In short: In our opinion short positions (half): gold, silver, and mining stocks are justified from the risk/reward perspective.

Gold, silver and mining stocks declined yesterday after a streak of uninterrupted daily gains. Is this the start of the decline or at least a more meaningful correction? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

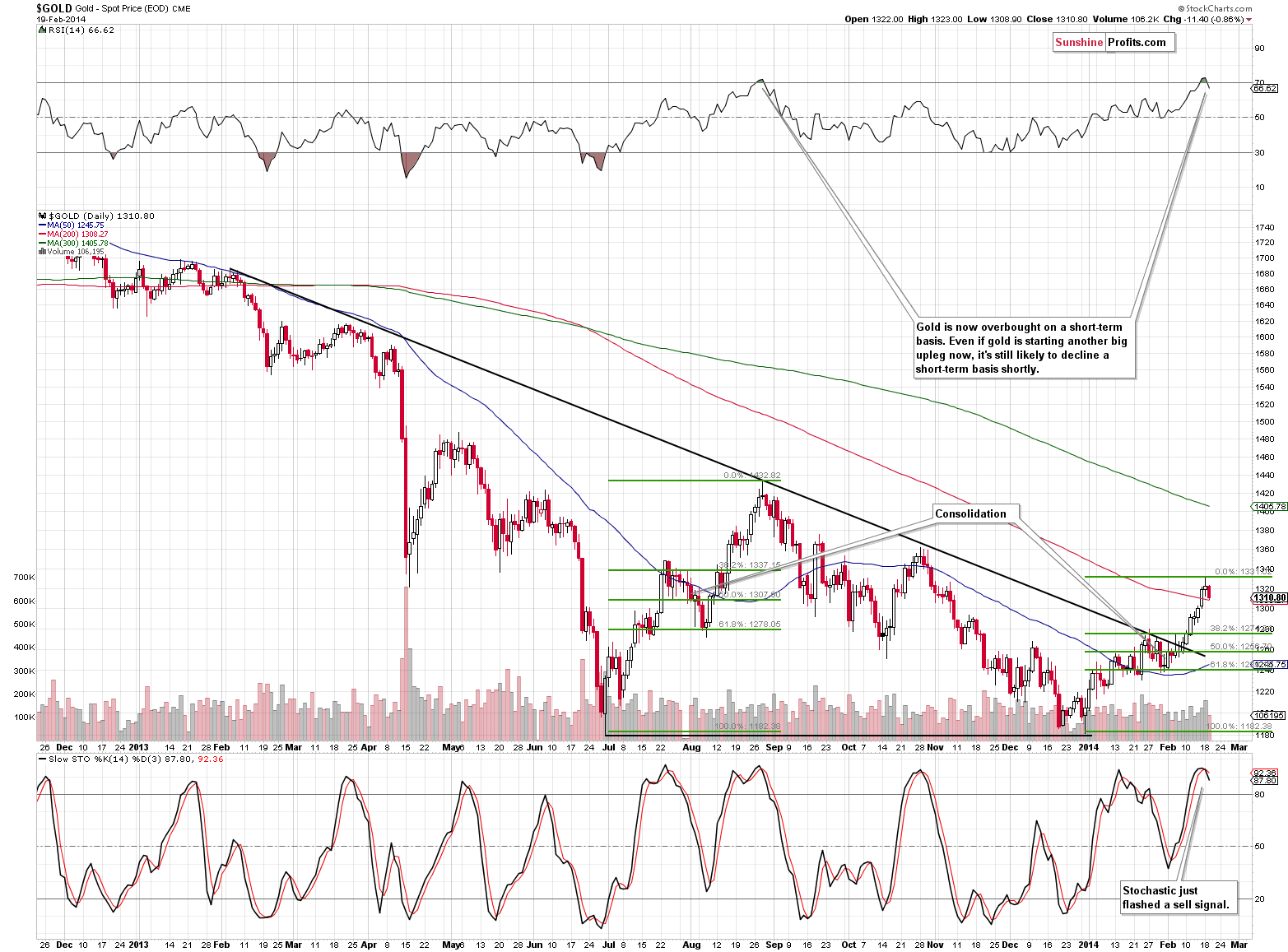

The RSI indicator moved back below the 70 level after being overbought. In August 2013, after gold’s previous significant rally that meant the beginning of another downturn. There’s one more similarity. In both cases gold consolidated a bit in the middle of the rally, more or less between 38.2% and 61.8% of the rally – as marked with green lines on the above chart.

The Stochastic indicator has also flashed a sell signal after being in the overbought territory. The above chart has bearish implications for the following days.

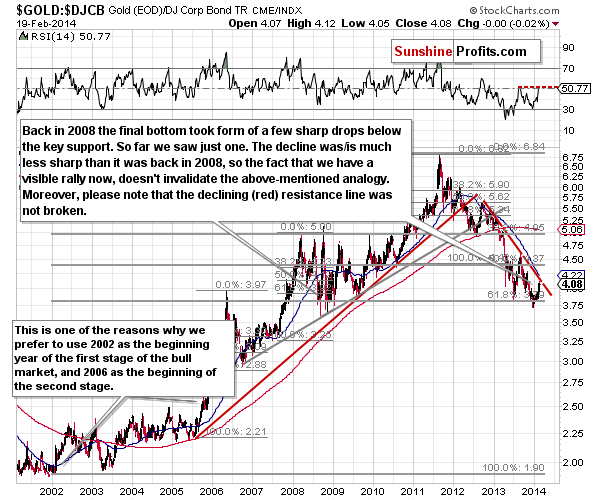

It’s been some time since we previously commented on the gold to bonds ratio, but it’s currently at a very interesting juncture, so it’s time to get back to it (on a side note, just because we don’t comment on something for some time, it doesn’t mean that we don’t monitor it). The ratio moved to its declining resistance line without breaking it – which is a negative divergence compared to all the breakouts that we saw in gold, silver, and mining stocks.

Some might say that the analogy to 2008 now suggests a rally as we have seen a double bottom. It doesn’t necessarily look like that in our view. Back in 2008 there were several moves below the key support level before the final bottom was in. Since the current (2011 – today) decline is much less sharp than the 2008 plunge, we can expect another decline to or below the previous lows (at least based on the above chart alone) in the coming days or even weeks. Such a move would still be in tune with what happened in 2008.

As far as silver and palladium are concerned, there are basically no changes since yesterday (or they are analogous to the ones seen on the gold chart) – they both declined slightly.

What we wrote yesterday remains up-to-date:

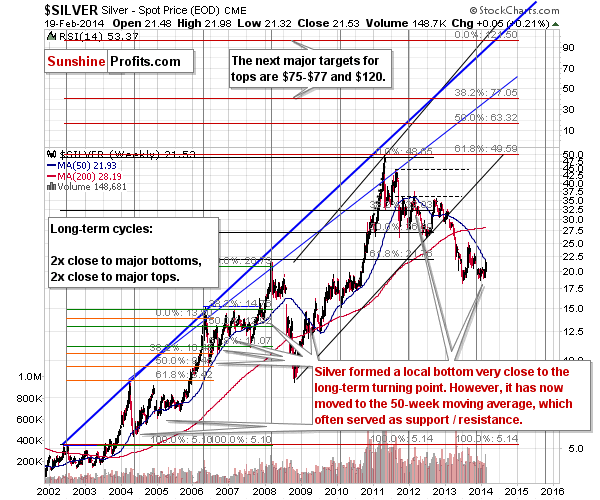

Silver has finally moved visibly higher. Friday’s rally took the white metal above both the rising and declining resistance lines and it moved higher this week as well. Did the outlook change substantially based on that? Not necessarily. The move was sharp and silver has been trading above the declining resistance line for just a few days now.

More importantly, silver moved to its 50-week moving average, which served as strong support and resistance numerous times. The last time that it served as resistance was right after silver rallied sharply after the previous long-term cyclical turning point.

Consequently, even though silver’s recent rally is impressive, let’s keep in mind that the same (actually, the rally was much more significant back then) was the case in August 2013 and was still followed by declines. In the coming years, silver will probably rally very far – well over its 2011 high. However, as far as short-term is concerned, it seems that traders and investors might expect at least (!) a short-term decline.

Palladium also suggests that at least a short-term move down will follow.

All in all, it looks like we are likely to see a correction or another big decline soon. Just like did yesterday, let’s see if this outlook is consistent with the situation in the currency markets.

Basically, the long-, and medium-term charts remain unchanged, so we’ll focus on the short-term one today.

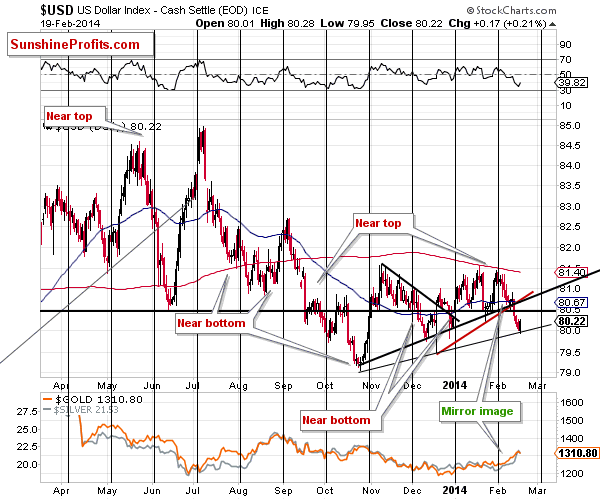

Yesterday, we wrote that the short-term support line – based on the October and December 2013 lows – was (...) reached. It was likely to be followed by a move higher and it was. The move has been small so far, but based on the medium- and long-term charts we can infer that it’s likely to become bigger, perhaps much bigger.

Even more importantly, the precious metals sector responded to the small rally by declining. The move lower has not been substantial just yet, but since the move higher in the USD has not been significant either, we can say that the reaction has been fair.

If the move up in the USD becomes more significant, then we can expect the decline in the precious metals to be more significant as well.

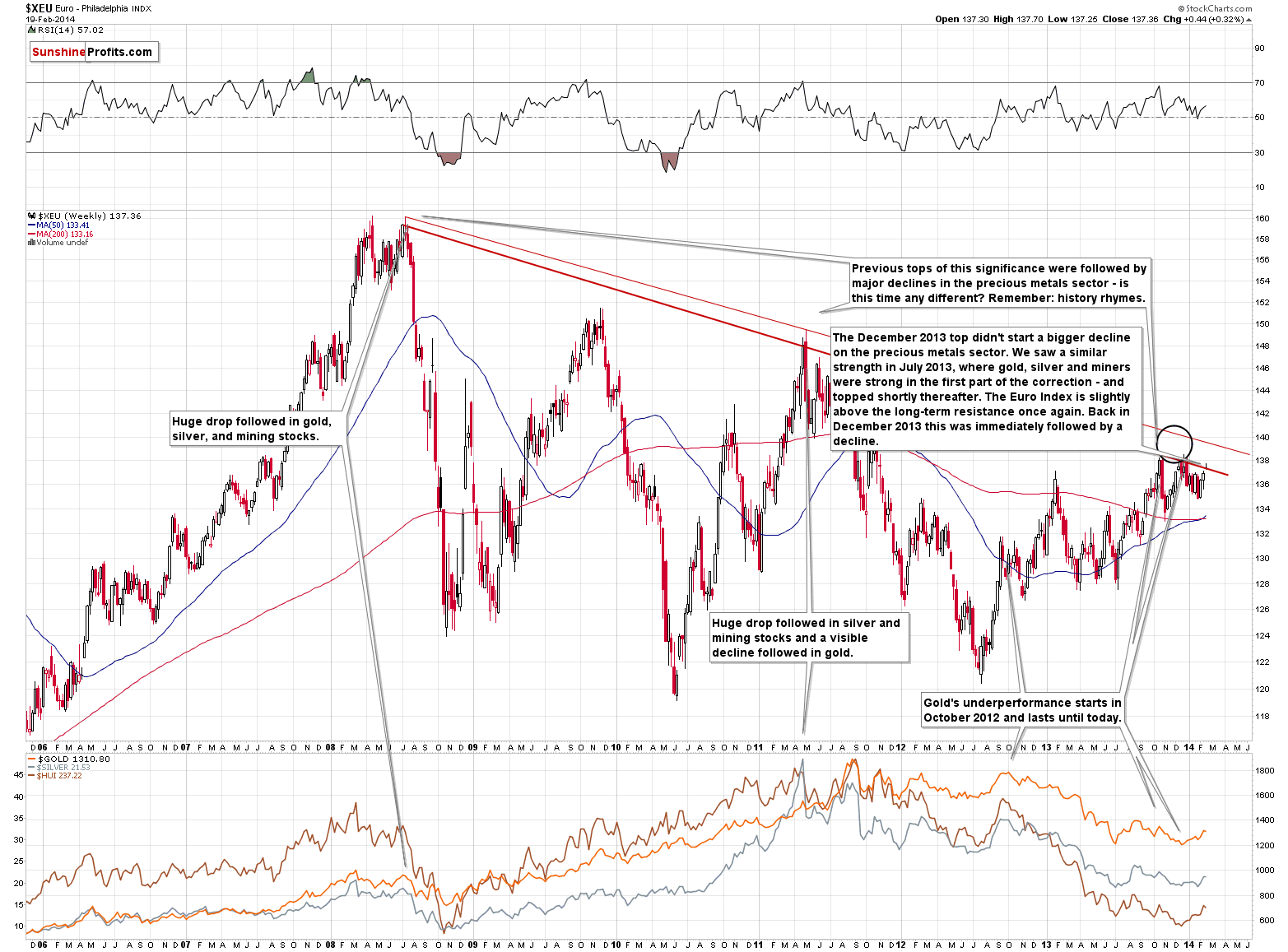

Yesterday, we wrote that the Euro Index [was] now even slightly above its long-term resistance line. This line kept rallies in check and the situation now is similar to what we saw in December 2013.

This further supports the bearish outlook for the precious metals market, at least for the short term as in the recent weeks short-term moves in the Euro Index and in gold, silver and mining stocks have been quite in tune with each other.

At this time precious metals are amplifying euro’s gains but if the decline in the euro is huge, the above strength will likely not be enough to prevent a decline in metals and miners. The point is that the resistance is significant enough to generate a big downswing.

The Euro Index moved lower yesterday, which means that the slight move higher that we had mentioned was erased. Based on the above chart, it seems that we will see another move lower quite soon.

Overall, what we wrote about the current situation in the previous alert remains up-to-date:

The “problem” with gold’s rally is that it is very unlikely to continue unless the USD Index gives in and declines below the medium-term line. We already saw a move very close to it yesterday and in today’s pre-market action. The USD is after a long-term breakout, and at medium-term support, which is a powerful bullish combination for the coming weeks.

If the USD Index breaks lower or it rallies strongly (not a daily rally, but at least a weekly one) and gold refuses to decline, then we will have a good indication that it’s safe to jump back into the precious metals market. At this time, we have an encouraging rally, but we also see a major threat (the USD is likely to start a significant rally) that is just waiting to impact the market.

If the USD rallies – and it seems likely that it will relatively soon – we will quite likely see invalidations of breakouts and subsequent plunges. This will be likely until either the USD breaks below the medium-term support or precious metals prove that the dollar’s substantial rally is not a major threat.

Even if the next big upswing in the precious metals market is underway, we are still likely to see a decline shortly as the situation in gold is now overbought on a short-term basis (...)

The situation deteriorated based on yesterday’s price moves and it looks (subjectively speaking) that the odds for another big ($100+) drop are a bit lower than in the previous weeks, but still close to 65% and the odds for at least a short-term move lower are close to 75% - the only question is how significant the latter might be.

Given the situation in the currency markets and because of the signals coming from the metals market, it seems to us that opening a small speculative short position is justified from the risk/reward perspective.

To summarize:

Trading capital: Short position (half): gold, silver, and mining stocks.

Stop-loss details:

- Gold: $1,346

- Silver: $22.26

- GDX ETF: $27.3

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts