Briefly: In our opinion no speculative short positions in gold, silver and mining stocks are currently justified from the risk/reward perspective.

Gold held up relatively well during yesterday’s move higher in the USD Index, but gold stocks declined. It’s yet another case when gold miners underperformed gold – will this bearish factor cause gold to decline?

It may not be able to do it on its own, but there are other bearish factors in place that support this outcome. Unfortunately, there are also bullish ones, but it seems that the bearish case is getting stronger. The situation in the gold stocks to gold ratio and silver seems to suggest so. Before we move to them, let’s take a look at the USD Index (charts courtesy of http://stockcharts.com).

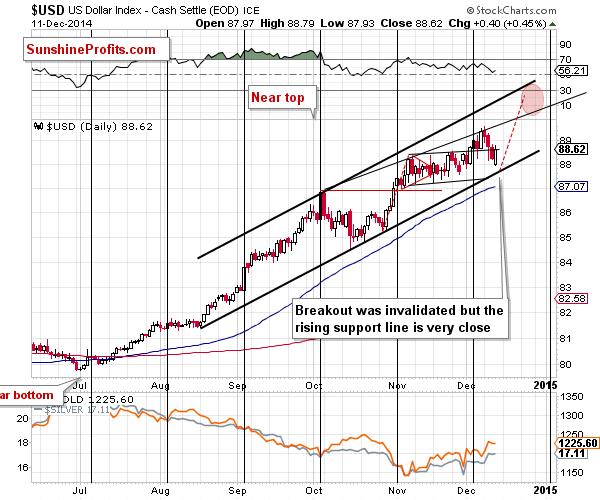

The USD Index moved higher yesterday, generally erasing the previous day’s decline. However, since the rising support line was not reached, it seems that we could see another very short-term downswing that would be followed by a bigger move up.

Without a breakdown here, the short-term trend, and thus the outlook, remains bullish.

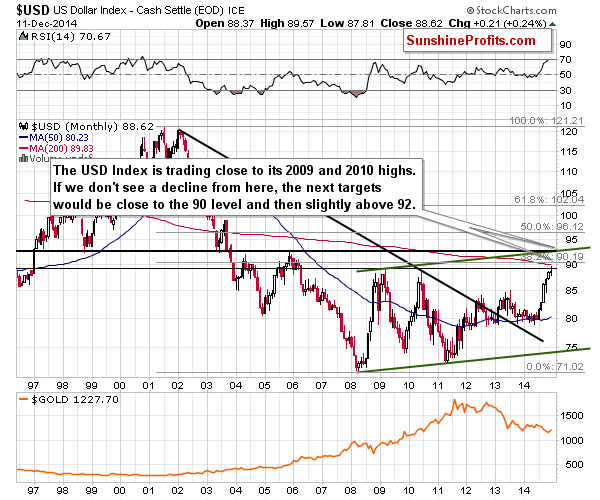

Interestingly, if the USD does indeed move higher, this could be viewed as a meaningful breakout above the 2009 and 2010 highs and the next resistance will be close to the 90 level (at 90.19; we adjusted the Fibonacci retracement by calculating it based on a higher, more important top – it seems that the resistance based on the highest of 2001 tops is more important and will provide stronger resistance). If the USD manages to rally even above this level, then the next resistance will be a bit above the 92 level, where the rising green resistance line and the 2005 top coincide.

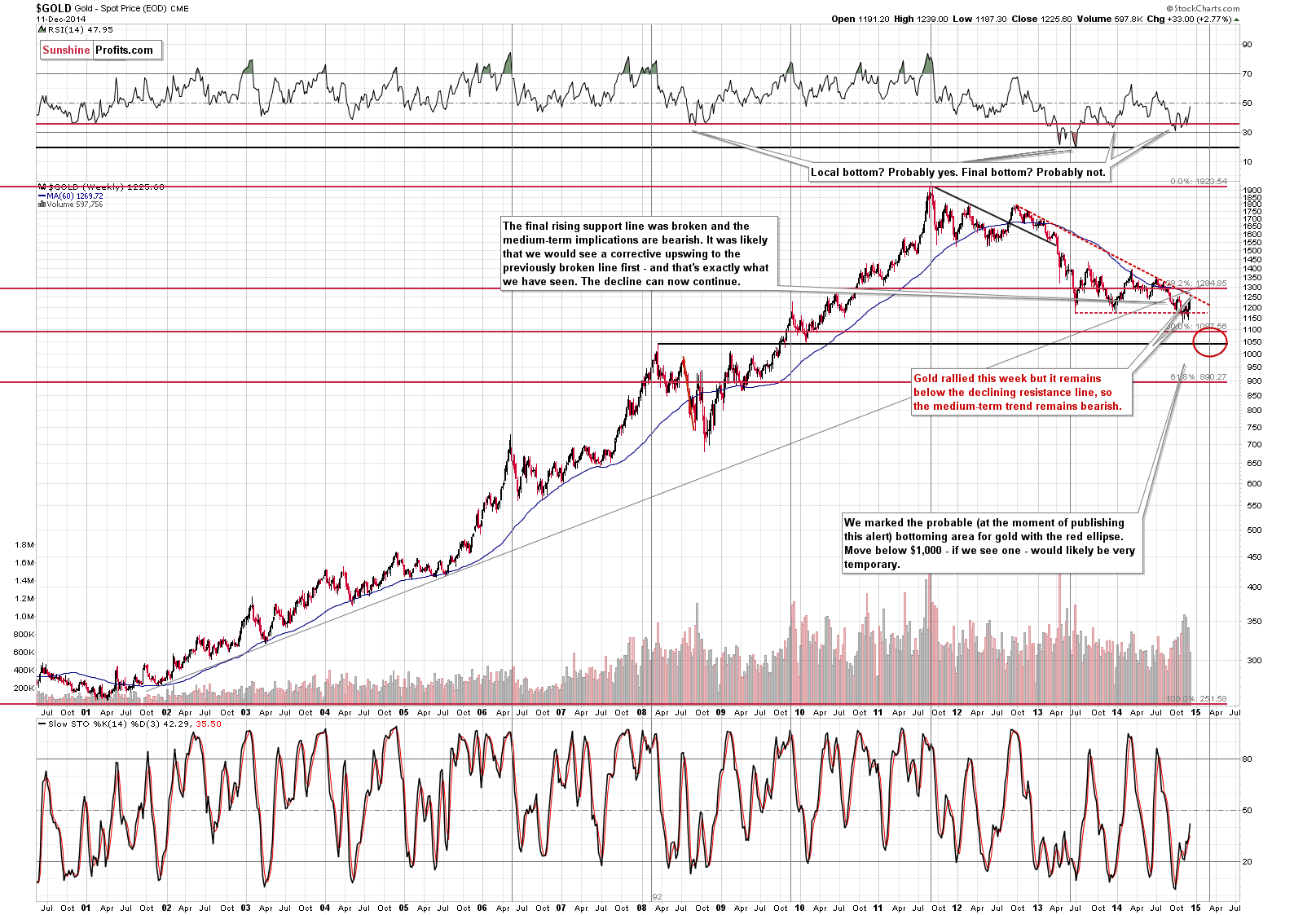

In the recent alerts we wrote that one of the things that could make the outlook for gold much more bearish was its ability to decline regardless of what was going on in the USD Index. In yesterday’s alert we emphasized that: gold indeed declined along with the USD Index yesterday, but it doesn’t seem that this was significant enough to indicate a new tendency. That was just daily price action, and since gold’s previous upswing was very sharp and significant, a daily pause is something natural – it doesn’t have to imply anything more.

The move was invalidated in both the USD and gold, so overall not much changed in case of the gold-USD link in the past 2 days.

Consequently, at this time, we are skeptical toward the gold’s ability to decline regardless of the U.S. dollar’s price swings and it seems that we need to see more signs that would point to this tendency.

Let’s keep in mind that gold remains in a medium-term downtrend and could move even higher in the short term (to $1,250 or so) and still remain in it. In other words, another short-term rally here would not invalidate the bearish medium-term outlook.

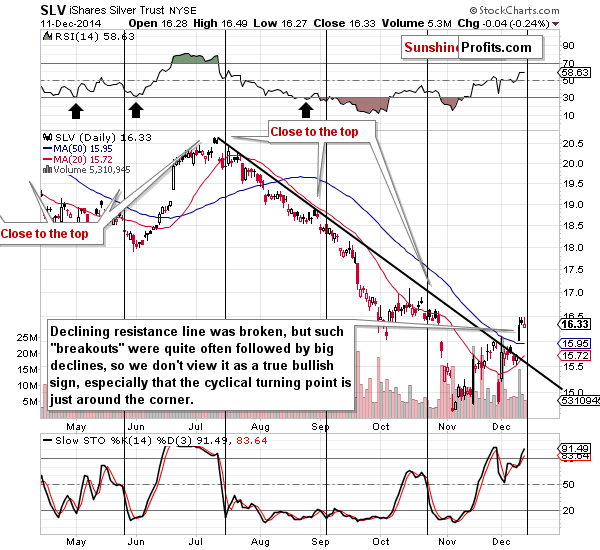

Let’s move to silver.

As far as the short term is concerned, comments from yesterday’s alert remain up-to-date:

Silver moved above its declining short-term resistance line just before its cyclical turning point. This is actually a bearish combination. Silver is known to flash fake buy signals (often in forms of various breakouts) just before taking another dive. This could be the case also this time.

In other words, viewing silver’s breakout as bullish might be premature at this point.

The situation didn’t change, but since we moved 1 day closer [once again] to the turning point without a decline, the latter becomes even more probable.

The gold stocks to gold ratio declined once again and the bearish implications that this situation has are now a bit stronger.

Our previous comments on the ratio remain up-to-date:

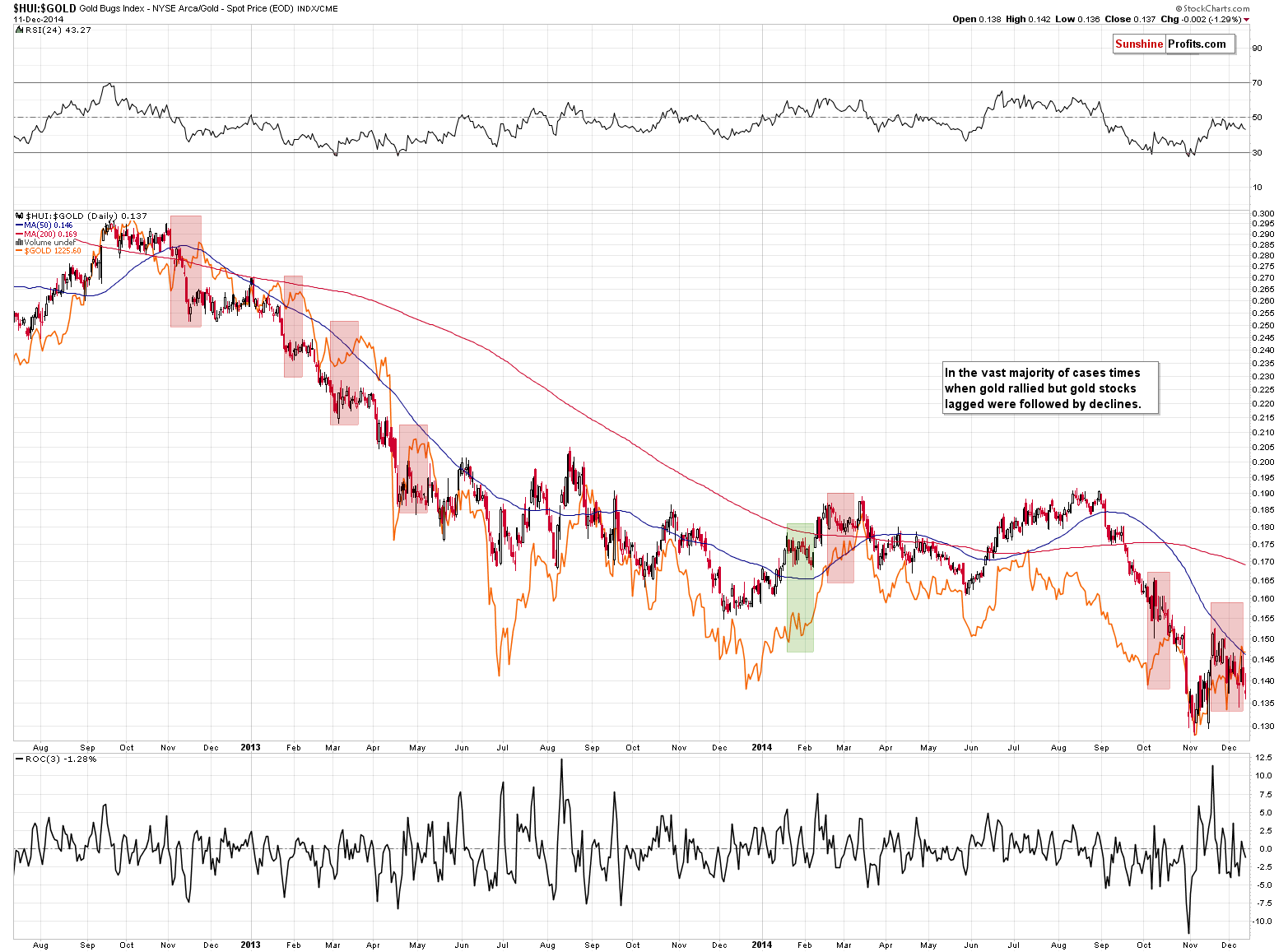

The above chart features the HUI to gold ratio. We marked the areas when gold rallied but the ratio declined at the same time (which is what we have been seeing for the last 3 weeks or so). It turns out that in almost all cases (and the only exception was seen when the decline in the ratio was very small, which is not the case right now) this was what preceded local tops and subsequent declines.

When commenting on gold, we wrote that it was important to note that the previous decline had ended at the end of 2013. Please note what the gold stocks to gold ratio did back then. It moved higher while gold continued to decline. It was a bullish sing and the opposite of what we are seeing at this time. Consequently, we might not have seen the final bottom just yet.

Overall, we can summarize the situation in the precious metals market as we did in yesterday’s alert with a note that the situation is now a bit more bearish than it was before but still too unclear to open any positions:

Summing up, there are many factors that are currently in play that have contradictory implications, which makes the short-term outlook rather unclear, even though the medium-term one remains bearish.

We have not seen silver’s huge underperformance and gold is not hated in the financial media (at least not very significantly) and long-term charts are showing declining trends. We could see some short-term strength in gold based on various factors, but at this time it’s too early to say that the next big upswing is underway. Most sings point out that the current rally in gold is simply a correction within a downtrend.

The thing that could generate a bigger upswing in gold is a big decline in the USD Index, and the latter could actually happen based on the resistance level being reached and that might happen relatively soon. However, the USD could move even higher – to the rising green support line – and we could also see gold’s move lower take place regardless of the situation in the USD. Perhaps gold is rallying not because of its inner strength (weak performance of mining stocks suggests that the sector is not really strong), but because it got too low too fast and simply had to correct.

It our view, the best approach is to continue to monitor the situation and take action once it clarifies. Gold’s ability to decline regardless of what’s going on in the USD Index would be a perfect bearish confirmation, but we have not seen it so far. If USD Index moves above the 90 level and holds it, then we would likely see an even greater rally and another big downswing in gold, anyway.

We’ll keep you – our subscribers - informed.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index is the lowest since early November. Is this a new downtrend, or just a downward correction of the October-November rally?

Stock Trading Alert: Stocks Sold Off Following Negative Global Economic Outlook

Earlier today, the U.S. Department of Labor reported that the initial jobless claims in the week ending December 6 dropped by 3,000 to 294,000, beating forecast. Additionally, the U.S. Commerce Department showed that retail sales increased by 0.7% last month, beating expectations for a gain of 0.4%, while core retail sales (without automobile sales), increased by 0.5% in November, surpassing forecasts for a 0.1% gain. These bullish numbers supported the greenback and pushed GBP/USD lower, but the pair is still trading close to the key resistance line. What’s next?

Forex Trading Alert: GBP/USD – Breakout Or Fakeout?

=====

Hand-picked precious-metals-related links:

Comex Institutes Trading Collars For Precious Metals

=====

In other news:

Crystal Ball: Top 10 economic predictions for 2015

Why the Greek selloff is exaggerated

Could The Fed Trigger A Deflationary Slide In Stocks?

A New Guide to Trading on Inside Tips Without Prison Time

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts