Briefly: In our opinion, a speculative short position (full) in gold, silver and mining stocks is justified from the risk/reward point of view.

The price of gold hasn’t done much lately – it’s been moving back and forth without any significant implications. In yesterday’s alert we discussed its performance relative to gold’s average performance at this time of the year. In today’s alert we’ll focus on gold’s movements relative to what we’re seeing in the USD Index.

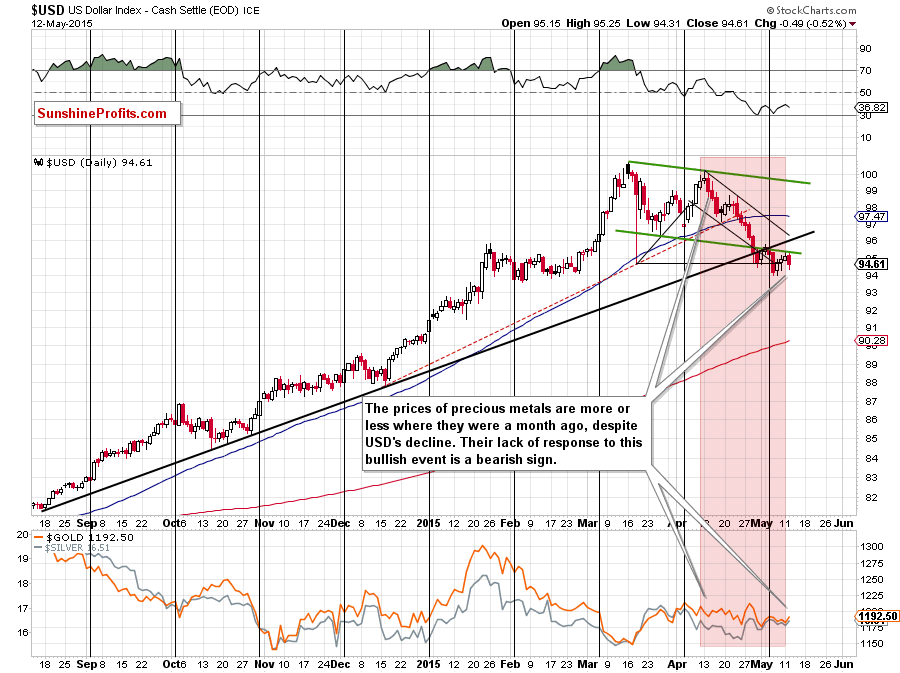

Let’s start with the chart featuring both the USD Index and gold (charts courtesy of http://stockcharts.com).

The USD Index was about 5 index points higher about a month ago, so it declined quite a lot. One could have expected precious metals to rally based on such a decline in the USD, but that didn’t happen. Instead gold and silver moved back and forth and gold is actually even lower than it was in the first half of April.

The above tells us 2 things:

- Precious metals are likely to decline as they are not responding to a major positive factor.

- Even if the USD Index moves lower – say to 92 or so – before moving back up, we don’t necessarily have to see higher gold and silver prices.

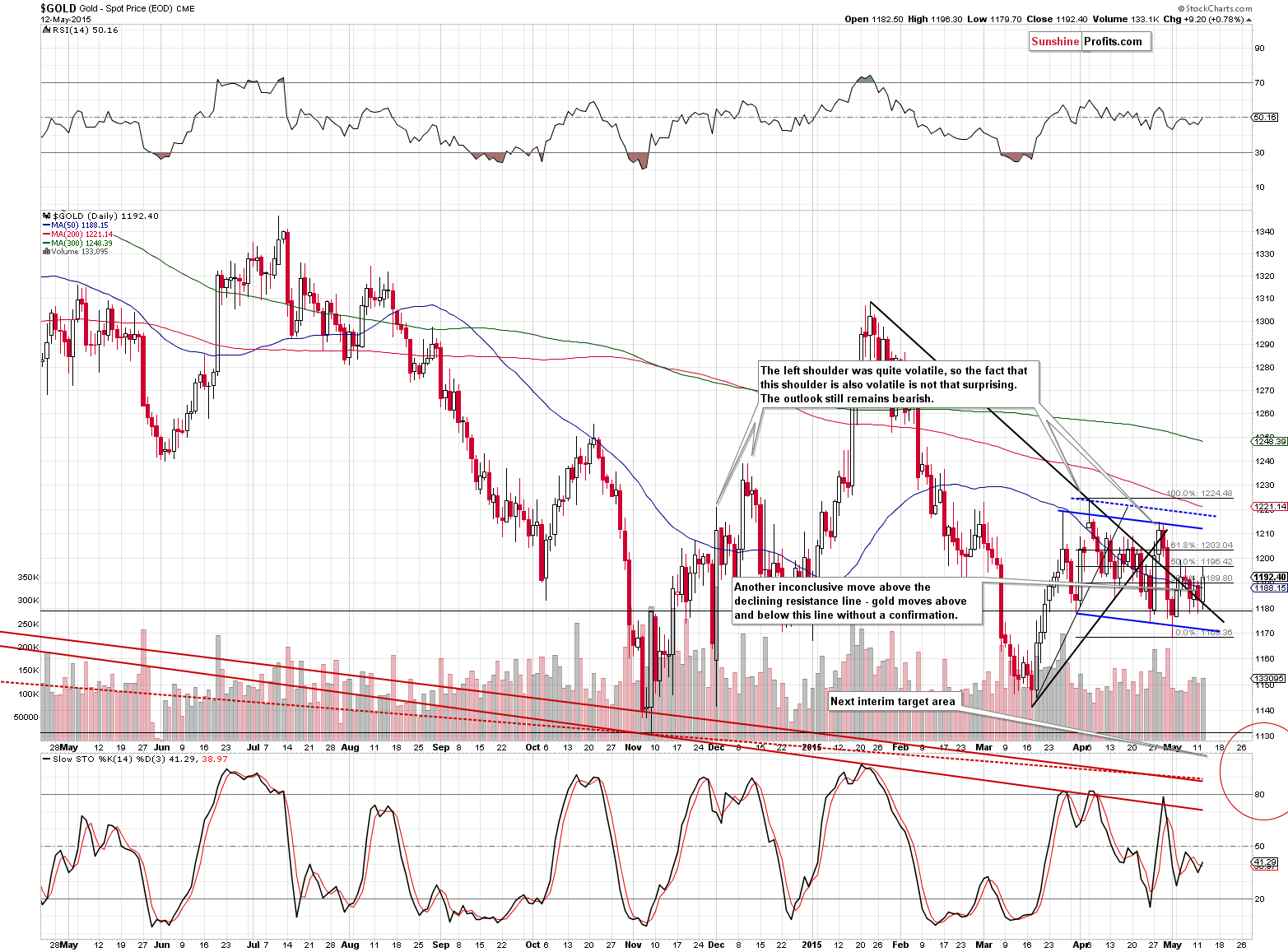

As mentioned above, gold once again didn’t do much. It’s been moving back and forth and the same is the case also this week. Gold moved above the declining resistance line, but since it’d been moving below and above it during previous trading days, we don’t find the close above this line as meaningful and truly bullish. We think that the overall lack of gold’s performance relative to the USD Index is a much more important factor to keep in mind.

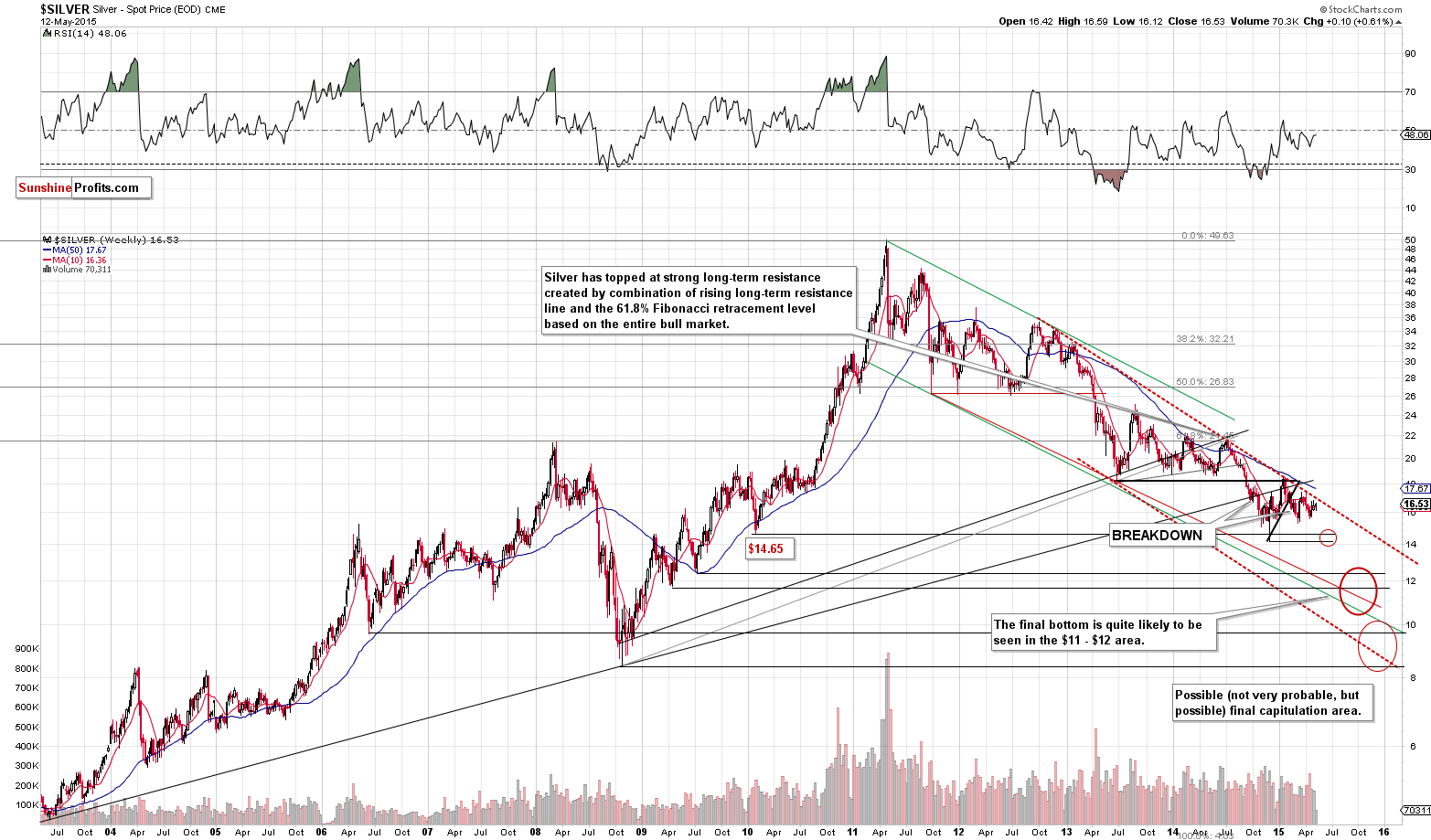

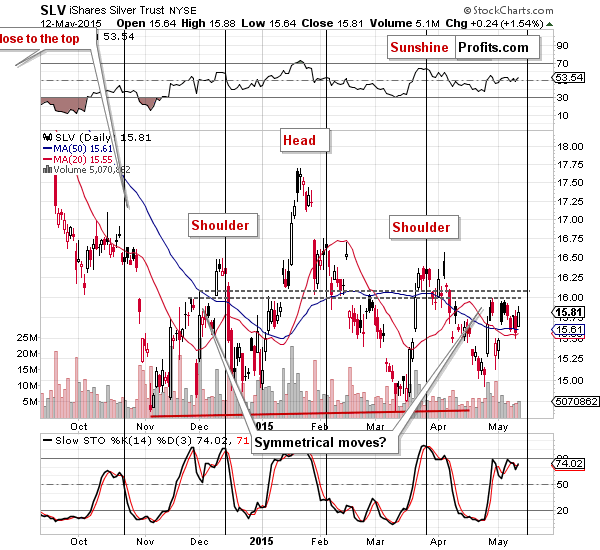

With regard to silver, there’s also not much that we can say except emphasizing once again that silver doesn’t have much room to rally as the very strong resistance line is very close. On the other hand, there is a lot of room for declines from the current levels.

There is a short-term reason for the decline in the form of the cyclical turning point. If silver moves even higher temporarily, this will not be really bullish as it will only make it clear that the turning point will have bearish consequences. Moreover, as it is the case with gold, silver didn’t move higher based on the USD’s decline, which can be seen as bearish.

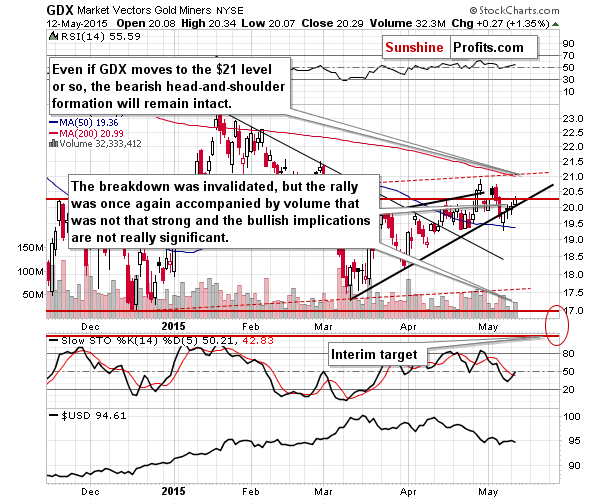

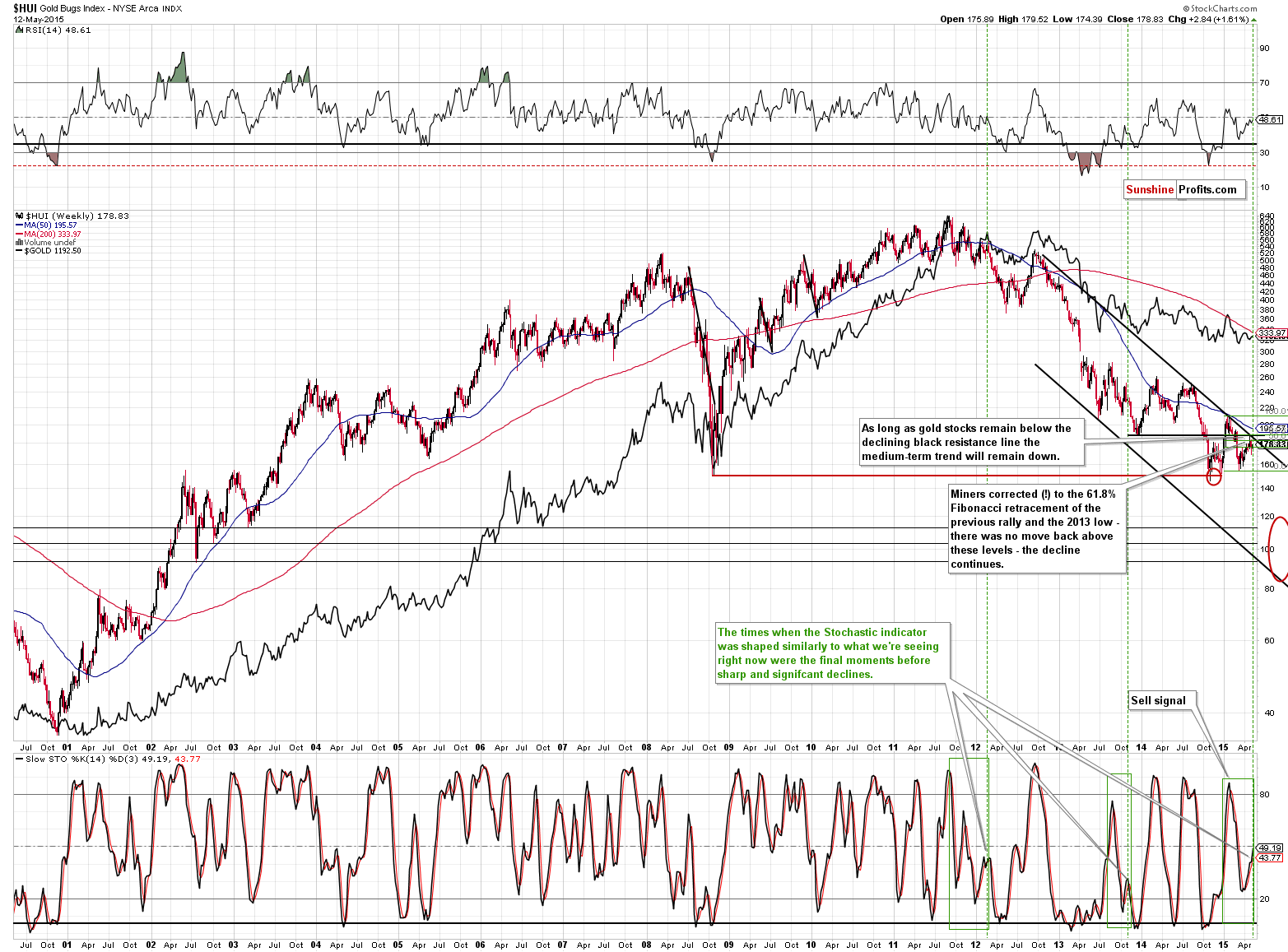

The action in mining stocks is more bullish than in gold and silver, but we don’t think that really changes the outlook for the entire sector. The miner’s performance is also quite weak given the size of the USD’s decline, and the moves higher in the GDX ETF are not accompanied by really high volume. The volume was very low on Monday and it was only moderate yesterday.

The most important thing here is that the long-term resistance is very close, and consequently it’s not likely that miners will move much higher before turning south again and it doesn’t seem that being out of the market with the short position when that happens is worth the temporary decline in profits.

The potential size of the decline is huge, while the potential size of another move higher is very limited. The implications are bearish and will remain bearish unless we see a confirmed breakout above the declining long-term resistance line.

Overall, since the situation didn’t really change yesterday, we can summarize today’s alert in a similar way to what we wrote previously:

Summing up, the medium-term decline is not threatened by last week’s or this week’s temporary upswing – it seems it was simply delayed (and it seems that we may not need to wait for much longer). The outlook hasn’t changed, so the odds are that the profits that we have on the short position in the precious metals sector will become even bigger in the following weeks.

We will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short (full position) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

- Gold: initial target price: $1,115; stop-loss: $1,253, initial target price for the DGLD ETN: $87.00; stop loss for the DGLD ETN $63.78

- Silver: initial target price: $15.10; stop-loss: $17.63, initial target price for the DSLV ETN: $67.81; stop loss for DSLV ETN $44.97

- Mining stocks (price levels for the GDX ETN): initial target price: $16.63; stop-loss: $21.83, initial target price for the DUST ETN: $23.59; stop loss for the DUST ETN $10.37

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: initial target price: $21.17; stop-loss: $27.31

- JDST: initial target price: $14.35; stop-loss: $6.18

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Earlier today, Greece repaid a €770 million loan installment to the International Monetary Fund, easing worries that the country was on the verge of default, which in combination with a renewed selloff in European government bond pushed EUR/USD sharply higher. In this way, the exchange rate reached its important resistance zone, but will we see further improvement?

Forex Trading Alert: EUR/USD Meets Resistance Zone Once Again

We didn’t see a move to $250 yesterday. In fact, we didn’t see much action at all. The volume was up but Bitcoin didn’t budge significantly, it actually stayed in a pretty tight range. Are we in for a move up or down? We comment on that in this alert.

Bitcoin Trading Alert: Short-term Outlook Might Be Clarified Soon

=====

Hand-picked precious-metals-related links:

JPMorgan’s silver supremacy, according to Ted

=====

In other news:

Bond Market Meltdown Deconstructed: Five Charts That Explain Why

China's data miss paves way for more easing

Greece Back in Recession as Bailout Impasse Drains Economy

Despite record $180M Picasso, art market no bubble

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts