Briefly: In our opinion opening small (half) speculative short positions in gold, silver and mining stocks is now justified from the risk/reward perspective.

At the first sight not much changed yesterday. Taking a second look, however, reveals that the intra-day action was indeed meaningful. Let’s take a closer look (charts courtesy of http://stockcharts.com).

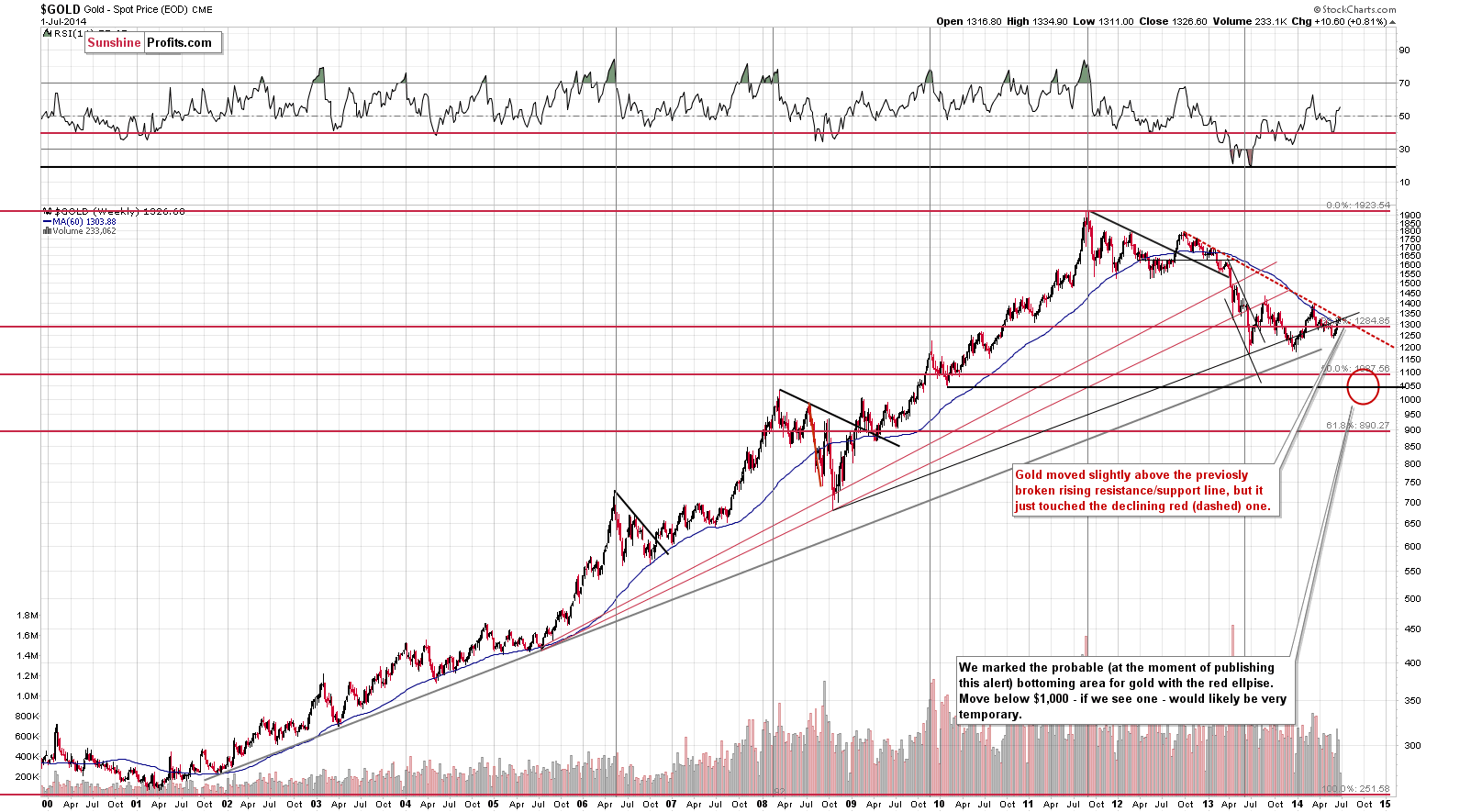

On the long-term chart we see that even though gold moved higher – slightly above the rising resistance line – it remained below the declining red (dashed) resistance line. From this perspective, not much changed yesterday. We still think that the medium-term trend remains down.

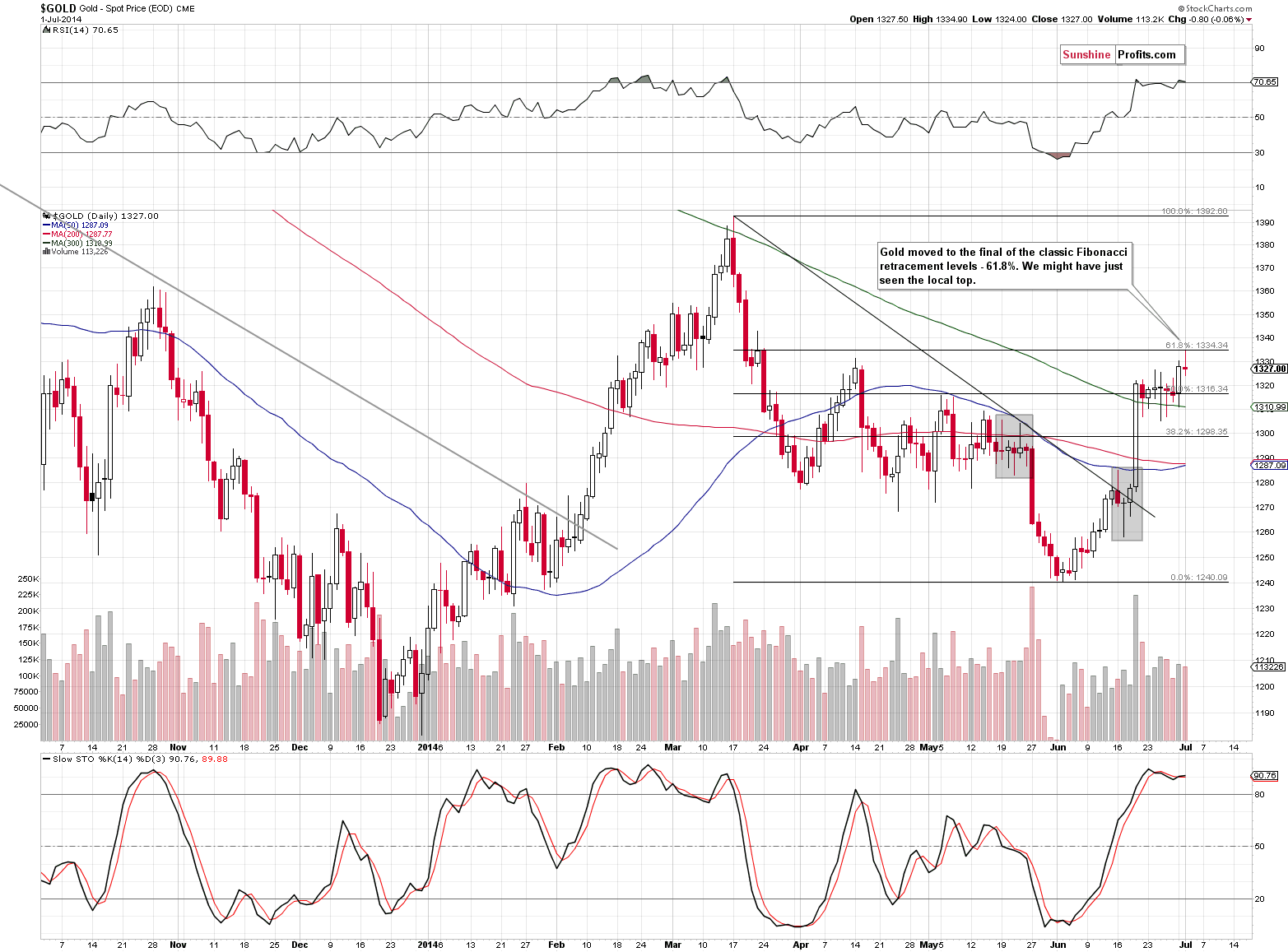

On a short-term basis, we can see the significant intra-day action that we mentioned in the opening paragraph of the alert. Gold moved temporarily to the 61.8% Fibonacci retracement level and then moved back down. That’s an important short-term target and it could be the case that we have just seen a local top. The RSI indicator is overbought, supporting the bearish outlook.

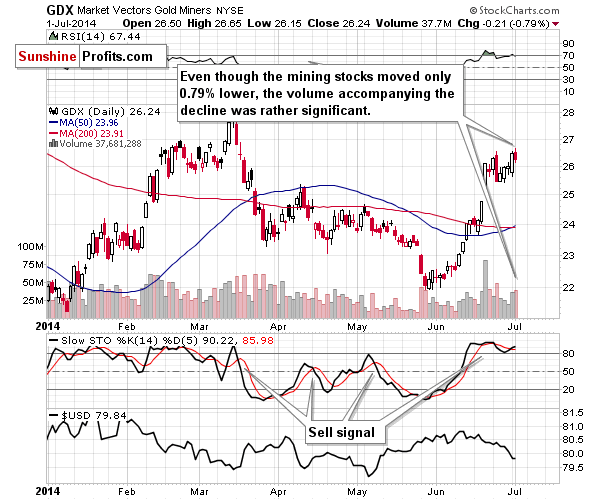

What’s even more significant than the daily reversal and the retracement that was just reached, is the reaction of the mining stock sector.

The interesting thing is that even when gold moved rather significantly higher, the mining stocks moved higher just a little. The intra-day high in case of the GDX ETF is just slightly above the previous daily high.

The even more interesting thing is the final outcome of yesterday’s session. Miners declined, even though gold hasn’t. One might think that this could have been the case due to a decline in stocks in general, but it was actually the case that the S&P 500 rallied visibly yesterday. Moreover, the move lower in the GDX ETF materialized on volume that was bigger than the previous day’s volume, even though the size of the move was smaller.

Consequently, the mining stocks have just visibly underperformed gold and the implications are bearish.

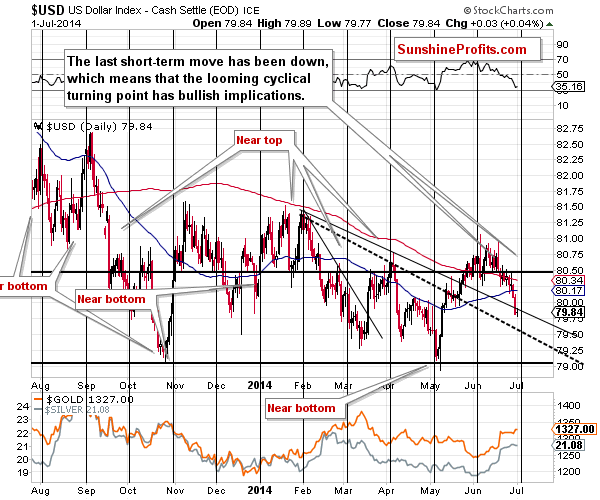

The USD Index is now at the cyclical turning point, which suggests that it will move higher any day now. The implications for the precious metals market are bearish, especially that PMs and miners are known to react to these turning points even before the USD Index.

There is still the possibility that the USD Index will move to the declining dashed line (based on daily closing prices), but even if that is the case, it’s just about 0.30 lower, and the proximity of the turning point suggests that waiting for this final part of the move, might be tricky – it could not happen at all.

Summing up, the situation on the precious metals market has deteriorated based on yesterday’s price action – gold reached 2 important resistance levels (the declining red line and the 61.8% Fibonacci retracement), its intra-day reversal and mining stocks’ underperformance (especially given a daily rally on the stock market). The additional bearish confirmation comes from the analysis of the USD Index, its support lines and cyclical turning point that is upon us.

Consequently, we think that opening small speculative short positions is now justified from the risk/reward perspective.

To summarize:

Trading capital (our opinion): Short (half) position in gold, silver and mining stocks with the following stop-loss levels:

- Gold: $1,343

- Silver: $21.43

- GDX ETF: $27.30

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts