Briefly: In our opinion no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective.

Yesterday we commented on the only thing that had changed during Monday’s session and that was the mining stocks’ move higher. During yesterday’s session we saw the opposite. Mining stocks followed the general stock market and declined substantially. Has the decline in gold stocks changed anything? Let’s take a look at the entire precious metals sector, starting with gold (charts courtesy of http://stockcharts.com.)

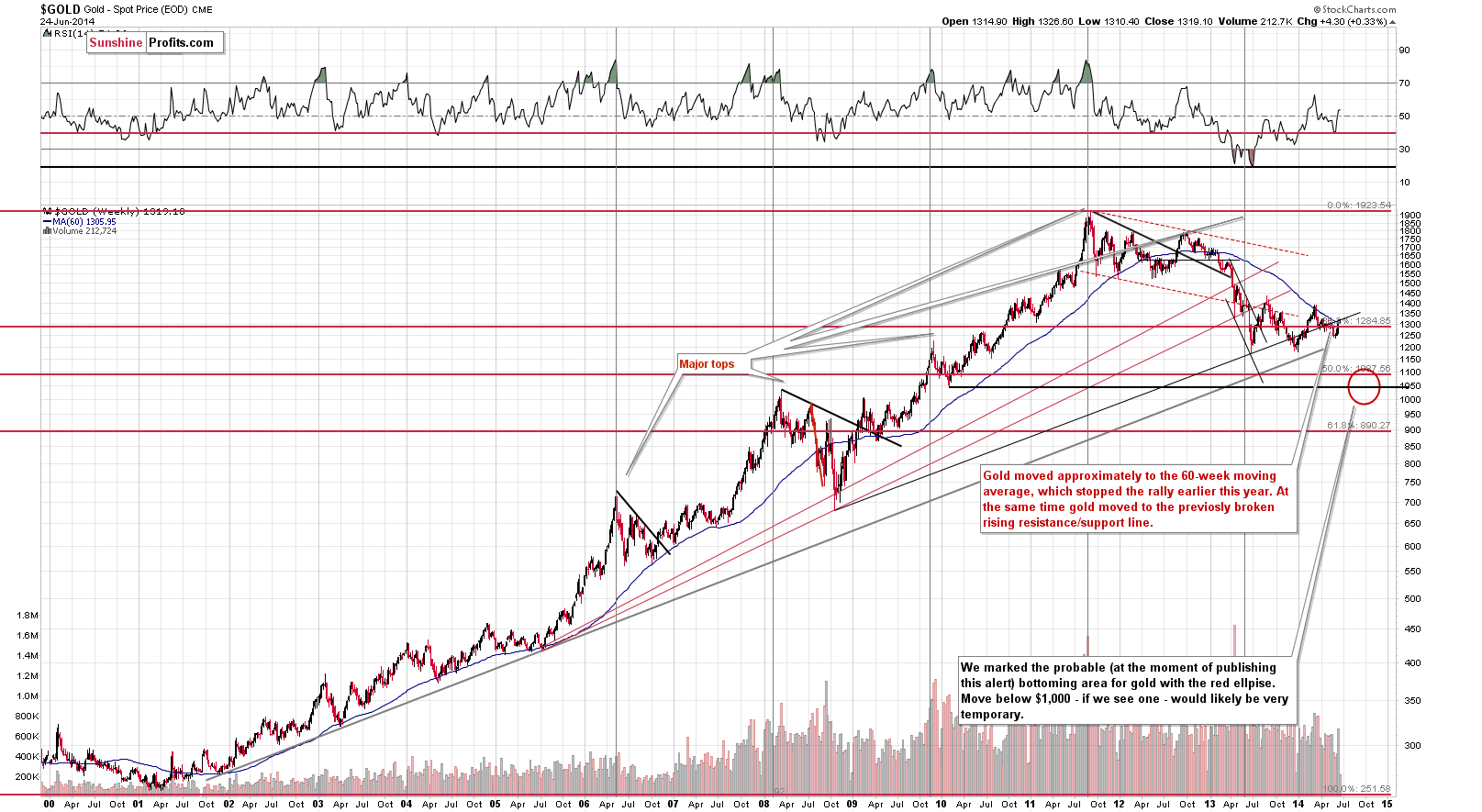

Gold moved higher recently, but from the long-term perspective, not much has changed. Gold is now slightly above the 60-week moving average, but remains below the rising long-term resistance line. Taking this line into account, the situation in gold is not really much higher than it was in late 2013. It’s higher in nominal terms, but relative to the rising resistance line, gold is slightly below it, just as it was in late 2013 and it is “lower” than it was in April 2013.

Overall, we remain doubtful as far as the strength of the most recent rally is concerned. It still looks like another correction before the final move lower.

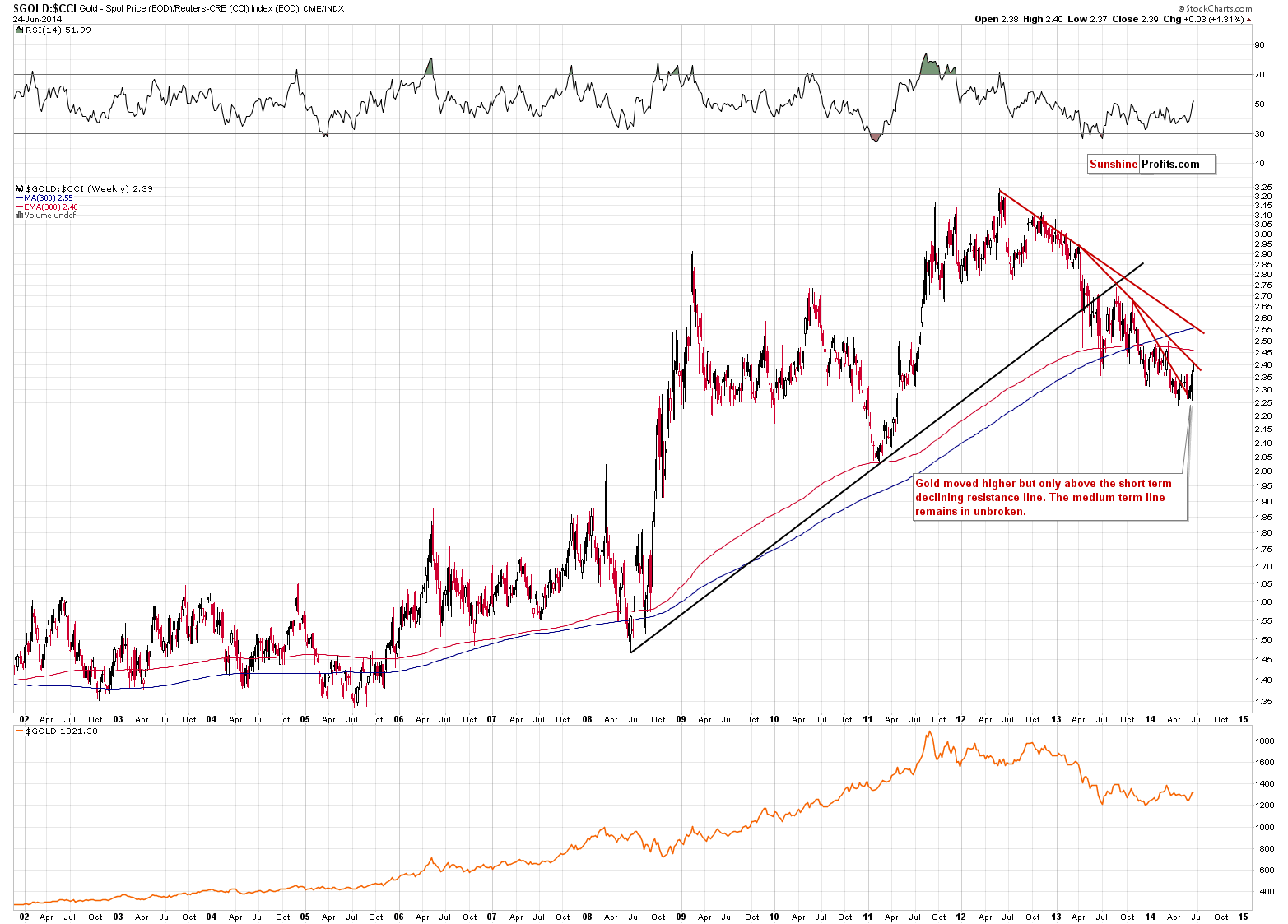

The price of gold relative to the prices of other commodities moved to the declining resistance line without breaking it. Without a breakout, it looks like a move lower is in the cards, in line with medium-term trend.

All in all, there haven’t been many important changes in the case of gold lately. Now, let’s move on to what has actually changed: the direction of the move in mining stocks.

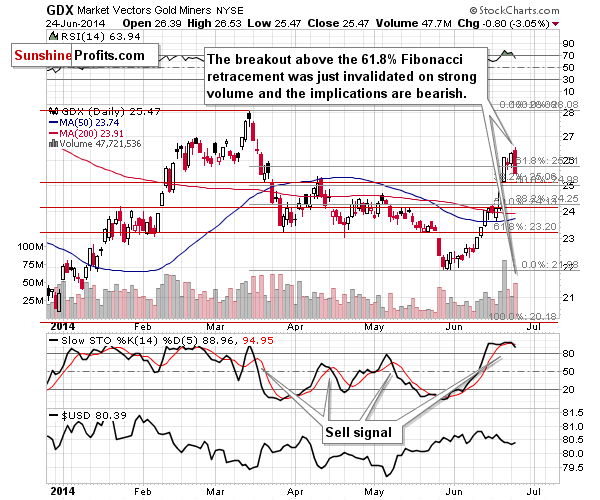

Monday’s decline was quite significant and it took place on big volume. The implications are bearish on their own, but before we say that they change everything, let’s consider the background. The general stock market declined sizably yesterday after a significant rally. Yesterday’s decline in mining stocks could have simply been a breather after a big rally, a breather influenced by the decline in other stocks – it didn’t necessarily have to mean weakness in the precious metals market.

The above might seem perplexing, as we still think that the medium-term trend remains down, but: A – we strive to remain as objective as possible, and B – one day of action doesn’t necessarily change everything and it seems that healthy skepticism is appropriate at this time.

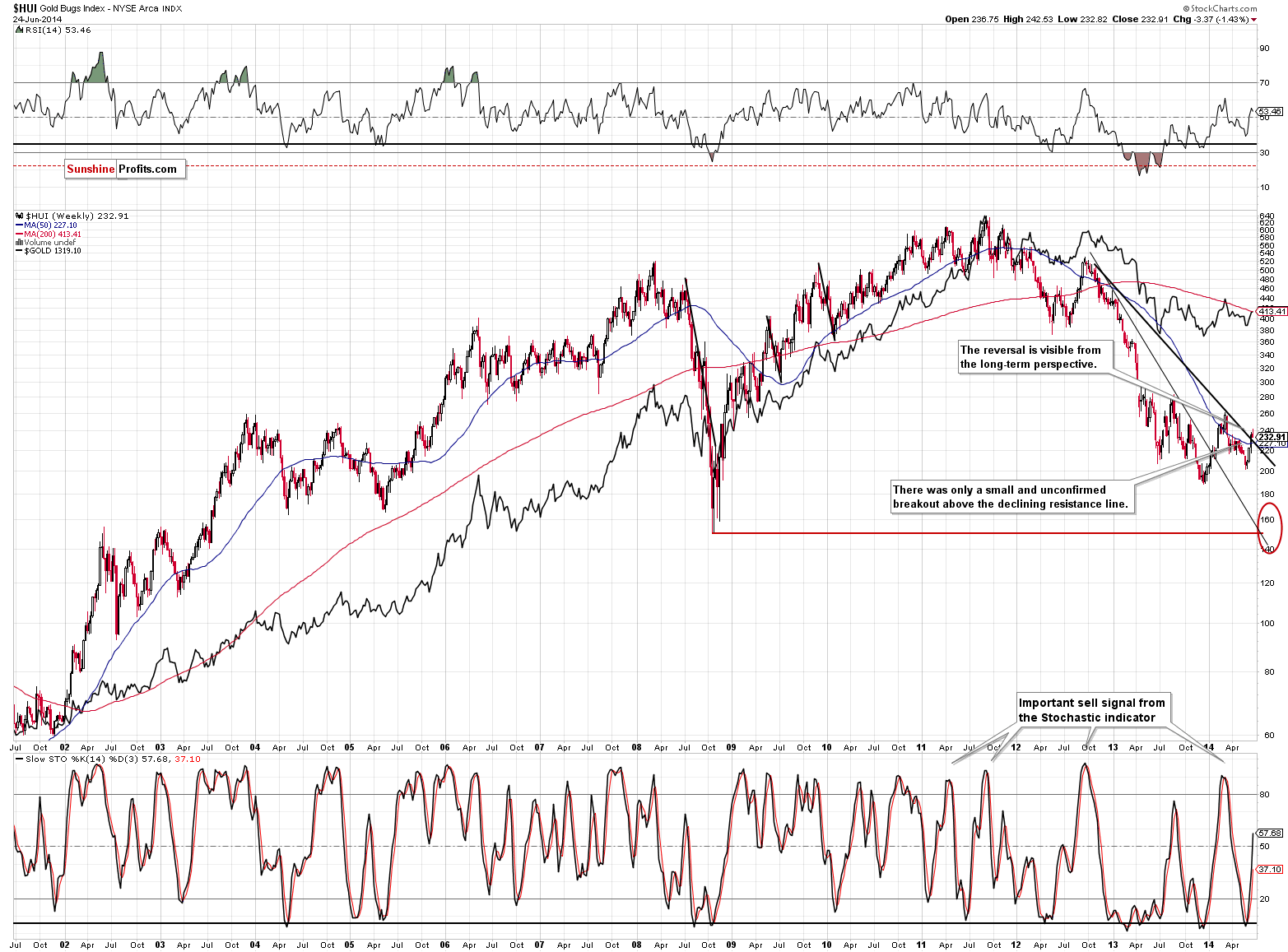

The interesting thing is that this week’s price action is already visible from the long-term perspective. On the above chart we see it as a significant weekly reversal after a sharp short-term rally. From this perspective, the outlook is bearish but let’s keep in mind that the above chart is comprised of weekly candlesticks and this week is not over yet, so this week’s candlestick is less relevant than the other ones.

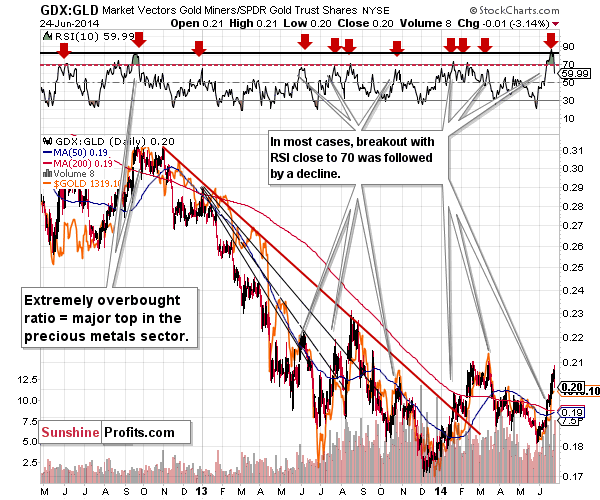

If we compare the miners’ performance to that of the GLD ETF, we’ll see that we finally saw a decline in the ratio. Moreover, the RSI indicator based on the ratio has finally moved back below the 70 level. There was only one time in the past when the RSI indicator was as overbought as it was very recently – in the second half of 2012 – and at that time the RSI moving below 70 was a confirmation that the bottom was already seen.

Overall, yesterday’s price action was bearish, but since we had just seen analogous – but supposedly bullish price action – on the previous day, and we had had a good reason for the miners’ decline in the form of the decline in other stocks, we don’t think that it was very bearish, and that opening short positions based on it is rather premature.

We continue to expect more volatility to follow. We will be actively monitoring the markets and report to you accordingly.

Summing up, even though the precious metals sector moved much higher in the previous week, it seems that we are at or quite close to a local top in the precious metals sector. While the medium-term trend in the precious metals market is down, we were likely to see a corrective upswing – and we have. While in the past days it seemed that the corrective upswing was not over yet, we have some signs that it is over now. We have gold at a significant resistance line, we have short-term outperformance in silver, gold has made the headlines and its volatility is very low – and these are all bearish signs.

The only thing that seems exceptionally bullish at the first sight – the miners’ strength – is not really that bullish after one examines it more closely. We think that we will see a good risk/reward situation in the following days that will allow us to open a trading position in the precious metals sector, but at this time the short-term outlook is still too unclear.

To summarize:

Trading capital (our opinion): No positions

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts