Briefly: In our opinion no speculative positions are justified. This means that in our opinion taking profits off the table and closing short positions in gold, silver and mining stocks is justified from the risk/reward perspective.

Theoretically, nothing happened yesterday. Gold, silver and mining stocks declined, just as they were likely to, and the USD Index moved higher, just as it was likely to. So, why have we just decided to close the short positions? Let’s take a look (charts courtesy of http://stockcharts.com.)

Yesterday we wrote the following:

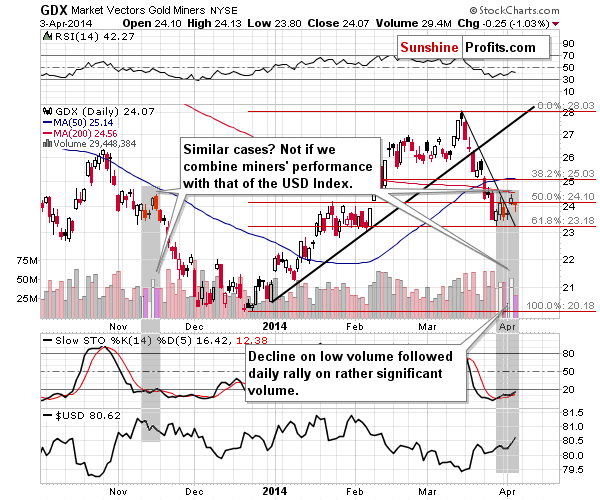

The volume was quite significant (not huge, though) on Wednesday, but that doesn’t necessarily confirm the bullish case just yet. Please note that a similar rally was seen after a similar decline in mid-November 2013. That was just the final step before the decline really began. Interestingly, the GDX ETF is now close to where it was in mid-November 2013.

The volume seen during Thursday’s decline was low. This is a bullish indication and something that increases the odds of a temporary move higher. Moreover, since the USD Index moved higher yesterday, we checked if the current situation is similar to what happened in November 2013 also taking performance relative to the dollar into account.

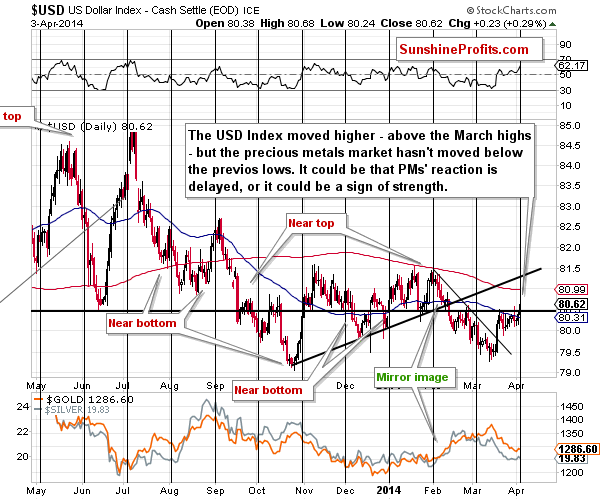

It turned out that these situations are indeed different. Back in November, miners moved higher as a result of lower USD values. This time, miners are moving higher despite the dollar’s move higher. Until yesterday’s session, the dollar’s move had been rather unclear and the above relationship hadn’t been visible.

Consequently, even though not much changed at the first sight, on second look, the situation became more bullish. It’s now not bearish enough to justify keeping speculative short positions in our view.

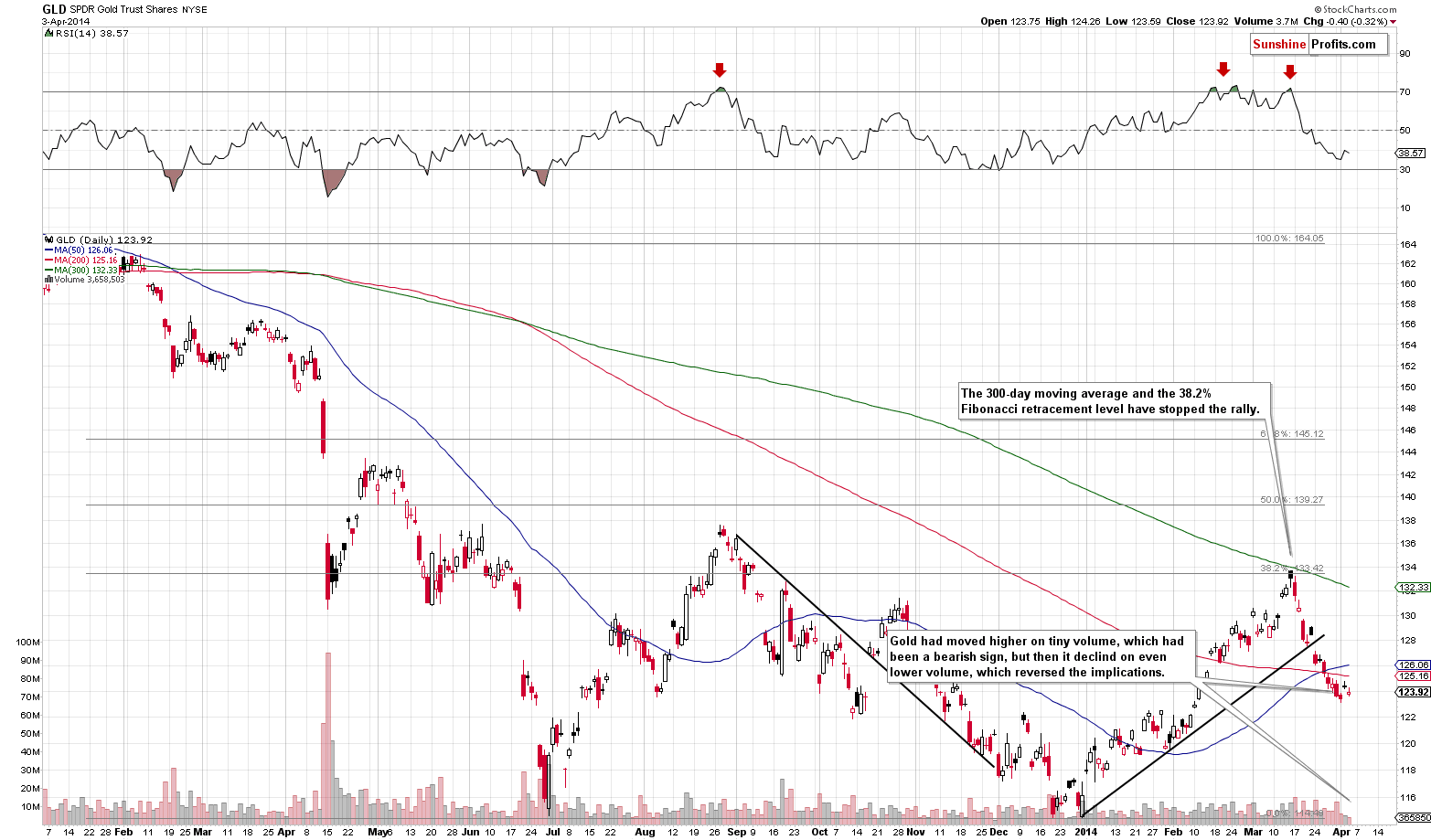

Here’s what we wrote about gold in yesterday’s alert:

Gold (the GLD ETF in this case) moved higher, but the accompanying volume was tiny. That’s generally a bearish sign. We saw something similar before each downswing in Nov 2013 and on many other occasions. Based on this price/volume combination, we are happy that we haven’t closed the short positions in the precious metals sector even though it a correction of some sort was quite likely.

It’s rather ironic that after such a bearish signal, we saw a completely contradictory signal on Thursday. The GLD ETF moved lower on volume that was even lower than the one we had seen on Wednesday. This is not a bearish factor, but a mildly bullish one. Gold is after a visible short-term decline, so a small rally here should not surprise us, especially since it didn’t move below the previous low despite the dollar’s move above its March highs.

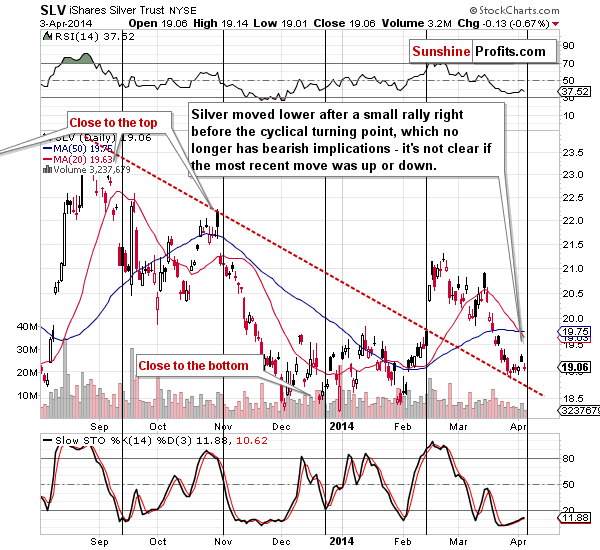

The situation in the silver market changed as well. Yesterday, we wrote: silver is almost right at its cyclical turning point, which means that since the preceding move was up, the implications are bearish.

Now, however, after a daily decline right before the turning point, the bearish implication was nullified. It’s now not clear if the most recent move has been really up, or down, and thus, what implications the turning point has.

Also, the SLV ETF moved lower on relatively low volume after rallying on relatively significant volume, which is a bullish sign.

The trend is still down, but there are signs that we could see a bigger corrective upswing shortly.

The metals and miners’ performance relative to the USD Index is one thing but what’s going on in the latter is another. The dollar moved higher right before the turning point and it’s now slightly more likely than not to correct in the coming days. This can ignite the corrective upswing in the precious metals market, signs of which we have seen in individual parts of the precious metals sector.

Consequently, with so many bullish factors (they are bullish on a short-term basis – the medium-term trend remains down and so does our medium-term outlook), it doesn’t seem that keeping short positions is really justified from the risk-reward point of view. We mentioned opening this short position on Mar. 5 (and we wrote about increasing it in the following days) when silver was above $21 and miners were almost at $27, so we are now taking profits off the table.

We plan to re-enter short positions in the coming days or weeks (most likely in the near future).

To summarize:

Trading capital (our opinion): No positions.

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts