Briefly: In our opinion, long (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

It might seem odd after so many days of weakness, but we finally saw a strong rebound in the precious metals market. Gold, silver and – especially – mining stocks moved substantially higher (on strong volume!) after the initial decline, thus forming a strong reversal. The question to be asked today might not be how much lower can the PMs decline, but how high they can rally.

Let’s move right to the charts (charts courtesy of http://stockcharts.com).

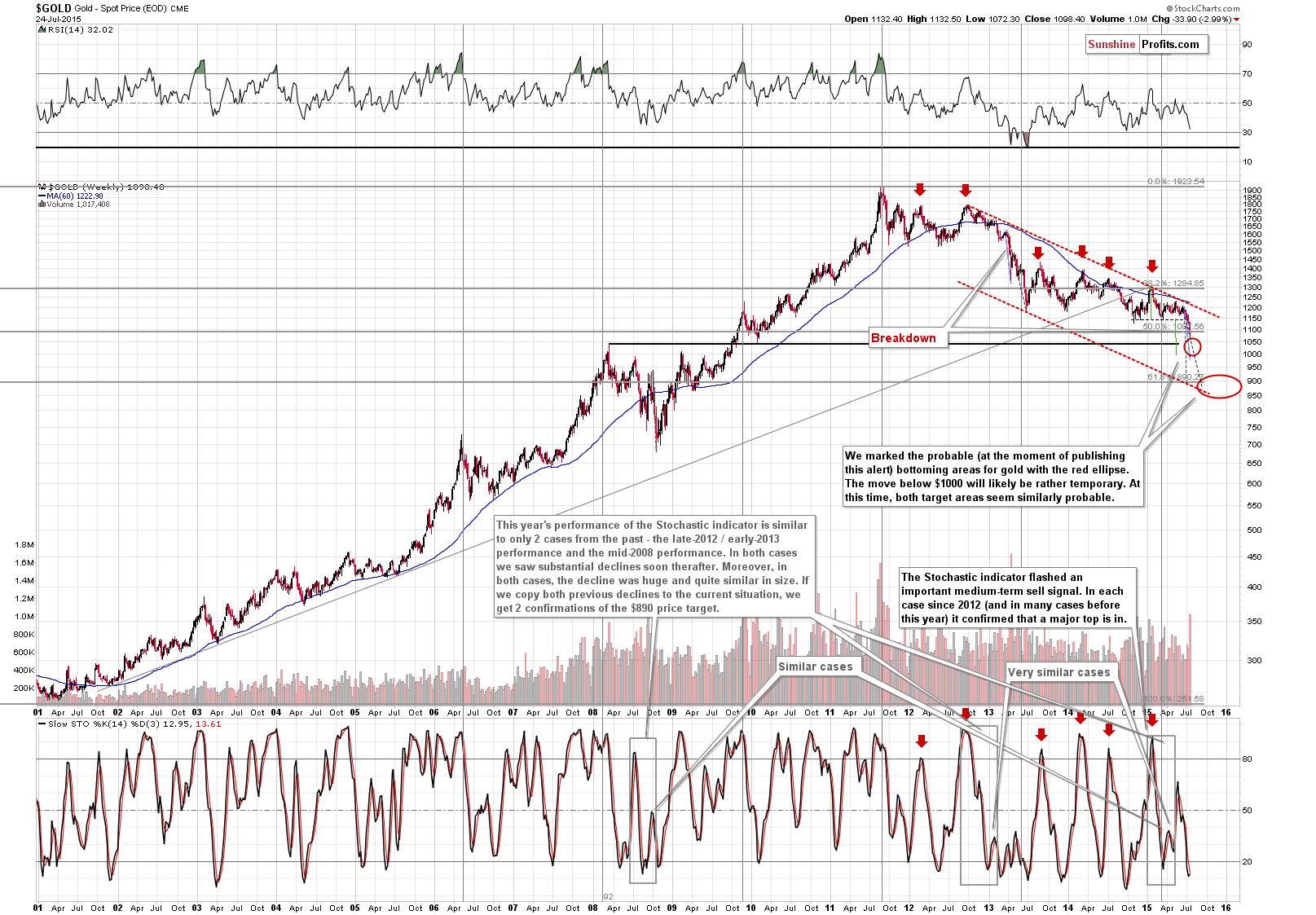

From the long-term perspective, not much changed – gold declined over $30 and didn’t move back above the key support/resistance – the 2014 low. With each passing day when gold stays below the 2014 low, the breakdown becomes more and more important. We previously wrote that with another weekly close below this level, we would say that it was confirmed and the implications would be very bearish for the medium term.

And they are. Gold closed visibly below the $1,130 level, so the breakdown is confirmed and the implications are very bearish for the following weeks. They are not necessarily bearish (based on the above) for the following days, though. The confirmation of the medium-term breakdown is simply a medium-term sign and not a short-term one.

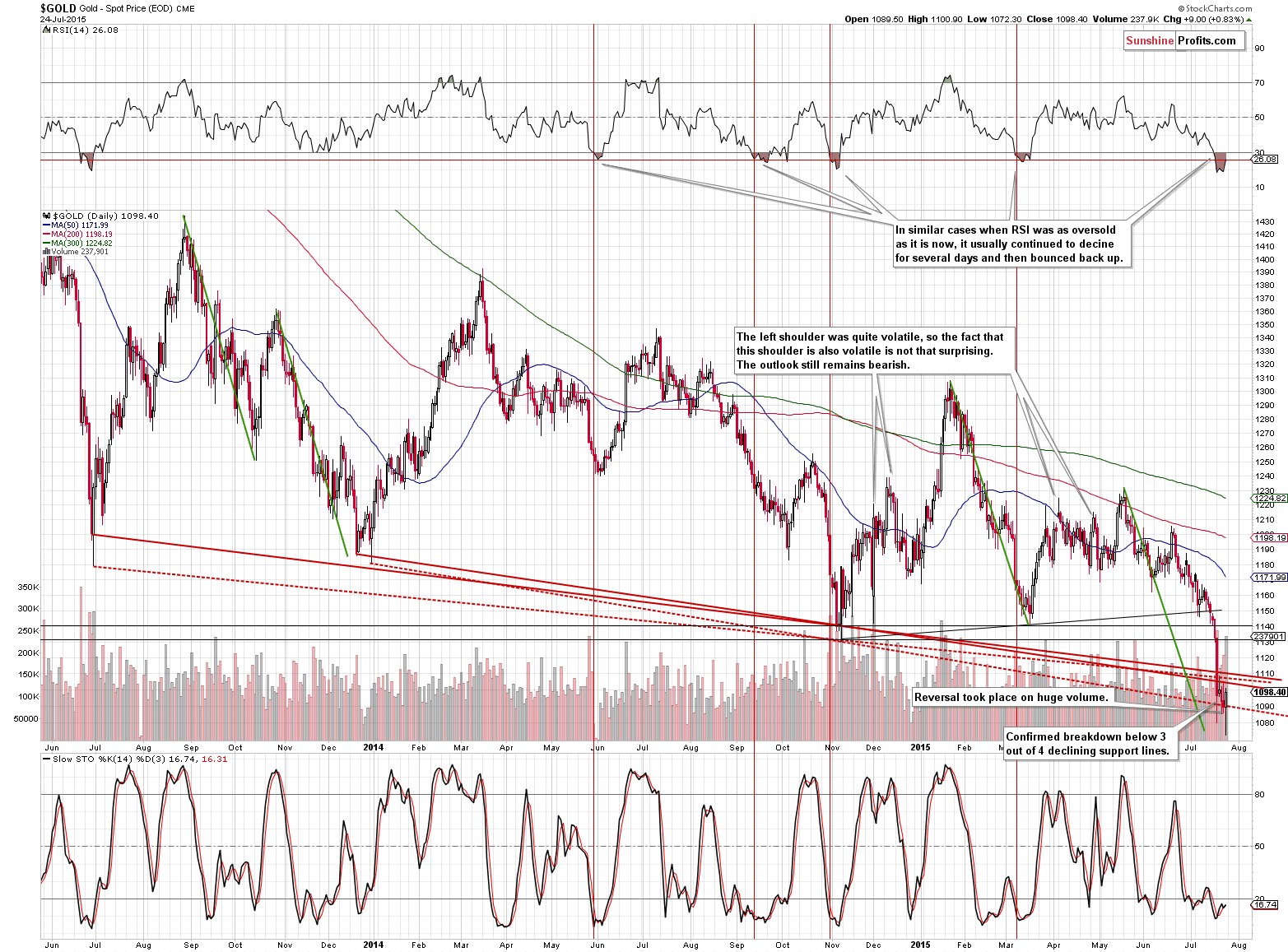

The change on the short-term chart might not seem significant (gold closed only $9 higher than on Thursday), but it is. Gold moved initially lower (below $1,075, which was more or less where profits from our short trades were taken off the table, as these levels corresponded to the $14.33 level in silver which triggered the exit), and from this low, gold managed to rally over $25. The entire action took place on huge volume, which makes the reversal very significant.

Interestingly, gold’s reversal perfectly fits the analogy that we described in Friday’s alert - green lines on the above chart emphasize that the size of the recent decline was almost the same as the previous one. Before Friday’s session the current decline was smaller and thanks to Friday’s initial decline, the current decline slightly exceeded the previous move. If history is to repeat itself, we can expect a pullback relatively soon or even right away.

The RSI indicator also suggests that a move higher is at hand. In previous cases when the RSI was below 30 and the horizontal red line, this indicated that a local bottom would be seen shortly (however, not necessarily immediately). Gold didn’t bottom immediately after the RSI declined below the red line – it moved lower for a few additional days and formed a daily reversal on Friday.

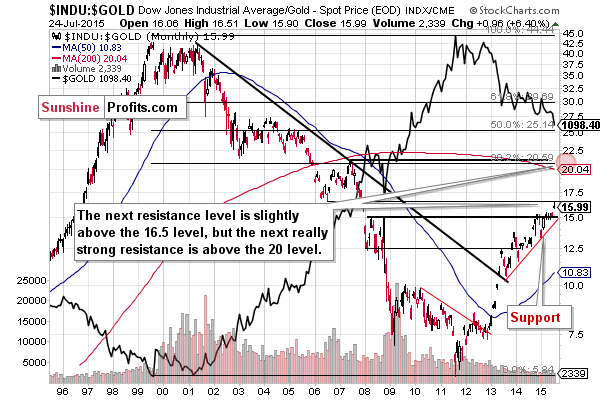

The Dow to gold ratio shows that gold is already correcting – just like the ratio after reaching its resistance – the 2006 low. The support is relatively close – the 15 level and it seems that this level will hold as it’s created by both the previous (and 2008) highs and the rising red support line. Additionally, the ratio spent quite a long time consolidating before the breakout above the 15 level, so it seems that the breakout is not accidental and will not be invalidated shortly.

The implications for gold are bullish for the short term, but bearish for the medium term.

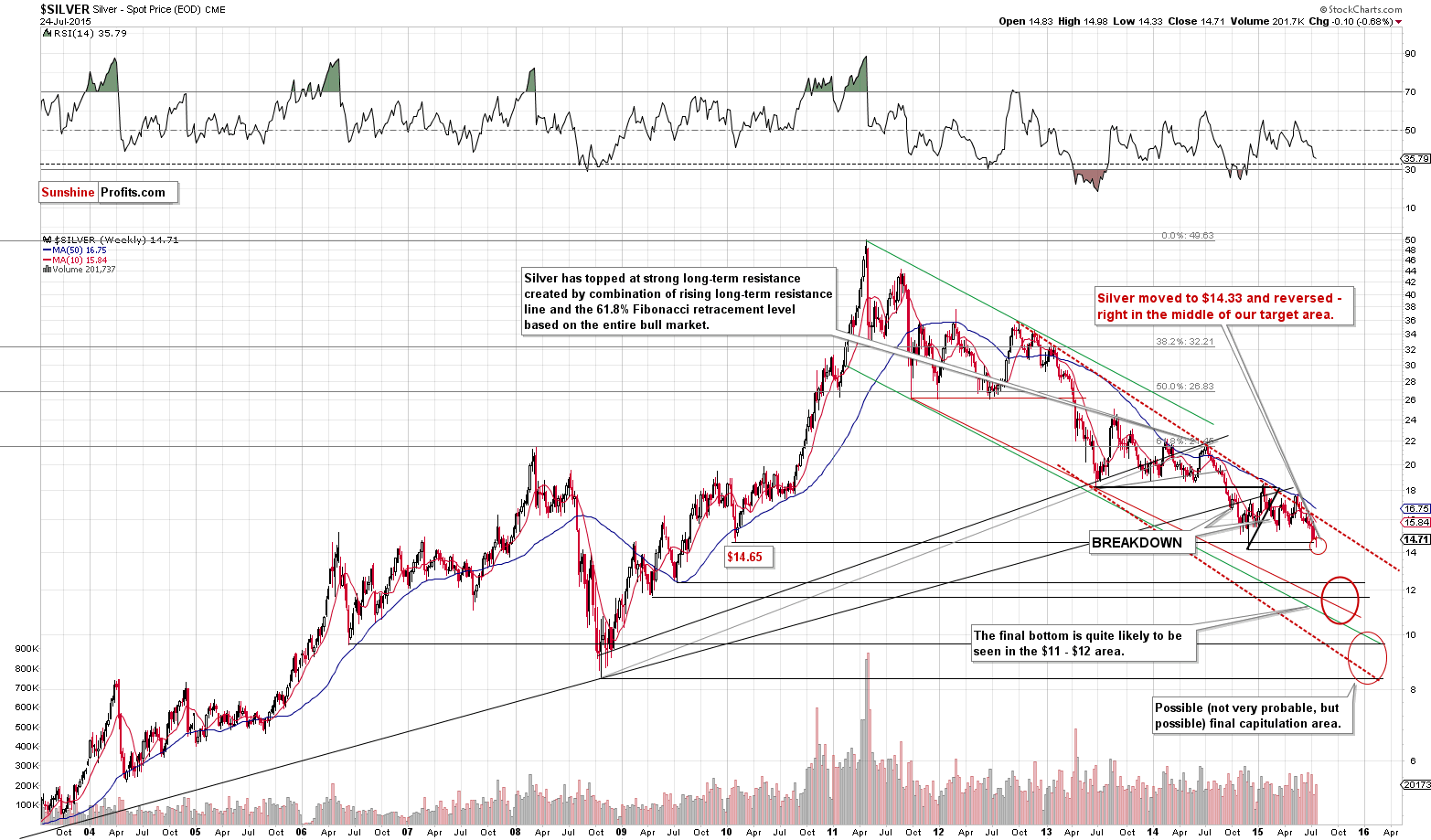

Silver moved initially lower and then rallied once again, just like gold did. The intra-day low was $14.29 according to kitcosilver.com and it was $14.33 according to stockcharts.com – either way the level at which we planned to exit the entire short position ($14.33) was just reached – right in the middle of our target area. Depending on the data provider we took profits off the table either right at the bottom or a few cents away from it.

What’s next? Silver will probably correct, just like gold. It will probably end the corrective upswing with a sharp daily rally, which – as it was the case many times in the recent past – will probably provide us with a good opportunity to enter short positions once again. How high will silver go? It’s not clear at this time, but we don’t expect it to rally above the declining red resistance line visible on the above chart, and if so, we don’t expect such a breakout to be confirmed. In other words, a significant move above $16 seems unlikely – that is if we get this far up (the trend remains down).

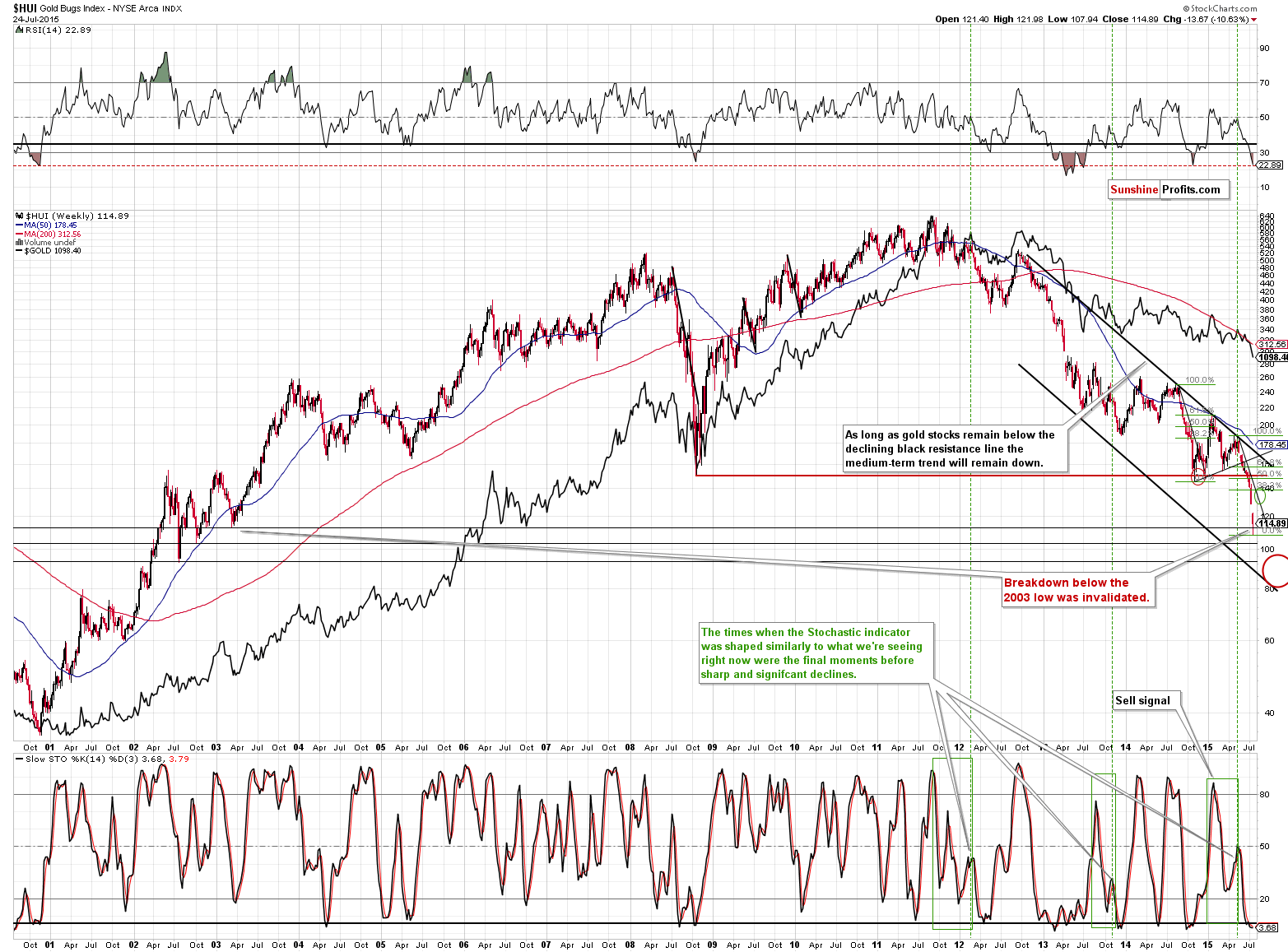

The HUI Index reversed and rallied very significantly before the end of the session. Just like in the case of gold, our short positions were exited and profits were taken off the table very close to the intra-day lows (108), as silver and the miners bottomed at the same time or in a very similar time.

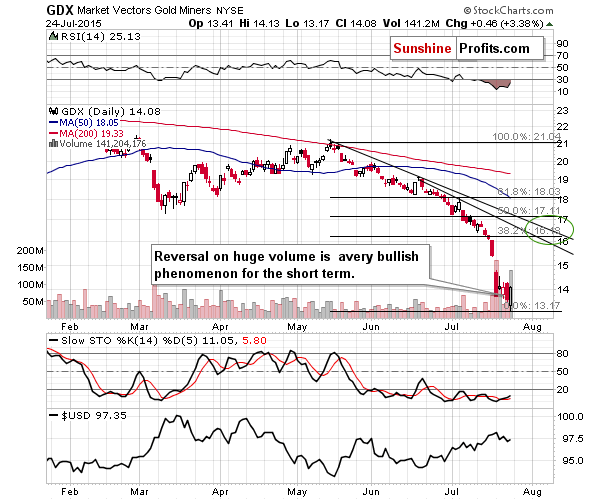

Gold stocks invalidated the breakdown below the 2003 low, which is a very bullish sign for the short term. It doesn’t seem that they are done declining, though – from the medium-term perspective that is. As far as short term is concerned, it seems that a corrective rally will be seen. We have been expecting one based on the size of the decline and the sudden increase in the negativity in the mass media. Friday’s reversal on strong volume (which you can see on the GDX chart below) serves as a confirmation that “it’s time”.

How high will miners rally? Since the recent decline is similar to the previous one in terms of size and sharpness, we might expect the post-decline corrections to be similar as well. In the final part of 2014, gold stocks corrected almost to the 38.2% Fibonacci retracement and moved slightly above the declining short-term resistance line. If we see similar performance also this time, we might expect gold stocks to correct to the target area that we marked green on the above chart.

Please note that even if this level is exceeded, the miners are not likely to rally above their 2008 lows during this correction – the resistance created by it is likely (based on our experience) too strong.

As we mentioned above, the reversal was accompanied by huge volume and you can see it on the above chart. The implications are bullish. How high will the GDX ETF rally? In analogy to the situation on the HUI Index chart, we marked the target area with a green ellipse. In short, it seems that the GDX ETF will rally to $16 or so (before turning south once again).

Summing up, while it doesn’t seem that the final bottom for the precious metals sector is in, it seems that a local one is and we are adjusting our trading position accordingly. Based on the silver’s decline and reaching the $14.33 level on Friday, we closed our short position and took massive profits off the table (even if we don’t take any leverage into account). We had entered this short position on March 30 when (previous trading day’s closing prices) gold was at $1,198.30 (over $120 higher than the price at which we exited the short position), silver was at $16.97 (over $2.60 over the price at which we exited the short position), and the HUI was at 166.22 (over 58 index points – more than 53% - over the price at which we exited the short position).

We wrote that the action that we would take after exiting the short positions (opening a long position vs. staying on the sidelines) would depend on the kind of signals that we got and we got strongly bullish signals for the short term. Consequently, we are opening full speculative long position in gold, silver and mining stocks. If the short position has not yet been exited, it seems that exiting it as soon as possible and securing profits (and opening the mentioned long position) is justified from the risk/reward perspective.

We are not making any adjustments to the long-term investment capital.

On a side note, if you’re not familiar with the way we choose individual gold stocks and silver stocks, we suggest that you become familiar with our tools: Golden StockPicker and Silver StockPicker – these are the tools that we will utilize to select miners to buy when getting back on the long side of the market, as they have greatly enhanced the performance of the simple buy-and-hold approach. They can be used for speculative trades as well and at this time they favor IAMGOLD Corporation and Rangold Resources as far as gold stocks are concerned and First Majestic Silver Corporation and Silver Wheaton Corporation as far as silver stocks are concerned.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Long position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,130; stop-loss: $1,063, initial target price for the UGLD ETN: $9.24; stop loss for the UGLD ETN $7.69

- Silver: initial target price: $15.20; stop-loss: $14.12, initial target price for the USLV ETN: $14.40; stop loss for USLV ETN $11.51

- Mining stocks (price levels for the GDX ETN): initial target price: $15.87; stop-loss: $12.77, initial target price for the NUGT ETN: $5.17; stop loss for the NUGT ETN $2.70

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in case of short-term trades – we if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.78; stop-loss: $17.67

- JNUG: initial target price: $12.01; stop-loss: $6.39

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Tuesday, the World Gold Council (WGC) published a new investment commentary on gold’s year-to-date performance and the potential tailwinds and headwinds it may face during the second half of 2015. What can we learn from this report?

New World Gold Council’s Investment Commentary

S&P 500 index broke below the level of 2,100 on Friday. There is still no clear medium-term direction - is this a topping consolidation, or just an accumulation phase within long-term bull market?

=====

Hand-picked precious-metals-related links:

Poll: When will gold regain its shine?

Gold below $1,100 threatens profit at one-third of producers

Hedge Funds Net-Short Gold First Time In History

Deutsche Bank: Just because all commodities are falling doesn't mean there's one driver

Can India come to gold's rescue?

=====

In other news:

Oil Bulls Are Fleeing at the Fastest Pace in Three Years

Will the Fed lift commodity currencies?

China stocks drop 8.5% in massive rout

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts