Briefly: In our opinion short speculative positions in gold (half), silver (half) and mining stocks (full) are justified from the risk/reward perspective.

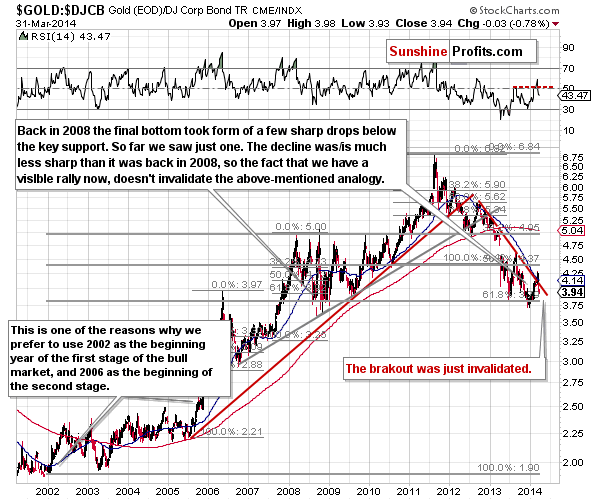

Generally, everything that we wrote in previous alerts remains up-to-date, but there’s one chart that we would like to comment on today (charts courtesy of http://stockcharts.com – gold’s performance relative to bonds.

We haven’t commented on the above chart in quite a long time as there was not much new to discuss (we have been examining each trading day, though). This time, however, we can see a very significant event – the invalidation of a major breakout. That is a strongly bearish indication and its effect can be seen in the weeks and months to come. It doesn’t necessarily have to have a short-term effect (in terms of days), as the entire chart and everything on it is long-term or medium-term in nature.

The most important thing that the invalidation of the breakdown tells us now is that we should prepare for another sizable downturn.

As mentioned previously, the situation in the precious metals market and in the USD Index is just as it was in the previous days. The USD index is likely to move higher as it has already paused after the short-term breakout and when it does rally, we are likely to see another slide in the precious metals sector. Some short-term strength could be seen, but we don’t put much weight to it as it would likely be only a very temporary phenomenon.

To summarize:

Trading capital (our opinion): Short positions: gold (half), silver (half) and mining stocks (full).

Stop-loss details:

- Gold: $1,342

- Silver: $20.85

- GDX ETF: $25.6

Long-term capital: No positions.

Insurance capital: Full position.

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts