Briefly: In our opinion speculative long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective.

Gold ended Friday’s session visibly lower than it had closed on Thursday and we can say the same about mining stocks. Silver – having earlier touched its major, long-term support line held up relatively well. Did gold and mining stocks simply start to catch up with silver’s decline or is the above a sign of a bottom?

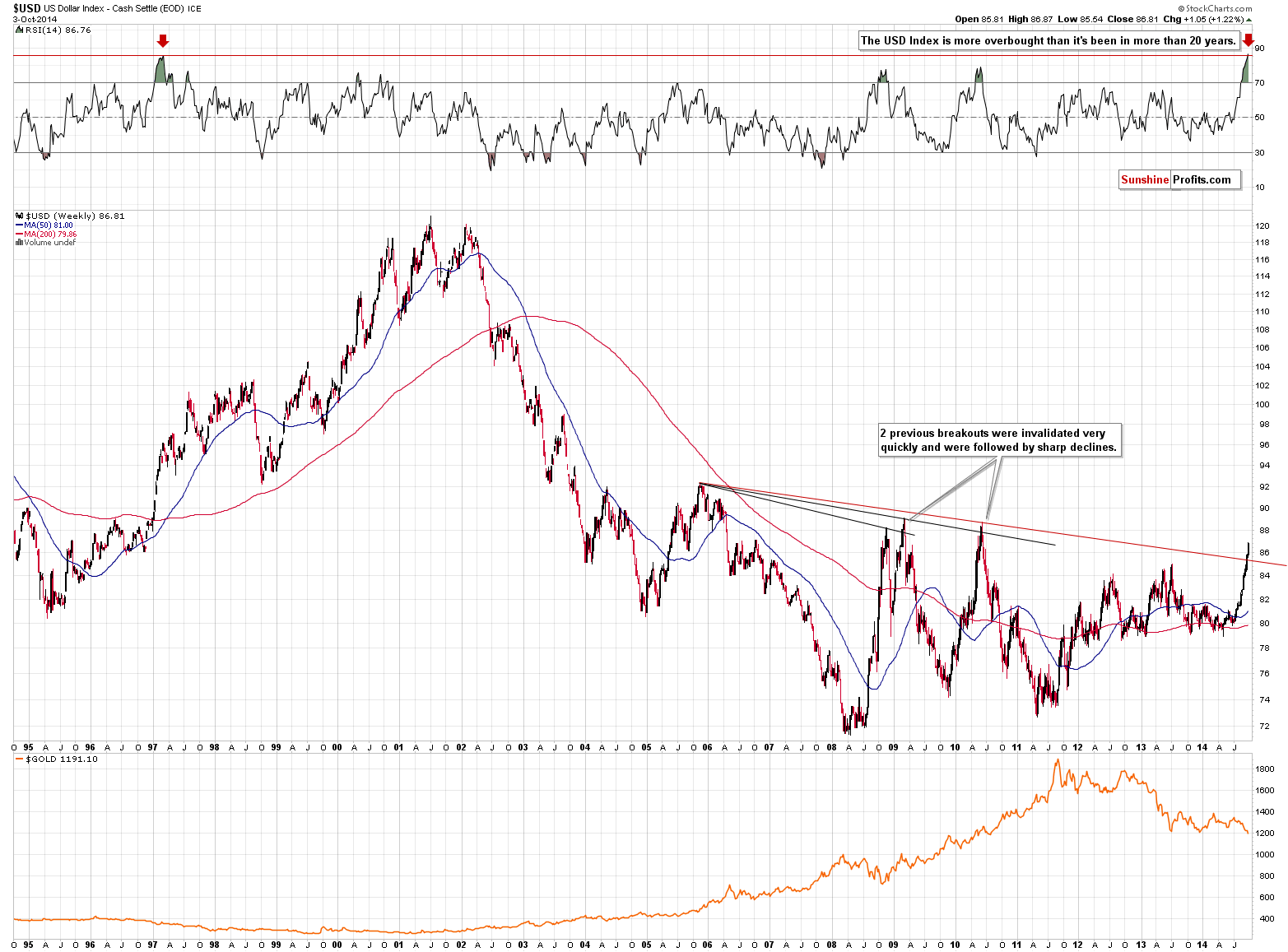

The latter seems to be more probable in our view. The USD Index is now more overbought than it’s been in more than 20 years, and since no market can move in only one direction, the corrective downswing is still very likely to be seen shortly. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

The RSI indicator is at the level that is higher than the previous 20-year high. The rally in the USD Index has surely been sharp in weekly terms, but it seems way too sharp to move in this manner without correcting. Given the sharp nature of the move, it seems that the corrective downswing will be sharp as well.

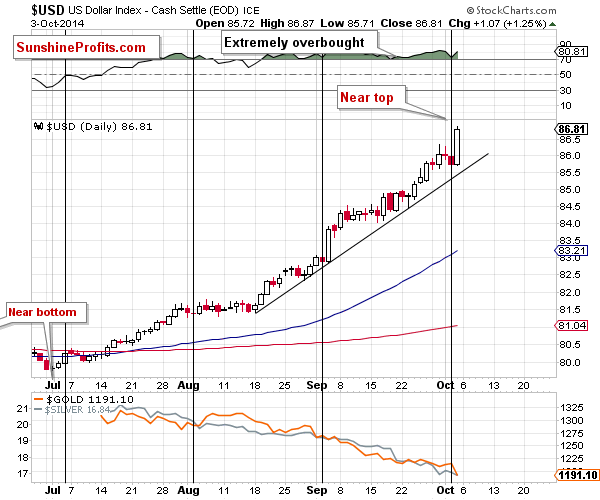

The Friday’s rally was huge and it’s no wonder that metals and miners declined. The move took place right after the cyclical turning point, so the odds are that we will not have to wait long for a reversal.

All in all, the outlook for the USD Index is still bearish based on the extremely overbought status, the turning point, and the fact that previous similar breakouts (as seen on the weekly chart) were invalidated.

What about the precious metals market? It’s likely to rally temporarily (yet visibly) in our view.

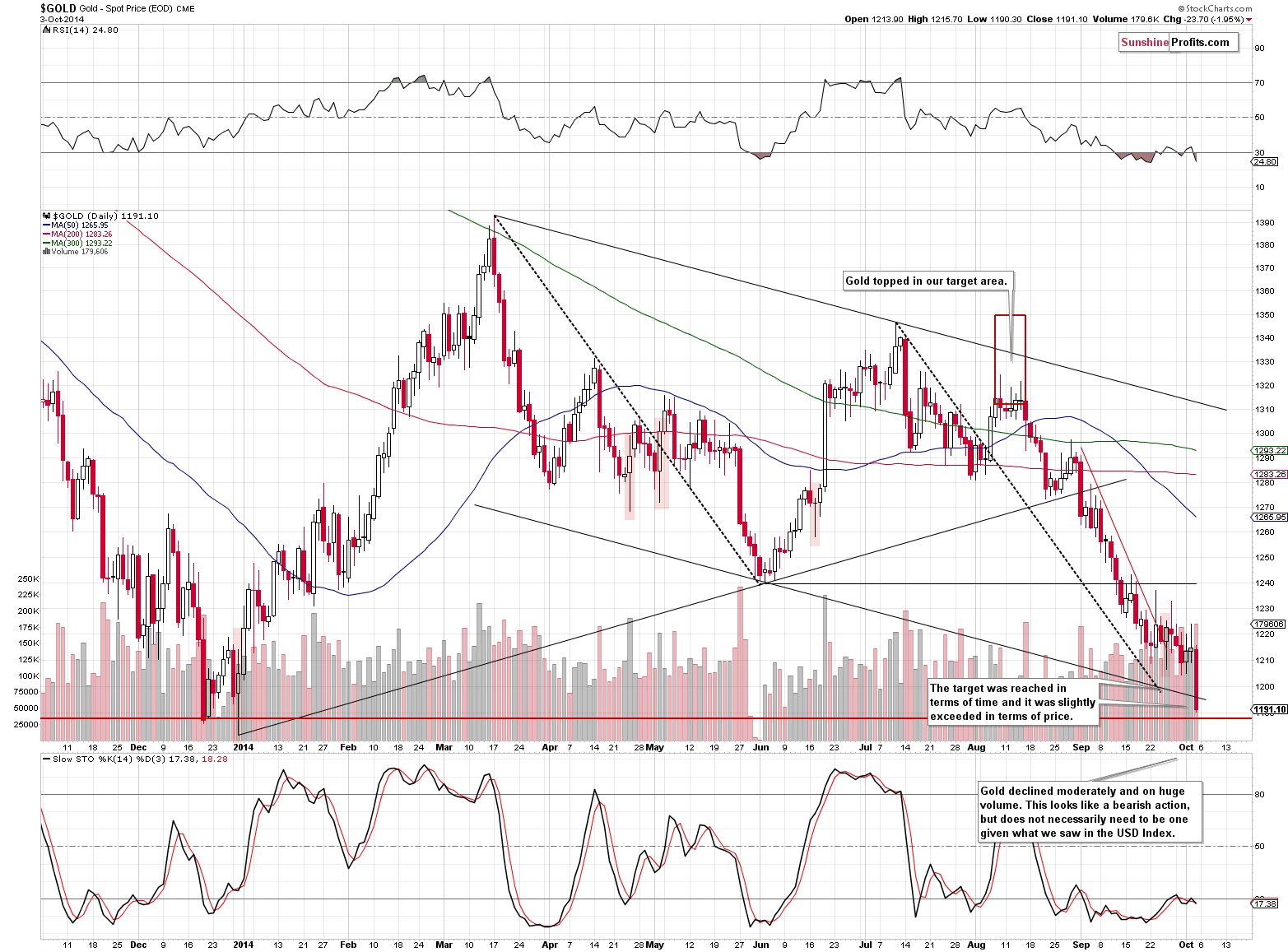

The situation in gold might seem very bad based on Friday’s price action alone, but when we take into account the level that was just reached and the similarity of the current decline to the March – May one, we get a different picture.

We have previously mentioned that these two declines are quite likely to be similar and we now have seen this type of movement – gold is currently very close to (a few dollars below) the lower border of the declining trend channel. Interestingly, in terms of closing prices gold is only a few dollars away from its Dec. 2013 bottom. These levels are both significant and likely to trigger a corrective upswing even if gold declines in the coming months.

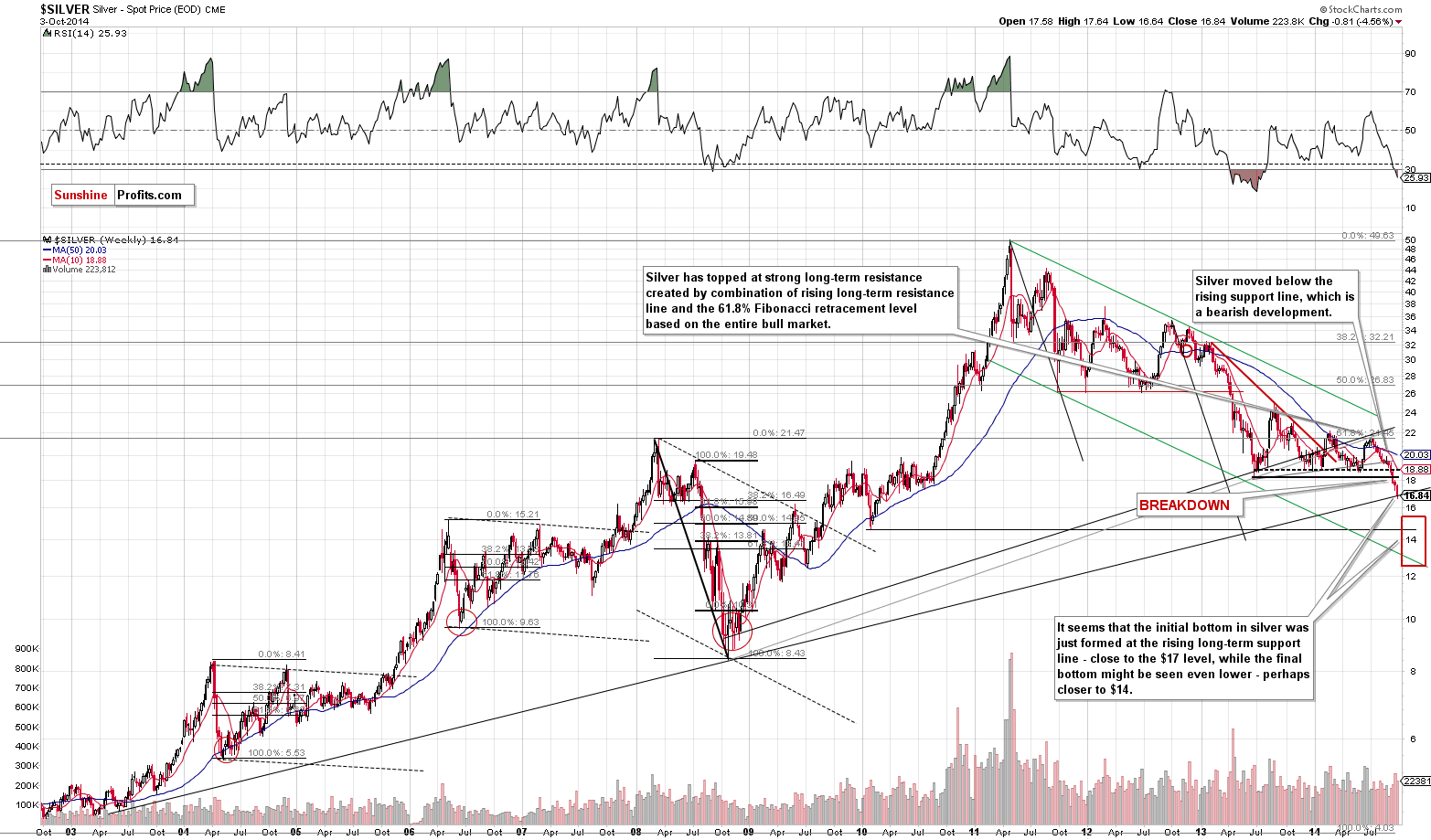

The situation in silver didn’t change much as it refused to decline below the rising, long-term support line. Silver is likely to rally based on this support combined with its heavily oversold status.

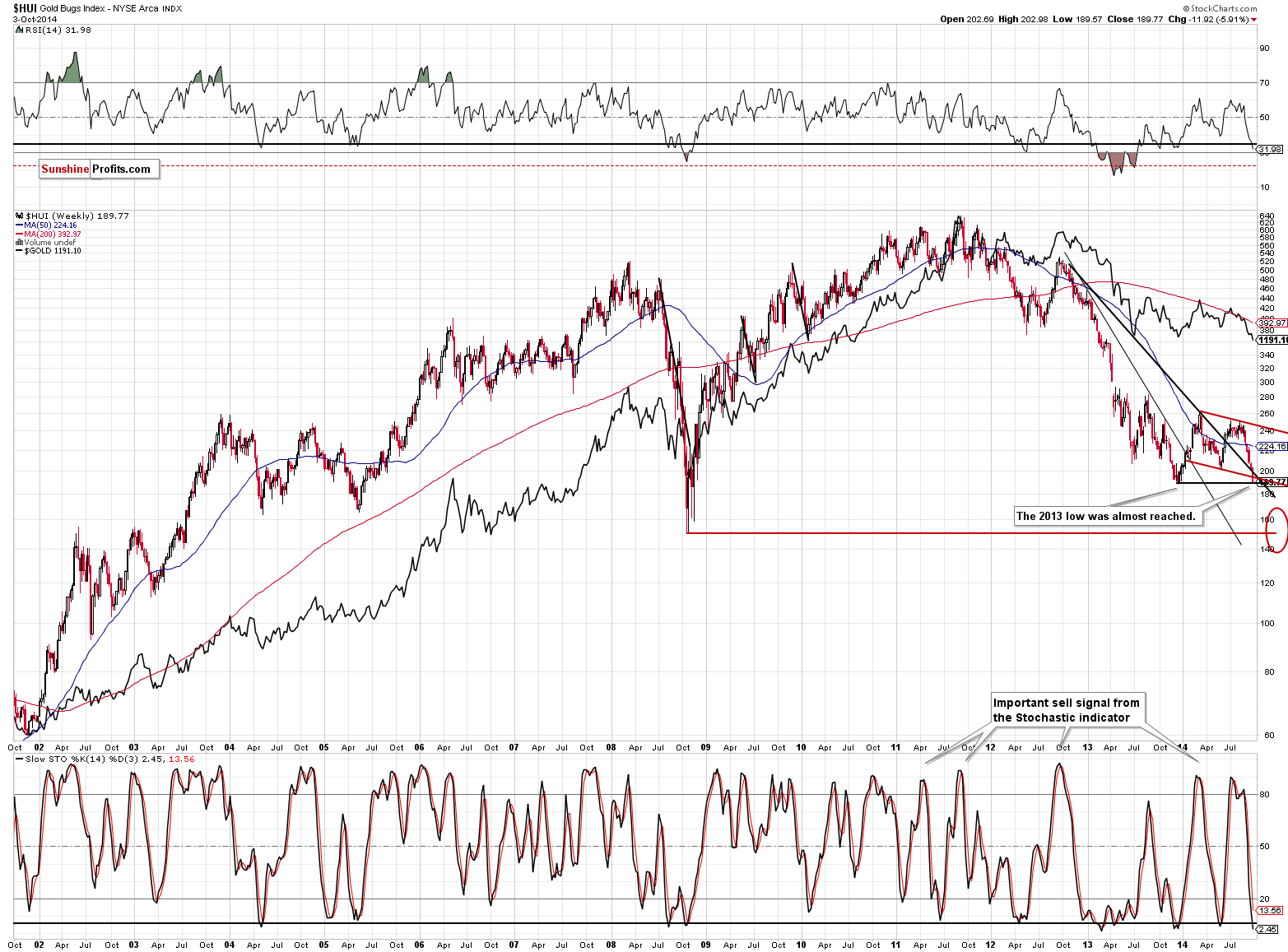

Gold stocks are now very close (almost at) their 2013 low, which is a major support level. Combined with a strong support for gold and silver and their oversold status, the above provides us with bullish implications also for the mining stocks sector.

Summing up, the situation in the precious metals market is still bullish for the short term, even if Friday’s intra-day action might suggest otherwise. While the move in the USD Index was indeed significant, it seems that a corrective downswing is just around the corner. The same goes for the precious metals sector, only in this case, the correction would be to the upside. A lot of money has been saved by staying out of the precious metals market in the past months with one’s long-term investments (details below), and it seems that the corrective upswing will provide additional profits from the trading capital.

To summarize:

Trading capital (our opinion):

It seems that having speculative (full) long positions in gold, silver and mining stocks is a good idea:

- Gold: stop-loss: $1,172, initial target price: $1,249

- Silver: stop-loss: $16.47, initial target price: $18.07

- Mining stocks (price levels for the GDX ETF): stop-loss: $19.94, initial target price: $23.37

In case one wants to bet on higher junior mining stock ETFs, here are the stop-loss details and initial target prices:

- GDXJ stop-loss: $28.40, initial target price: $37.14

- JNUG stop-loss: $6.19, initial target price: $16.34

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts