Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

The previous week started quite favorably for precious metals bulls, but as the week progressed, the situation became less bullish, and finally we saw some bearish signs. Overall, the previous week didn’t change much. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

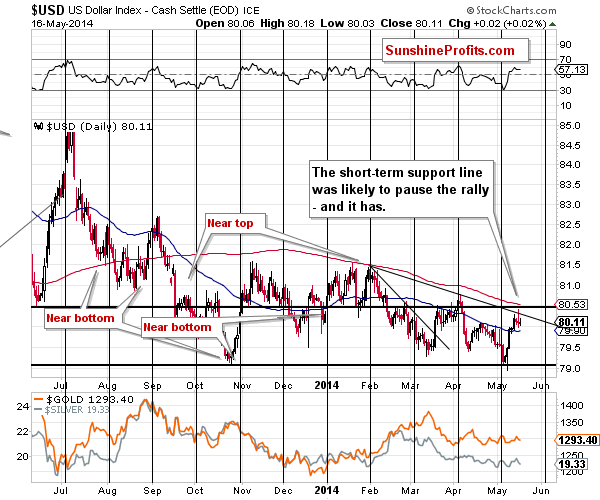

In the previous alerts we wrote a lot about gold, silver and miners’ reaction to the dollar’s rally (more precisely: about the lack of reaction) and the strength of the implications. In short, we didn’t think that the consequences were really bullish, because there had been many cases when the precious metals’ reaction was simply delayed, not absent. We saw some other bearish signs, but we’ll move to them in the following part of this alert. As far as the USD Index is concerned, we saw a pause after a strong rally. It was nothing surprising, as the previous rally was quite sharp and the index moved to the short-term resistance line.

What’s interesting is that while the first part of the last week was rather bullish for metals – they didn’t decline despite the dollar’s rally – the final part of the week was bearish as metals declined without a rally in the dollar. It could be the case that metals are starting to catch up as far as their reaction to the dollar’s rally is concerned.

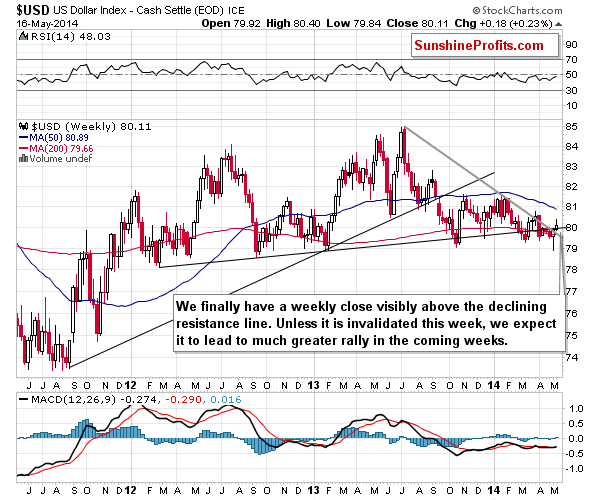

Has the USD Index really paused or is the rally already over?

The medium-term chart suggests that the move higher has just begun as we saw a breakout above the important resistance line, and we saw a weekly close above it. Another move higher will further confirm the breakout and likely convince more traders that the currency is really about to rally substantially in the coming weeks.

This means that the biggest (bearish) impact on the precious metals sector is still ahead of us.

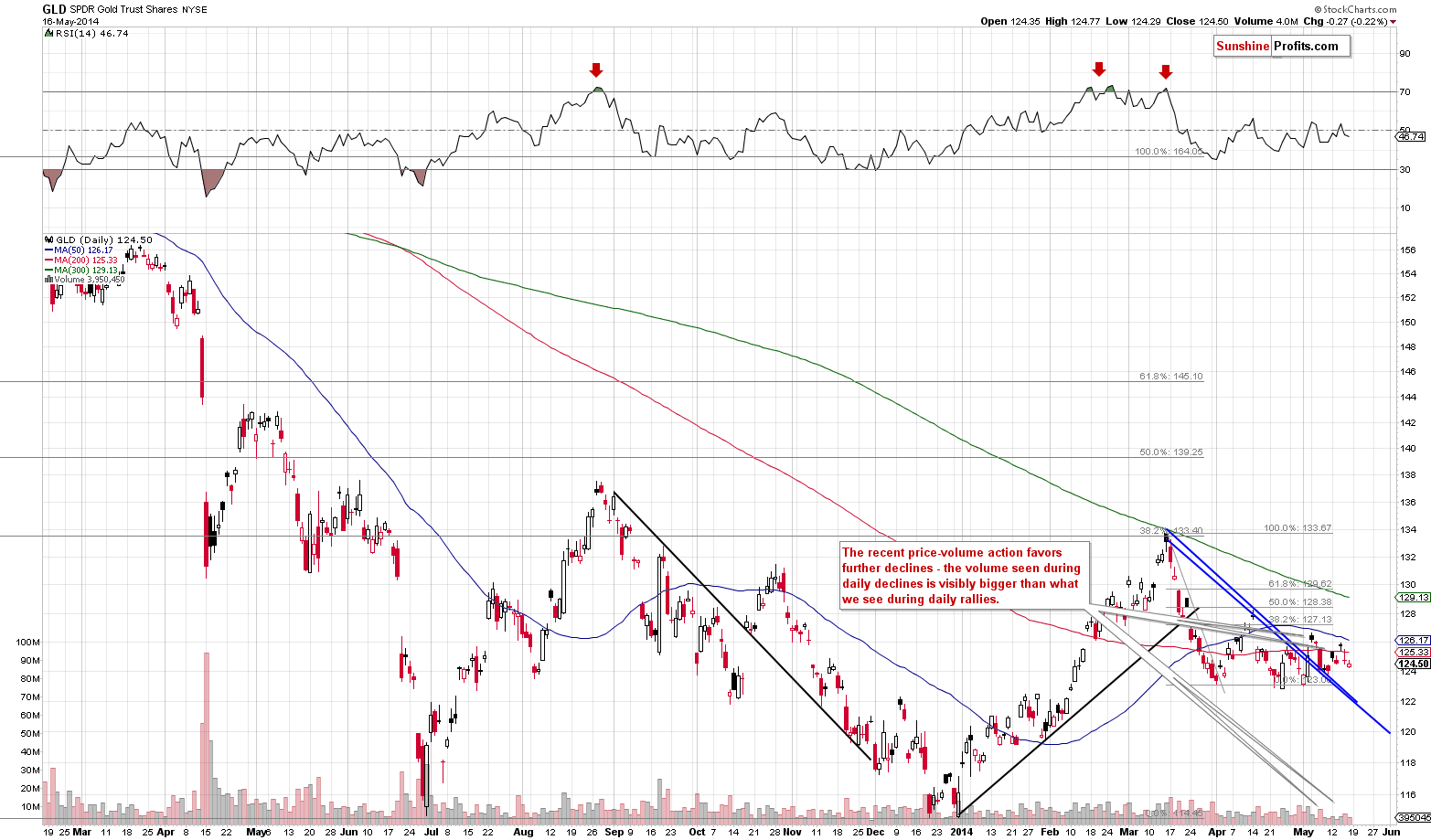

The situation in the gold market didn’t improve on Friday, and what we wrote in Friday’s alert remains up-to-date:

Yesterday, we wrote that GLD ETF had moved higher on tiny volume, which was a bearish sign. Another bearish sign (or more precisely: not a bullish one) was that we didn’t have gold above the previous local high. Moreover, we emphasized that this week’s small upswing hadn’t made gold move above the 50-day moving average and that the small move higher still seemed to be a counter-trend move.

The above is up-to-date and yesterday’s session confirms it – the GLD declined on volume that was significantly bigger than the volume accompanying the previous daily rallies.

The price-volume signs continue to point to lower prices in the coming days.

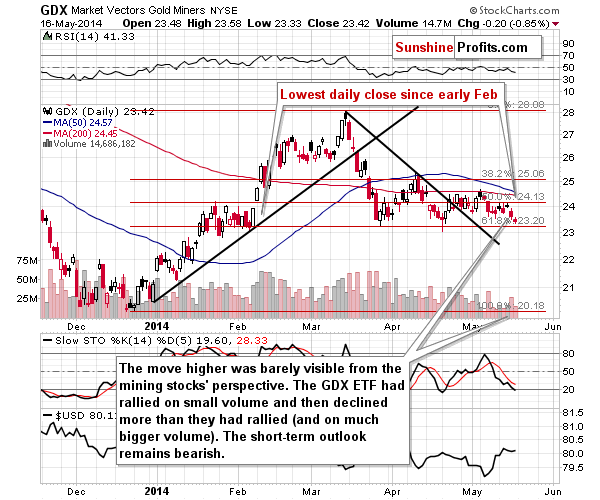

Mining stocks moved lower even more visibly than gold did. In fact, please note that while gold is above its March and April lows, the GDX ETF has just closed slightly below them. Mining stocks are showing weakness and suggest that another move will be to the downside.

What we wrote previously about the mining stocks sector remains up-to-date:

The “lower highs” observation applied to the mining stocks sector and the bearish price-volume implications were seen here as well. Just as it is the case with the gold market, the situation remains bearish, and yesterday’s decline on relatively big volume confirms it.

The precious metals sector usually declines in the middle of May, so we have bearish implications also from this perspective.

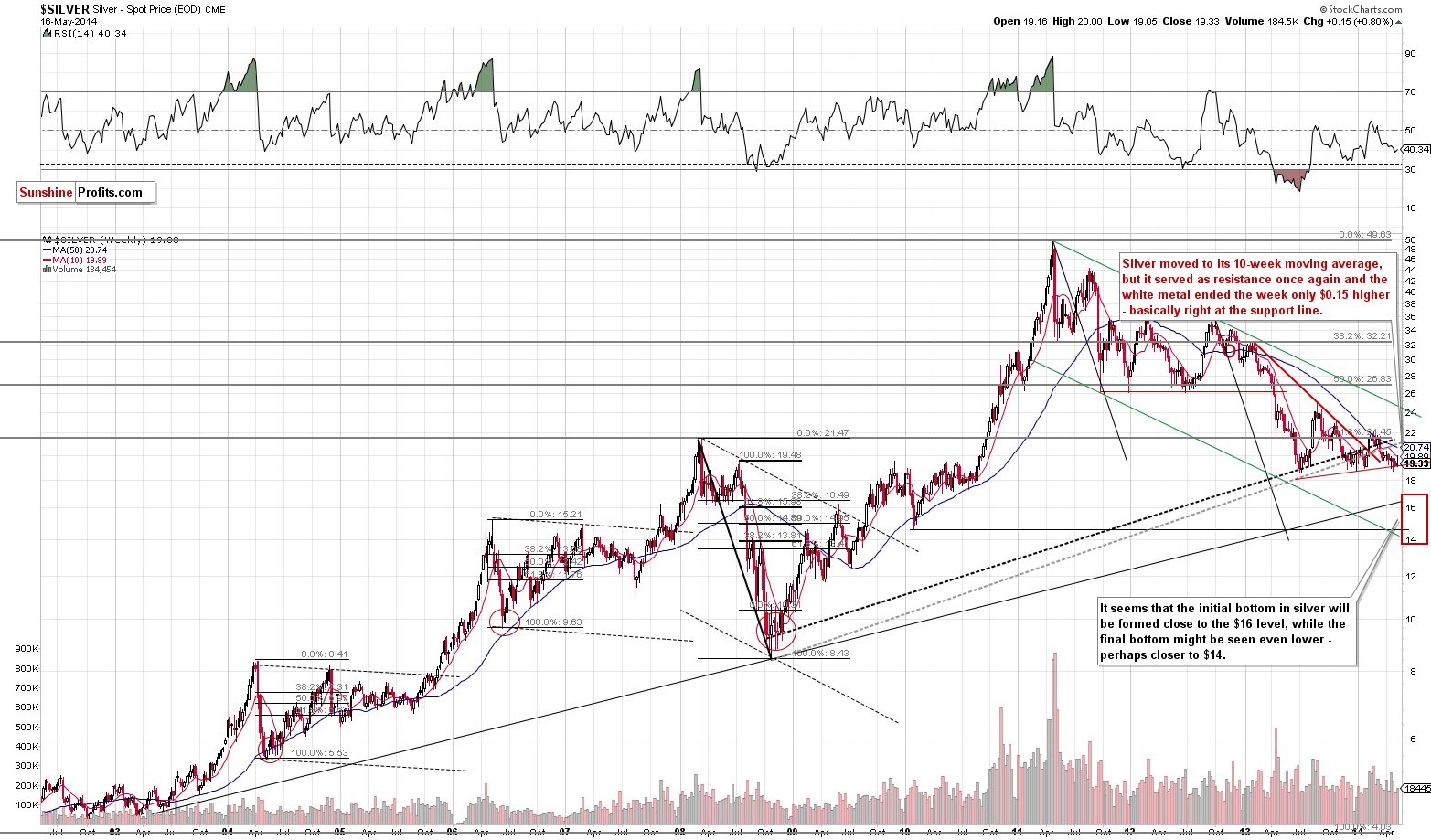

Before we summarize, let’s take a look at the long-term silver chart.

In the May 15, 2014 Alert we wrote the following:

Silver, on the other hand, has moved visibly higher this week. Is this a bullish factor? Not necessarily. Silver’s outperformance used to be a very bullish signal in the past years, but that was not the case in the more recent past. Since March all cases of silver’s outperformance (and many cases before that) have been the final sell signals for the precious metals sector.

History – the recent history – seems to have repeated itself once again. Silver moved sharply higher only to disappoint in the following days. Overall, the white metal moved higher by only $0.15, which means that it was basically flat.

The important factor to keep in mind here is that silver was (at the beginning of the week) and once again is right at its rising support line. Once this line is broken, we can expect a big (say, more than $1) move lower. It’s quite visible – many traders realize this. With this in mind, it’s no wonder that the current support was the start of a sharp rally. However, the fact that the rally was only very temporary and followed by an immediate move back to this line means that the strength of buyers is smaller than the strength of sellers.

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet. Precious metals are not responding strongly (we saw some reaction in the final part of last week, though) to the dollar’s rallies so far, but it seems that investors and traders are simply waiting for a confirmation of the breakout in the USD Index (there have been cases when the metals’ reaction was delayed in the past). Plus, silver’s strong performance and the lack thereof in the case of mining stocks, plus lower highs in gold and mining stocks, are a bearish combination.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts