Briefly: In our opinion no speculative positions are currently justified from the risk/reward perspective. Being on the long side of the precious metals market with half of the long-term investment capital seems justified from the risk/reward perspective.

Gold reversed yesterday but did it move much lower? Mining stocks declined significantly, practically erasing the move above their 2014 low. Is the rally over?

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

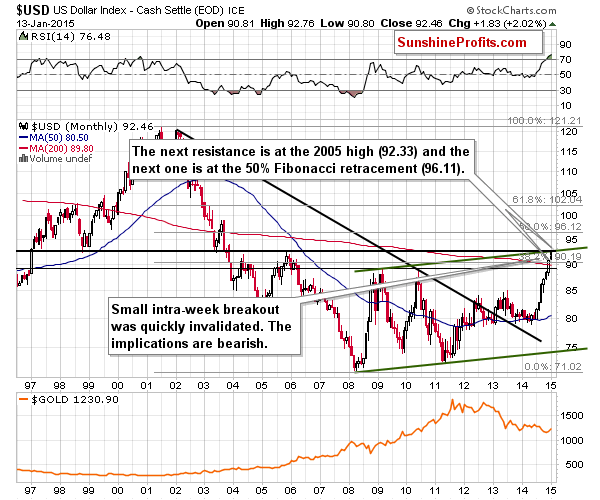

The situation in the USD Index didn’t change at all on Tuesday, so our previous comments remain up-to-date:

In the previous alerts we emphasized the significance of the long-term resistance that was just reached. It – combined with short-term resistance and the cyclical turning point – was likely to stop the current rally and trigger a correction. It seems that we are seeing the beginning thereof.

The USD Index moved a little above the long-term resistance last week, but this “breakout” was quickly invalidated and the USD ended the week below the key resistance. In fact, the weekly reversal is a bearish sign on its own.

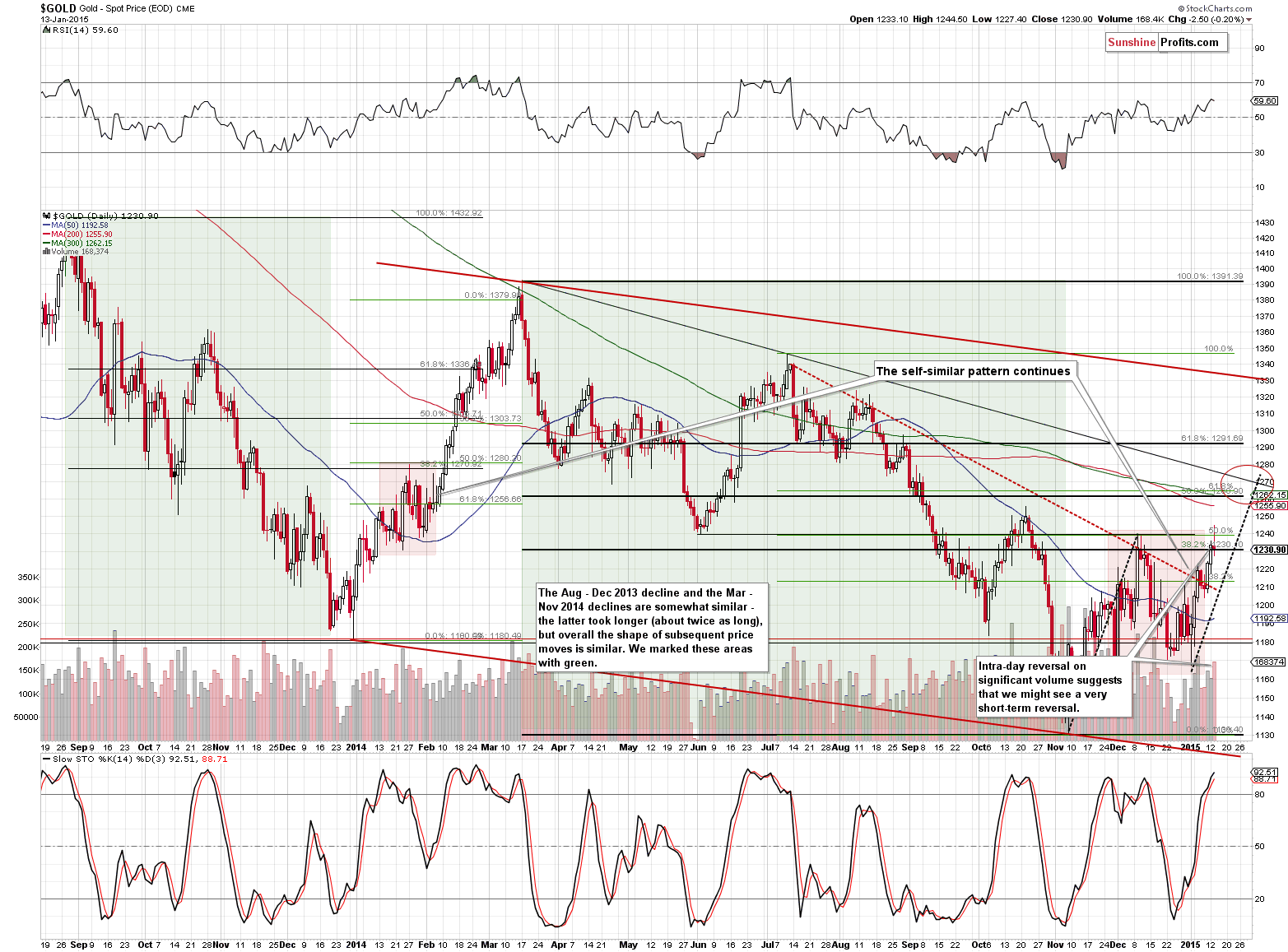

From a daily perspective we just saw a bearish piece of action in gold. The yellow metal reversed on significant volume which is a bearish sign. Moreover, it invalidated the move above the previous December 2014 high, which makes the very short-term outlook even more bearish. Does it make the outlook very bearish? Not necessarily. Our yesterday’s comments remain up-to-date:

Gold closed at the price level that is close to the early Dec. high (in terms of the daily closing prices), so we can say that gold reached a resistance level and could pause or correct at this time. Still, that seems rather unlikely (or any correction would likely not be significant) because the U.S. dollar’s decline has not really begun so far. If it materializes, then the price of gold will likely rally regardless of the short-term resistance.

(…)

Will gold stop at $1,260 - $1,280?

That’s just our initial target. Much will depend on the way gold reacts to the dollar’s decline and the way gold stocks react to gold’s performance – we will be monitoring the situation.

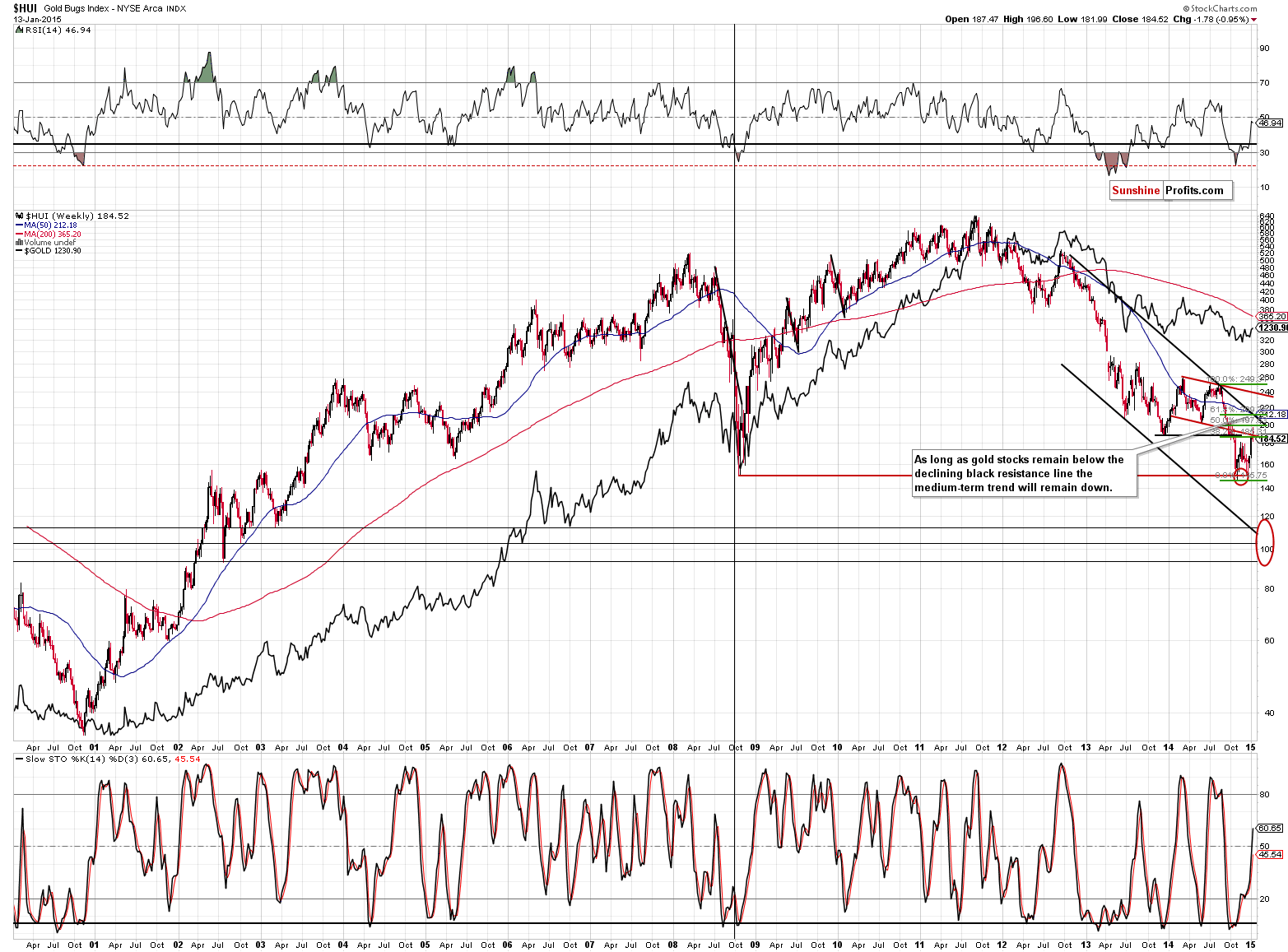

The HUI Index (proxy for gold stocks) moved visibly lower yesterday, practically invalidating Monday’s rally. The key question is: “what does ‘practically’ mean here?” On the above HUI chart, we see a move back below the 2014 low, which is a very bearish sign.

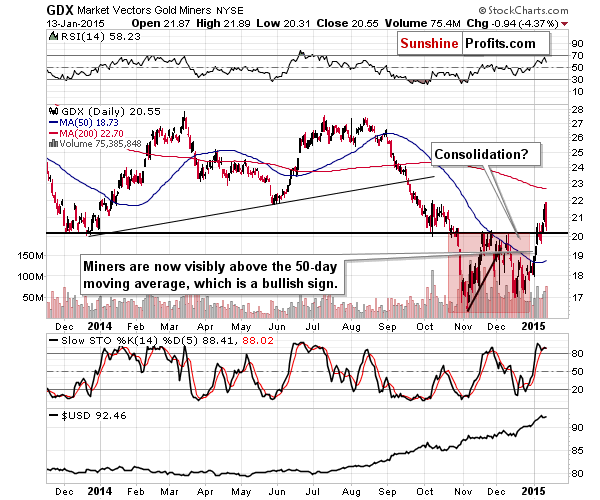

However, the above GDX ETF chart (a different proxy for mining stocks) shows that we saw a move back to the 2014 low, but without a move below it. This would imply that yesterday’s move lower was nothing more than just a verification of the breakout. This interpretation has bullish implications.

With unclear implications of yesterday’s move, the implications for the short term are also unclear.

Summing up, gold reversed on relatively high volume (bearish sign), while miners moved significantly lower (underperformance is bearish, but it’s unclear whether we just saw a breakdown back below the 2014 lows) and silver soared on a daily basis. Since the white metal tends to outperform temporarily at local tops, we have another bearish sign. The USD Index is still at the long-term resistance level and it’s still likely to correct visibly, but the implications here are of medium-term and not short-term nature. Consequently, based on several bearish signs, it seems that taking profits off the table for the speculative trading positions is justified from the risk/reward point of view at this time. We are not changing the long-term investment approach at this time – it seems that half of the capital should be invested in the market, mainly because the USD Index is likely to move lower relatively soon and because gold even stopped reacting to the USD’s strength.

We will probably get back on the long side of the market with the speculative / trading positions, but that’s not the case just yet. We’ll keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): Half positions in gold, half positions in silver, half position in platinum and half position in mining stocks.

We continue to favor senior mining stocks over junior mining stocks, but this will likely change relatively soon as the SP Junior Long Term Indicator is already below the lower of the signal lines and as soon as it turns back up, we will see a “move from seniors to juniors” signal. As far as senior gold stocks and silver stocks selection is concerned for speculative and long-term investment purposes, we continue to view our tools: Golden StockPicker and Silver StockPicker as the optimal way of choosing them.

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

We've seen a strong and volatile move down. Bitcoin has taken a significant dive, losing some 13% and the volume has ballooned to the highest level since the Jan. 4 plunge. There are important implications for our short-term outlook.

Bitcoin Trading Alert: Beginning of an Extremely Important Decline

=====

Hand-picked precious-metals-related links:

Strong dollar, weak oil a lifeline for struggling gold miners

BMO: Gold Prices To Remain Weak In 2015

Faber: Gold will rally 30% in 2015

Gold bulls – beware of Greeks bearing gifts!

=====

In other news:

World Bank cuts global economic outlook

Draghi says ECB needs expansive monetary policy: paper

Europe court backs ECB bond-buying program

Japan government approves record $812 billion budget; deficit-halving goal in sight

Russia braces for ‘junk’ downgrade as oil drags

Oil at $40, and Below, Gaining Traction on Wall Street

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts