Briefly: In our opinion short speculative positions in silver (half) and mining stocks (full) are justified from the risk/reward perspective.

Gold, silver, and mining stocks paused on Tuesday after declining earlier this week. All in all nothing changed in the precious metals sector, but this lack of change has some implications for gold, so this is the only chart that we will feature today (charts courtesy of http://stockcharts.com.)

Here’s what we wrote about gold yesterday:

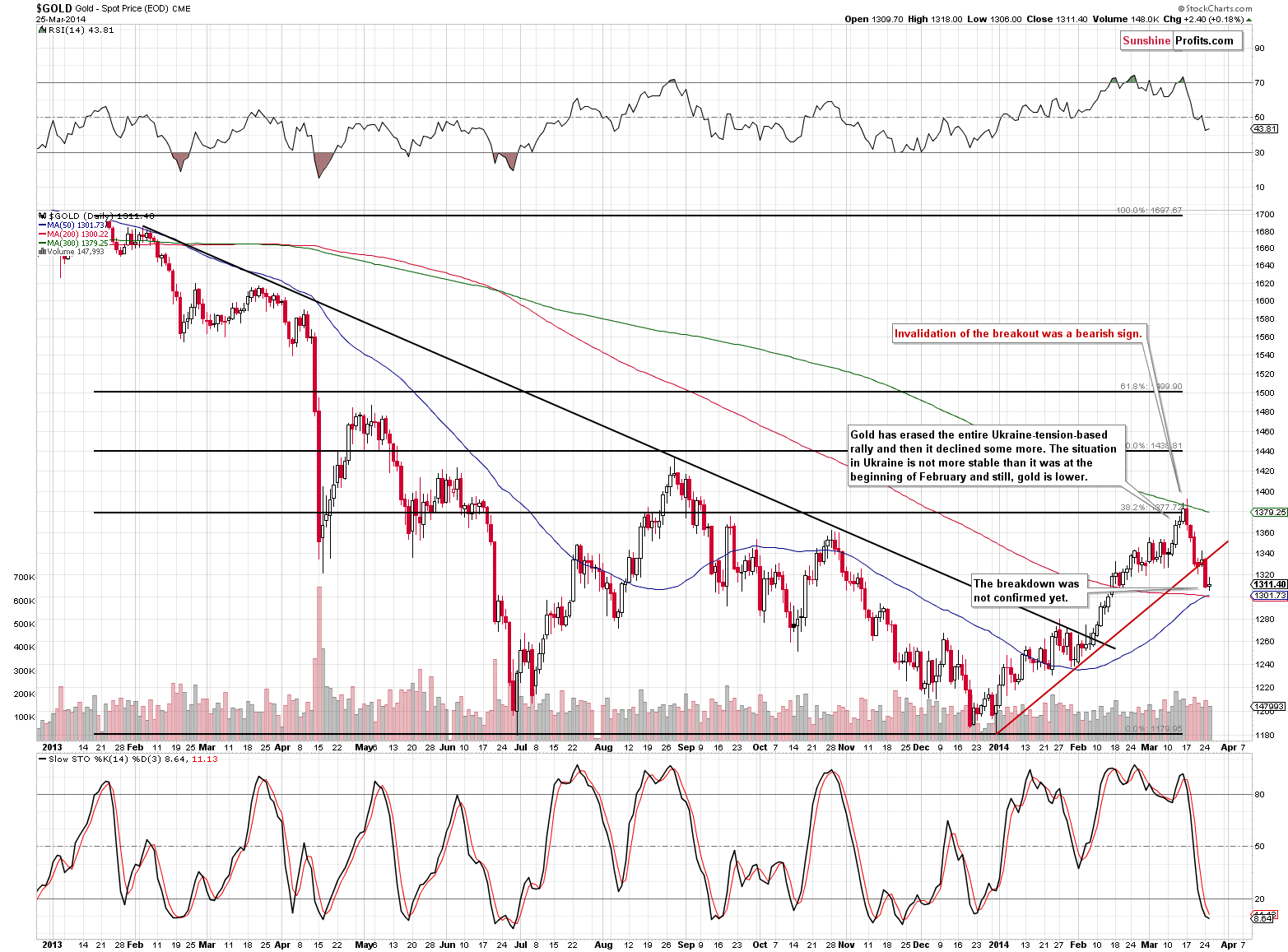

Gold has finally moved below the rising support line. The implications are bearish but not strongly bearish just yet, as the breakdown is not confirmed. If we see two more closes below this line or a close below $1,300 level, we will view the breakdown as confirmed.

At that time, we might open a speculative short position in gold and/or exit the long-term investment (currently keeping half of the regular position is justified in our opinion).

Gold is currently already below the levels we saw before the Crimea crisis even though the situation is not more stable then it was back then. This is a kind of underperformance of the yellow metal and a bearish sign. If Russian troops advance further into Ukraine, the price of gold might jump again. If that doesn’t happen, the decline is likely to continue.

The above remains up-to-date with the slight difference that we now have not one but two daily closes below the support line and the breakdown is now almost confirmed. Consequently, the situation is slightly more bearish than yesterday, but not a lot. Therefore, we don’t change our view on the precious metals sector – not just yet:

It seems that the precious metals sector will move lower in the coming weeks, but just in case the situation in Ukraine deteriorates, we are keeping half of the long-term investment position in gold. If Russian troops move further into Ukraine – and we can’t rule it out at this time – gold will likely gain and once again outperform silver and mining stocks.

The technical picture for silver and – especially – for mining stocks is bearish, so in our opinion short positions here are justified from the risk/reward perspective. We might add to the short position in silver and open one in gold relatively soon – we will keep you informed.

It seems to us that if it weren’t for the events in Ukraine, the precious metals sector would be already declining and perhaps testing the 2013 lows or moving below them. This could still take place and it’s quite likely to happen once the situation in Ukraine stabilizes.

To summarize:

Trading capital (our opinion): Short positions: silver (half) and (full) mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.9

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts