Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective.

The tensions in Ukraine have increased due to the Russian plan to conduct a referendum as to whether Crimea should belong to Ukraine or Russia. How many voting’s has Putin lost? That’s not his specialty. Meanwhile, the U.S. is sending 12 F-16 fighter jets to Poland due to the decision to “extend the scope of the aviation detachment training”...

Our best guess is that the outcome of the voting will be that Crimea wants to join Russia. The only unknown here is the real reply of the West. The Western countries will say that they don’t find the voting constitutional – they are already saying that. The question is how much they will do about it. The Russian troops are already there.

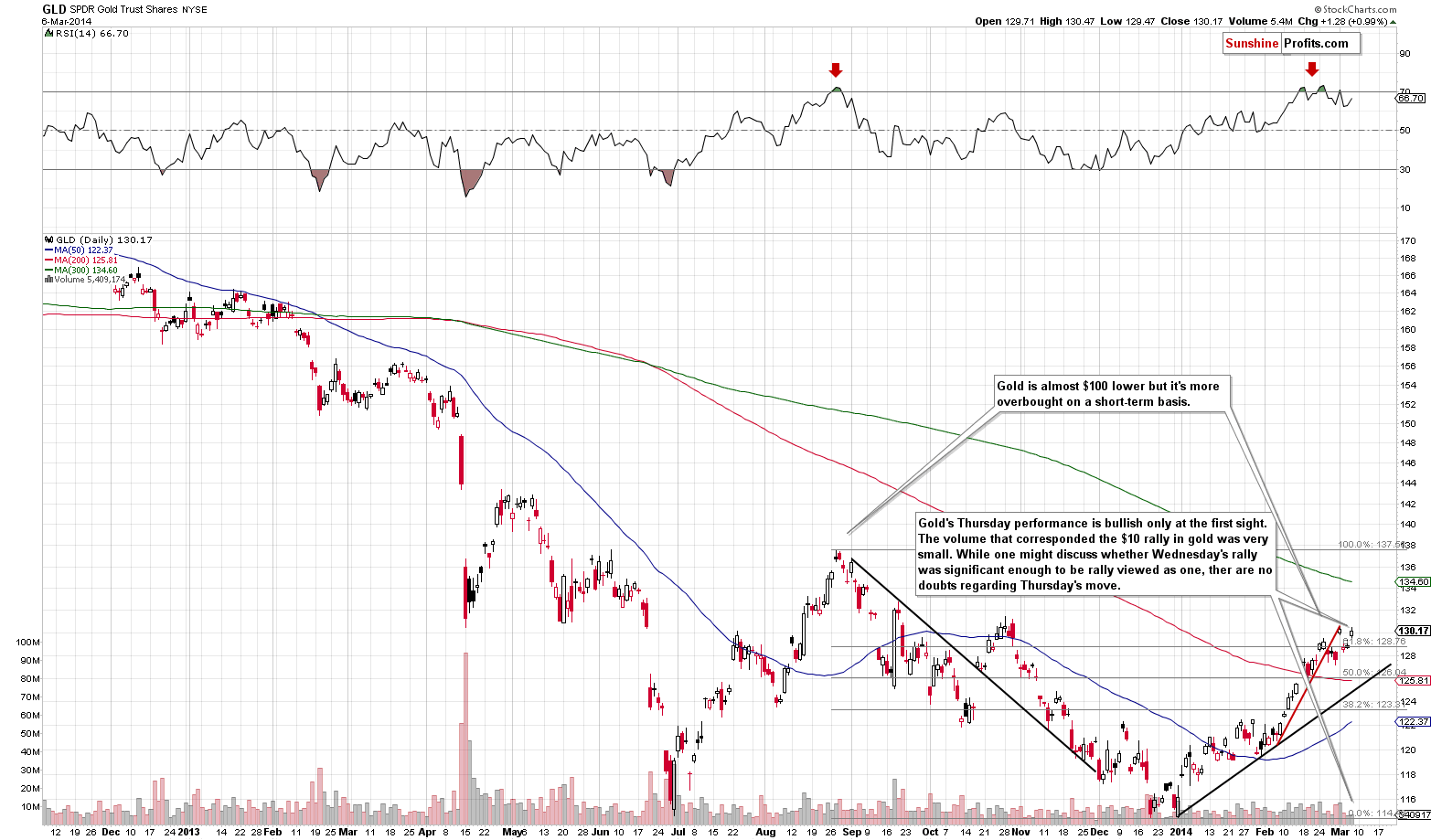

Based on the above it seems that gold should be rallying on strong volume and be well above the previous highs. Is it? No. It moved higher, but it did so on very low volume and stopped before reaching its recent high. Let’s look at the charts more closely (charts courtesy of http://stockcharts.com.)

The volume was very low during yesterday’s upswing, which has bearish implications. We wrote the same yesterday, but this time the implications are clearer as the rally was clearer as well. Bigger rally + very low volume have more bearish implications than a rather small rally on the same volume levels.

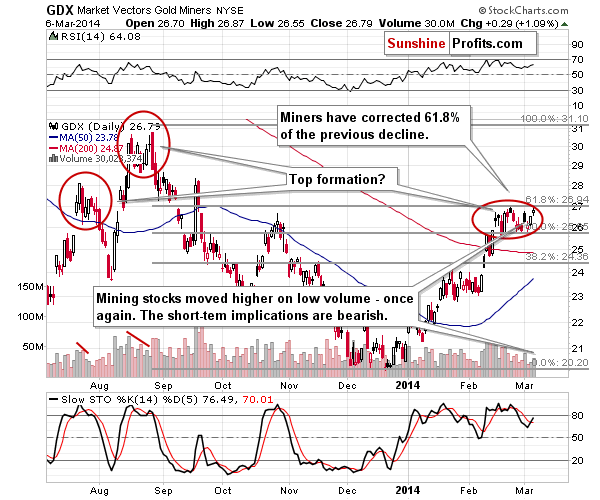

The same was the case in the silver market and for mining stocks. Let’s take a look at the latter.

The mining stocks sector (GDX ETF) moved higher once again, but the rally – just like the one seen in gold – took place on low volume. Just as it’s the case with gold, the above is a bearish sign. Please note that the current consolidation is still in tune with the July 2013 and August 2013 top formations. There has been no breakout above the 61.8% Fibonacci retracement level based on the Aug.-Dec. 2013 decline, which means that the 2014 move higher is just a counter-trend rally.

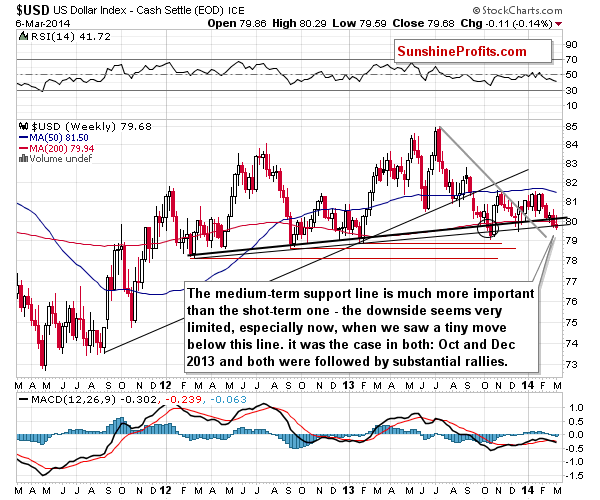

The USD Index declined below the previous 2014 low (while gold, silver, and mining stocks didn’t move above their 2014 highs), but this “breakdown” doesn’t really have bearish implications. Similar “breakdowns” were followed by significant rallies back in October and December 2013. The breakdown is not confirmed in a technical sense, and it seems doubtful that it will be followed by more weakness or that it will really be sustainable.

All in all, it doesn’t seem that keeping the full long position in the investment category is justified at this point in our view. Based on this weekend’s events and what had happened in the recent days it was likely that gold would move much higher – but its reaction has been very weak. It looks like there will be no rally in gold before a bigger decline. We are keeping half of the funds in gold, though, just in case the next days bring improvement. If not – things will become even more bearish and we will likely adjust the position once again.

We might suggest changing the short-term speculative position and / or the long-term investment one shortly, based on how the markets react and what happens in Ukraine. We will keep you – our subscribers – informed.

As a reminder, we have just posted an important report on the role of rebalancing in the case of the mining stocks sector. It compares the buy-and-hold approach with a strategy including “some rebalancing,” and with another one based on “rebalancing using Golden StockPicker and Silver StockPicker”. These tools were based on strong financial and statistical foundations, but now – after years of these tools being available – we can evaluate their performance and usefulness. While we were certain that they were useful because of the theory backing them, the results are even better than we had expected. As a reminder, as our subscribers you have access to both tools in the current Gold & Silver Trading Alert package (previously known as the Premium Service).

To summarize:

Trading capital (our opinion): Short position (half): silver and mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.9

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts