Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective.

While last week’s Monday had been a significant day in terms of volume, price, and corresponding events, this Monday was quite calm. Let’s take a closer look at what happened (charts courtesy of http://stockcharts.com.)

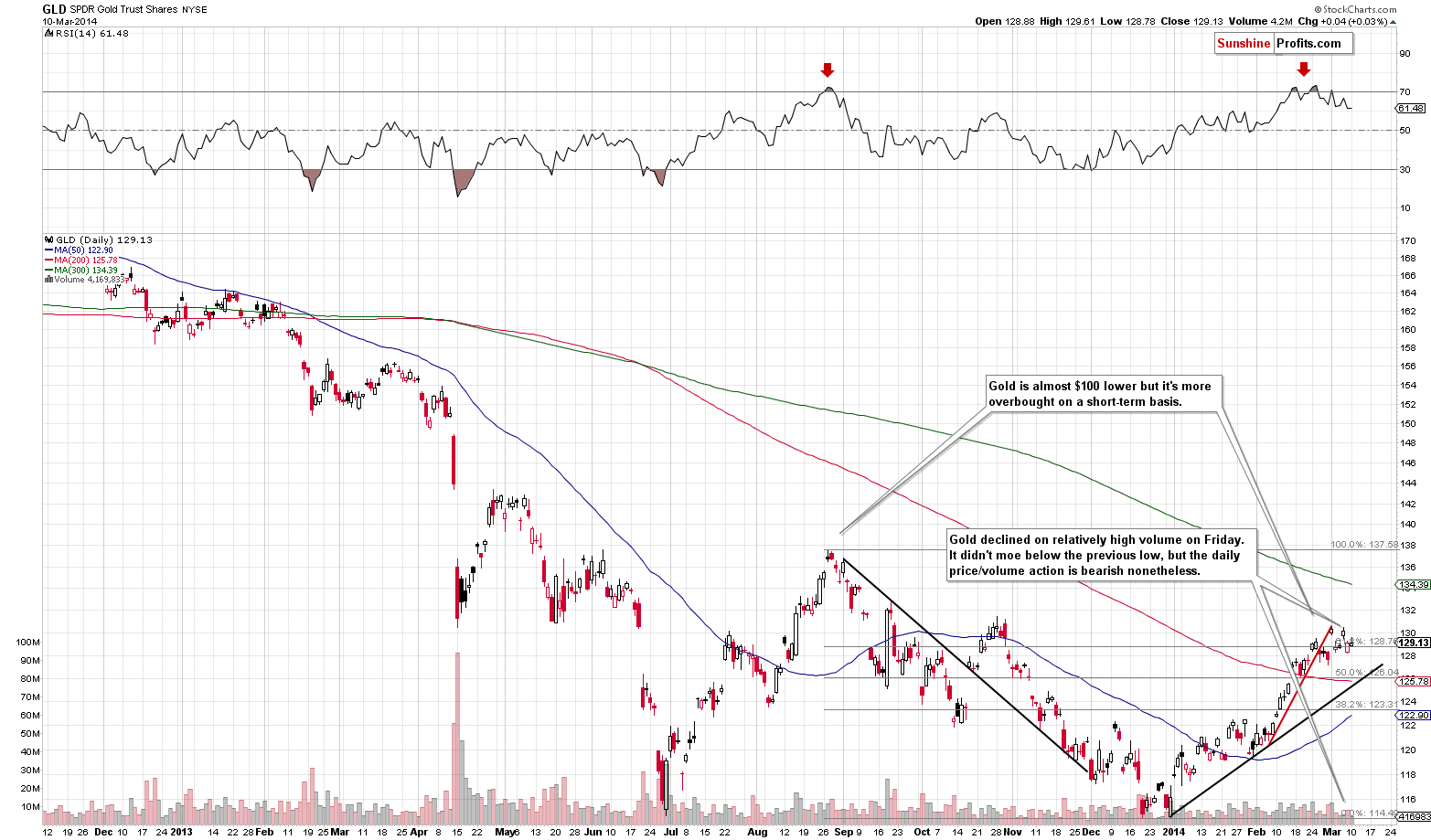

Basically, gold prices didn’t change, so what we wrote previously remains up-to-date:

On Friday gold declined on relatively strong volume, which is another confirmation of the bearish outlook. The yellow metal now follows the rally-on-low-volume-but-decline-on-high-volume pattern, which is a bearish phenomenon. High volume usually tells the true direction of the market and in this case it’s down.

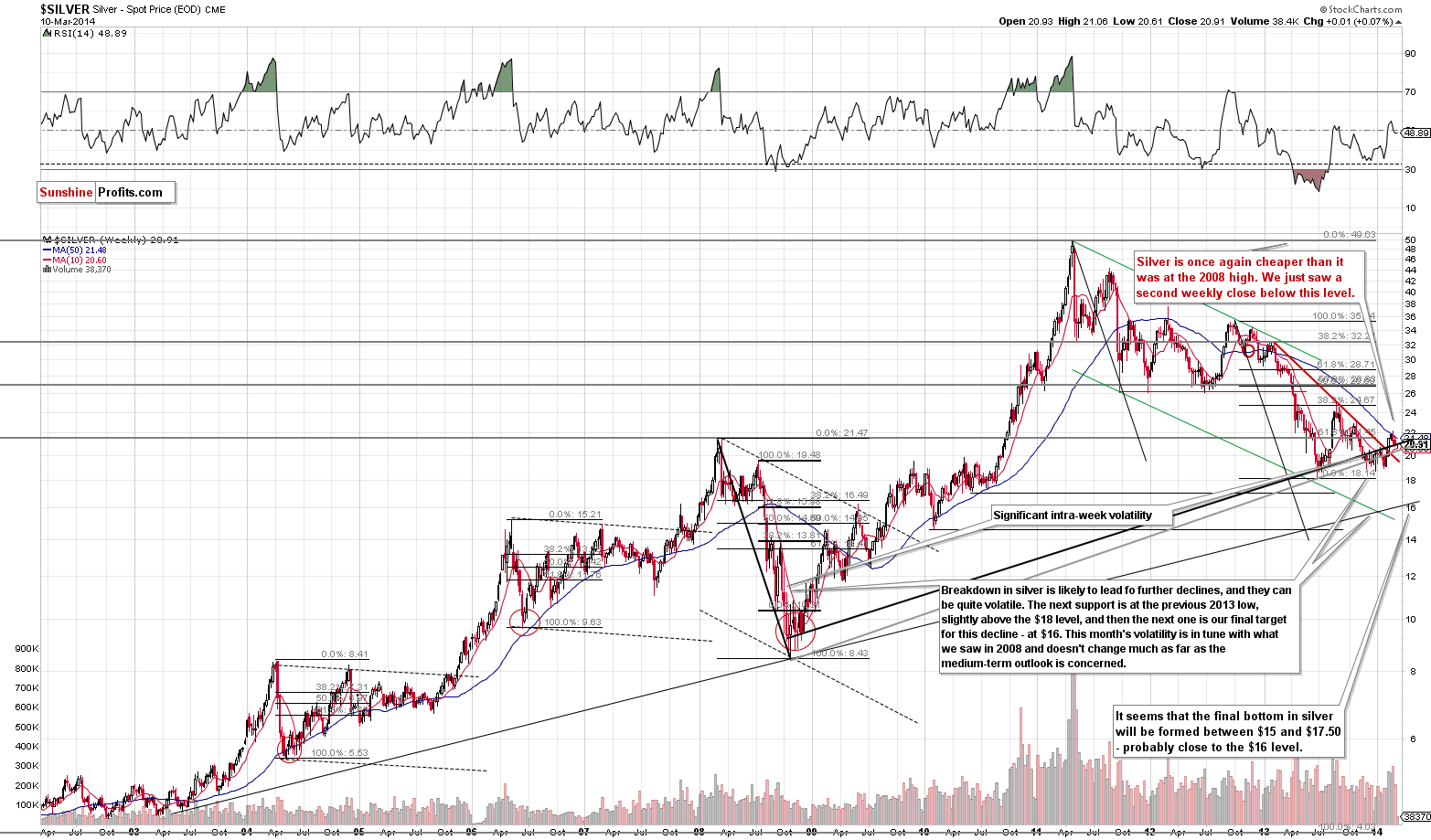

The same was the case in the silver market.

Silver simply haven’t moved so far this week. Last week it declined and confirmed the move below the 2008 high, so the outlook is bearish. It will be even more bearish if we see a breakdown below the rising long-term support lines, but that has not been the case so far.

Meanwhile miners declined slightly. That’s not that bearish until you combine it with the fact that metals rallied slightly. Overall the implications are bearish.

The currency indices didn’t change yesterday and the same was the case for stock indices. Consequently, what we wrote about the outlook for the precious metals sector yesterday remains up-to-date.

Based on last week’s events and what had happened over the weekend it was likely that gold would move much higher – but its reaction has been very weak. It looks like there will be no rally in gold before a bigger decline. We are keeping half of the funds in gold, though, just in case the next days bring improvement (or perhaps the tensions in Ukraine would increase). If not – things will become even more bearish and we will likely adjust the position once again.

We might suggest changing the short-term speculative position and / or the long-term investment one shortly, based on how the markets react and what happens in Ukraine. We will keep you – our subscribers – informed.

As a reminder, we have just posted an important report on the role of rebalancing in the case of the mining stocks sector. It compares the buy-and-hold approach with a strategy including “some rebalancing,” and with another one based on “rebalancing using Golden StockPicker and Silver StockPicker”. These tools were based on strong financial and statistical foundations, but now – after years of these tools being available – we can evaluate their performance and usefulness. While we were certain that they were useful because of the theory backing them, the results are even better than we had expected. As a reminder, as our subscribers you have access to both tools in the current Gold & Silver Trading Alert package (previously known as the Premium Service).

To summarize:

Trading capital (our opinion): Short position (half): silver and mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.90

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts