Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

The most important developments that are about to impact the precious metals market were covered in Monday’s alert, and in today’s message we will once again focus on the key 2 markets: gold and the USD Index. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

Before commenting on the interesting phenomenon that we observed based on the last 2 trading sessions, we invite you to take a moment to once re-examine what we wrote previously as it remains up-to-date also today:

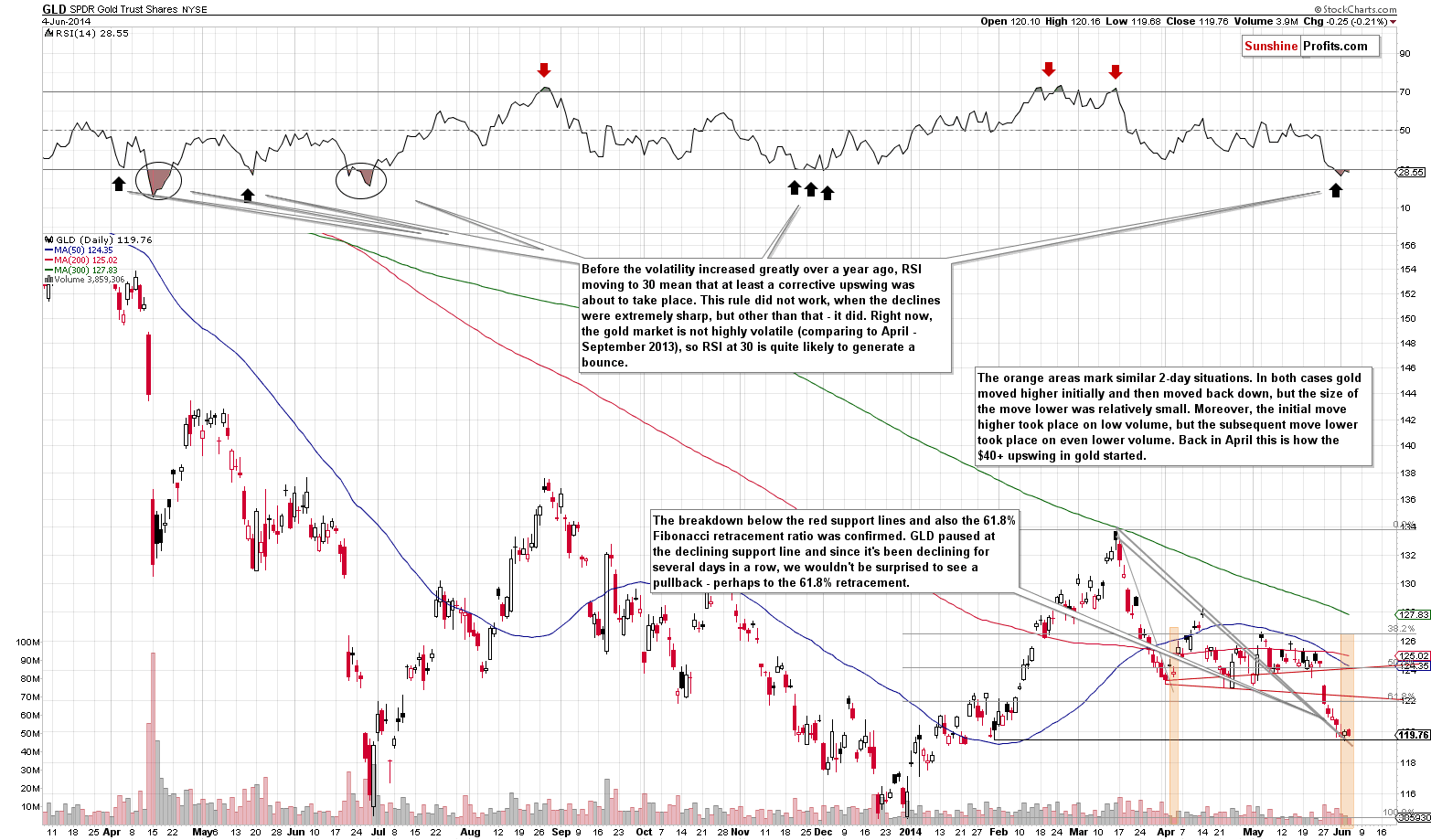

The RSI indicator flashed a buy signal for the first time in many months by moving to the 30 level. This signal had worked well when there was no significant volatility in the gold market – which means that it’s likely to work now. The way it worked in the past was that we saw some short-term strength, either in the form of a rally, or a pause within the decline. Right now we have gold after a breakdown below support lines and below the 61.8% Fibonacci retracement level, so we have good reasons to believe that the decline will continue, but at the same time we are quite likely to see a correction up to the previously broken level – either the 61.8% retracement or the support/resistance lines.

Once the pause has played out, we still expect gold to move to $1,200 initially, and then to new lows – perhaps to $1,000 or so. As far as timing is concerned, in our opinion the odds are (based on the data available today) that the move lower will take place within the next several months and that we will see the final bottom for this lengthy decline this year.

Friday’s session was very specific in the case of silver, because it was bullish and bearish at the same time. It was bearish because from the long-term perspective we saw an important breakdown. Silver closed 8 cents below the lowest weekly close of 2013 – not a clear, major breakdown, but still. It also closed below the support line created by connecting the 2013 lows. This is also a bearish piece of information. The important thing to keep in mind is that while the implications are bearish, they are medium-term in nature – we don’t have to see a move lower immediately. We are just likely to see it soon – perhaps within a week or two.

The interesting thing is that the last 2 days are similar to the 2 days that started the previous counter-trend rally. What’s even more interesting, is that the 2 situations occurred right after several-day long declines without any meaningful correction – which makes the situations even more similar. The implications are bullish for the short term and it seems that we will see some kind of short-term rally shortly – especially since the cyclical turning point for the USD Index is here.

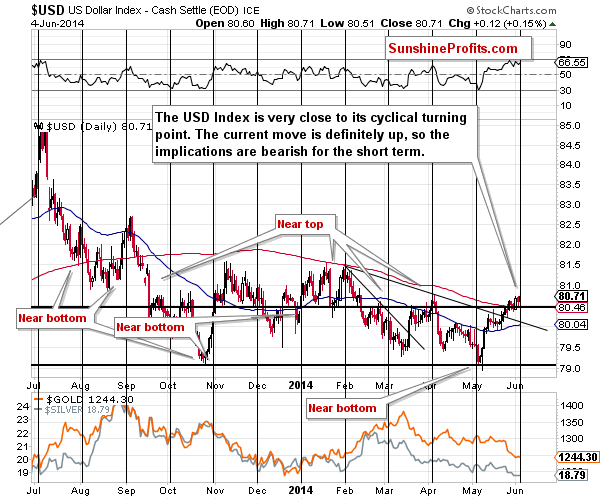

The situation in the USD Index has become even more bearish than it was the case yesterday, because of the lack of decline despite moving closer to the cyclical turning point – in fact, right to it. The index is now right at the cyclical turning point and the recent price action emphasizes that the most recent move was up. Therefore, what we wrote previously is even more accurate:

There was no significant price move, but the important thing here is that the dollar is now closer – in fact, very close - to the cyclical turning point at that it hasn’t declined recently. This means that the most recent price move before the turning point is up, and thus that the turning point has bearish implications. Consequently, we might see some kind of reversal and a pullback in the coming days – perhaps to the 80 level or so. The implications for the precious metals market are bullish for the short term but bearish for the medium term, as the USD Index is already after a breakout and once the correction is over it’s likely to continue its upward march.

Please note that the dollar’s turning points have often worked for gold and silver even if the reaction in the USD Index was delayed. That was the case in April and May – in both cases metals were the first to react. Perhaps this time we will see the same thing.

Summing up, the medium-term trend in the precious metals remains down, however, there are signs that suggest that will we will see a short-term correction to the upside. Consequently, it seems that cashing out of our profitable short positions in gold, silver, and mining stocks is a good idea. We will monitor the market for an opportunity to re-enter the short positions – please be prepared to re-enter them shortly (perhaps as early as this week). The upswing will likely be a small one, so we don’t suggest making any changes in case of the long-term investment part of the portfolio (no positions).

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts