Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

The precious metals sector declined yesterday. That’s not surprising – we wrote that the lack of positive reaction to the previous day’s decline in the USD Index was a bearish factor. Today’s situation confirmed that it was the case. The Dollar Index moved higher, but only slightly, and yet this was enough to trigger a significant decline in gold. Let’s see the bearish implications and estimate how strong they are (charts courtesy of http://stockcharts.com.)

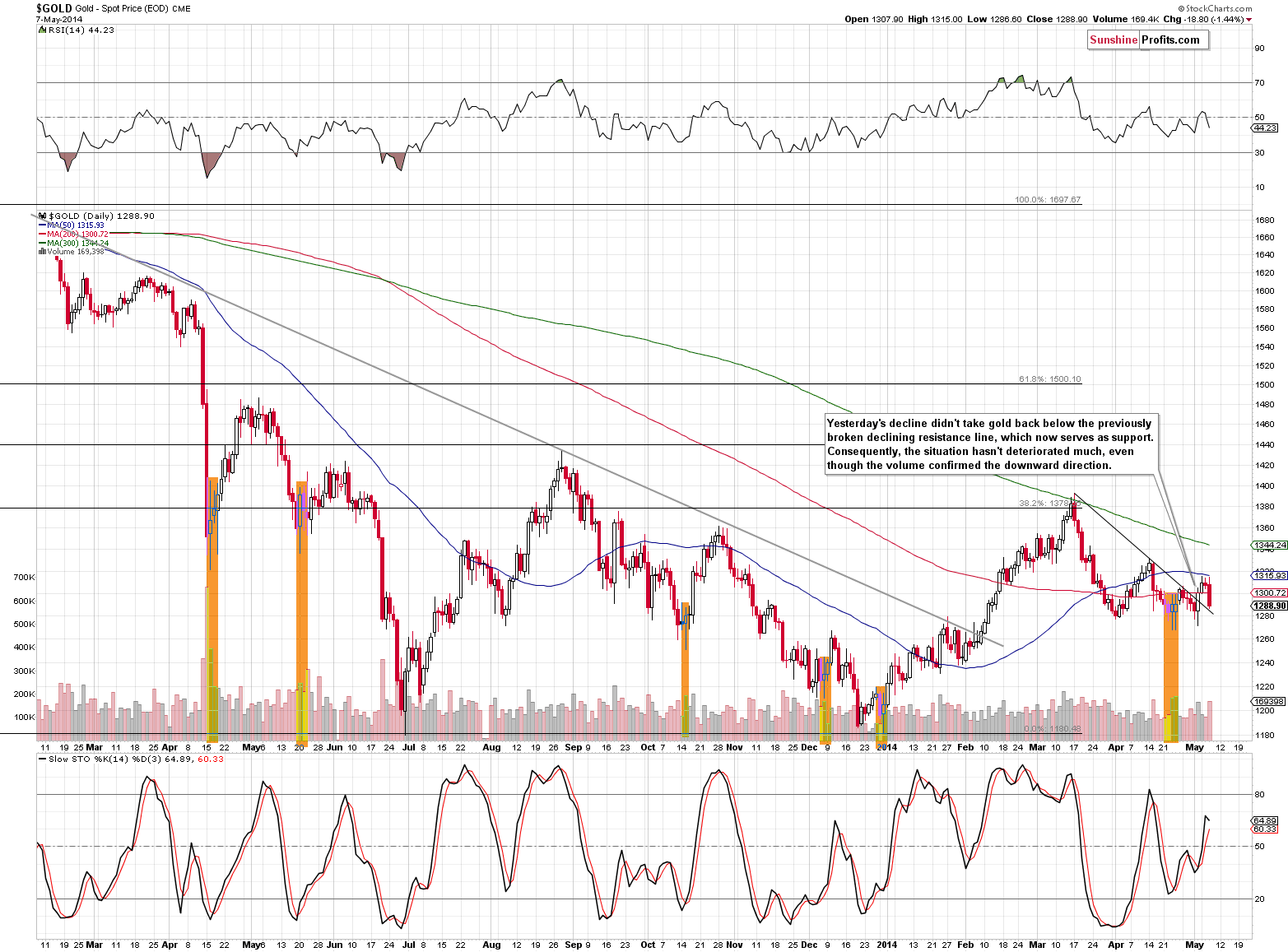

Gold had moved higher in the past few days but basically erased these gains just yesterday. Yesterday’s decline materialized on huge volume, which suggests that this is the real direction in which the precious metals market is moving / about to move. The move itself has been bearish, but not overly bearish. It hasn’t taken gold below the declining support/resistance line, which means that the situation hasn’t become more bearish. A significant decline on significant volume is what we saw, but it’s not enough to justify increasing the size of the short position in this market.

While gold declined yesterday, not much happened in the USD Index. This means that gold can decline without direct support from the currency market and that is a bearish piece of news. Generally, what we wrote recently is up-to-date and the most recent market action seems to confirm that – the precious metals market is underperforming. Gold stocks and silver moved lower on significant volume a well.

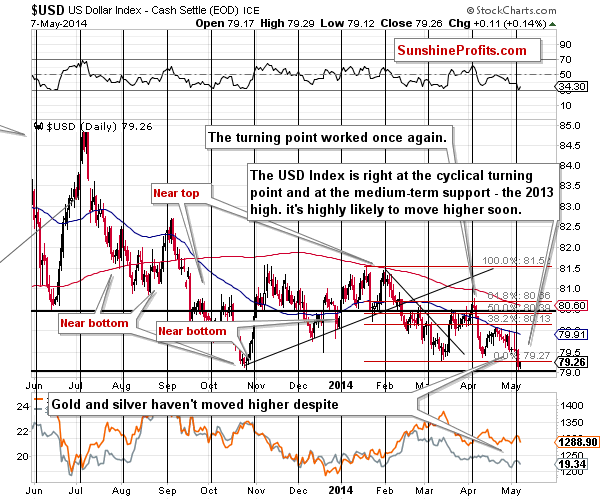

You can see it more clearly on the USD Index chart. We saw a visible decline in the USD Index this week, but gold and silver simply stayed where there were. This is bearish action, suggesting that the precious metals market is not ready to move higher again. Moreover, the USD Index itself is about to move higher based on the cyclical turning point. Both factors are bearish for the precious metals sector.

Summing up, the way the precious metals market reacted to the U.S. dollar’s move lower (to the 2013 lows) is a bearish sing, and it confirms the bearish outlook that we outlined in the previous alerts.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts