Briefly: In our opinion speculative short positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. We are once again lowering stop-loss levels, so in a way we are once again “increasing the locked-in profits”, and at the same time, we’re keeping a chance of increasing them further. We are also changing initial target levels into exit orders (meaning that it seems a good idea in our opinion to close positions as soon as these price levels are reached without our additional confirmation).

Today’s commentary will be longer than yesterday’s one, but just as we did yesterday, we will focus on the few key things that changed in the precious metals market and in the case of the USD Index. The rest remains more or less unchanged and the previous alerts remain up-to-date.

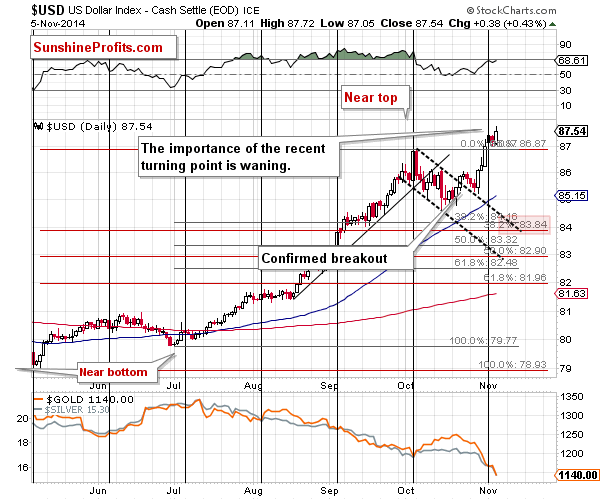

Let’s start with the USD Index (charts courtesy of http://stockcharts.com).

The USD Index moved higher once again yesterday which is not surprising as it had confirmed the breakout above the October high by closing above it for 3 consecutive trading days. At this time the importance of the cyclical turning point is starting to decrease as we are moving past it. The only thing it caused at this time seems to have been a daily decline – a very small pause. The short-term outlook for the USD Index has just improved.

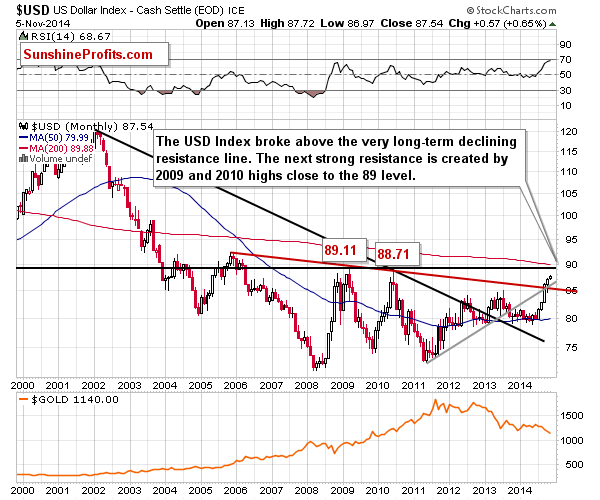

This means that the outlook for the precious metals market based on it has just deteriorated. It deteriorated more significantly than it seems based on the above chart and the long-term chart shows why.

The USD Index is after a major breakout and there is no strong resistance level until about 89. This means that the USD Index is likely to rally for another 1 – 1.5 before the top is in. In other words, the USD Index has room for further gains and gold seems to have room for further declines.

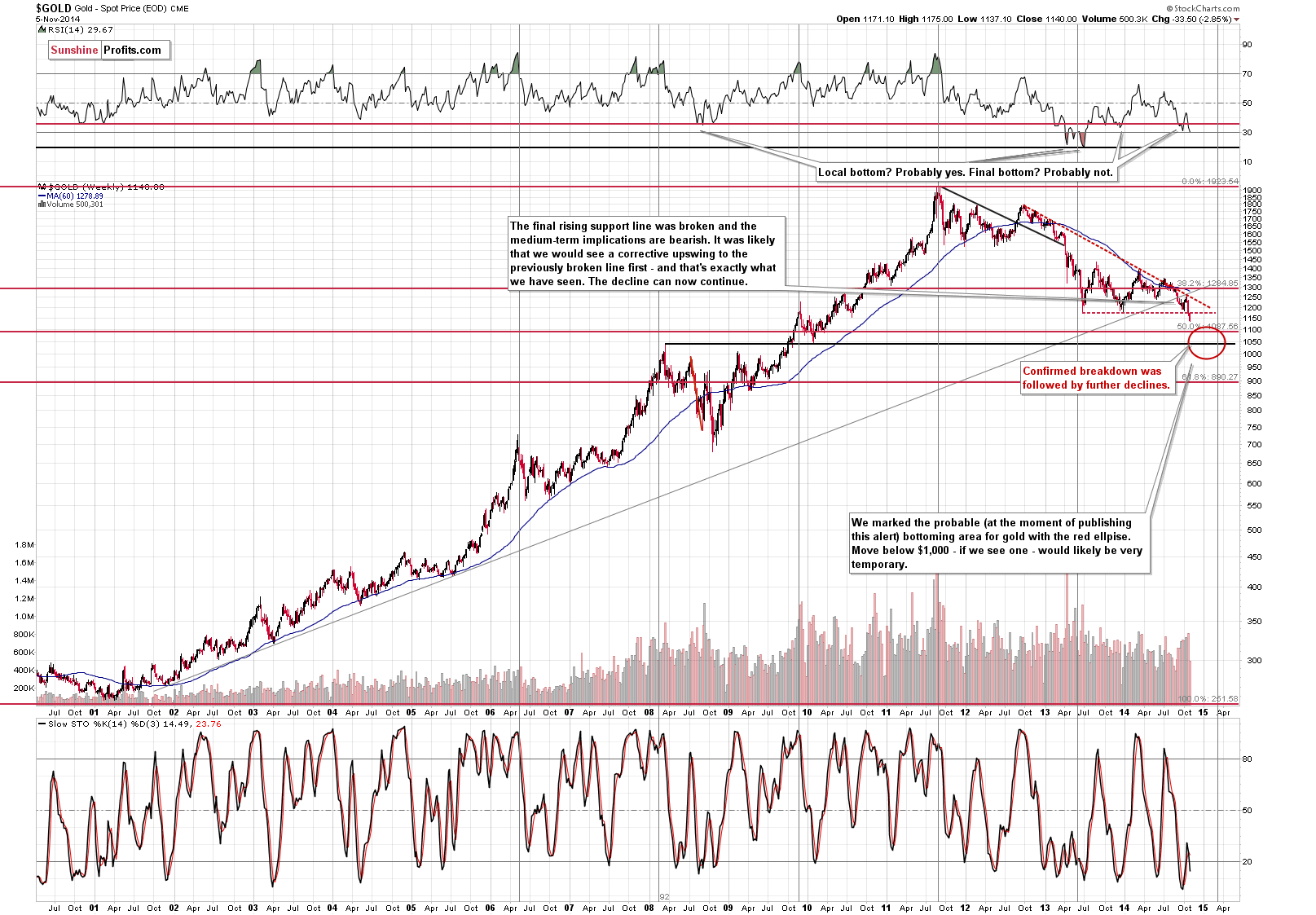

Gold already replied to the U.S. dollar’s strength by declining visibly yesterday. Did gold reach an important support yesterday? No. It actually moved below the mid-2010 low and corrected a bit. The closest strong support is at $1,087.56, and it seems likely that gold will move at least to the $1,100 before bottoming (at least initially).

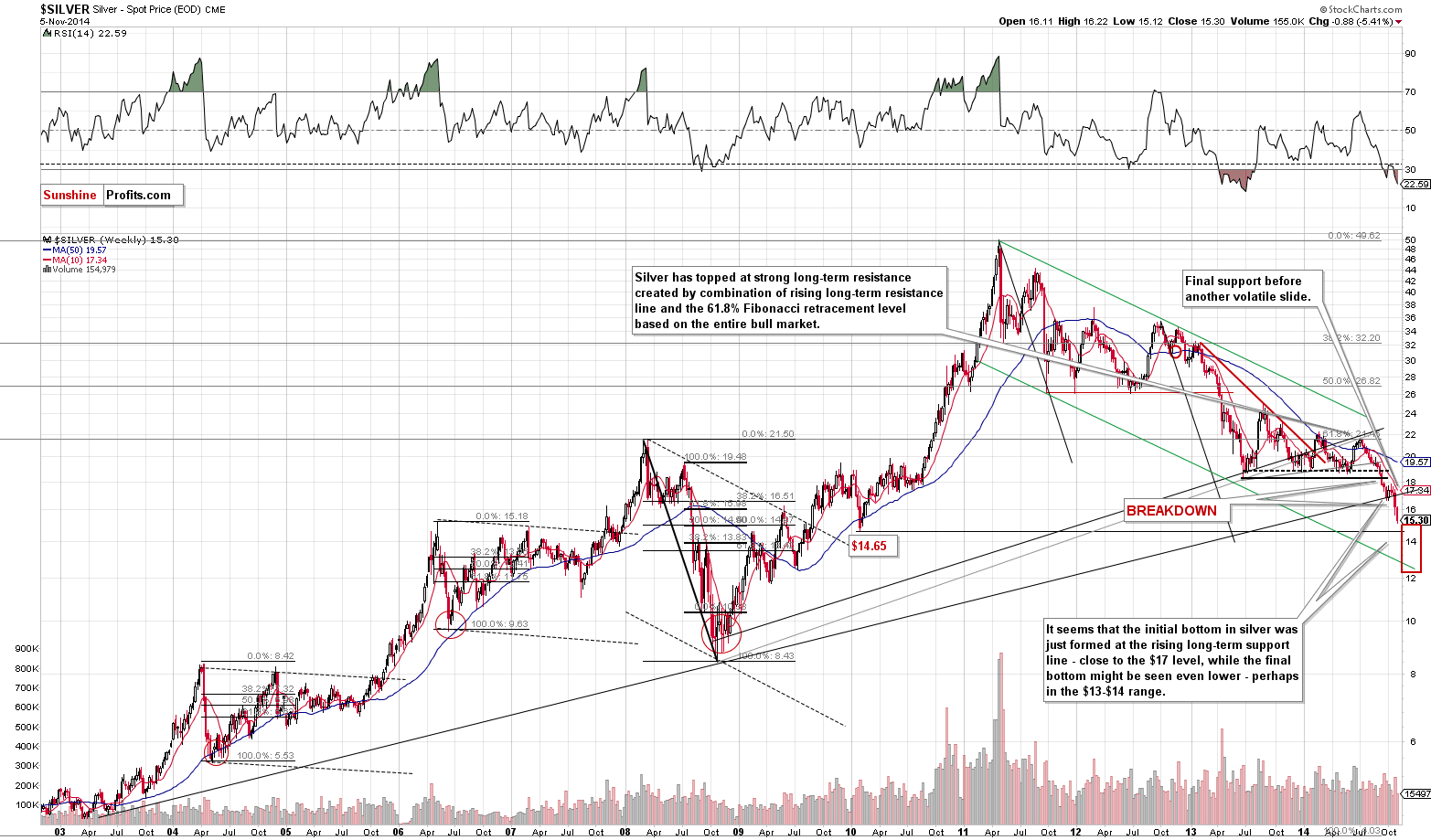

Silver declined substantially once again and almost reached the $15 level. It’s now relatively close to the early 2010 low, which is the closest significant support level – at $14.65. It seems that silver will move at least slightly below the $15 level before the bottom (it’s not clear if it will be the final one; most likely not) is formed.

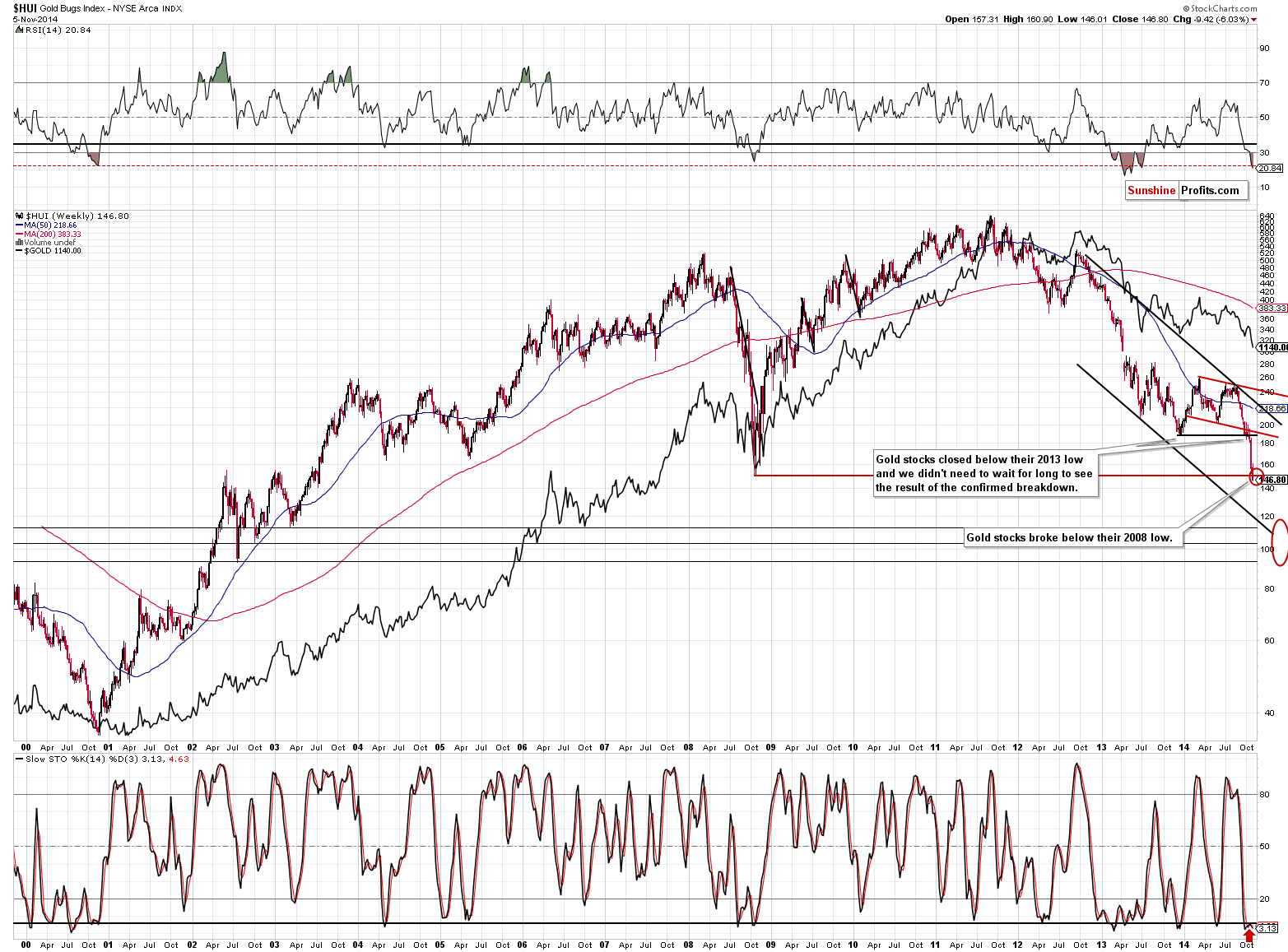

Gold stocks refused to move significantly below their 2008 low, but the lack of strong underperformance doesn’t seem to be very significant. It looked impressive during the session, when gold stocks held up strong despite gold’s $20+ decline and our initial thought was to consider closing shorts and perhaps even open long positions. However, after giving this thought a few more minutes, we decided not to proceed. Just because miners didn’t move below their support level for a part of the session is not a very bullish sign. The first reason is that we just saw daily “strength” in gold stocks that was followed by weakness on the following day. The second reason is that we have recently seen the same type of performance in silver. The white metal initially refused to move below its long-term support line, but once it did, it quickly caught up with gold and mining stocks by declining even more sharply than them.

We didn’t need to wait long for another downswing – it materialized in the final part of the session. Gold miners gave up the gains and closed visibly below their intra-day 2008 low. The implications are bearish.

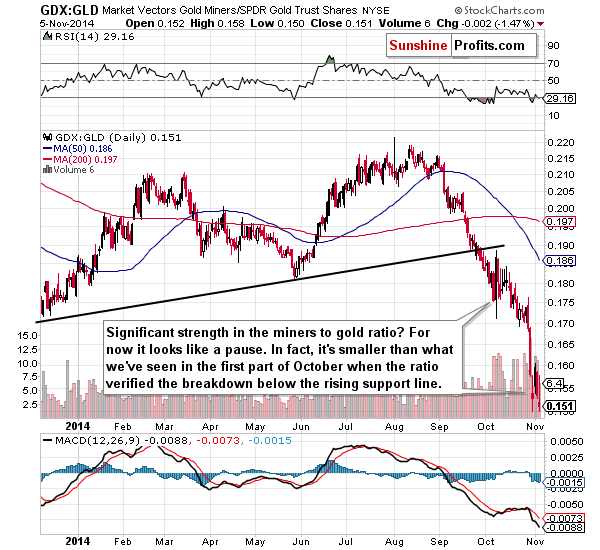

Furthermore, if we consider the miners to gold ratio, we see that yesterday’s early outperformance was much less significant than it had initially seemed. In fact, it was smaller than what saw about a month ago. It was not necessarily a sign of strength – it might have simply been a pause.

Other than the above, nothing changed in the precious metals market and what we wrote in Tuesday’s and Monday’s alerts remains up-to-date (please read the latter if you haven’t done so already).

Consequently, we will summarize today’s alert exactly as we did yesterday.

Summing up, the situation in the precious metals market was bearish and metals and miners were likely to decline – and they did. Will they decline further based on gold’s major breakdown (after all, gold didn’t break down from more than a yearly consolidation pattern to decline $40) or will the resistance and turning point in the USD Index trigger a bigger upswing in the precious metals sector?

As always, there are no sure bets in any market, but we think that the short-term resistance in the USD Index (given the metal’s negative correlation with the U.S. dollar) is much less important than the breakdown in silver and gold. The critical support in gold and silver was broken and they are likely to decline significantly now. They could still turn around and rally today or in the coming days, but they could also continue their decline and if they do, they could drop fast and far – and it would be a waste not to take advantage of this move.

Consequently, we think that instead of closing the short positions, we will keep them “almost closed”. By this we mean moving the stop-loss orders lower once again. In this way, if gold, silver and mining stocks rebound, the short positions will be automatically closed and substantial profits will be secured anyway. If metals and miners continue to slide, we plan to continue to move the stop-loss order lower and thus make the substantial profits from the current short positions even bigger. Please note that by entering a new stop-loss order, you are effectively making sure that the current trade is profitable no matter what the market does.

The miners’ initial outperformance that we saw yesterday doesn’t seem to be a major bullish signal (after all, miners closed below their 2008 low) and, at the same time, we have room for a further rally in the USD Index and for further declines in gold and silver.

Since gold, silver and miners have moved close to our target levels, we are now changing initial target levels to exit orders (meaning that it seems a good idea in our opinion to close positions as soon as these price levels are reached without our additional confirmation). We are also moving stop-loss orders for gold and silver lower.

Our plan is to exit the short positions at the below levels as the risk of a corrective upswing will become significant (too significant to justify keeping a short position opened – it seems to be a better idea to take substantial profits off the table at that time). At this time it doesn’t seem that this will be the final bottom for this decline.

We are not automatically suggesting opening long positions at these levels (at least not yet).

We will continue to monitor the situation and report to you – our subscribers – accordingly.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) short positions in gold, silver and mining stocks is a good idea:

- Gold: exit order: $1,094 ; stop-loss: $1,176, exit order for the DGLD ETN: $99.87; stop loss for the DGLD ETN $80.65

- Silver: exit order: $14.83 ; stop-loss: $16.36, exit order for the DSLV ETN: $99.83; stop loss for DSLV ETN $72.41

- Mining stocks (price levels for the GDX ETN): exit order: $15.83 ; stop-loss: $18.33, exit order for the DUST ETN: $57.25; stop loss for the DUST ETN $38.03

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

- GDXJ: exit order: $20.13 ; stop-loss: $26.53

- JDST: exit order: $53.35; stop-loss: $25.80

Important: If gold reaches its exit order value ($1,094) we think it will be a good idea to close the entire short position (also in silver and mining stocks).

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

S&P 500 index extends its short-term consolidation. Is it justified to be out of the market?

On Tuesday, crude oil lost 1.09% as the combination of soft U.S. data and a European Commission‘s decision fueled concerns over a global demand, pushing the price lower. Additionally, Saudi price move continued to weigh on the commodity. Because of these circumstances, light crude hit a fresh multi-month low of $75.84 and broke below important support levels. What’s next?

Oil Trading Alert: Crude Oil - Oil Bears In Charge

=====

Hand-picked precious-metals-related links:

Gold Most Expensive to Silver Since ’09 Means More Losses

Top gold-ETF holdings fall back to Lehman levels

Can the Swiss Single-Handedly Buoy Gold Prices?

A 'falling knife', gold could hit $800

=====

In other news:

ECB to wait for stimulus to sink in, Draghi style in limelight

Randgold says industry largely unprofitable – CEO

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts