Briefly: In our opinion speculative long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold continued to move higher this week as we had expected. Gold stocks finally moved higher yesterday, but the size of their move was nothing to call home about. Is the top in?

In short: in our opinion, not yet. What we saw yesterday is the same type of action that we had written about previously. In other words, our previous comments are up-to-date and the market continues to react as expected. The general stock market declined again (it seems to be very close to its final bottom, though) and, thus, the lack of good performance in mining stocks and in silver is not surprising. When stocks rally, it seems that silver and mining stocks will catch up. Let’s take a look at yesterday’s changes (charts courtesy of http://stockcharts.com).

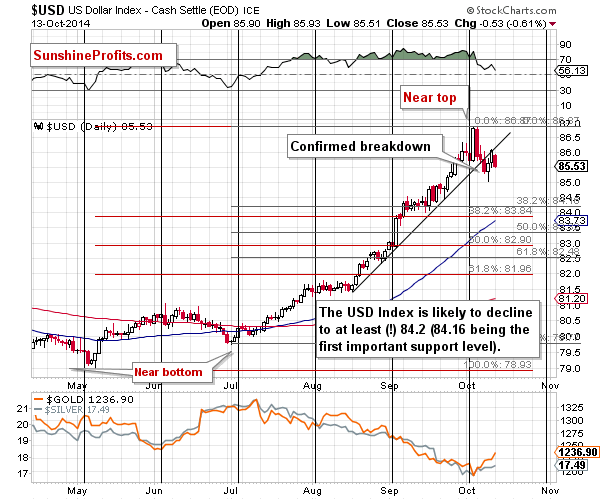

Yesterday, we wrote that the breakdown below the rising support / resistance line was not invalidated and that the implications were bearish for the USD Index and bullish for the precious metals market.

The USD Index declined yesterday and we now have an even more bearish picture.

Our other comments about the USD Index remain up-to-date as well:

How low can the USD Index move during the corrective downswing? It could decline to 82 (81.96 is the 61.8% Fibonacci retracement based on the May - October rally), but the decline could end as soon as the USD reaches 84.2 or so (84.16 is the 38.2% Fibonacci retracement based on the July – October rally). Either way, the USD Index is quite likely to decline at least by additional 1.4 index points, which is quite a lot. Even if the USD declines to 84.2 and bottoms, this decline would still be likely to trigger a bigger upswing in the precious metals sector.

Why? Because gold, silver, and mining stocks are negatively correlated with the dollar in the short term.

Please note that USD has still not moved to even the highest of these target levels, so the bottom in the USD Index is likely not yet in.

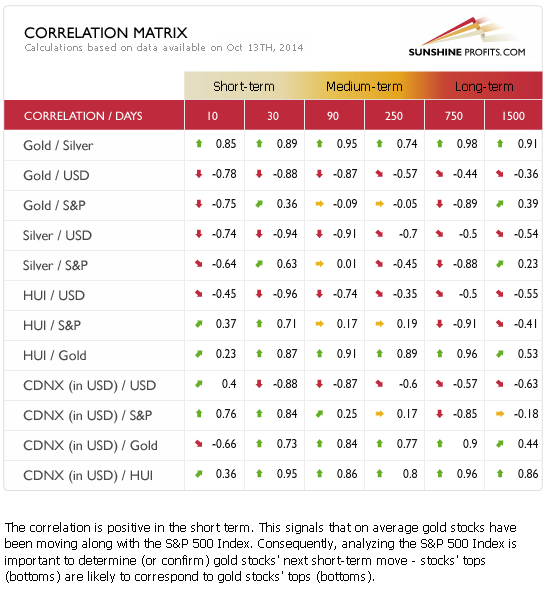

Generally, everything that we wrote about the correlations and their implications remains up-to-date:

The Correlation Matrix is a tool, which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. In the short-term (30 trading days) column we see values very close to -1 in case of gold/USD, silver/USD, and HUI/USD correlations. Consequently, the markets are very strongly negatively correlated, and a move lower in the USD is quite likely to impact precious metals in a positive way.

Moreover, please note that the correlation between the stock market and silver (0.73) and between the HUI and the stock market (0.72) is visibly higher than it is between the stock market and gold (0.55). Consequently, it shouldn’t surprise us that miners and silver have not performed so well recently – stocks have been declining. Once stocks bottom, it seems that silver and gold stocks will catch up with gold.

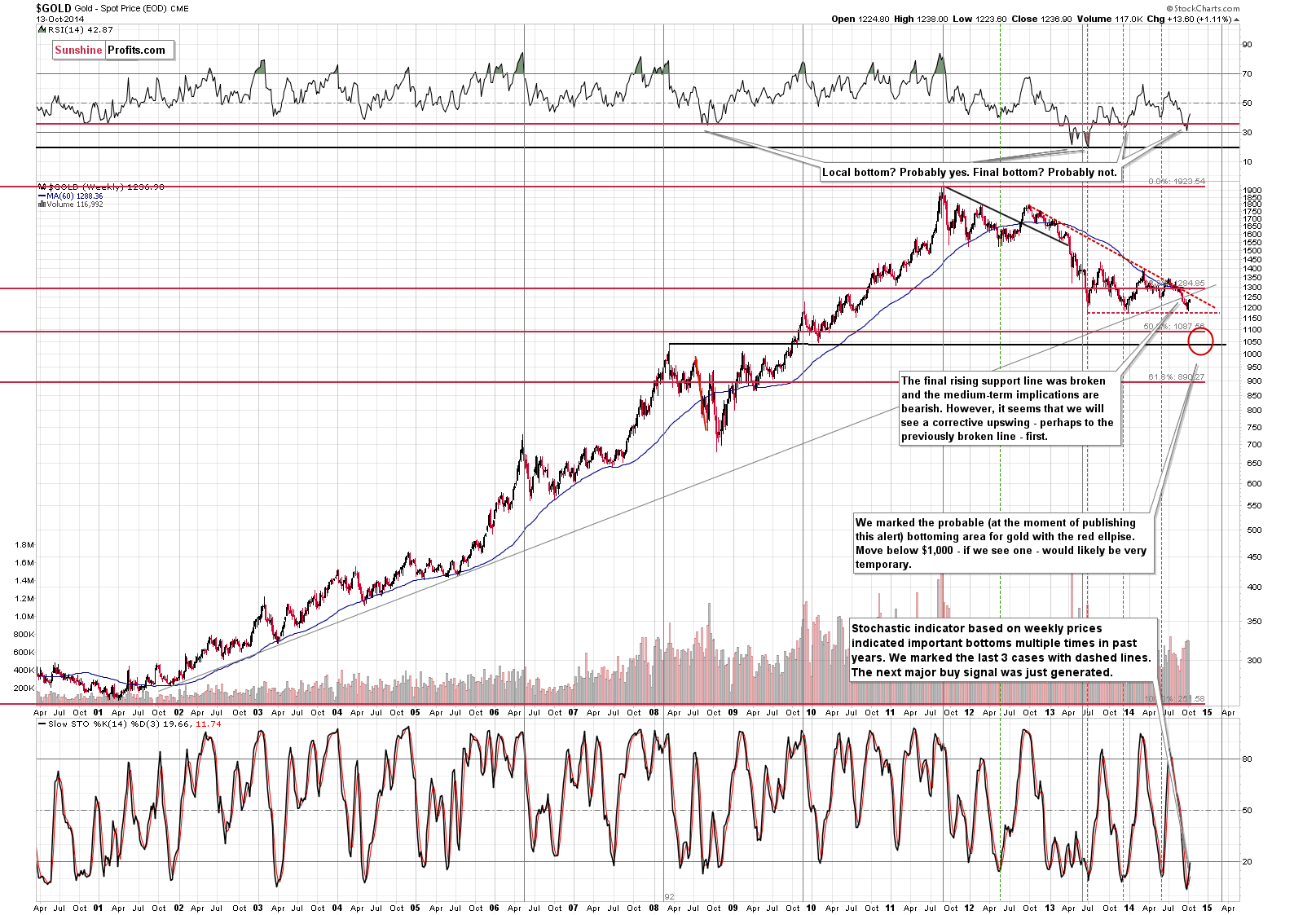

Having said that, let’s take a look at the yellow metal. Again, our previous comments remain up-to-date, as gold moved higher yesterday, but not high enough to reach our price target:

In our opinion, it’s quite likely to rally to the combination of resistance levels: the long-term rising (grey) line and the declining red dashed line. These lines intersect just a little above the $1,250 level, so it seems to makes sense to expect the next local top to form there. Please note that this is based on the information that we have available today. It will be crucial to monitor the USD Index and its link with gold to determine whether a top is indeed being formed or not. If we don’t see bottoming action in the USD Index, but gold reaches the above-mentioned resistance levels, it might not be the final top for gold. We will keep our eyes opened and report to you accordingly.

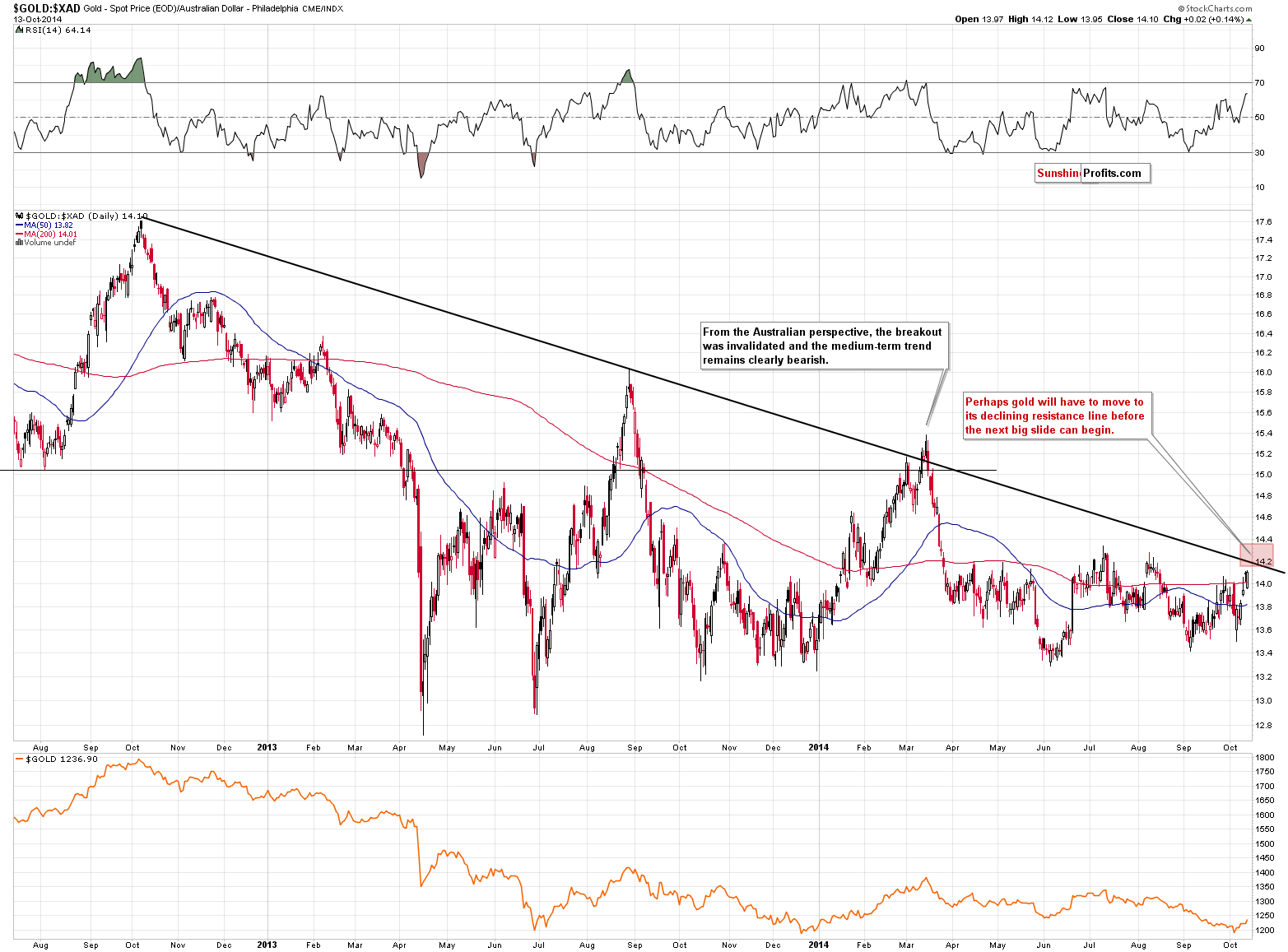

In Friday’s alert (we suggest that you read it in case you haven’t had the chance to do so yet) and in Monday’s alert, we commented on gold’s price seen from the Australian perspective.

We wrote the following:

When we take a look at gold priced in the Australian dollar, we see a rather straightforward picture. There is a big declining resistance line that might stop or delay any rallies. At least, that’s been the case so far this year. To be precise – in March, gold moved slightly above this line, but it plunged shortly thereafter. In case history rhymes also this time, we drew the target area at and slightly above the declining resistance line. Either way, it’s rather close, so we are quite likely to see a pause or top rather soon.

Gold moved closer to the target area, but it’s not in it yet, so it doesn’t seem that the rally is over.

The rally has still not taken gold to the target area, so we can expect the yellow metal to move at least a little higher before the top forms.

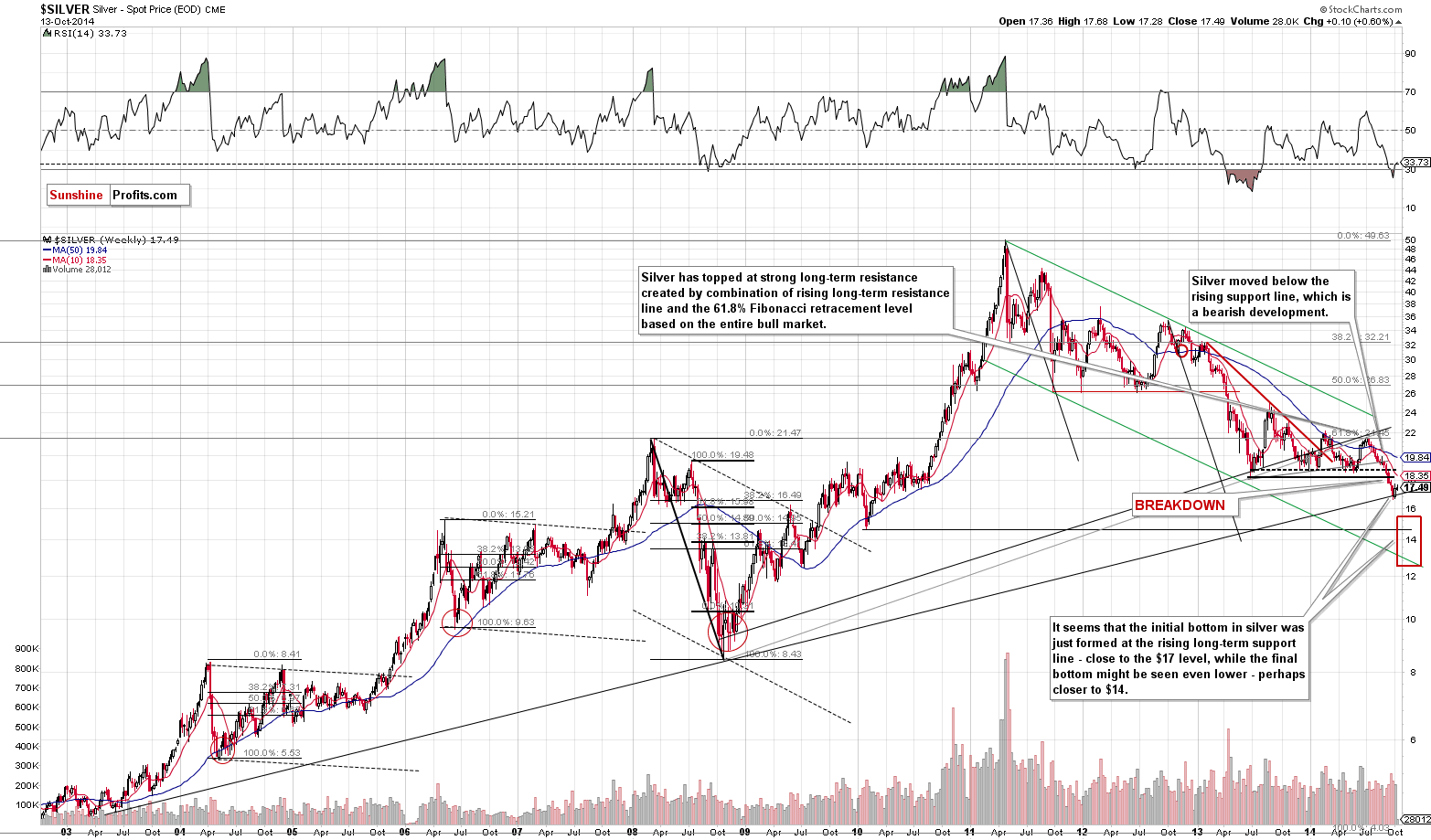

The situation in silver is also unchanged from what we saw on Friday and Monday and our previous comments remain up-to-date:

As you can see on the above chart, the situation in silver hasn’t changed much recently. The white metal seems to have bottomed at the long-term rising support line and the correction seems to be under-way. How high is silver likely to move before it declines once again? It’s a particularly tough call in case of this part of the precious metals sector as it can be, and is, very volatile at times, however, it seems that it could move to its 2013 low or the previous 2014 lows. Consequently, $18 - $18.50 is our target area based on the information that we have available today. Just as it is the case with gold, it will be crucial to consider the situation in the USD, before making trading / investment decisions regarding silver.

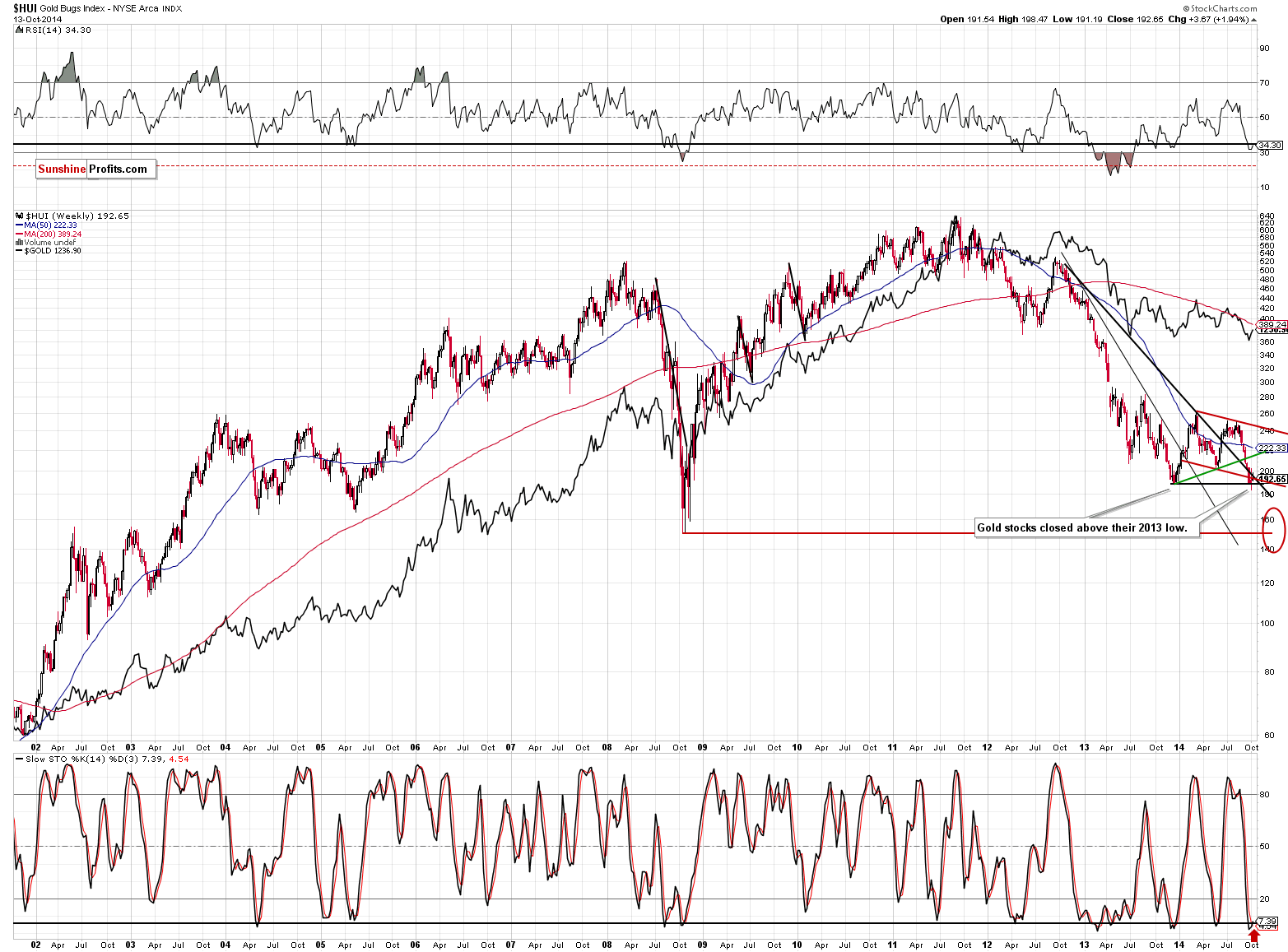

Gold stocks moved only a little higher yesterday, but as we had written previously, the fact that miners underperform gold is not necessarily a bearish sign at this time. There is a good reason for it – the decline in the stock market, which is likely to be over soon.

The important thing about the HUI Index is that it closed above the 2013 low on Friday and that it moved back to the declining support/resistance levels on Monday. The invalidation of the breakdown below the 2013 lows is a bullish sign for the short term.

How high can the HUI Index go (before moving lower again) based on the information that we have today? To approximately 213-215, in our opinion. That’s where the rising, green support line is. Again, the above could change and we will keep you – our subscribers – informed.

Overall, we can summarize the situation in the precious metals market in the same way as we previously did:

Summing up, it seems that the corrective downswing in the USD Index and the corrective upswing in the precious metals market are underway. In our opinion, it seems to be a good idea to use speculative capital to profit from these moves. Today’s alert features our estimations of where the next local tops might be in gold, silver and mining stocks, but there are still quite a few unknowns, especially in the case of the USD Index. The price targets that we provide below are “initial” meaning that they are based on our estimations at this time. We will monitor the situation and will let you – our subscribers – know (we will send a confirmation) when we think it’s a good idea to exit the current long position and take profits off the table.

A lot of money had been saved by staying out of the precious metals market in the past months with one’s long-term investments (that is if one followed our suggestions; details below), and additional gains have been made on the recent speculative short positions. The corrective upswing that we are already seeing will likely provide additional profits from the trading capital.

As always, we will keep you – our subscribers – updated and informed.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,172, initial target price: $1,249, stop loss for the UGLD ETF $11.29, initial target price for the UGLD ETF $13.56

- Silver: stop-loss: $16.47, initial target price: $18.07, stop loss for USLV ETF $23.94, initial target price for the USLV ETF $31.73

- Mining stocks (price levels for the GDX ETF): stop-loss: $19.94, initial target price: $23.37, stop loss for the NUGT ETF $18.25, initial target price for the NUGT ETF $28.99,

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $28.40, initial target price: $37.14

- JNUG stop-loss: $6.19, initial target price: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts