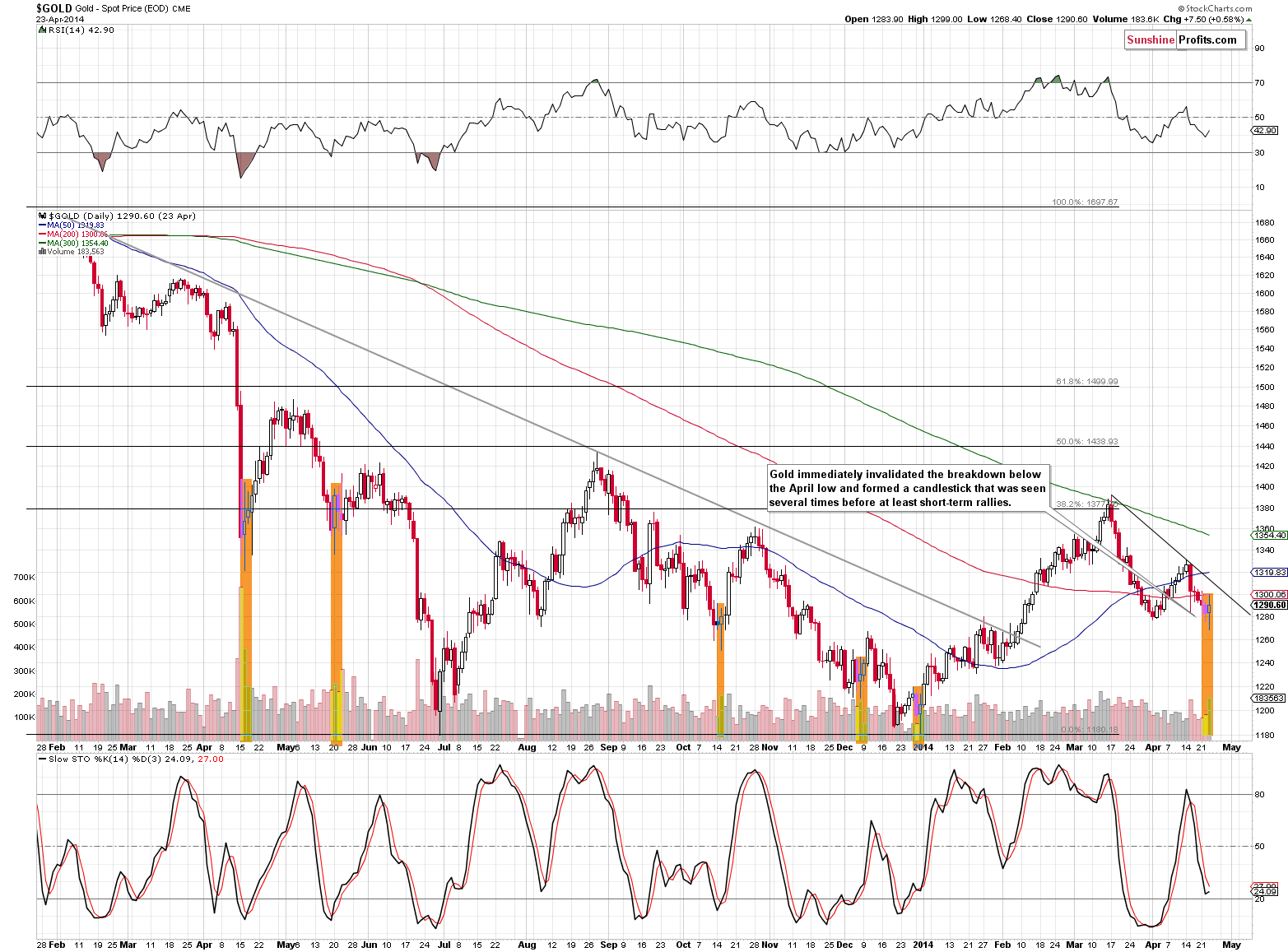

Gold hasn’t done much in terms of daily closing prices, but the session itself was very specific. We marked similar sessions (similar volatility + significant volume) on the above chart with orange rectangles. It turned out that these sessions didn’t necessarily mark the final bottoms, but they have practically always (at least recently) been followed by short-term rallies (very short-term in early December 2013). Consequently, while the medium-term trend remains down, the short-term implications are bullish.

Yesterday, we also saw a move below the previous April low and the immediate invalidation thereof, which by itself is also a bullish sign.

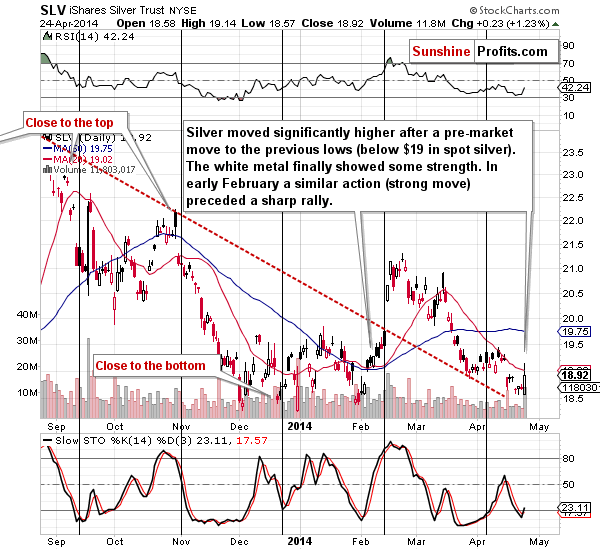

In the case of silver we also saw something very important. The problem is that it’s not clear what the implications are. Before the session started, silver declined to the declining resistance line (in case of the SLV ETF that would be the declining red dashed line) and then moved back up with a vengeance. That’s a bullish sign, especially that it happened on huge volume.

On the other hand, silver has rallied temporarily right before significant declines in the past – like in mid-March 2014 and late October 2013. Still, in these 2 cases, the volume was not as big as it was yesterday, so the bearish implications may not apply here.

What’s even more perplexing is that silver simply moved to its 20-day moving average, which line stopped the rally earlier this month. The white metal reversed immediately after moving slightly above this level. That’s bearish.

We also saw a buy signal from the Stochastic indicator.

Consequently, the situation in the silver market is now tense, but not very bullish just yet.

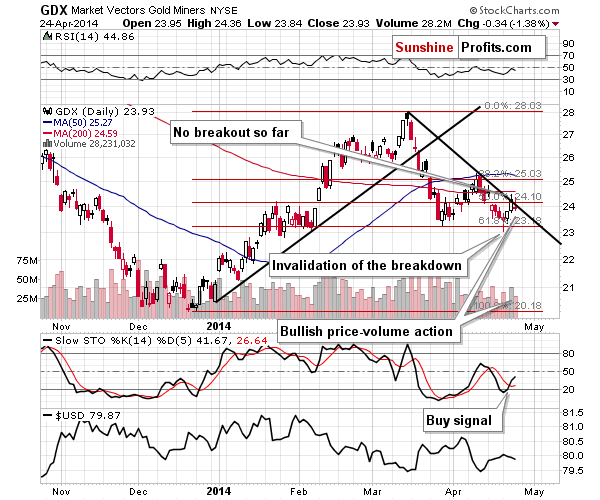

Mining stocks were performing very well earlier this week, but paused on Thursday, which is odd given the strong bullish signals coming from gold and silver, which, in fact, rallied. This daily underperformance is a bearish sign, but not a strong one, since we already saw some outperformance earlier this week.

Also, the miners’ move lower yesterday happened on volume that was lower than on the previous day when they had rallied, so the implications are not that bearish – we could have simply seen a pause after a rally. The GDX ETF had a good reason to pause – it reached its declining resistance line.

Overall, the situation in the mining stocks is also unclear.

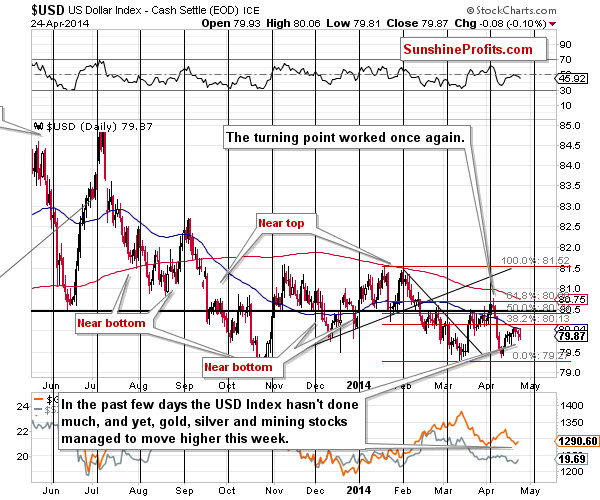

It would be possible to draw more specific conclusions based on the previous charts (featuring gold, silver and mining stocks) if we were able to compare the recent price swings to moves in the USD Index. We would be able to discuss whether what we saw is a sign of strength or weakness, but at this time… The U.S. dollar doesn’t move much.

Consequently, we don’t have the benefit of relying on one of the most important signals that often affects the precious metals market. Without meaningful implications from the gold-USD link and a rather mixed situation throughout the precious metals sector (bullish situation for gold, mixed with bullish bias for silver, mixed with bearish bias for mining stocks and bearish for platinum) it still seems that the situation is too risky to open any positions at this time. We will continue to monitor the market and report to you as soon as the situation crystallizes.

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts