Briefly: In our opinion short speculative positions in gold (half), silver (half) and mining stocks (full) are justified from the risk/reward perspective.

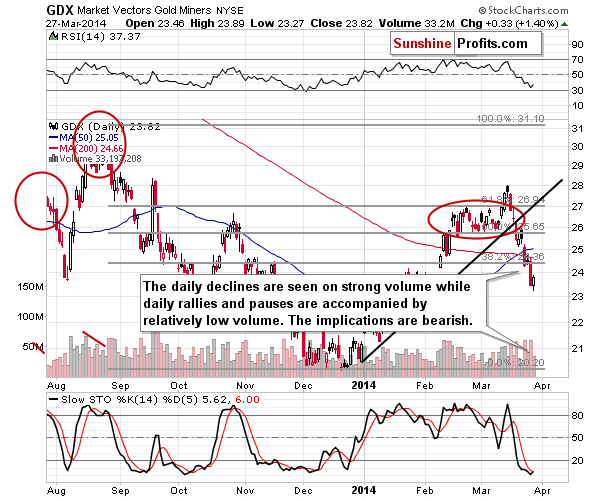

Generally, everything that we wrote yesterday is up-to-date, but there are 3 things that we would like to comment on today. The first one is the GDX ETF (charts courtesy of http://stockcharts.com.)

Miners moved slightly higher yesterday, but the thing that we would like to emphasize is that this move took place on relatively low volume. Consequently, while we could see another daily rally, it doesn’t seem that it would last or be significant. The short-term trend seems to be down.

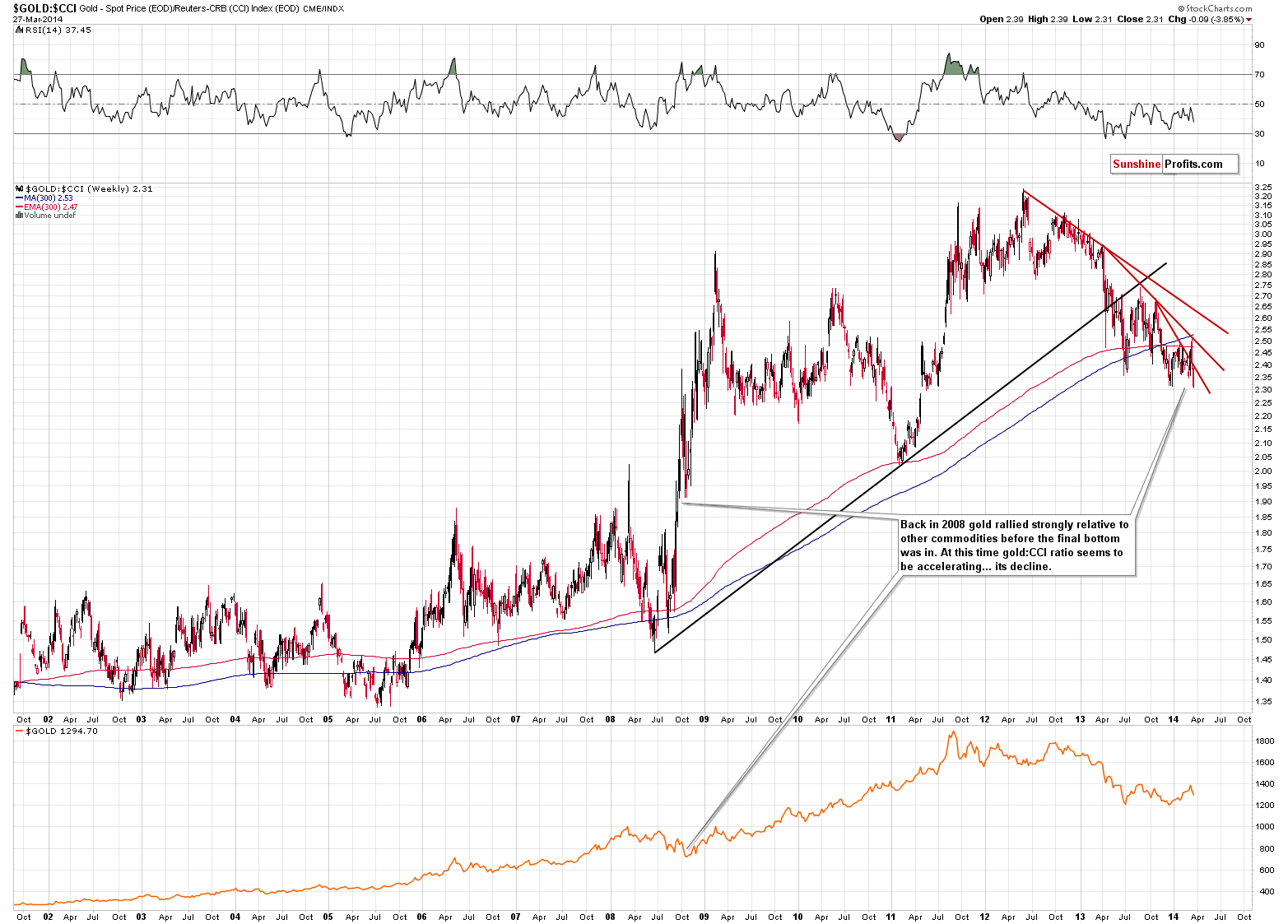

The second chart features gold’s value relative to other commodities.

The gold to CCI Index ratio closed below the previous daily close – it closed at the lowest level since mid-2011. In other words, we just saw a “stealth” breakdown. It’s not confirmed and small, but it’s something to keep in mind. Relative to other commodities, gold moved to a new low and that’s bearish.

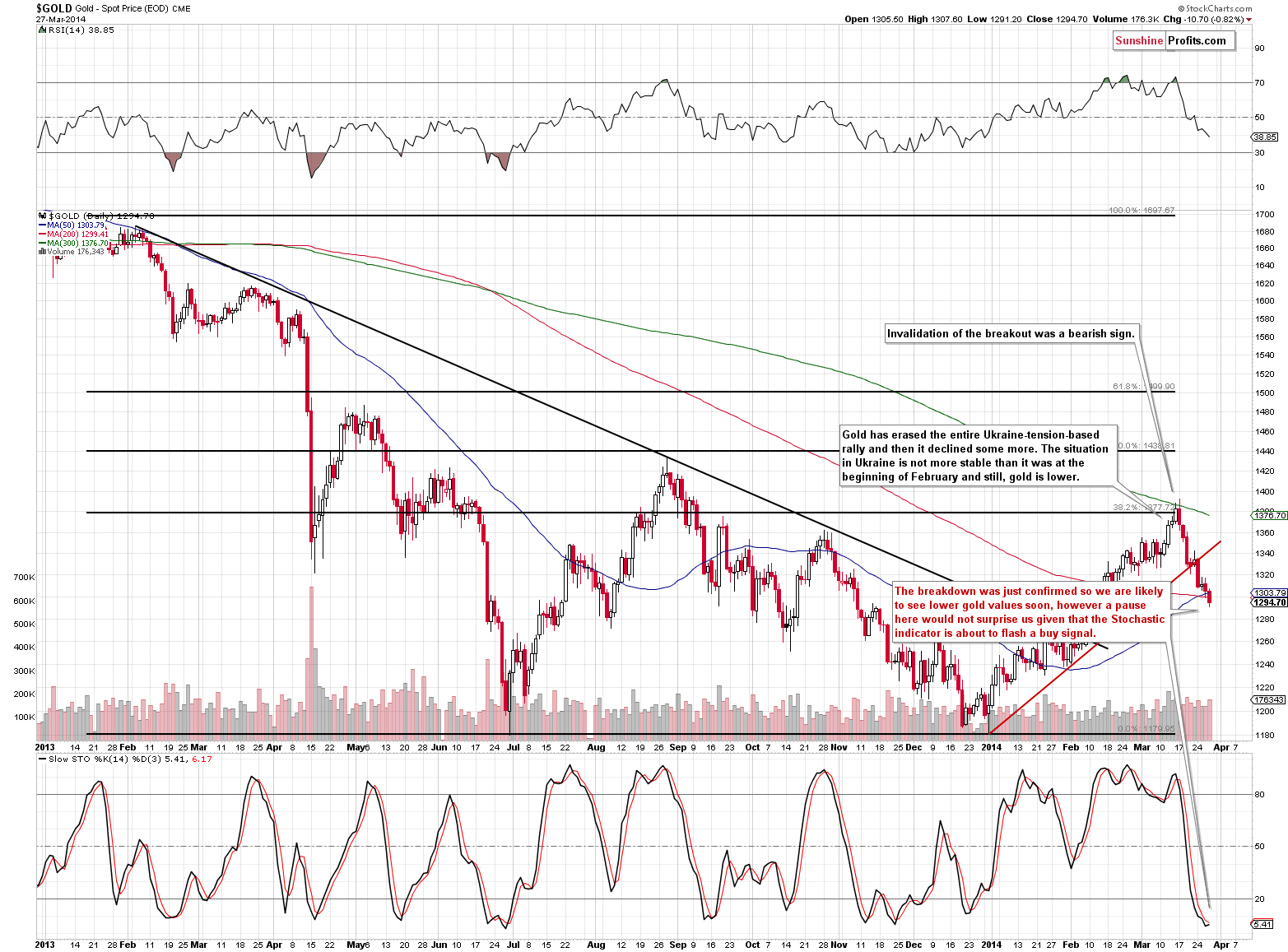

Finally, let’s take a look at gold itself.

Like we mentioned above – there’s not much new to tell. The reason that we’re featuring the above chart is the position of the Stochastic indicator. It hasn’t flashed a buy signal yet, but it’s oversold and it might give us such a signal when we see some kind of strength. While we don’t think it would change much, as the breakdown was already confirmed, we could see a pause or a small pullback in gold. It should not come as a surprise to you.

Having said that, we can summarize today’s alert in the same way we summarized our alert yesterday:

The precious metals sector appears to be likely to decline even without the U.S. dollar’s „help“, but it seems that it will receive this „help“ anyway.

To summarize:

Trading capital (our opinion): Short positions: gold (half), silver (half) and (full) mining stocks.

Stop-loss details:

- Gold: $1,342

- Silver: $20.85

- GDX ETF: $25.6

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts