Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Mining stocks moved significantly higher yesterday, even though the underlying metals barely moved. The implications are… surprising.

Before jumping into the world of charts, we would like to point out that the reasons for which we think the medium-term move is down were covered in the previous Monday’s alert, and if you haven’t had the chance to read it, we encourage you to do so today. Having said that, let’s move on to charts (charts courtesy of http://stockcharts.com.)

As mentioned above, gold didn’t do much yesterday. Consequently, what we wrote yesterday remains up-to-date:

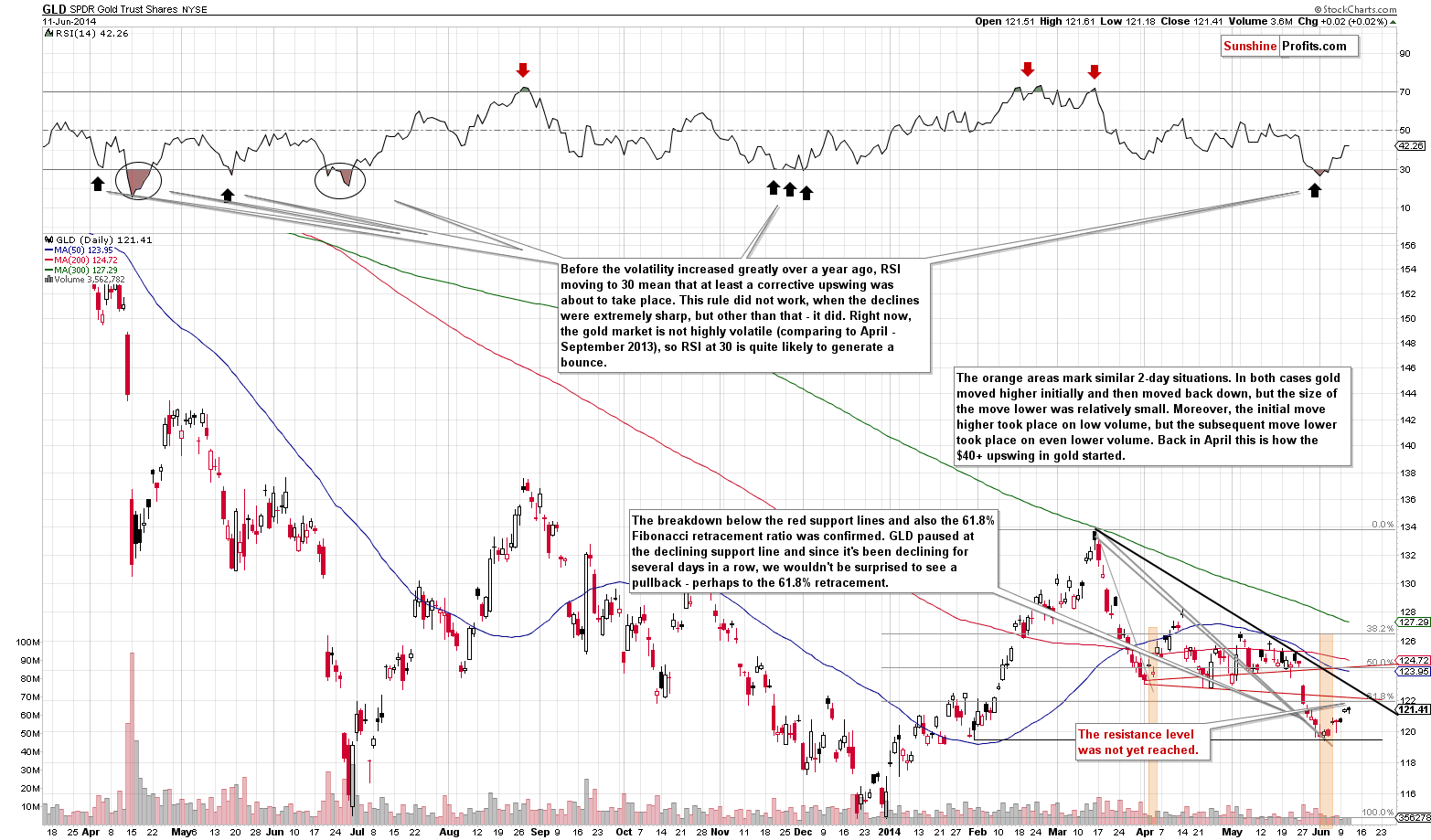

How high will gold rally before turning south again? There are no sure bets, but our best guess is that it will correct to the previously broken 61.8% or 50% Fibonacci retracement levels – which means a move to (or very close to) $122 or $124.50 or so in case of the GLD ETF and $1,260 or $1,290 in case of spot gold. We will be looking for bearish confirmations (signals from indicators, ratios, other markets, etc.) around these levels and we’ll probably re-enter short positions once we see them.

We saw the GLD ETF close at $121.41, so it's still below the lowest of the resistance levels and thus it seems that the rally will continue for at least a while.

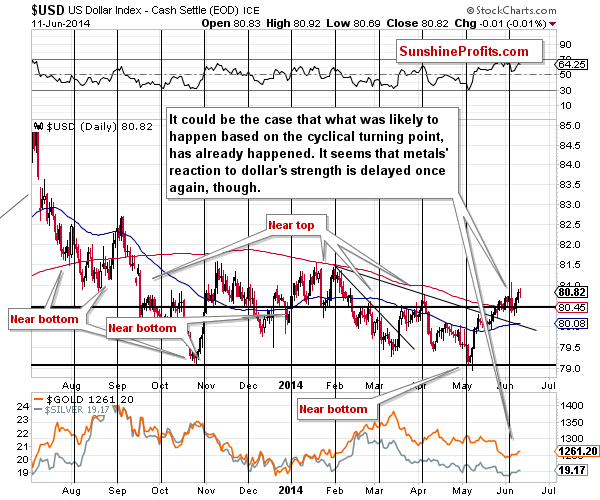

What's even more interesting, is the fact that gold managed to rally despite a rally in the USD Index.

Similarly as it was the case with gold, the USD Index didn’t change much yesterday, so what we wrote yesterday remains up-to-date:

When a given market refuses to react in a certain way in spite of a visible factor for such a move, it usually means that a move in the opposite direction is likely. At this time, precious metals refused to decline given the move higher in the USD Index, which means that they “don’t want to” move lower and that they are not done rallying.

During Tuesday’s session gold not only not-declined – it actually managed to rally despite the USD gains, and the short-term implications for the precious metals market are bullish for the short term. There are no implications for the medium term as the metals' reaction to the dollar's strength can – and likely is – delayed once again.

The situation in the silver market remains rather unclear so we will once again seek confirmation in the mining stock sector.

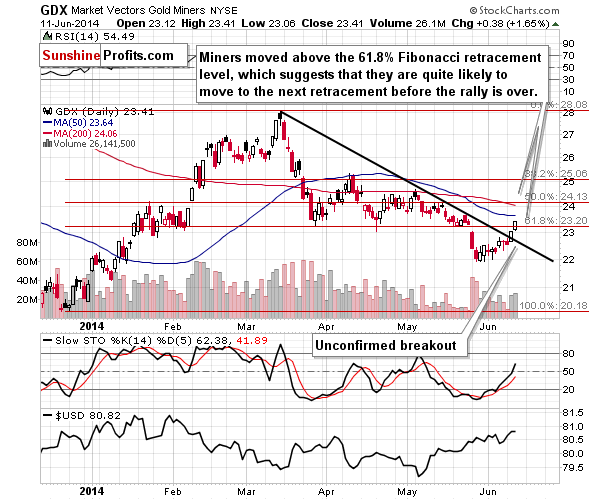

We can once again state that the situation in mining stocks is even more bullish for the short term than it is the case with gold. Before commenting on yesterday’s price/volume action we would like to quote our previous comments as they remain up-to-date:

In case of the GDX ETF, the price targets are relatively close as well. The first one is slightly below the $23 level, at the declining resistance line, and the second one is at the 61.8% Fibonacci retracement. The third one is at the 50% Fibonacci retracement slightly above the $24 level. Either way, the upside is rather limited and we don’t think that the GDX will move and stay above $24 for long – if it gets there, that is.

If gold is to double its recent move higher, then we could expect mining stocks to move at least to their 61.8% Fibonacci retracement, slightly above $23.

Miners moved not only above the declining resistance line but also above the 61.8% Fibonacci resistance line. Keeping in mind that gold could still rally some more before topping, it seems that we could see the GDX ETF move to the 50% retracement, slightly above the $24 level. Are there any signs pointing to the top being not far away? Yes, there are. Here’s one of them:

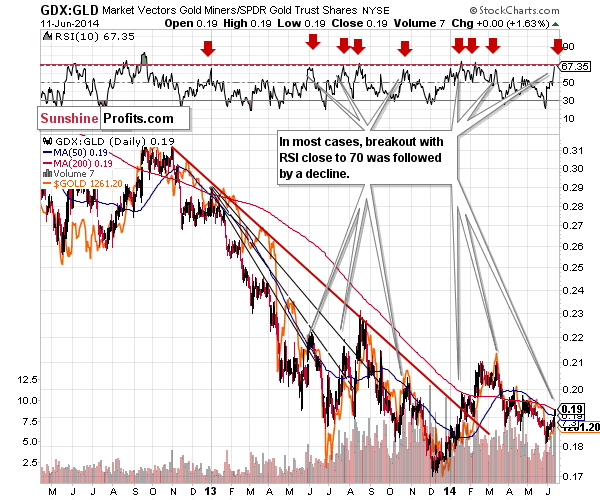

The way the mining stocks performed relative to gold is very significant. The rally in the GDX to GLD ratio was strong and sharp. With something as visible as that, one might expect it to mean something. We think it does. While in the past, strong performance of the mining stocks relative to gold used to herald more gains, it doesn’t seem to be the case at this time anymore. In most cases, in the past months, the times when the miners to gold ratio rallied particularly strongly – and by that we mean when the RSI indicator moved close to the 70 level – heralded either a consolidation in the precious metals sector, or a decline.

At this time the RSI indicator based on the ratio is slightly above 67, which is very close to the 70 level, and the analogy we mentioned is already in place. This doesn’t mean that it will cease to be in place if the precious metal sector rallies some more.

What do we make of all the above? It seems to us that the days of the rally in the precious metals market are numbered. The resistance in case of the GLD ETF is very close, and even though miners rallied quite strongly, they too have a resistance level (50% retracement) that can prevent further gains. Additionally, the extent of the miners’ outperformance suggests that at least a pause is likely.

Summing up, while the medium-term trend in the precious metals market is down, we are seeing a corrective upswing and it doesn’t seem that it’s over yet. It seems quite likely that the rally will be over relatively soon, perhaps when the USD Index reaches the 80 level (however, this level might not be reached based on this week's rally in the USD, so we will look for other signs that the rally in metals is over as well).

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts