Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

Precious metals didn’t do much yesterday, but mining stocks moved higher. Was this really a bullish sign? Let’s take a look (charts courtesy of http://stockcharts.com).

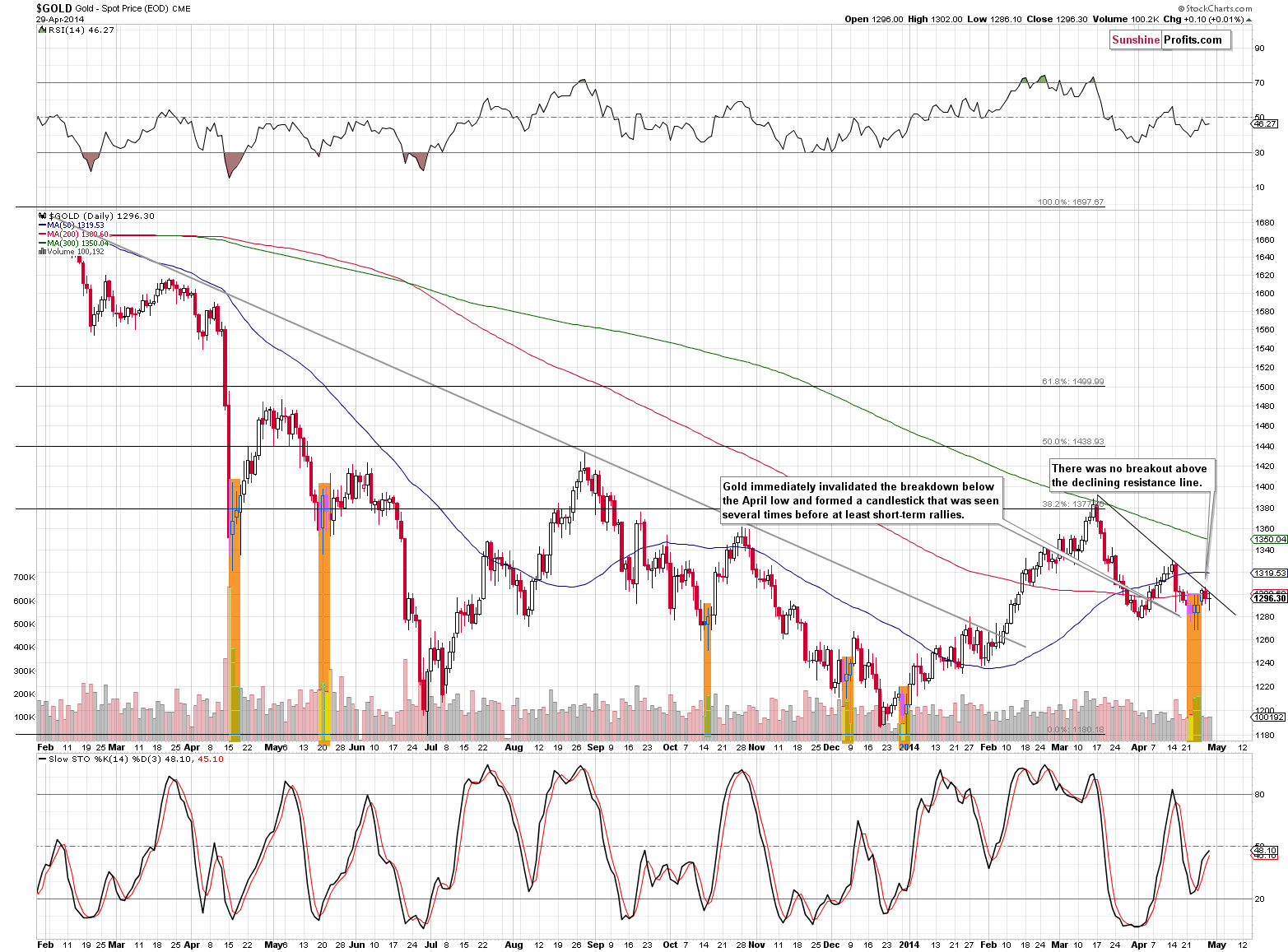

There’s only one thing that we can say about gold today and that’s that it still hasn’t moved above it declining resistance line. Consequently, the situation remains as we explained in yesterday’s alert.

There still has been no breakout above the declining resistance line and since the trend remains down, we should expect more declines.

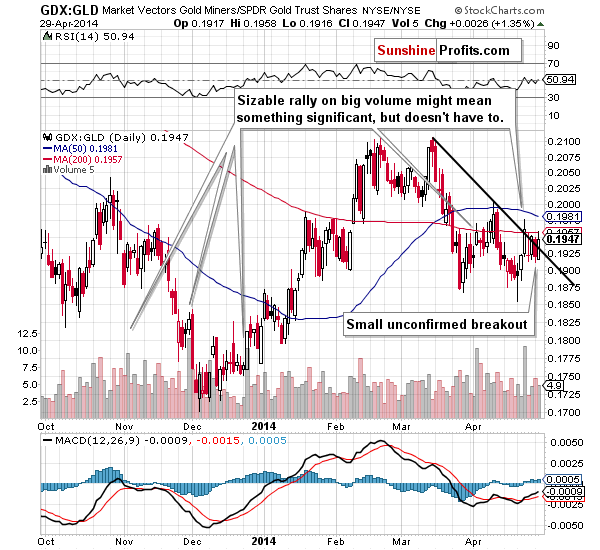

Yesterday we wrote the following regarding the GDX:GLD ratio:

Even if there had been a breakout, it would have been invalidated yesterday. At this time, the trend remains clearly down.

At this time we are seeing another attempt to move above the declining resistance line. “Attempt” because the move above it has been so insignificant that we doubt it will really hold up. Please note that the situation was the same just a few days ago, and afterwards the ratio declined once again. We expect to see an invalidation of this small breakout shortly.

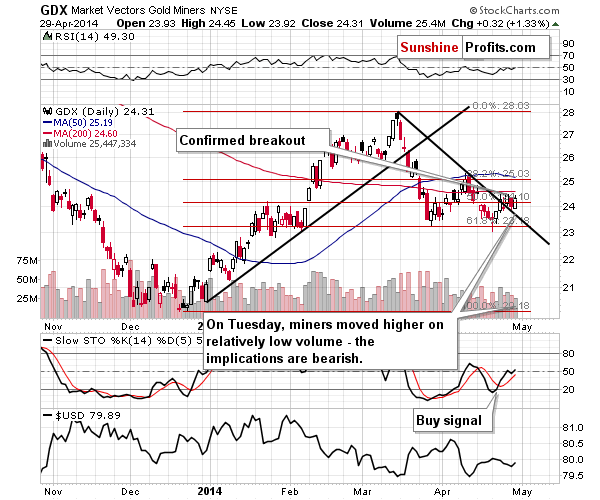

Mining stocks have just confirmed their breakout above the declining resistance line by closing above it for 3 consecutive days, but it’s less bullish that it appears on the first sight. The reason for this is that Tuesday’s rally materialized on relatively low volume, which is a small clue that tells us that even if a rally follows it will be rather weak. Of course another move higher on strong volume would be a bullish sign, but we have yet to see it.

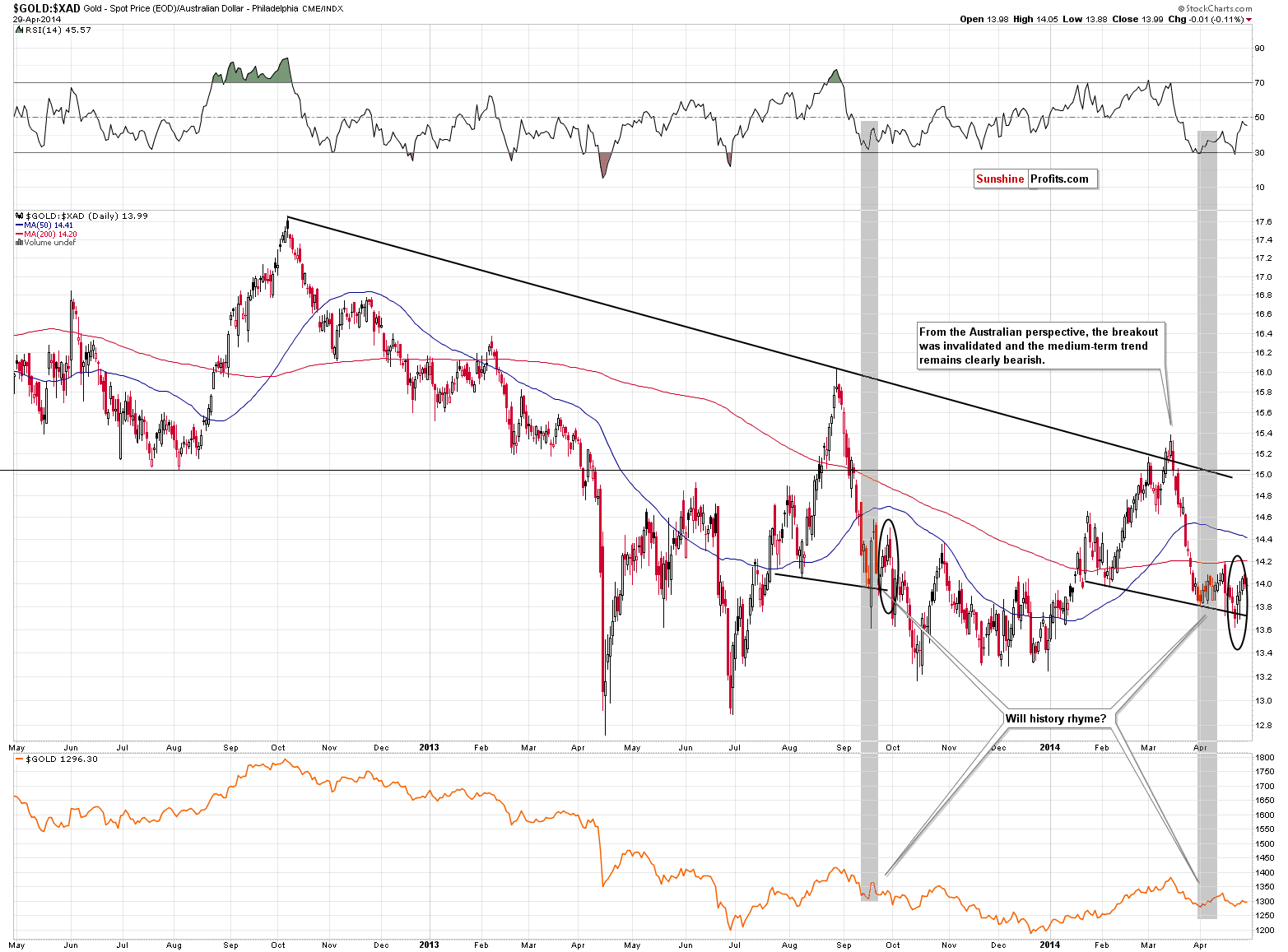

Let’s get back to gold for a minute.

Earlier this month we emphasized that the current situation in gold was very similar to what we had seen in September 2013 if you take a look at gold from the Australian perspective (gold priced in the Australian dollar). The similarity continues. We saw a move higher after an initial attempt to complete the head-and-shoulders pattern and the size of the move is so far very much in tune with the September upswing. If history is to repeat itself here, we are likely to see a move lower shortly.

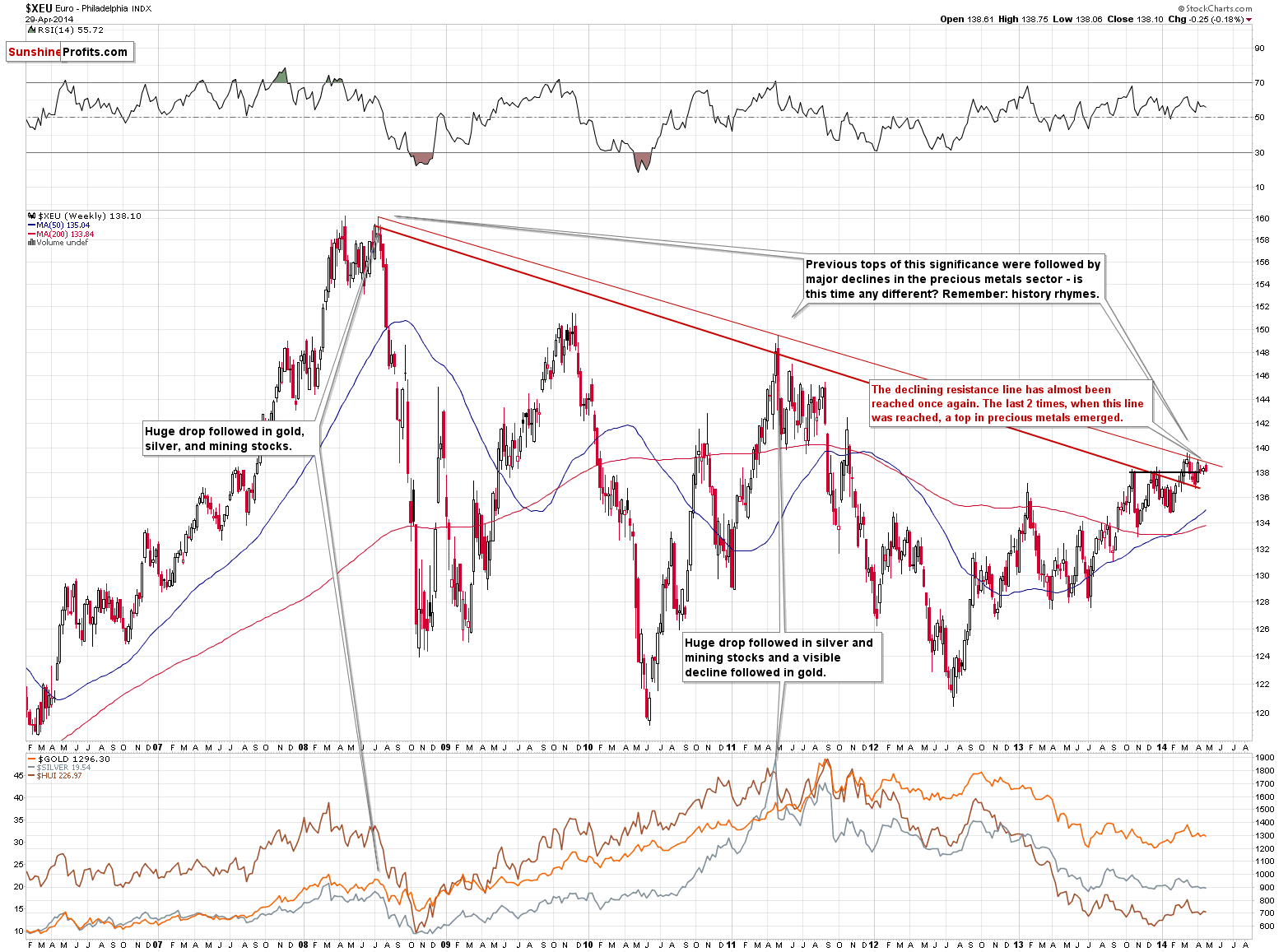

The recent movement in the Euro Index surely seems to confirm it. The European currency has once again moved to the very long-term declining resistance line and seems to have once again failed to break it. The last 2 times that this happened corresponded to local tops in the precious metals market. Please note that we can see a strong divergence in case of the euro, gold and silver. While the subsequent local tops in the euro were quite close to each other, they were visibly lower in case of gold and silver. One can say that the precious metals market is underperforming the euro at this time.

The bottom line is that the situation in the precious metals market remains too unclear to open any speculative position and the medium-term trend remains down. If miners invalidate their breakout, we will consider re-entering speculative short positions.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts