Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective.

Before we continue with providing you with our thoughts on the current market situation (and as you read above not much changed), we would like to make an announcement.

While the decline in the precious metals market may not be over yet, it does seem like a good time to prepare yourself for higher mining stock prices. In fact, what we found in our many-months-long research should prove useful (seems both simple and effective) also during downturns.

Mining stock ownership can be compared to growing a small garden. You can get amazing results over time with just a little effort, but if you plant/invest and forget, you might ever regret starting in the first place. In case of a precious metals mining stock portfolio, the key thing to keep in mind is rebalancing. According to our research, by forgetting to rebalance one is likely missing on a large part of the profits. If the above has your curiosity, the following will get your attention: while the rest of the market was down, over 30%, rebalanced gold stocks portfolios managed to gain as much as 94.92% and rebalanced silver stocks portfolios – as much as 90.64%! What do we mean? How to rebalance the portfolio to make the most of it? How often? This report deals extensively with the above issues and also covers a few aspects of mining stocks trading. Enjoy!

Mining Stocks Rebalancing Report

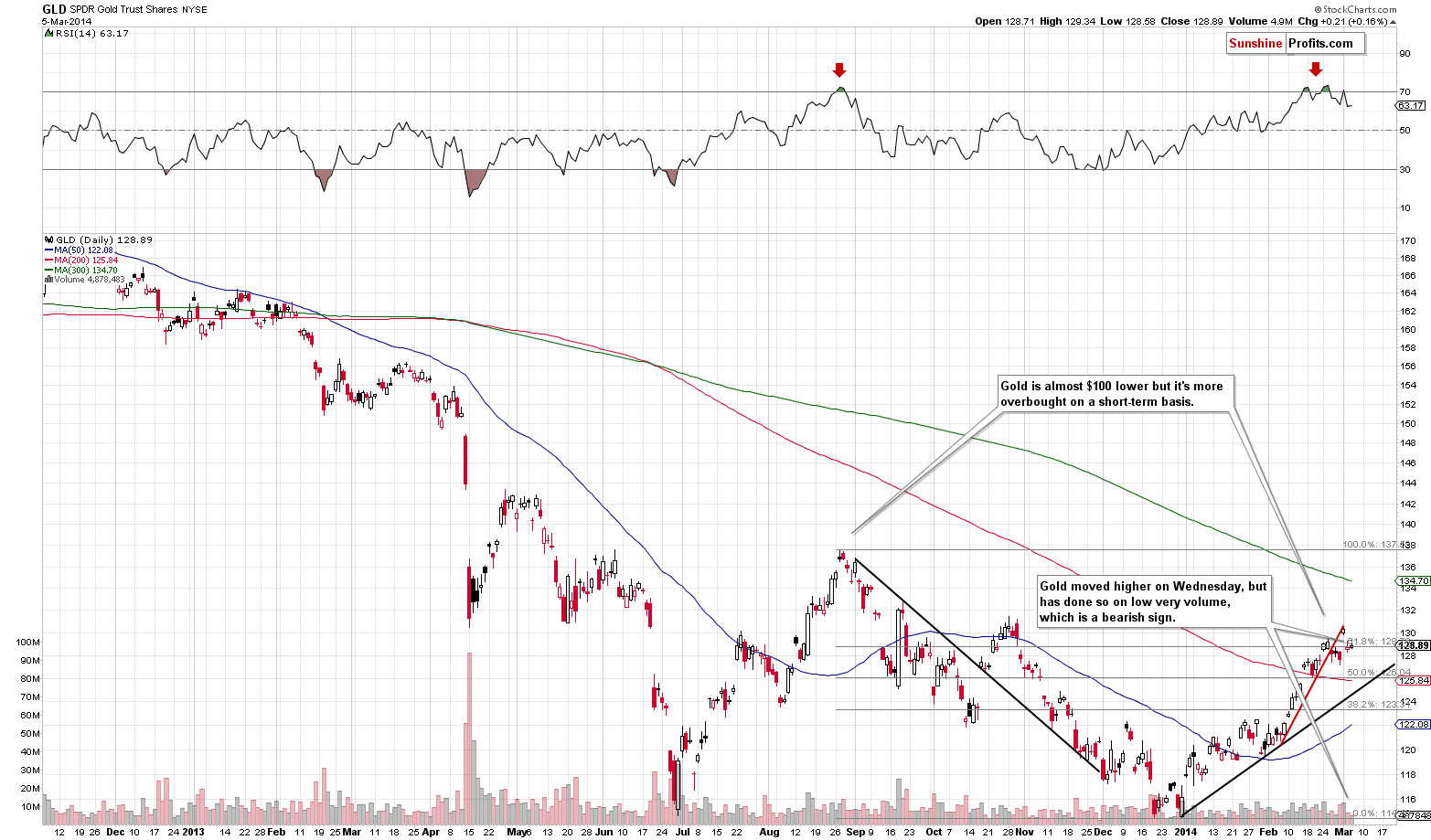

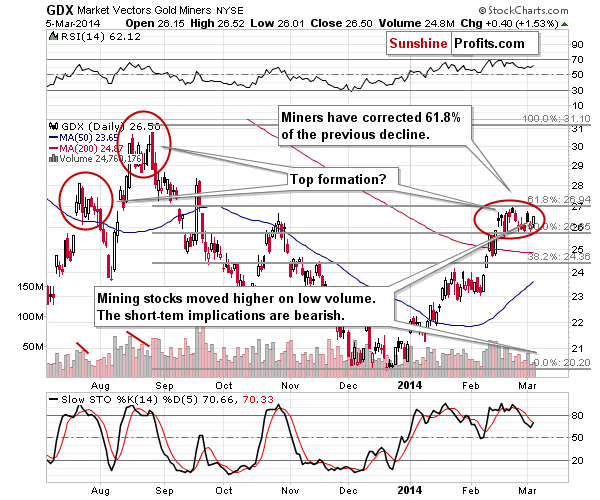

The tensions in Ukraine have either eased or not depending on your approach. They have eased in the way that the Russian troops are not moving further into the country, but they have not eased when you consider the fact that they have not left Crimea. Precious metals sector is not reacting with higher prices and this is a bearish sign on its own. Let’s look at the charts more closely (charts courtesy of http://stockcharts.com.)

There’s not much to comment on except for the fact that the volume was very low during yesterday’s upswing, which has bearish implications. Other than that, what we wrote yesterday and in previous days remains up-to-date.

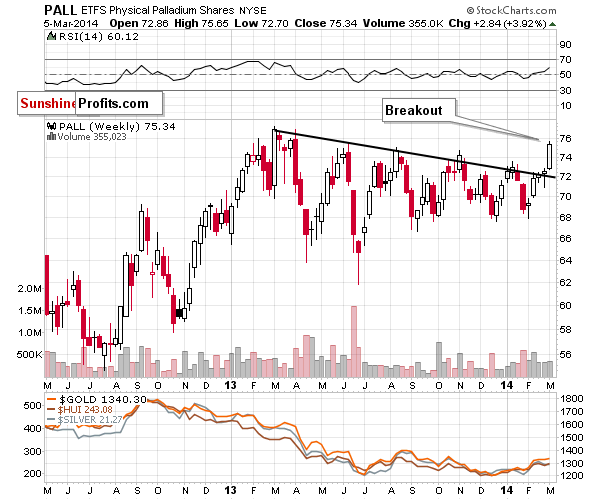

We were asked to comment on palladium’s strong move higher this week and explain whether it changes anything for the rest of the precious metals sector.

We previously used palladium as a leading indicator for the sector and times when this metal moved to its declining resistance line meant that local tops were in or about to be formed. Consequently, one might be expecting us to view the breakout as something very bullish.

However, the way this market works relative to the rest of the precious metals sector changed (at least temporarily) over the weekend.

About 40% of palladium's yearly supply comes from Russia. With various embargo threats toward Russia and analogous threats from Russia, there comes a greater risk of limiting supply to Western producers. The situation on the palladium market changed this weekend and the “Supply/Demand 101” implies that the price should rise in this environment. Consequently, the palladium's rally doesn't necessarily reflect the state of the entire precious metals market (it can’t be used to estimate precious metals investors’ attitude) at the moment and therefore its short-term outperformance (the breakout) doesn't have meaningful implications for the rest of the precious metals sector in our view.

The mining stocks sector (GDX ETF) moved higher but the rally – just like the one seen in gold – took place on very low volume. Just as it’s the case with gold, the above is a bearish sign. Please note that the current consolidation is still in tune with the July 2013 and August 2013 top formations.

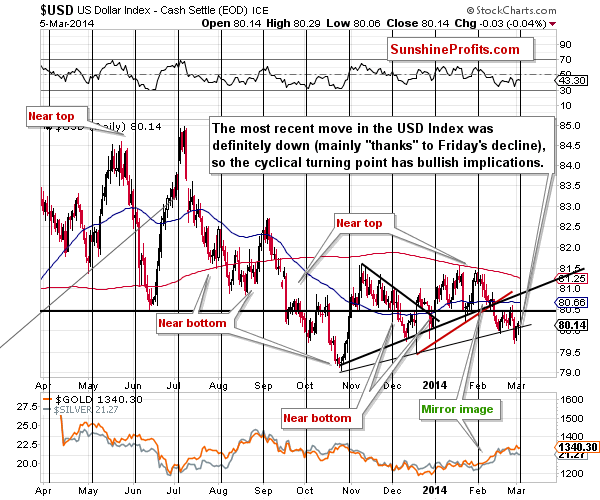

The USD Index is right at the cyclical turning point after a monthly move lower. This makes the turning point a bullish factor. What’s particularly interesting is that when you examine these turning points’ effect on the precious metals sector (gold and silver are in the lower part of the above chart) you will see that they worked particularly well. At this time – the turning point suggests declines for the PMs.

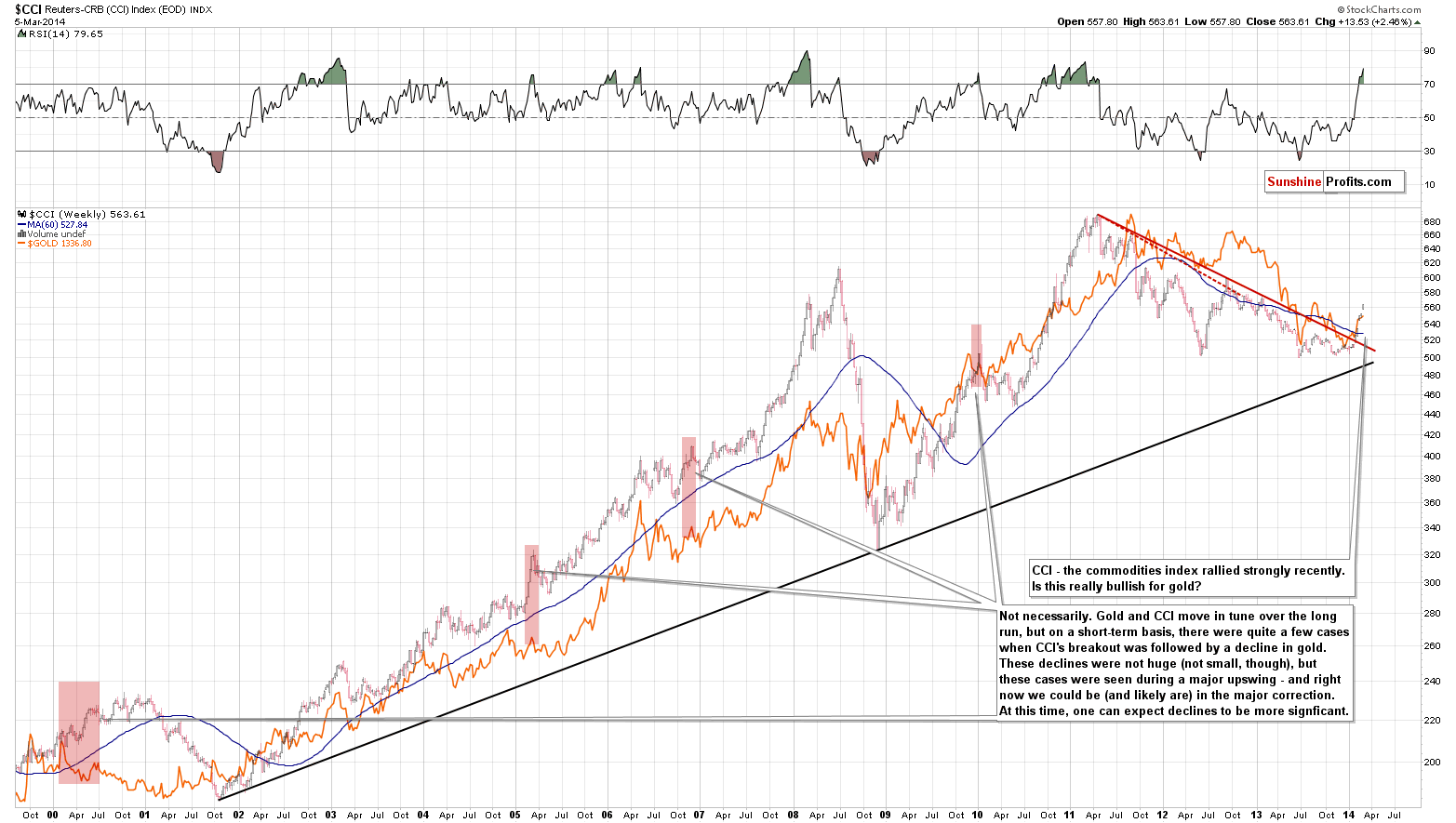

Before summarizing, we would like to discuss something that might appear very bullish at this time – a significant breakout in the CCI Index, a proxy for the commodities sector.

The CCI Index is presented with candlesticks, while the orange line represents gold. We have dedicated a substantial amount of time to analyzing this chart using various means, comparing the CCI to other indices (like the S&P 500) and plotting various indicators on it, but have always arrived at the same conclusion.

Namely, the commodities sector moves in tune with gold over the long run, but there can be various deviations from this tendency in the short term. We identified a few cases when a breakout in the CCI didn’t result in a breakout in gold, at least not shortly, and in fact was followed by a short-term decline.

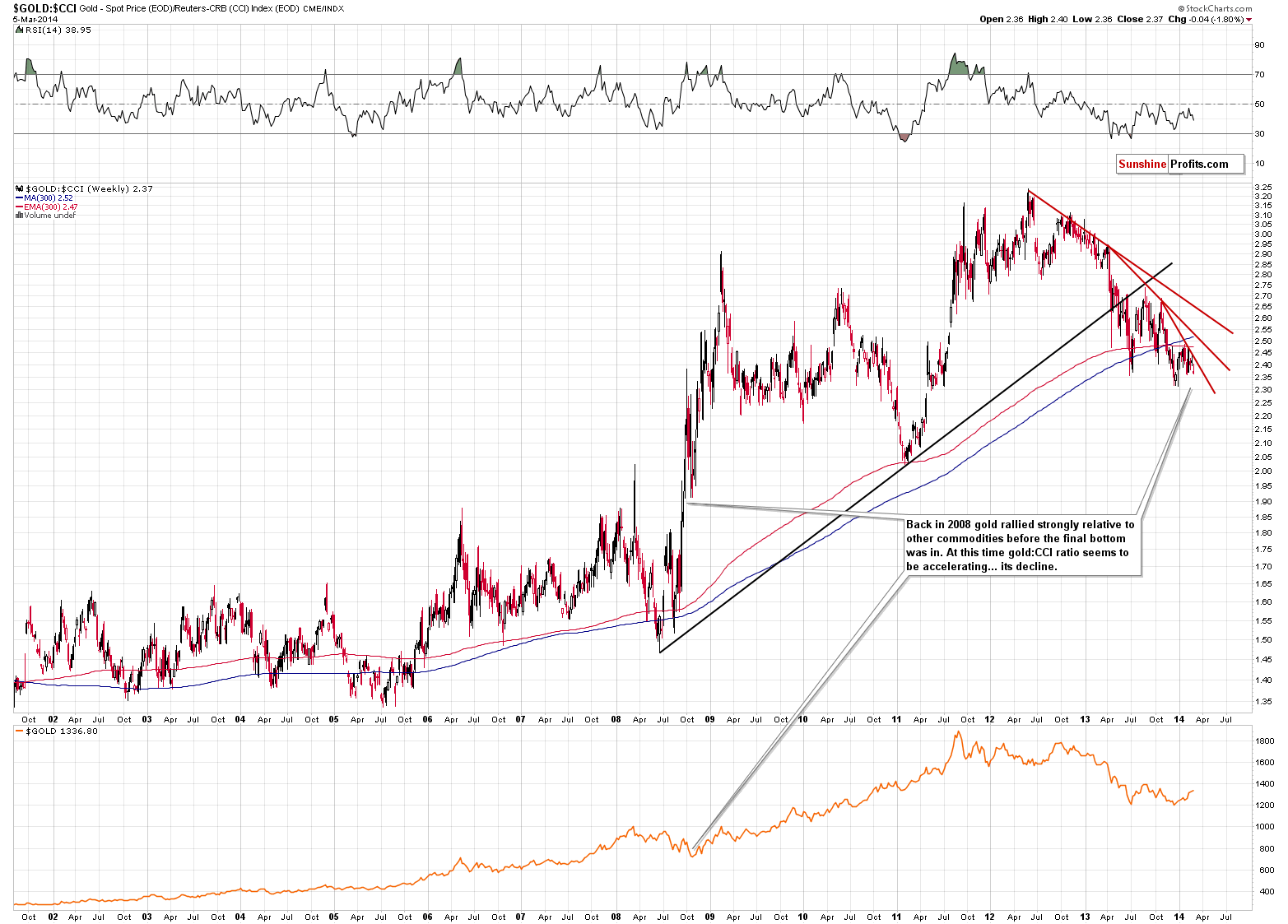

We dug deeper and wanted to focus on what happened in 2008, during the only decline that was significant enough to be comparable to what we’ve been seeing since 2011. In this case we’ll use the gold to CCI ratio.

Back in 2008 there was a huge rally in the gold to CCI ratio before the final bottom was formed. Not only are we not seeing something similar at this time, but also the past year or so can be described as an accelerating decline. From this perspective gold is already at its July 2013 lows and the outlook is bearish.

All in all, it doesn’t seem that keeping the full long position in the investment category is justified at this point in our view. Based on this weekend’s events it was likely that gold would move much higher – but its reaction has been very weak. It looks like there will be no rally in gold before a bigger decline. We are keeping half of the funds in gold, though, just in case the next days bring improvement. If not – things will become even more bearish and we will likely adjust the position once again.

We might suggest changing the short-term speculative position and / or the long-term investment one shortly, based on how the markets react and what happens in Ukraine. We will keep you – our subscribers – informed.

As a reminder, we have just posted an important report on the role of rebalancing in the case of the mining stocks sector. It compares the buy-and-hold approach with a strategy including “some rebalancing,” and with another one based on “rebalancing using Golden StockPicker and Silver StockPicker”. These tools were based on strong financial and statistical foundations, but now – after years of these tools being available – we can evaluate their performance and usefulness. While we were certain that they were useful because of the theory backing them, the results are even better than we had expected. As a reminder, as our subscribers you have access to both tools in the current Gold & Silver Trading Alert package (previously known as the Premium Service).

To summarize:

Trading capital (our opinion): Short position (half): silver and mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.90

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts