Briefly: In our opinion speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

We yesterday wrote that gold and mining stocks were likely not done declining as it was the end of the session that stopped the decline, not the strength of the market and in the following session we saw the decline continue (and that doubling the size of the short position was a good idea, which means even greater profits given yesterday's and today's declines). Let’s see where we stand (charts courtesy of http://stockcharts.com.)

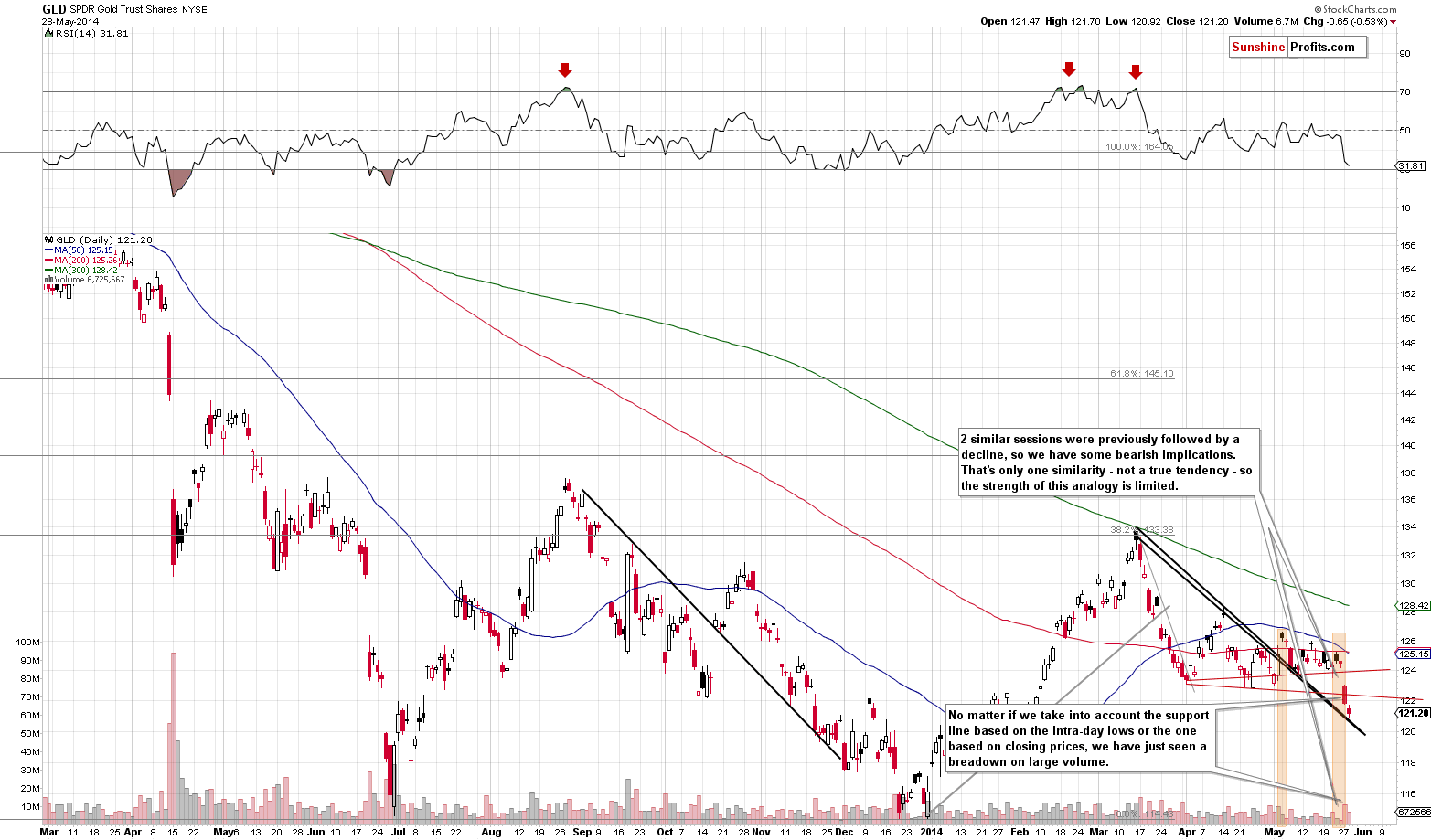

The GLD ETF continued its decline on volume that was not as huge as the one seen on Tuesday, but it was not low either, so we don’t have bullish indications. Basically, everything that we wrote yesterday remains up-to-date – it was only strengthened by the continuation of the decline and the lack of a corrective upswing:

We saw a breakdown. Perhaps it will be called “the breakdown” in a few weeks when we will be looking back at this move. The reason that makes it so significant is the combination of several factors:

- Gold is still in a medium-term downtrend, which means that bigger moves to the downside are to be expected – this by itself makes yesterday’s move more believable

- Gold was in a consolidation since the beginning of April, so a breakout or breakdown from this pattern is quite significant (because the consolidation was rather significant as well)

- The move that preceded the consolidation was down (the decline in the second half of March), which means that the move following it, was also likely to be down (thus making the breakdown more believable)

- The breakdown itself took place on huge volume, which confirms the move

- GLD didn’t correct before the end of the session, thus creating a bearish candlestick pattern. In other words, it seems that GLD didn’t stop declining because it showed some strength – it only stopped declining because the session ended and it couldn’t decline more

- The breakdown was actually 2 breakdowns – below support lines created by daily lows and daily closing prices.

As you can see, there are quite a few reasons to think that yesterday’s move is indeed a bearish phenomenon, not a fake move. In fact, we think that the above combination of factors make the breakdown verified even without waiting for 2 more closes below the support/resistance lines that were just broken.

What we wrote about gold in the previous alert remains up-to-date:

We wrote that the strength that we could see here would likely be temporary. It turned out that the rally that this reversal generated was indeed very small and temporary. We saw another lower intra-day high in gold, and the move higher materialized on low volume. We’re once again seeing this bearish combination. If the USD Index confirms its breakout, gold might finally break below the short-term support.

How far can it go initially? Our best guess at this particular moment (this might change as the situation develops) is the $1,200 level or close to it. One of the ways to estimate the size of a given move is to assume that the move following the consolidation (which we’ve been seeing since the beginning of April) will be similar to the one preceding it. In this case, the move following the breakdown could be similar to the March decline, and such a move would take gold close to the $1,200 level. This level is very close to the 2013 lows, so we expect gold to pause there (but not to end the decline).

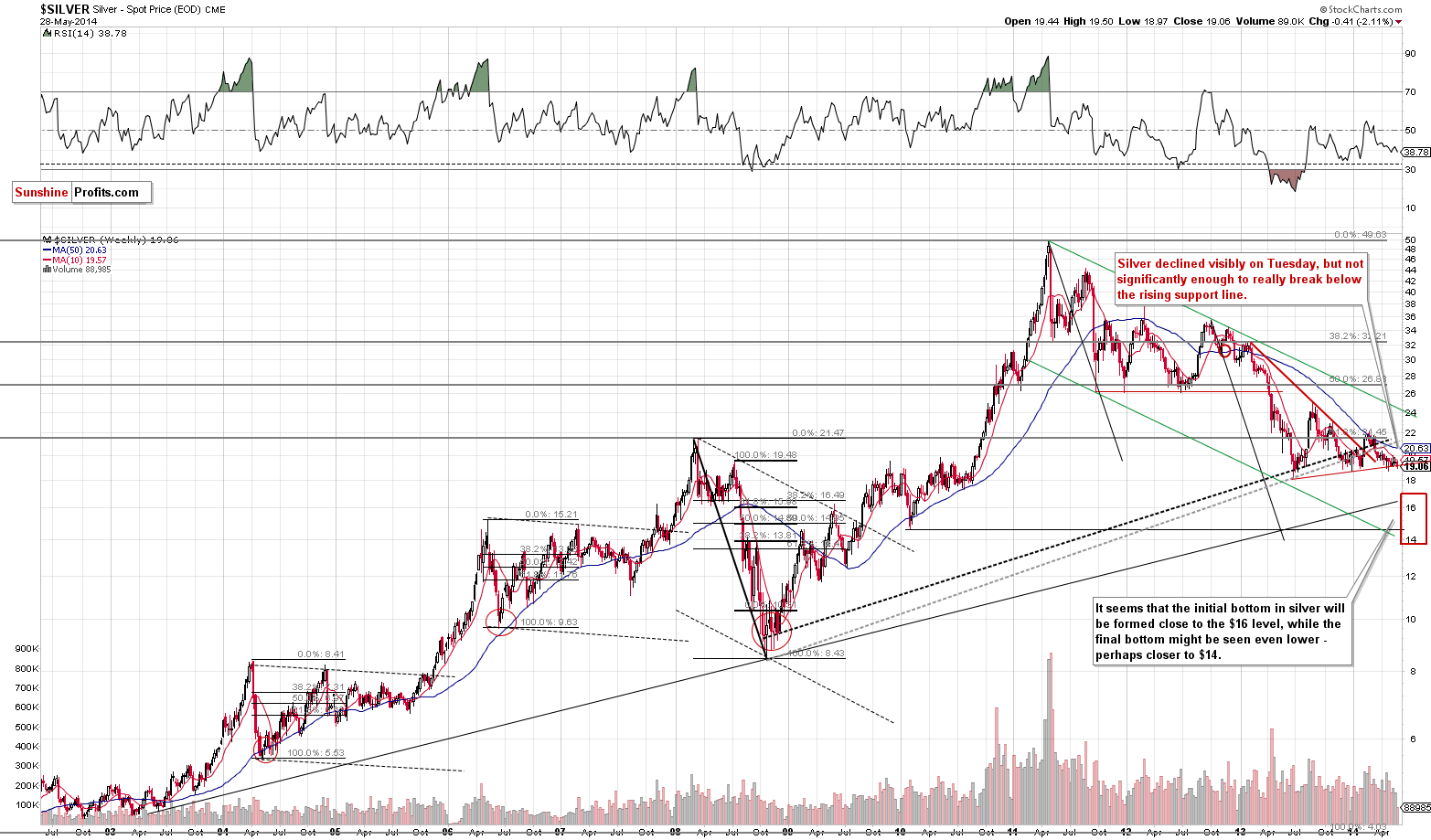

Meanwhile, the support line in silver managed to prevent further declines – at least for now. That’s not that surprising and not necessarily a bullish divergence simply because the support line in the silver market is stronger than the one that was broken in the case of gold and mining stocks.

In addition to the 2013 lows this is the key support level that prevents silver from moving much lower – to the $14 - $16 target area. Once this level is broken, silver may and likely will move sharply lower. Being this significant, it’s no wonder that this support line is not easy to break. Since gold, silver, and mining stocks are highly correlated in the short term, it’s also no wonder that silver’s refusal to move lower already is accompanied by a similar refusal in the case of gold and mining stocks.

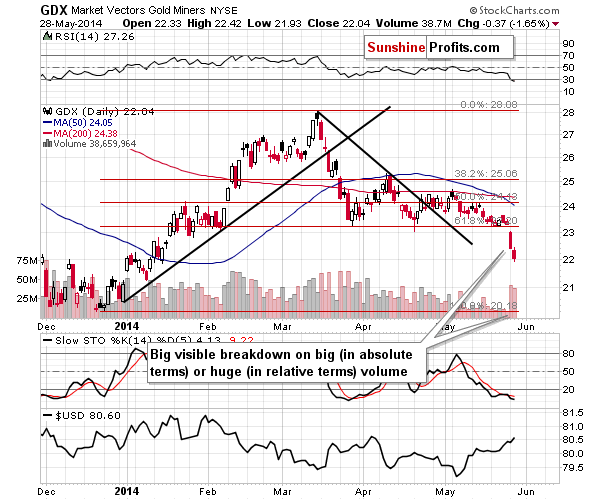

The slide in mining stocks was once again more visible than the one in gold. The volume was huge and it almost equaled the one seen on Tuesday. The (bullet) points that we made about the breakdown in gold still apply to mining stocks as well. These two markets confirm each other’s breakdown and the strength of this confirmation is even greater today, after 2 days of simultaneous declines on large volume.

The RSI indicator is below 30, so we might see a pause in the near future, but based on the size of the volume that accompanied the breakdown, we don’t think that the move higher will be significant or worth betting on.

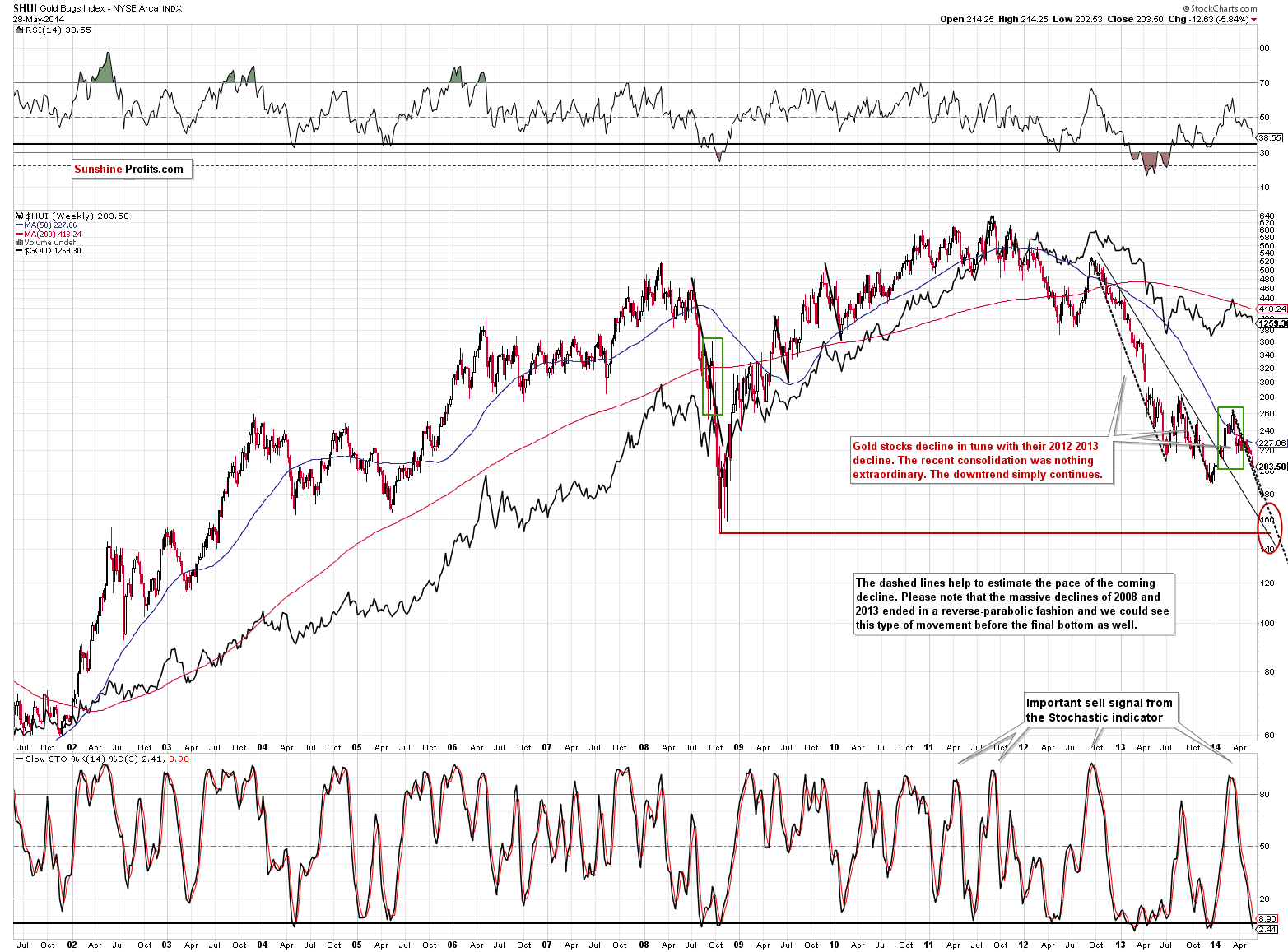

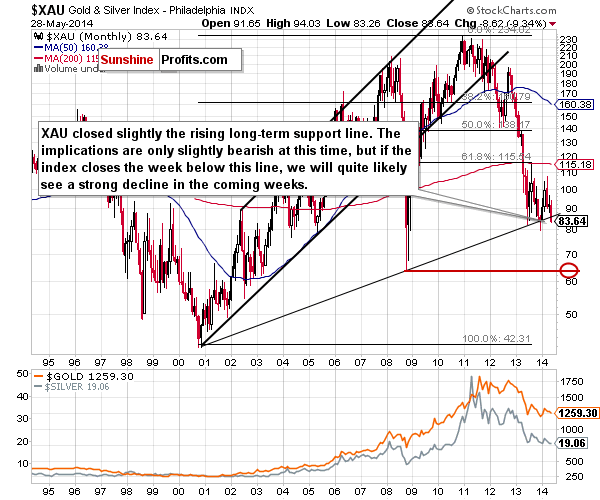

We already featured the long-term charts of the HUI Index and XAU Index yesterday, but we think these charts are important enough to re-emphasize the latest events.

The pace at which gold stocks are declining remains in tune with the past decline (similarities in the pace of decline are illustrated with dashed lines above). Consequently, the outlook is still bearish.

The XAU Index which covers both gold and silver stocks also declined once again, and in this case the situation changed a bit – it became more bearish. The index is now more visibly below the rising long-term support line and it’s one step closer to closing below this line on Friday. If we see a weekly close below it, the next huge drop will become much more probable.

The XAU chart is one of the clearest ones in the sector when it comes to estimating the target area. The reason is that once the XAU breaks below the rising support line and the 2013 lows – they are very close to where the index is right now – there will be no additional strong support all the way down to the 2008 low.

We have been writing about XAU moving back to its 2008 lows for months now, and it seems that the move will take place quite soon.

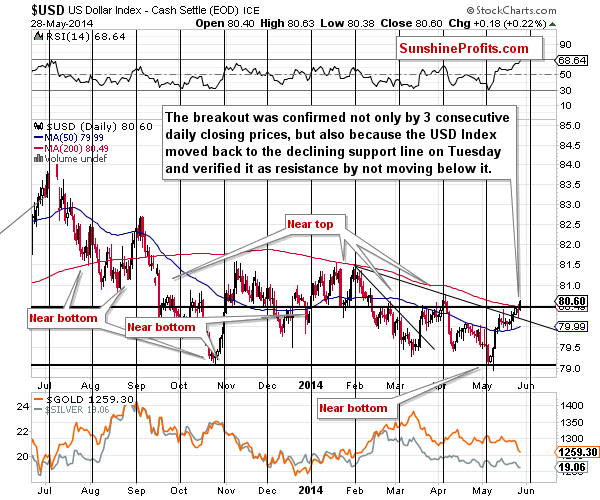

The USD Index moved higher once again and closed above the 200-day moving average. It seems that the amount of people that are convinced about the dollar’s strength is growing.

Please note that while the USD Index is close to its April high, gold and silver are well below the levels that they were trading at at the beginning of April. Consequently, speaking of the metals’ outperformance relative to the USD Index is not appropriate – their reaction to the dollar’s rally was only delayed.

It was right before the decline in metals that we wrote the following:

The U.S. dollar moved higher once again and almost confirmed the breakout above the declining resistance line. Precious metals are not reacting yet. Unless metals start to react to the dollar’s strength (by declining) we will view this as a sign of their strength. For now we still think that the reaction is delayed – not really absent.

Please note that based on the proximity of the cyclical turning point, we could see another pullback to the support/resistance line that was just broken in a few days, but it doesn’t seem to be really concerning – it’s not likely to be anything more than just that – a pullback. Once it’s over (or we’re sure that it hasn’t happened) we will likely adjust the stop-loss orders for our positions in the precious metals sector.

Summing up, the situation in the precious metals market deteriorated once again – not only in terms of what has already happened (yesterday’s and Tuesday’s declines), but also in terms of the outlook. Consequently, we think that we can now increase the size of the profitable short position in the precious metals sector.

To summarize:

Trading capital (our opinion): Short positions (full) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts