In short: In our opinion, small (half) short positions in gold, silver, and mining stocks are still justified (no changes since yesterday).

Generally, the vast majority of the points that we made in yesterday’s alert is up-to-date also today, so if you haven’t read it yet, we suggest that you do. In particular, the points made about the junior mining stocks sector and the USD Index remain in place.

In today’s alert we’ll focus on the biggest changes that we saw during yesterday’s session. Let’s start with gold (charts courtesy of http://stockcharts.com.)

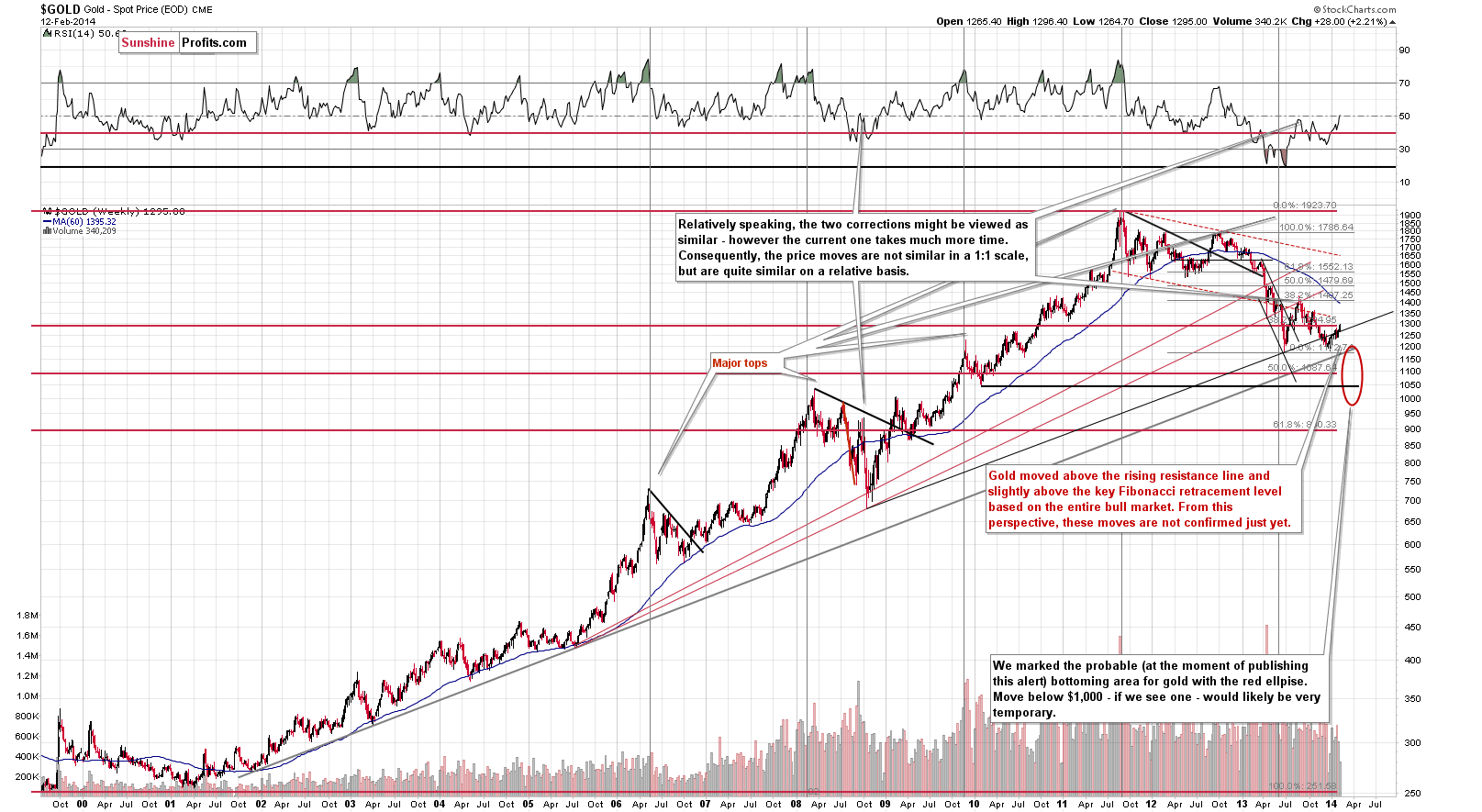

Actually, the long-term gold chart is the one that we didn’t see a change on, but it’s so important for the outlook for the entire precious metals sector that we decided to include it in today’s alert anyway.

Gold moved higher, but you wouldn’t see it based on the above chart alone… and that’s pretty much the point. The move up was not visible from the long-term perspective and the breakout above the key resistance lines is so small that it seems doubtful that it will have meaningful consequences.

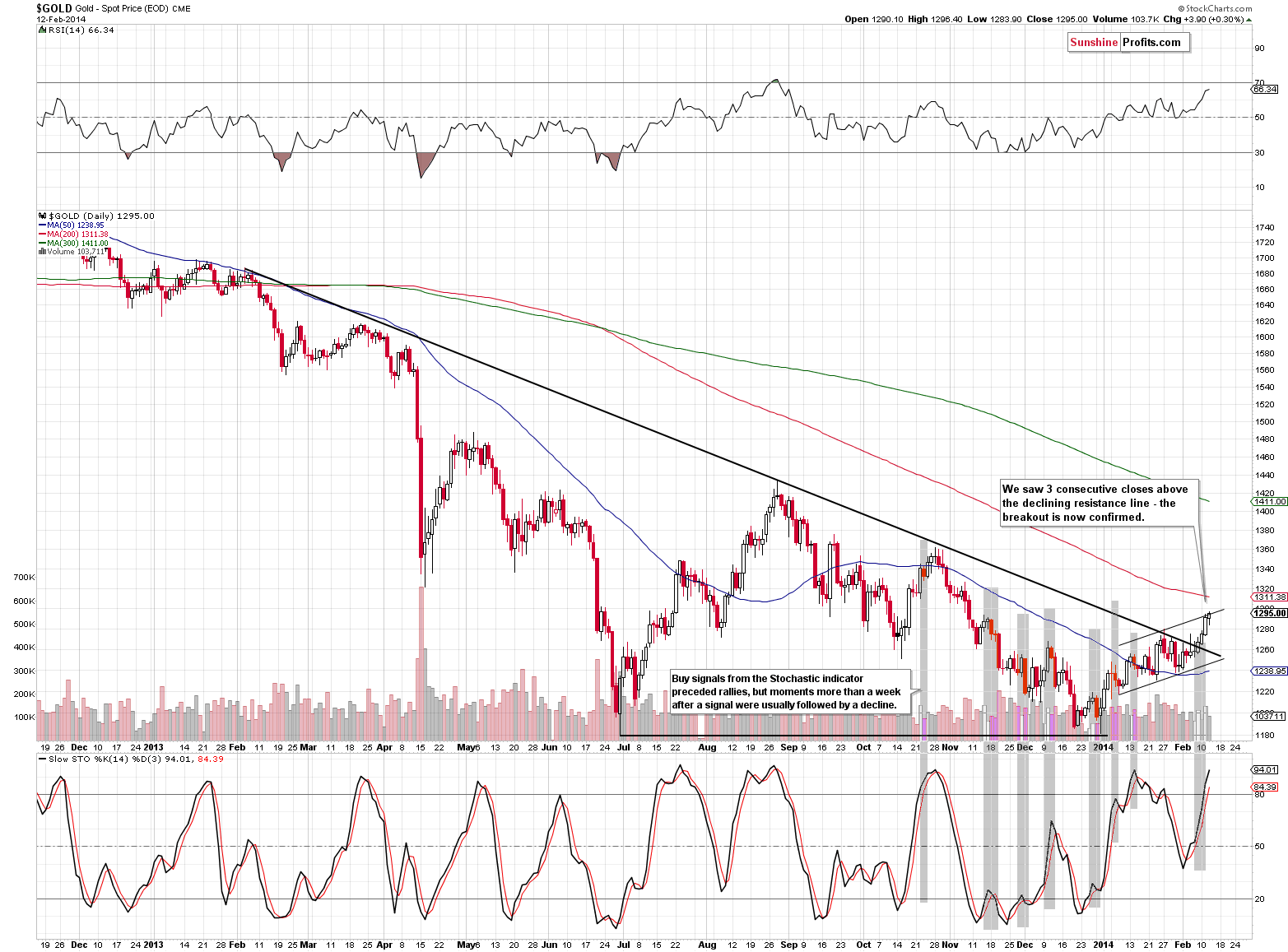

Regarding the medium-term perspective, yesterday we wrote the following:

Gold moved higher on Tuesday once again and from this perspective the situation became more bullish as we saw a third consecutive close above the declining medium-term resistance line.

Let’s keep in mind, however, that the long-term resistance lines / levels and breakouts are more important than medium-term ones (and medium-term ones are more important than short-term ones), so the points that we made regarding the 38.2% Fibonacci retracement level based on the entire bull market are the ones that we should focus on, not the bullish signal coming from the above chart.

Gold moved higher yesterday, but at the moment of writing these words it’s a few cents lower than it was 24 hours ago, so we might already have the local top behind us.

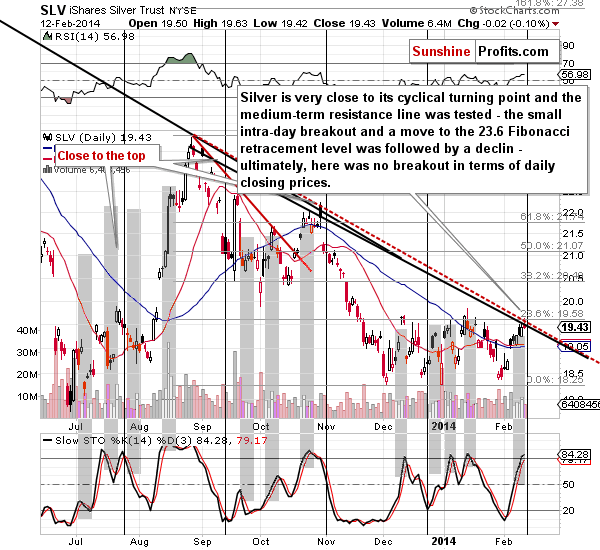

As far as silver is concerned, the situation didn’t change much yesterday – it remains below key support lines, which means that the downtrend remains in place and that actually nothing changed in this market in the past few days.

On a short-term basis, we see that the situation has deteriorated.

The SLV ETF moved only slightly higher yesterday and only in the first hours of the session. It pulled back down in the following part of the day and ultimately closed 2 cents below the previous close.

However, during this temporary upswing, the SLV ETF managed to test the declining resistance line and the 23.8% Fibonacci retracement level. They both held, which means that the outlook didn’t change. In fact, since the resistance levels have already been reached without a breakout, it seems that silver is ready to decline once again.

The proximity of the cyclical turning point confirms that. Turning points work on a “near-to” basis, which means that they already affect prices. With each day we are getting closer to the nearest one and we are already very close, so we are more and more likely to see a short-term decline.

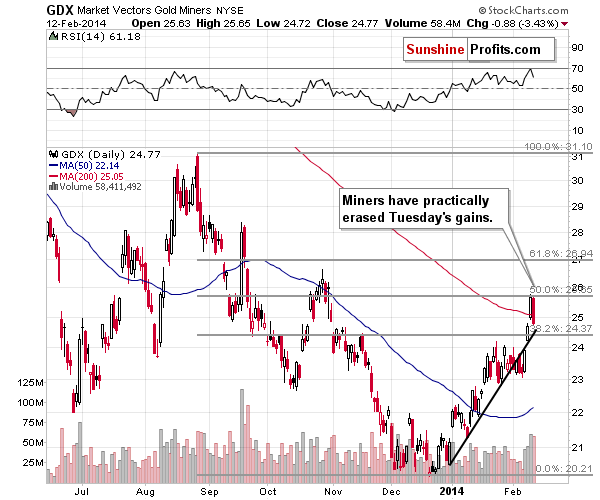

Meanwhile, mining stocks have reversed their direction. Their recent upswing was very sharp, though, so Wednesday’s decline doesn’t mean much – it’s just a pullback – something that one can expect to be seen after a huge rally.

However, the move lower took place on huge volume and if we combined the last 2 days, we would get a huge-volume reversal.

Overall, we just saw a correction to the 50% Fibonacci retracement level, which was followed by a downturn.

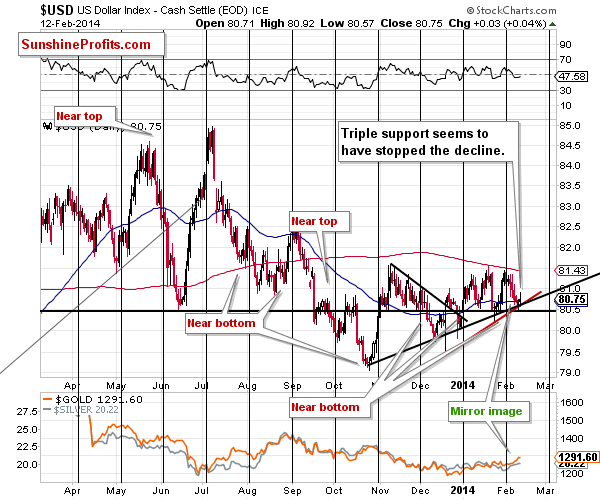

Yesterday, we commented on the USD Index chart in the following way:

The USD Index didn’t move below the rising support line, which means that it’s likely to reverse direction and head north any day now. In fact, the index moved to the 80.50 level earlier today, which means that the bottom might already be in. This means that gold and the rest of the precious metals sector will likely soon have a “reason” to decline.

The USD Index indeed reversed direction before the end of the session and it moved slightly higher on Wednesday as well. It seems that the USD Index has formed a bottom this week and that higher prices will follow. The implications for the precious metals sector are bearish.

Overall, we can summarize the situation in the same way as we did yesterday:

The breakouts (in gold) are unconfirmed, which means that if we see more weakness, they will be invalidated. The invalidations of breakouts would serve as a bearish signal and something that would make adding to the short positions a good idea (probably), as the invalidations would make further – significant – declines very likely. Volume spikes in juniors and silver stocks suggest that we will see at least a temporary decline in metals and miners and the situation in the USD Index and the cyclical turning point present in the silver market serve as confirmation. Based on the current situation in USD Index, metals and miners, it seems quite likely that we will see a small decline which will then turn into a much bigger decline (based on the invalidations of breakouts). It seems the most likely outcome in our view.

Summing up, taking all of the above into account, we arrive at the same conclusion at which we arrived previously – namely, in our opinion it’s a good idea to use a small part of the speculative capital to trade the (likely) coming decline in precious metals.

We have previously described the nature of this position (and the stop-loss orders reflect it) – it’s not about small moves to the upside or downside. It’s about a final, major downswing that is likely to take the entire precious metals sector much lower. We’re not closing the position in order not to be out of the market when it starts, as the initial move can be very volatile. In a way, we’re letting smaller fish go in order to catch a really big one.

If we see a meaningful confirmation of the bearish case (for instance, the invalidations of breakouts), we will likely think that increasing the size of the short position might be a good idea. Naturally, in case of an invalidation of the bearish outlook, we will keep you – our subscribers - informed as well.

To summarize:

Trading capital: In our opinion a short position (half) in gold, silver and mining stocks is justified from the risk/reward point of view. We are planning to profit on a significant downswing, so the stop-loss orders that are appropriate in our opinion are not that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop-loss orders are not reached).

Stop-loss orders for the short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA