In short: No changes: small (half) short position in gold, silver, and mining stocks.

In Monday’s alert, we provided detailed reasoning behind our decision to open the short position in the precious metals sector. Basically, points made in it remain up-to-date and we have seen some confirmations. The situation became more bearish, but not bearish enough to justify adding to the short positions. Let’s see what just how much changed (charts courtesy of http://stockcharts.com.)

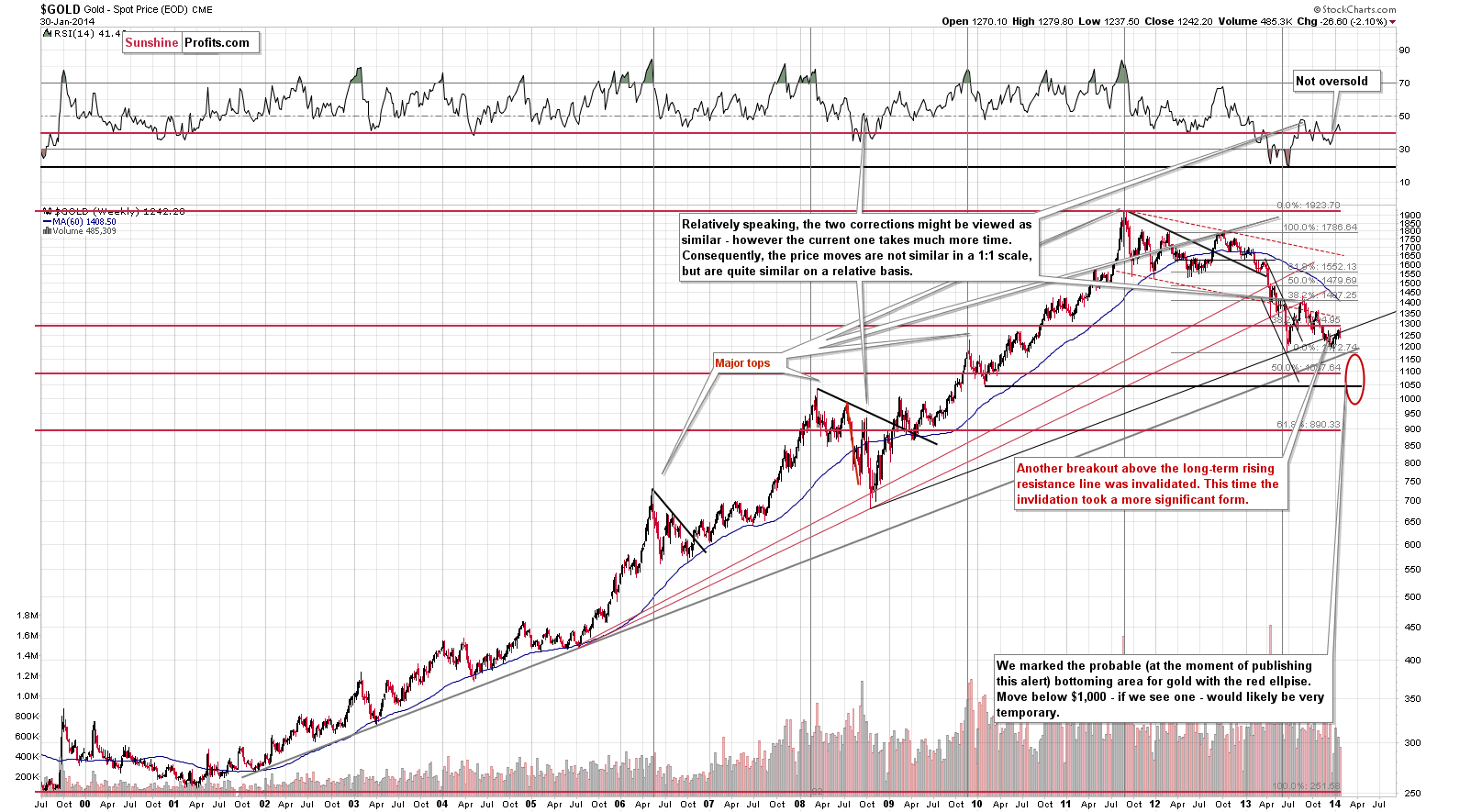

From the long-term perspective, we saw an invalidation of the breakout above the rising long-term resistance line, which, of course, is a bearish sign. Interestingly, gold moved very close to the $1,280 level, which is close the 38.2% Fibonacci retracement level based on the entire 1999 – 2011 rally.

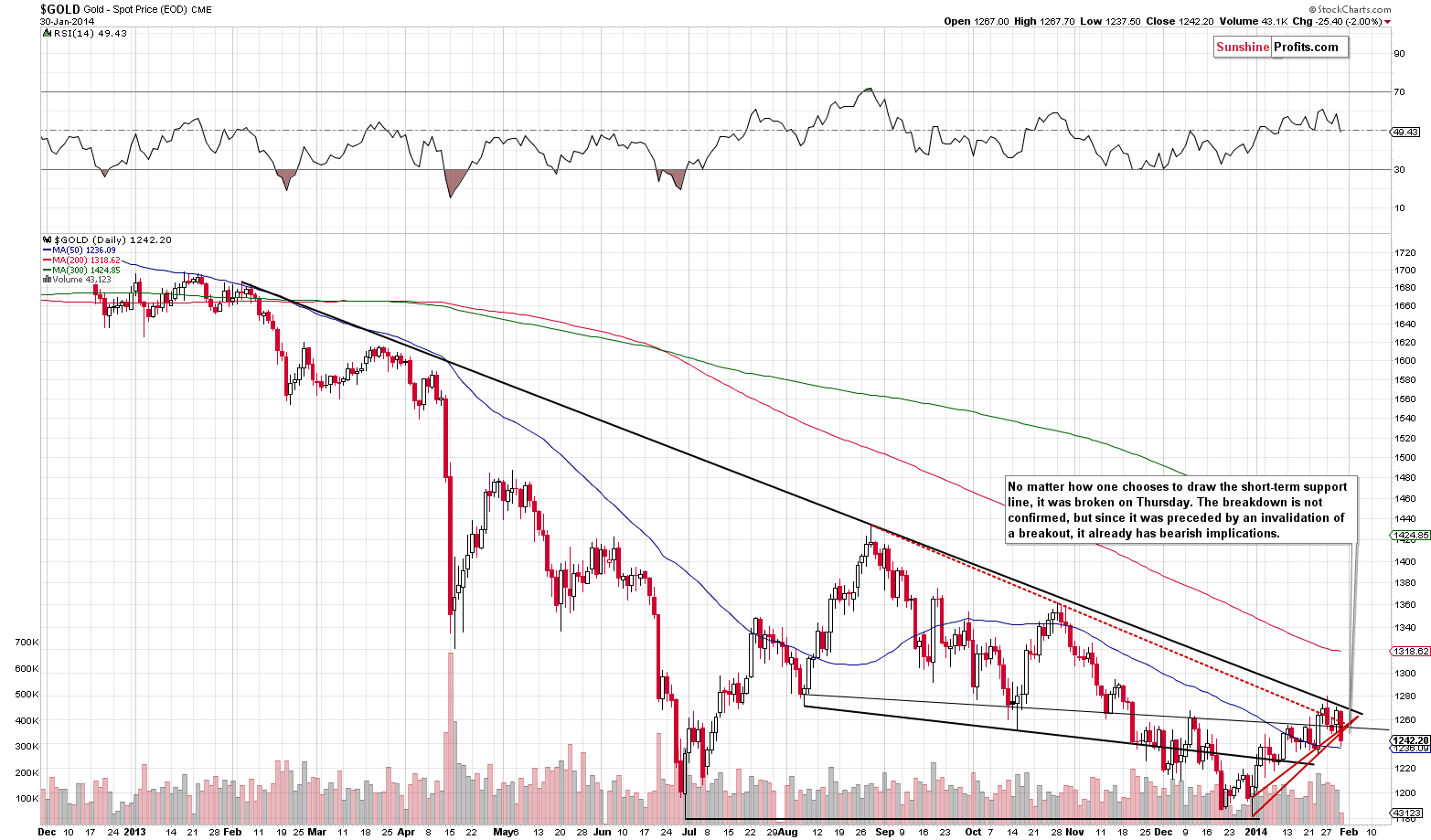

From the medium-term perspective, nothing changed – gold remains below the declining resistance line and thus the trend remains bearish.

What’s more interesting, we saw breakdowns below the rising, short-term support lines (based on intra-day lows and based on daily closing prices). This is also a bearish indication, even though the breakdowns haven’t been confirmed just yet.

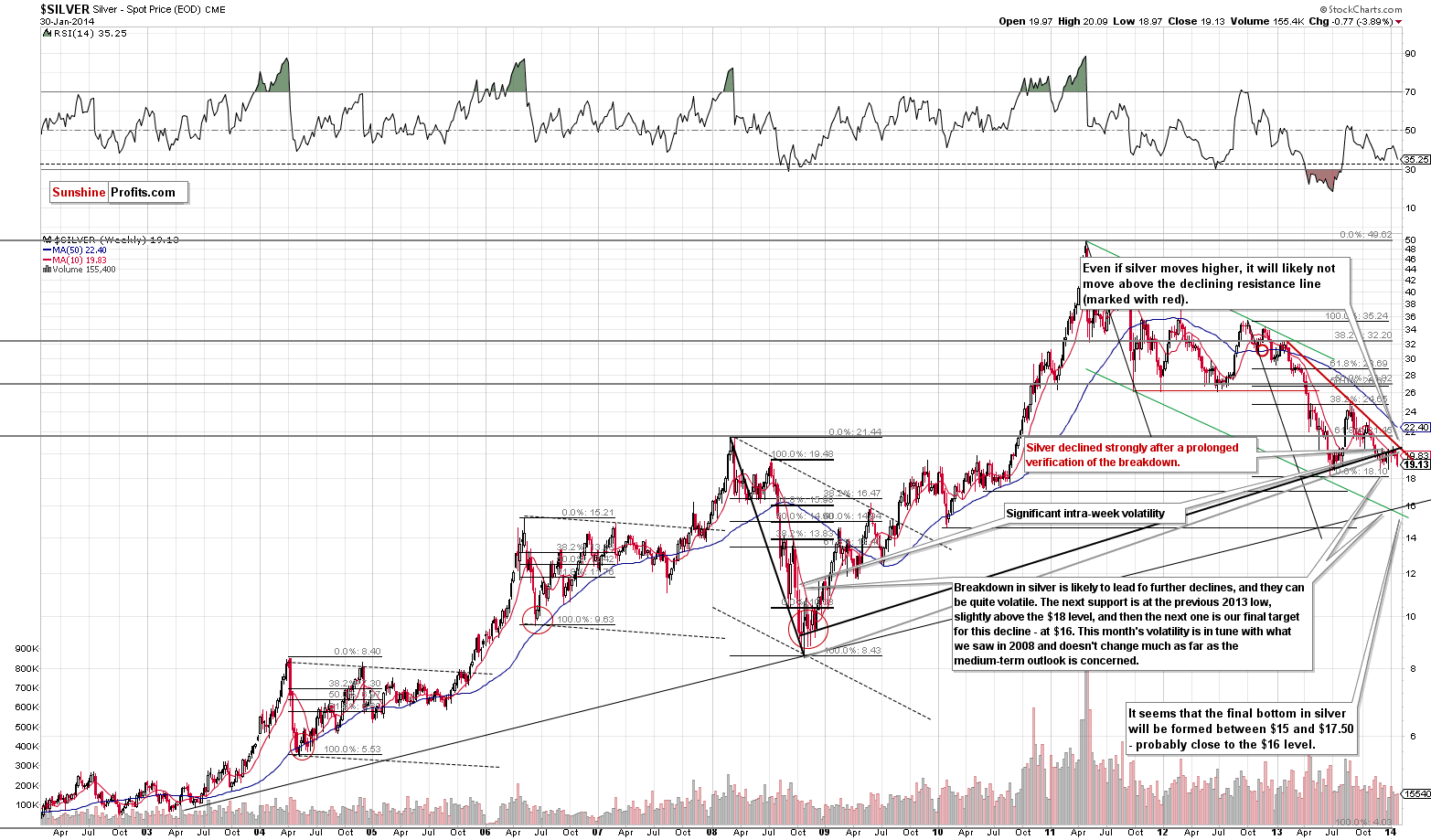

Meanwhile, silver continues to decline and there are no changes in case of the signals coming from this market – they remain bearish.

Silver certainly took its time to consolidate below the rising, long-term resistance lines, but it seems that the breakdown is more than confirmed. Thursday’s strong decline to previous lows seems to confirm the bearish outlook for the following weeks.

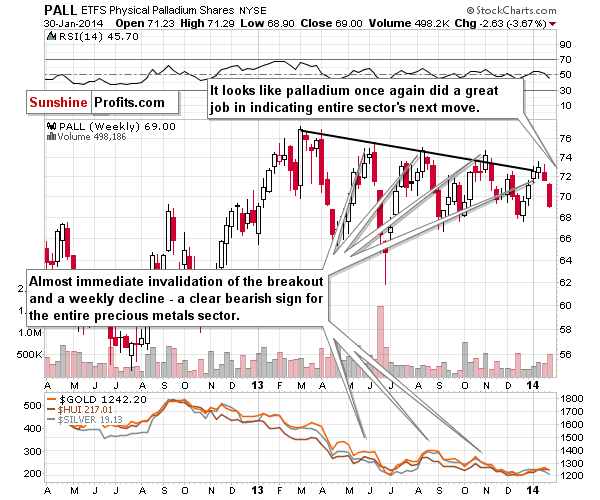

The next chart that we would like to feature today is palladium.

We have previously commented on palladium’s usefulness as a short-term indicator for the entire precious metals sector, and at this time we would like to emphasize that the bearish signal coming from it just got – once again – stronger. Palladium moved decisively lower yesterday, which had previously meant that the rest of the sector would follow. From this perspective, the situation once again deteriorated. The failure to break above the declining resistance line was a sell signal and now we see a confirmation thereof.

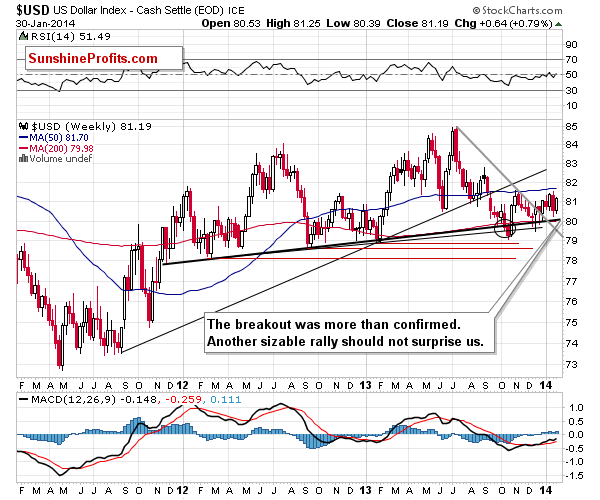

Meanwhile, the USD Index just rallied strongly and that was one of the biggest daily rallies in a few months. The US currency is already after a long consolidation that followed a breakout above the declining resistance line, so we can expect a big move to the upside to happen quite soon.

I (PR) was talking to Nadia Simmons about the current situation in the USD Index and we agreed that if it manages to move above the previous 2014 high, then it could rally much higher – at least (!) to 82.70. Such a move would obviously very likely have a devastating effect on precious metals prices.

We received a question from one of our subscribers and came to the conclusion it could benefit all of our readers if we answered it in the alert.

Q: I have a small position in platinum; do you recommend holding or converting to silver or gold? If so, at what price point.

A:We currently don't suggest holding any precious metal as it seems that they will decline significantly (naturally, that's just our opinion, no guarantees). However, we do think that platinum has greater upside potential than gold at the moment. We will follow-up on the topic of platinum in the following days.

Summing up, taking all of the above into account, we arrive at the same conclusion, at which we arrived yesterday – namely, that it’s a good idea to use a small part of your speculative capital to trade the (likely) coming decline in precious metals. If we see a meaningful confirmation of the bearish case (for instance, a decline on strong volume or a breakdown in the HUI Index), we will likely suggest adding to the position. Naturally, in case of an invalidation of the bearish outlook, we will keep you informed as well. For now, this short position is already profitable.

To summarize:

Trading capital: Short position (half) in: gold, silver and mining stocks. We are planning to profit on a significant downswing, so the stop-loss orders will not be that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop-loss orders are not reached).

Stop-loss orders for the short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA