In short: No changes: small (half) short position in gold, silver, and mining stocks.

In yesterday’s alert, we provided detailed reasoning behind our decision to open the short position in the precious metals sector. Basically, points made yesterday remain up-to-date, but there are 3 charts that we would like to comment on today.

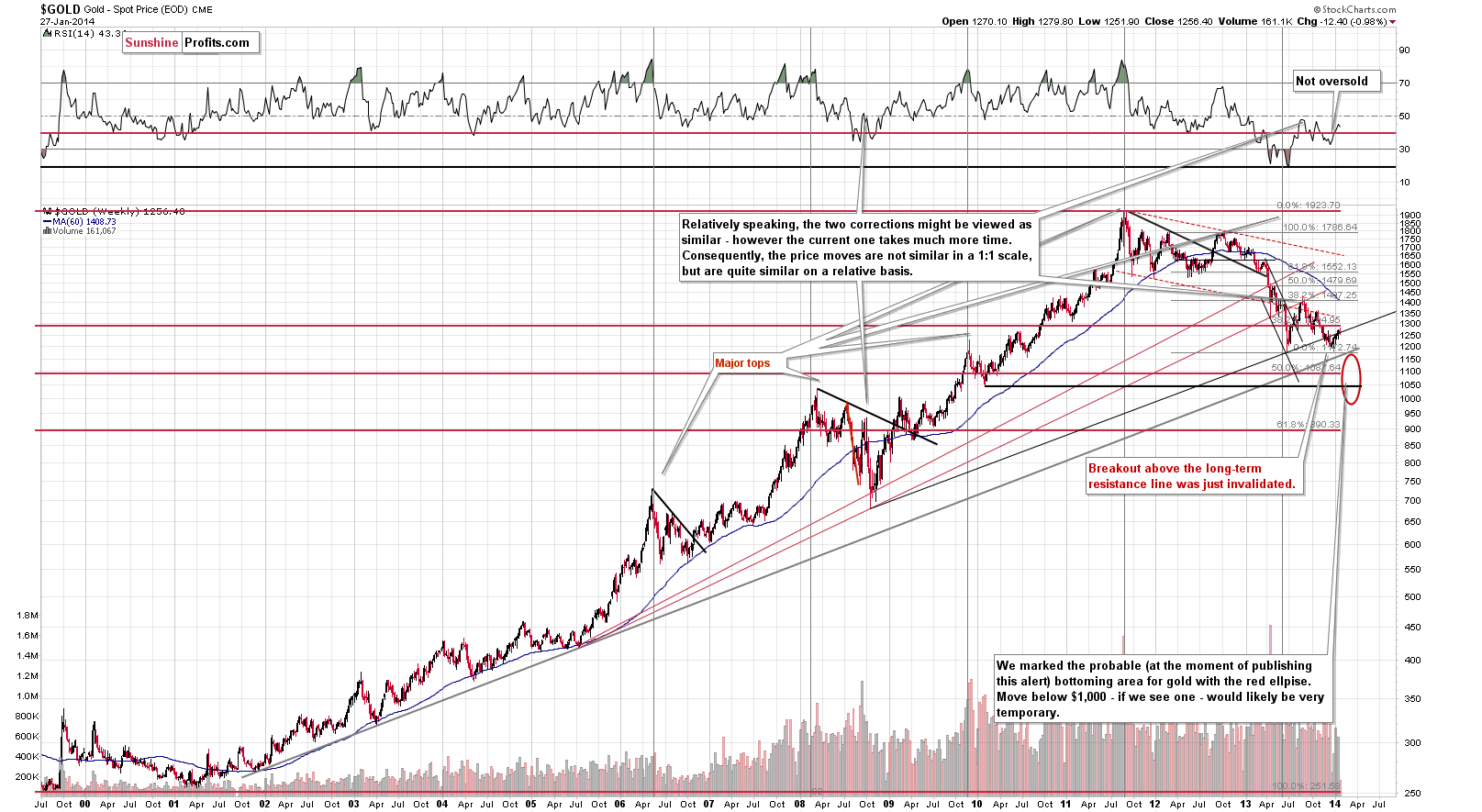

Let’s start with the long-term gold chart (charts courtesy of http://stockcharts.com.)

There’s only one change, but it’s very important. The small breakout above the rising long-term resistance line was invalidated yesterday, which is a bearish indication and a sell signal on its own. There was no rally in the USD Index that could have triggered the invalidation, which makes the situation even more bearish.

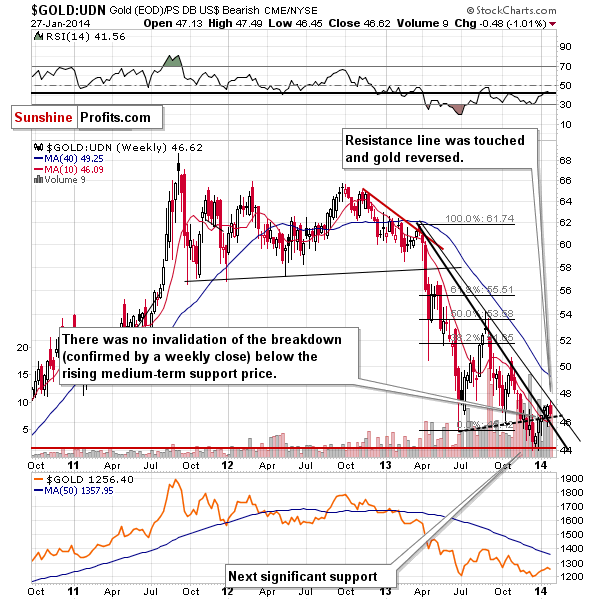

The second chart that we would like to show you is the one featuring gold from the non-USD perspective.

Yesterday, we wrote the following:

From the non-USD perspective, gold has almost reached the declining resistance line, which suggests that the top is either in or about to be in. However, to be clear, a bit higher on the above chart could mean $20 or so in spot gold in USD terms, so the above signal is not that precise.

This resistance line was not only reached, but gold also declined right after reaching it, which is another bearish signal.

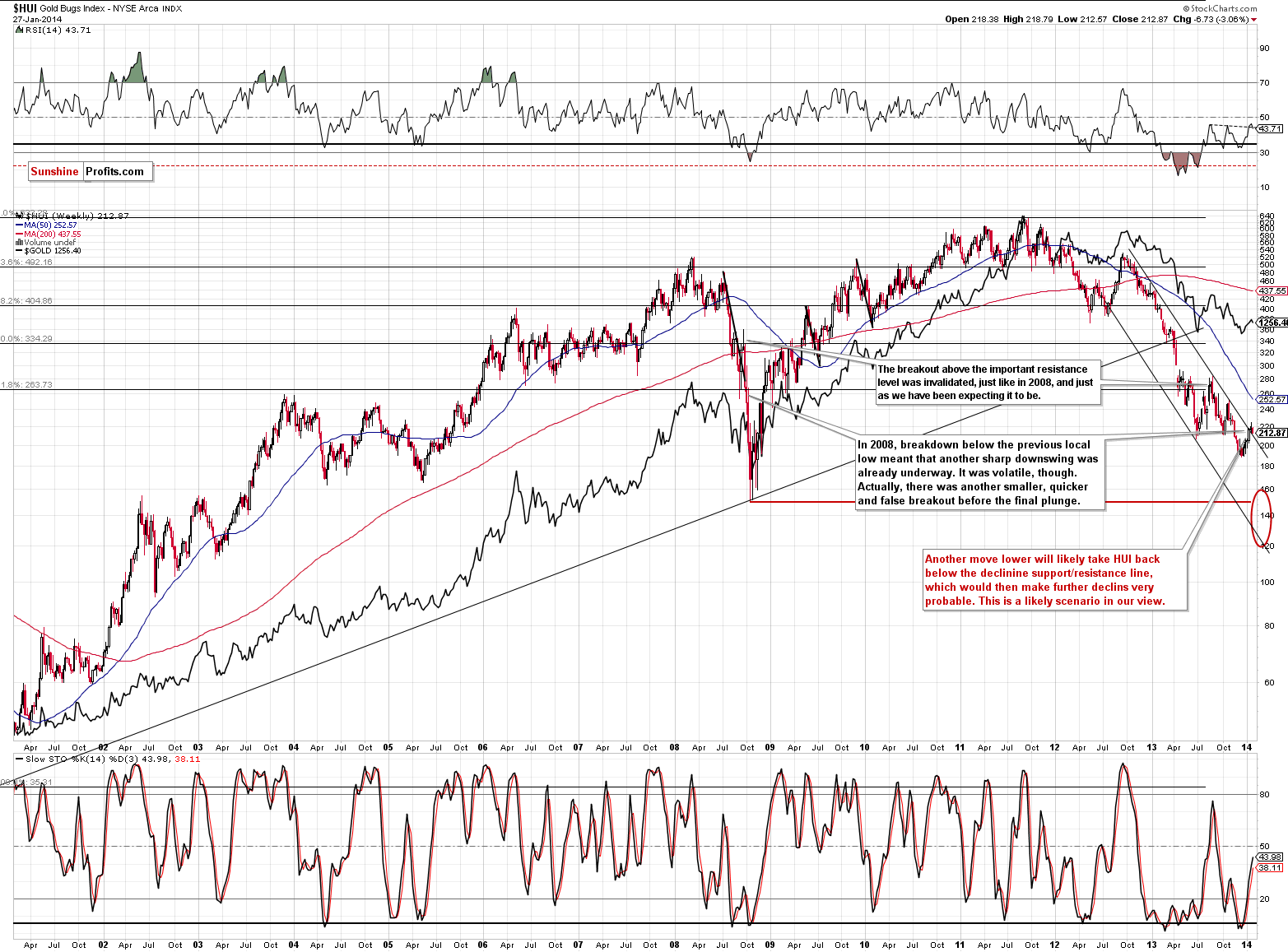

Finally, we would like to discuss the latest development in the HUI Index.

Gold stocks declined visibly on Monday, but are not yet back below their declining support/resistance line. This means that the outlook hasn’t become much more bearish than it was based on Friday’s closing prices. It’s more bearish now, but it will be the decisive move back below the resistance that will make the situation bearish enough for us to suggest adding to the speculative short positions.

Meanwhile, silver continues to decline and there are no changes in case of the signals coming from this market – and they remain bearish.

Summing up, taking all of the above into account, we arrive at the same conclusion, at which we arrived yesterday – namely, that it’s a good idea to use a small part of your speculative capital to trade the (likely) coming decline in precious metals. If we see a confirmation of the bearish case (for instance, a decline on strong volume), we will likely suggest adding to the position. Naturally, in case of an invalidation of the bearish outlook, we will keep you informed as well. For now, this short position is already profitable.

To summarize:

Trading capital: Short position (half) in: gold, silver and mining stocks. We are planning to profit on a significant downswing, so the stop-loss orders will not be that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop loss orders are not reached).

Stop loss orders for the above-mentioned short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA