Briefly: In our opinion speculative short positions (half) in gold, silver, and mining stocks are justified from the risk/reward perspective.

Yesterday we wrote that there had recently been very little changes in the precious metals market and that there was not much to comment on. Today we have a bit more to discuss. Let’s start with the USD Index (charts courtesy of http://stockcharts.com.)

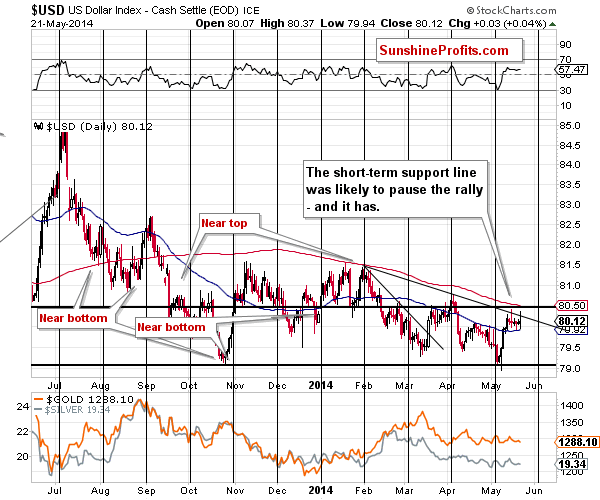

Overall the USD Index closed only 0.03 higher, but the intra-day volatility was significant. More importantly, the USD Index once again attempted to move above the declining short-term resistance line. This could have been seen as a sell sign for gold traders and the subsequent move back below the resistance line could have been seen as an invalidation of this signal.

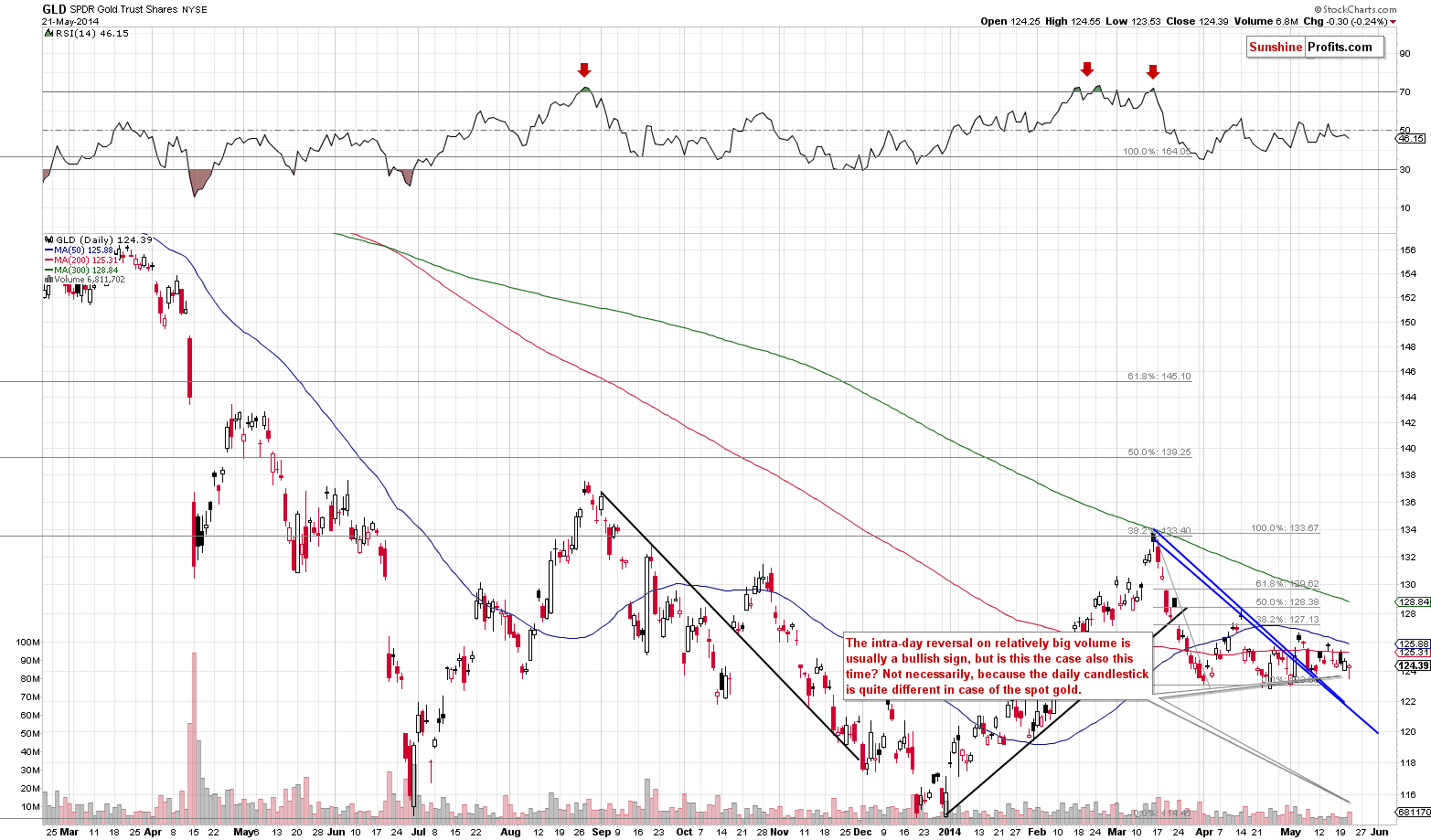

It seems that the above is the reason for the GLD ETF’s yesterday’s price movement.

The intra-day reversal took place on relatively big volume, which by itself is a bullish sign. However, as we already know, there was good reason for such movement, and that’s not necessarily a sign of gold’s internal strength. If spot gold had confirmed this bullish sign, we could be discussing whether or not this signal was indeed meaningful.

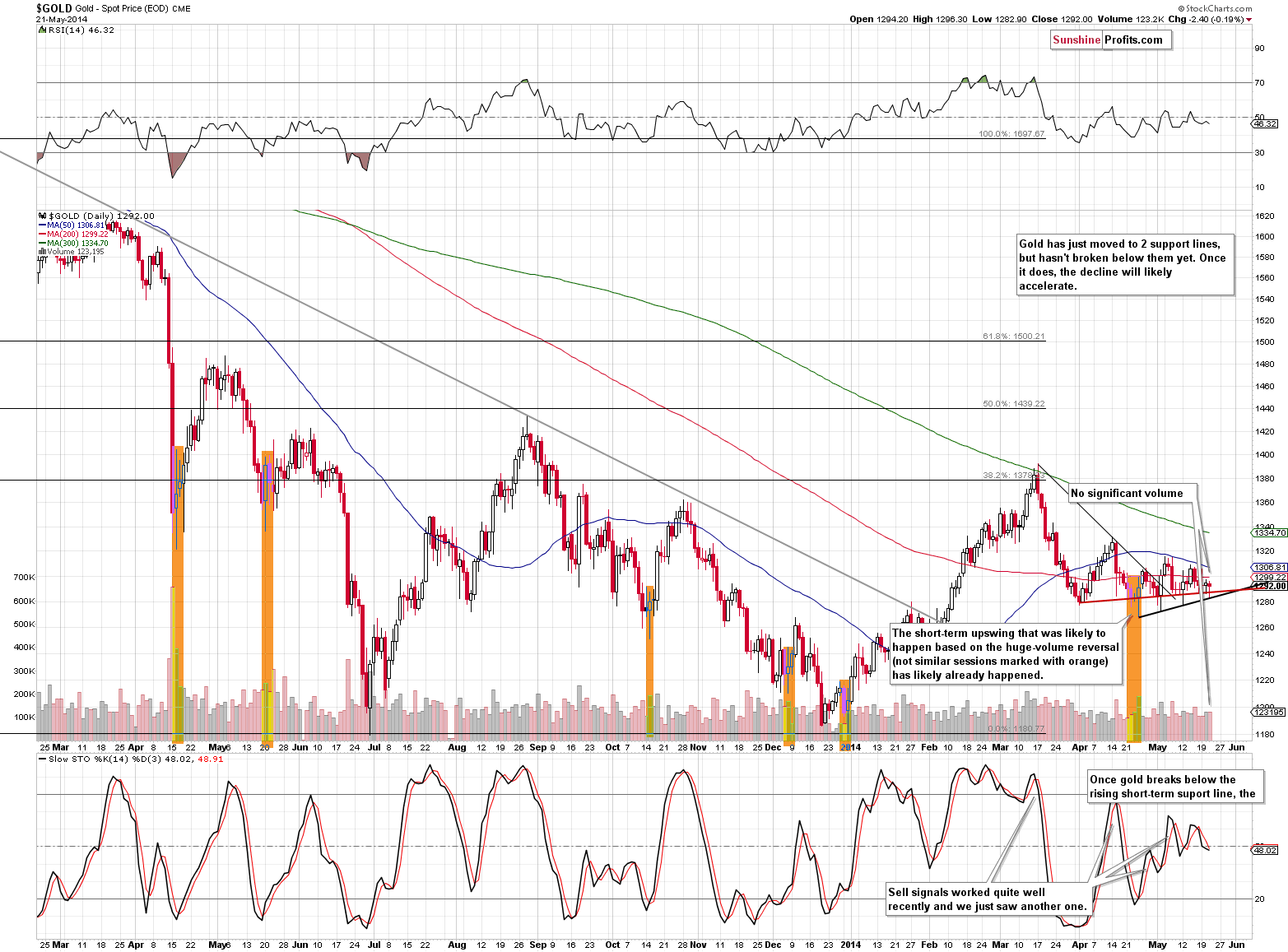

But it didn’t. Spot gold reversed as well, but the volume was not big in this case, so the session was less significant than it seemed based on the GLD ETF chart alone.

Gold moved to the short-term support lines created by intra-day lows and closing prices, but there has been no breakdown so far. It seems to us that gold is waiting for the breakout in the USD index and doesn’t want to make a decisive move without it.

However, when the decisive move and the breakdown finally materialize, gold is likely to drop quickly. How far can it go initially? Quite likely to the $1,200 level or close to it. One of the ways to estimate the size of a given move is to assume that the move preceding the consolidation (which we’ve been seeing since the beginning of April) will be similar to the one following it. In this case, the move following the breakdown could be similar to the March decline, and such a move would take gold close to the $1,200 level. This level is very close to the 2013 lows, so we expect gold to pause there (but not to end the decline). If we see an upswing today, it will likely be just a temporary phenomenon and as long as the stop-loss levels are not breached, it will not change our outlook on the precious metals market.

In other news, we were asked to comment on the fact that even though gold hasn’t done much recently in terms of the USD Index, it has declined visibly in terms of the Indian rupee. In short, we view it as the first sign of a coming breakdown also in the U.S. dollar. Please note that gold underperformed in rupee terms also in mid-March, right after the important local top. Let’s keep in mind that major tops and bottoms in both currencies take place at the same time, even if gold priced in one of them is visibly above or below gold priced in the other.

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet. Precious metals are not responding strongly to the dollar’s rallies so far, but it seems that investors and traders are simply waiting for a confirmation of the breakout in the USD Index (there have been cases when the metals’ reaction was delayed in the past). Plus, silver’s strong performance and the lack thereof in the case of mining stocks, plus lower highs in gold and mining stocks, are a bearish combination.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts